If you haven't started planning for retirement, thinking about it can be overwhelming. If you have started, it can be hard to know if you're doing enough.

You don't have to do it all at once. Starting with a single step can set you on the path—and that includes saving what you can in a retirement account. Here are some factors to consider.

Think about how much money you'll need in retirement

Depending on where you are in life, retirement could be very far away or it could be just around the corner. To make your plan a reality, start with an estimate of the amount of money you'll need in retirement. Fidelity has some rules that may help you hone in on the amount that will allow you to maintain the lifestyle you want once you've retired. These rules are just a starting point. Be sure to factor in your personal circumstances in order to fit the guidelines to your life. Some factors that could influence the numbers include your age, financial situation, and risk tolerance for investing.

One way to roughly estimate the amount you may need to save is with the 10x rule. Fidelity's rule suggests aiming to save 10 times the salary you will be making by age 67.1 The salary people earn often goes up as they get older, so your retirement savings target would go up too. Having a ballpark figure to aim for can help you decide if your savings are on track or if you need to save a little bit more or less.

Your savings rate—the amount you save from each paycheck—can be another important piece of the puzzle. Try to save 15% of your pre-tax income, which includes any match you may get from your employer. If you cannot save that amount, try to save as much as you can to receive the full employer match.

Read about all 4 of Fidelity’s retirement saving guidelines: Retirement roadmap

It’s important to save for the expenses that you know you’ll need to pay in retirement. But it’s also important to be prepared for the unexpected. Here are 3 important variables that could affect your retirement if you’re not ready for them.

1. Health care expenses

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

The estimate doesn't include the potential cost of long-term care (LTC). The majority of people may require some type of LTC services at some point in their lives, according to the US Department of Health and Human Services.2

It sounds a little scary but you can do something about it now.

Consider long-term care insurance: Insurers base the cost largely on age, so the earlier you purchase a policy, the lower the annual premiums, though the longer you'll potentially be paying for them.

If you have the option to be covered by a high deductible health plan (HDHP) that is health savings account (HSA) eligible, you may want to take advantage of that. An HSA offers a triple tax advantage:3 You can save pre-tax dollars, which can grow and be withdrawn state and federal tax-free if used for qualified medical expenses—currently or in retirement. It's a pretty powerful tax benefit, and if you can save even a part of the money you contribute to the account for your retirement, the money will be able to potentially grow and compound for years.

To learn more about HSAs, read Viewpoints on Fidelity.com: 3 healthy habits for health savings accounts and What is an HSA, and how does it work?

2. Inflation

Inflation can eat away at the purchasing power of your money over time. Inflation affects your retirement income by increasing the future costs of goods and services. Including investments that have the potential to help keep pace with inflation as part of a diversified portfolio that also reflects your time horizon, risk tolerance, and financial circumstances may make sense.

3. Longevity

As medical advances continue, it's quite likely that today's healthy 65-year-olds will live well into their 80s or even 90s. This means there's a real possibility that you may need to fund 30 or more years of retirement. People are living longer because they're healthy, active, and taking better care of themselves.

Annuities are an option: When it's time to turn your retirement savings into income, an annuity may be an option worth considering. Annuities provide regular income payments that are guaranteed for as long as you (or you and your spouse) live.4

Saving money is vital but it can only take you partway to your retirement goals. Earning a return on your money above the rate of inflation can help supercharge your retirement plan.

Investing for growth could help you get there

An investment strategy, or asset mix, that balances growth potential while managing risk may help you hit your retirement goals. (Risk in this context refers to volatility of returns.) Your mix of investments should reflect your time frame for investing (for instance, the number of years until you retire), your tolerance for risk (how upsetting market fluctuations would be to you), and your financial situation (your ability to invest this money and leave it in the account for decades).

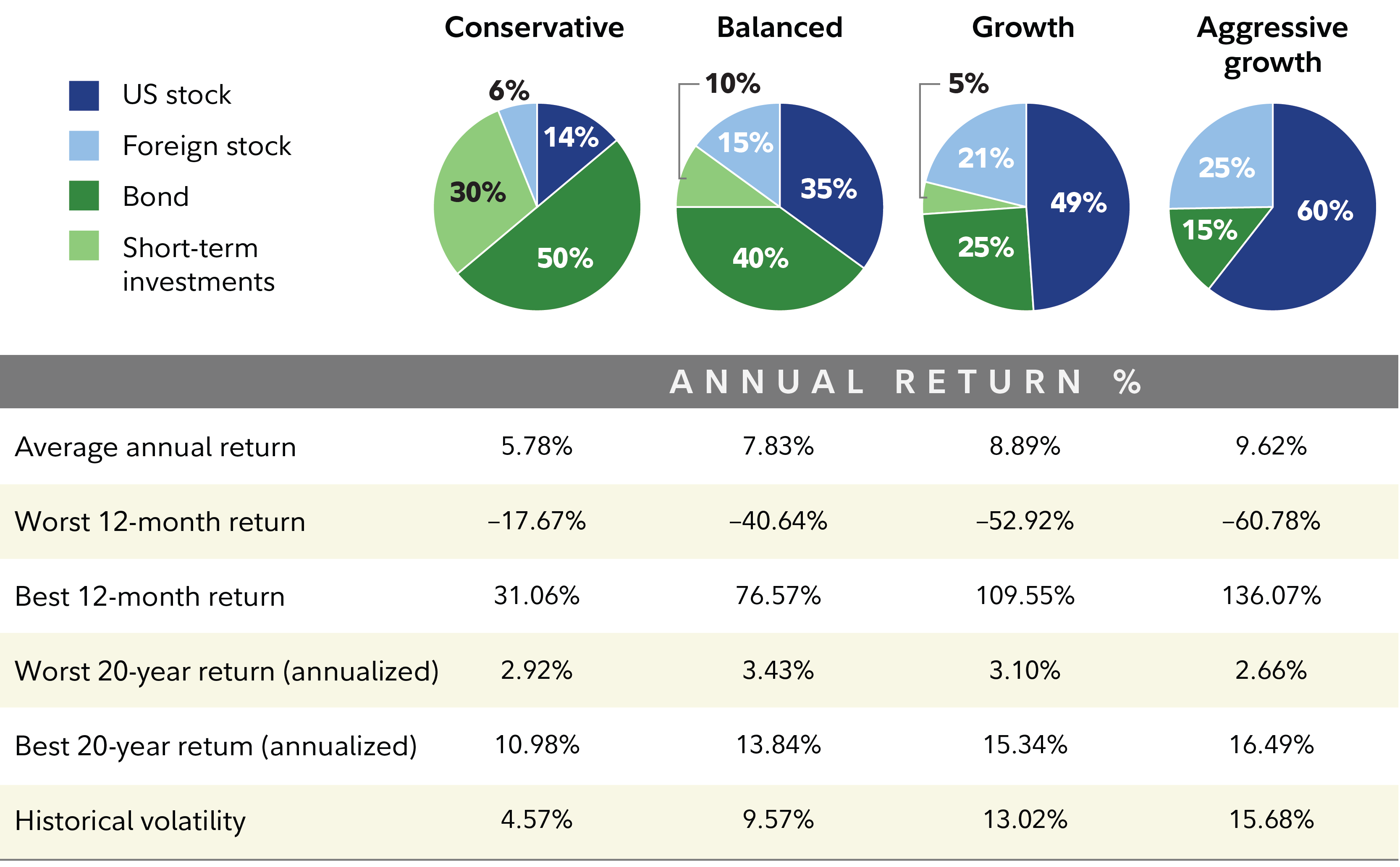

The sample investment mixes below show illustrative blends of stocks, bonds, and short-term investments with different levels of risk and growth potential. If you have a very long time until retirement, that gives investments time to recover from potential downturns, which means you may be able to take more risk.

Risk and return are generally linked: Lower-risk investments tend to have relatively lower returns, while higher-risk investments have the potential for relatively higher returns (but require a higher tolerance for risk, as they tend to be more volatile). An investment mix including a combination of relatively higher-risk investments, like stocks, and relatively lower-risk investments, like bonds, is one way investors aim for higher returns while helping to manage risk.

Consider diversification

Build a diversified mix of stocks, bonds, and short-term investments, according to how comfortable you are with market volatility, your overall financial situation, and how long you are investing for. That may provide the potential for the growth you need without taking on more risk than you are comfortable with. But remember: Diversification and asset allocation do not ensure a profit or guarantee against loss.

You don't have to do it yourself (if you don't want to). If you're looking for simplicity, a single-fund option may help you get invested right away with professional management. There are typically 2 types: target date funds (based on an anticipated retirement date) and target allocation funds (asset allocation remains aligned with your risk tolerance). Investors or savers who want more personalized attention, or who are navigating a complex financial situation, may benefit from a managed account service.

Read Fidelity Viewpoints on Fidelity.com: The guide to diversification

You're not alone

It sounds like a lot to tackle, but you don't have to do it all at once—or on your own. The Fidelity Planning & Guidance Center can help you every step of the way, from building your plan to maintaining it over time. It factors in variables like inflation, Social Security, unpredictable markets, and tax considerations to help you develop a strategy for saving and investing.

You'll also get ideas for the next steps you can take to strengthen your financial foundation. After you have a plan, you can monitor it on your own or with the help of a financial professional. It can be an ongoing process, but taking the first steps toward planning can give you one less thing to worry about.