Fear of loss is a powerful motivator, but fear, like greed, is a dangerous sentiment for investors. After the financial crisis of 2008-2009, many investors clung to the seeming safety of cash, only to miss out on a 13-year bull rally. (Beware of letting nervousness over market volatility derail your long-term investment plan.)

Excessive fear of loss causes many investors to act counterproductively. "There is a segment of the investor population that knows they should hold stocks and who need that growth potential, but are too afraid to take that step," explains Stefne Lynch, vice president of product management at Fidelity Insurance Agency.

Fortunately, you don't have to treat growth and protection as mutually exclusive. Certain strategies can help you benefit from potential market gains, while protecting you on the downside.

The fiction of market timing

It is highly unlikely that anyone has ever successfully and consistently predicted stock market returns. The strategy of jumping in and out of the market is known as market timing; but buying low and selling high consistently is difficult to do.

Avoiding stocks altogether has major drawbacks too. Stocks provide the potential growth nearly every long-term investor needs to stay ahead of inflation. Cautious investors with long-term saving goals—those who will not need to access a portion of their assets for 5 to 10 years—may benefit from strategies that allow them to protect principal while investing some of their assets to benefit from the stock market's growth potential. If you fit that description, consider the following strategies: the anchor strategy or the protected accumulation strategy.

Anchor strategy

An anchor strategy involves dividing your portfolio into a conservative anchor and a more growth-oriented investment. The anchor portion of your portfolio uses investments that offer a fixed return, such as certificates of deposit (CDs) or single-premium deferred annuities (SPDAs). These assets have a set lifespan, and in this strategy, the amount you invest is designed to grow back with interest to your original principal. This portion of your portfolio acts as your anchor, while your remaining assets are invested in more volatile, growth-oriented securities such as stock mutual funds or ETFs.

A true anchor strategy protects your entire starting principal. For example, say you have $100,000 in assets and a 5-year investment period in a tax-deferred account. You could invest $82,200 in a 5-year SPDA yielding 4.0%—leaving you free to invest the remaining $17,800 for growth because after 5 years that SPDA would be worth $100,000.1

The anchor strategy can remove negative outcomes cautious investors sometimes fear because even if the markets fall, your anchor makes sure you at least have your initial investment.

Tip: Remember, inflation can erode the purchasing power of your original investment over time and this strategy generates taxes each year in a taxable account.

Protected accumulation strategy

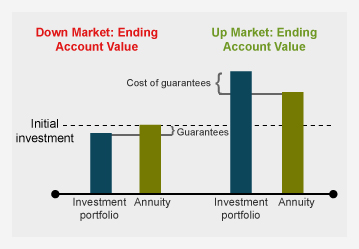

The protected accumulation strategy takes advantage of principal protection features on deferred variable annuities, commonly referred to as guaranteed minimum accumulation benefit (GMAB) riders. Your assets are invested in a portfolio that typically has a larger equity position than the roughly 15-20% stake outlined in the anchor strategy above. For a fee, the GMAB rider allows you to participate in the market for growth potential while guaranteeing that at the end of the annuity's investment period—typically 10 years—you'll at least have your initial asset value.2

Another potential benefit is that most GMAB riders let you reset the level of principal protection each year if your investments have grown in value. If you lock in a higher balance, the investment period resets and your balance is guaranteed for another 10 years. It is possible that your fee may increase if you elect to reset and annuity features will vary by the issuing company.

For example, let's say you originally invested $100,000 in a variable annuity with a GMAB rider. After the first year, the annuity's underlying investments grew to a value of $110,000. Locking in that new balance would guarantee that you would have at least $110,000, regardless of how the markets performed after a new 10-year period. Conversely, if the underlying investments lost value in that first year, you could be comforted by the knowledge that your original $100,000 was guaranteed.

Tip: If you do decide to implement a protected accumulation strategy, you should do your research as the GMAB terms and fees vary from one product or company to another.

Principal protection with growth potential

Which loss aversion strategy is right for you?

Determining which, if either, strategy makes sense for you will depend on a number of factors, including your investment goals, interest rate environment, fees on your investments, your time horizon, and your tolerance for risk. First, consider if you might be better off investing in a diversified portfolio, because either strategy (anchor or protected accumulation) may limit your upside growth potential—and the diversified portfolio may offer a greater long-term benefit.

You also need to consider when you will need access to these assets, because both strategies might penalize early withdrawals. For instance, redeeming a CD before it matures typically means forfeiting some or all of the interest earned, while annuities may levy a surrender charge representing a percentage of the account value. If your goal is less than 10 years away, the protected accumulation strategy is not a good fit.

Bottom line: The decision may well come down to your investor personality. With your principal protected from loss, would you gain the confidence to invest more aggressively than you are today? To recap:

- The protected accumulation strategy requires little action from you aside from your initial investment and an optional annual decision whether to lock in any growth.

- The anchor strategy requires that you invest the assets left over after establishing your anchor.

Those may or may not be decisions you're interested in making. "All these factors hit on the same point," Lynch says. "What kind of investor are you? What are you going to be most comfortable with, and most importantly, what will help you sleep better at night?"

Consider working with your financial professional to explore how to protect your principal while keeping a watchful eye on your overall goals, diversification of your portfolio, and exposure to taxes.