Learning to balance your financial obligations with your short- and long-term goals is an important skill. However, making money mistakes may make it harder. Avoiding some of the following missteps may help set yourself up for financial success in the future.

Mistake #1: Neglecting your savings

The secret to achieving most financial goals is saving money. While housing, utilities, food, bills, and other obligations are a priority, setting aside some of your earnings should be a just as important.

Look for areas you can save. For example, spending less on fast food, ridesharing, canceling or consolidating streaming subscriptions, or spending less on extracurricular activities are options that may help.

You could also consider maintaining a budget to help you track your spending and where your money goes.

Mistake #2: Spending too much on housing

It's a national benchmark to spend no more than 30% of your gross income on rent or housing. For example, if you take home $2,500 a month, you should spend around $750 on housing. Allocating about 30% of your income on housing may be a benchmark; that may not work for everyone. For example, if you live in high rent or less affordable areas, depending on your income, 30% may not cover the cost.

The amount you spend on housing depends on your financial situation and how you spend your money. For example, many young people have high student loan or other educational debt that are a big portion of their financial obligations.

Choosing to live with your parents can be a great strategy that can help your finances in the long run. You could also consider finding a roommate to help share housing cost, and even other household essentials. If solo living is your choice, you may be able to find special promotions offered by landlords, rental agencies, or secure a lower interest rate if you're looking to buy. Once you're ready to live on your own, be sure your housing costs don't jeopardize your long-term goals and you're paying an amount you can afford.

To learn more read Viewpoints on Fidelity.com: How much house can I afford? and Should you buy a home or keep renting?

Mistake #3: Having high interest rate credit cards and not paying outstanding balances

Credit cards can sometimes be used as a quick fix to financial hardships. However, in reality once you've accumulated a balance it can be challenging it repay your debt. High annual parentage rates (APRs) can also add to your problem.

If possible, try to pay off your entire statement balance before the end of your payment due date. Doing so may help prevent the card issuer from charging you interest.

It's a good financial decision to try and avoid maxing out credit cards, missing payments, and maintaining a credit utilization ration under 30%. For example, if your credit card limit is $2,500, try not to let your balance exceed $750.

Additionally, some card issuers are often willing to lower your interest rate if you have a history of on-time payments, as well as offer to waive late payment fees once or twice a year—but they won't, if you don't ask.

Credit card debt is a continuous problem, that can reflect negatively on you in the long run as a borrower, decreasing your credit score. Pay your balance; ditch your debt and spend wisely.

To learn more read Viewpoints on Fidelity.com: How to save for an emergency

Mistake #4: Not saving for retirement

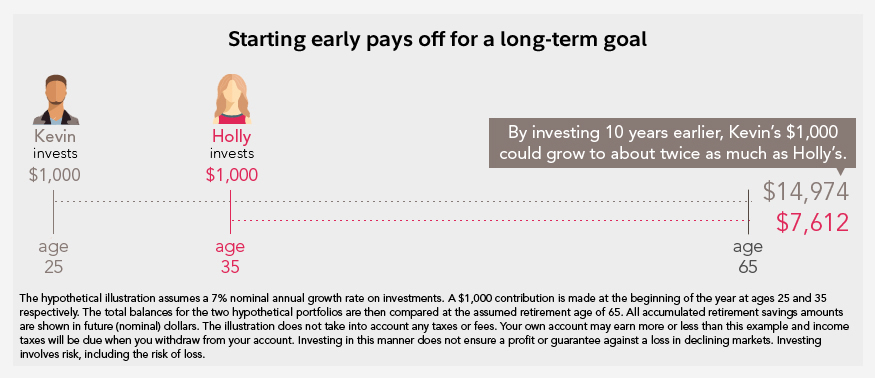

You're never too young to contribute to retirement, but lack of money is a common obstacle. Many young adults feel they can’t save enough to make a difference. However, saving even a little matters, especially early in your career because time is on your side. You have years for the power of compounding to work in your favor.

Over time, the money you invest can generate earnings of their own. The earlier you start saving, the less you have to in the future. Remember, even saving small amounts can boost your retirement contributions.

Mistake #5: Investing too conservatively for long-term goals

Many young investors are overly cautious. This could be because they don’t have a lot of money to begin with and are afraid of losing what they have.

If you have a long-term goal like retirement, an overly conservative approach to investing could mean skimping on the level of stocks in your investment mix, which tend to be more volatile than bonds. However, stocks historically tend to outperform bonds over the long run— considerably. You will likely need to save far more money to reach your long-term goals, leaving less room in your budget for anything else, if your investment mix is too conservative.

Of the three main investment types (stocks, bonds, and short-term investments), stocks have historically offered the opportunity for the highest return. Holding a diversified mix of stocks, bonds, and short-term investments could reduce the level of risk in your portfolio and potentially boost returns for that level of risk. An appropriate investment mix is one that balances the considerations of risk tolerance, investment horizon, and financial situation.

If you’re saving for retirement, you probably won’t access your money for 40 or 50 years, so what happens in the market this month or the years to come is much less important than what’s likely to happen over the coming decades.