Many employers are offering HSA-eligible health plans to their employees. These plans are also known as high-deductible health plans (HDHPs) and are paired with HSAs. If your company offers this option and you are not taking advantage of it, you may miss an opportunity, as HDHPs are generally the lowest-premium and HSAs can play a valuable role in your financial wellness.

To learn more, read about a hypothetical account holder through their first year with an HSA.

Tip: If you are already enrolled in an HSA-eligible health plan, but do not have an HSA to which your employer is making contributions, consider opening a Fidelity HSA®.

You may have heard that HSAs are a convenient way to pay for out-of-pocket costs, such as doctor visits or prescriptions at your local pharmacy. HSAs can also be used in a variety of ways to help manage other current qualified medical expenses, as well as for future qualified medical expenses—even after you retire.

HSAs: The basics

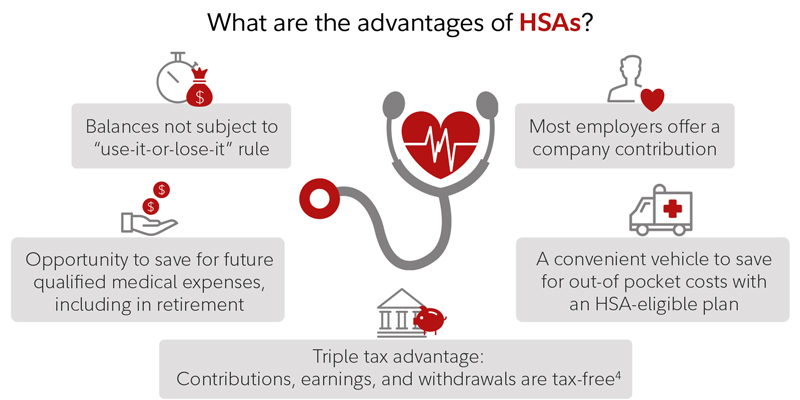

HSAs are accounts that work in conjunction with an HSA-eligible health plan to allow employees to pay for qualified medical expenses. If you put money in an HSA and use that money to pay for a doctor's visit or another qualified medical expense anytime now or in the future, you'll never pay federal taxes on that money. Although state taxation may vary, most states follow federal tax law in this area.

Additionally, unlike health flexible spending accounts (FSAs), HSAs are not subject to the "use-it-or-lose-it" rule. Funds remain in your account from year to year, and any unused funds may be used to pay future qualified medical expenses.

For 2025, the IRS contribution limits for health savings accounts (HSAs) are $4,300 for individual coverage and $8,550 for family coverage. The HSA contribution limits for 2026 are $4,400 for self-only coverage and $8,750 for family coverage. Any employer contributions will count toward these limits.

If you're 55 or older during the tax year, you may be able to make a catch-up contribution, up to $1,000 per year. Your spouse, if age 55 or older, could also make a catch-up contribution, but will need to open their own HSA. See IRS Publication 969 for more on annual HSA contribution limits.

You can use your HSA to pay for some or all your qualified medical expenses each year and let the rest of the money potentially grow for use in the future, including retirement. If you have the cash to pay your medical costs out of pocket, you can also let your entire HSA grow tax-free for future qualified medical expenses.

Once you’ve paid a qualified medical expense out of pocket, you can reimburse yourself at any time, even years later. It's a good idea to save your receipts, just in case you need to substantiate a claim or take a reimbursement from health accounts in the future. Having a record of past qualified expenses can help you remember bills paid years or even decades ago. If the IRS requests documentation, producing receipts can help easily prove your claim.

If you have a Fidelity HSA or an employer-sponsored health benefits plan administered by Fidelity, you can store receipts in the Fidelity Health® app. Receipts can also be stored on Fidelity.com.

To learn more about how to pay yourself back for qualified medical expenses, read Fidelity Viewpoints: HSA reimbursement guide.

Watch Money Unscripted from Fidelity

On this episode of Money Unscripted from Fidelity Investments, join host Ally Donnelly and Fidelity pro Amy Richardson as they explore ways an HSA could help you now and in retirement.

3 healthy HSA habits

Consider how these healthy habits can help you get the most value from your HSA, now and in the future:

1. Cover anticipated out-of-pocket health care costs. Each year, during annual enrollment, you have the opportunity to make health care choices that serve the needs of you and your family. You may be wary of enrolling in an HDHP because you are concerned about potential out-of-pocket costs. You may worry about what will happen in the event of a sickness or accident, or even where you'll get the money to pay the deductible. These are concerns.

First, consider factoring in the deductible and any out-of-pocket costs. You may not realize that you may be paying more in premiums for a "lower-deductible" plan—such as a traditional preferred provider organization (PPO) plan—whether you need services under the plan or not.

Those who elect an HSA-eligible plan typically pay a lower premium for health coverage and can direct those premium savings to their HSA to help cover any "worst-case" expenses. HSA-eligible plans also generally provide generous coverage above the higher deductible, including an out-of-pocket maximum for protection. To add, most preventive care and screenings are typically covered 100% by insurance, including HSA-eligible plans.

Tip: Consider how much cash on hand you may need to cover anticipated or unanticipated qualified medical expenses at any one time. If you’re not sure how much to set aside in cash, you may want to start by keeping your plan's in-network deductible in cash and make changes over time as needed. Then, you can invest the rest of your HSA dollars for the longer term, perhaps for use in retirement.

Also, while you cannot be enrolled in a general-purpose FSA if you elect an HSA-eligible plan, some employers may offer the option to enroll in an HSA-eligible FSA. This means, for 2025 you can potentially set aside up to $3,300 pre-tax in a limited-purpose FSA1 to pay for current year dental and vision expenses. For 2026, you can potentially set aside up to $3,400 in pre-tax dollars. However, the employer would set the maximum level allowed, which could be less than $3,300 for 2025 and $3,400 in 2026. Unlike an HSA, the amount you set aside in an FSA will typically face use-it-or-lose-it rules each year. Consult your employer to see what they offer.

2. Take advantage of available employer contributions. If your company supports your efforts to save with an employer contribution to your HSA, then you’re in good company.

The average employer contribution varies for individual and family coverage, depending on several factors, for example, the employer size, type of plan, and employee demographics. Some employers may not contribute at all.

Combined with your own contributions, those from your employer can go a long way to meeting any anticipated qualified medical expenses. While employers may have different rules and timing for their contributions, a common approach is to deposit their full annual contribution into your account at the beginning of the year, or as soon as you enroll in the HSA-eligible health plan and open your HSA.

Your HSA is portable. If you leave an employer or open a new HSA with a different provider, you can transfer your existing account to the new one. Consolidating your HSAs can help you centralize your savings, minimize fees, access investments, and potentially take advantage of compounding growth in your investments.

3. Save and invest for future qualified medical expenses. While individual tax situations will vary, the triple tax advantages offered by HSAs merit a closer look. Generally, an HSA-eligible health plan with an HSA enables you to set aside pre-tax dollars through a payroll deduction plan.

An HSA can also be funded with after-tax dollars, which can be taken as a tax deduction on your personal taxes. These contributions can accumulate and can be withdrawn tax-free to pay for current and future qualified medical expenses, including those in retirement.2 An HSA balance can remain in your account from year to year, and you can take it with you should you switch employers or retire.

HSAs can positively impact your tax situation. For example, an individual in the 22% federal income tax bracket could potentially save nearly 30% in taxes (federal income + FICA + potentially state income) on each dollar contributed to the HSA through a payroll deduction. The tax benefits of HSAs are a good way to help you save—and invest. Investing a portion of your HSA dollars can be a smart move, supporting longer-term goals by potentially growing your balance faster.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

For many, health care is likely to be among their largest expenses. Fortunately, employees who have access to an HSA-eligible health plan through their employer may have the option of saving and investing in an HSA to help pay for current or future qualified medical expenses (such as prescription drugs, doctor's visits, hospital stays, and vision and dental care).

Tip: After receiving other important benefits, such as your full employer match on a 401(k), and paying down credit card debt, consider contributing the maximum that you can afford to your HSA or up to your maximum annual contribution limit.

4 ways to use your HSA in retirement

Once you retire, there are additional ways you can use the money:3

1. Bridge to Medicare If you retire prior to age 65, you may still need health care coverage to help you bridge the gap to Medicare eligibility at 65. Generally, HSAs cannot be used to pay private health insurance premiums, but there are some exceptions, including paying for health care coverage purchased through an employer-sponsored plan under COBRA and paying for health care coverage while receiving unemployment compensation.

Retiring before 65? Explore health insurance options and estimate potential costs before you’re Medicare-eligible.2. Cover Medicare premiums You can use your HSA to pay certain Medicare expenses, including premiums for Part A (if applicable), Part B and Part D prescription drug coverage, but not supplemental (Medigap) policy premiums. For retirees over age 65 who have employer-sponsored health coverage, an HSA can be used to pay your share of those costs as well.

3. Long-term care expenses Part of the cost for a "tax-qualified" long-term care insurance policy can be covered.4 You can do this at any age, but the amount you can use increases as you get older.

4. Pay everyday expenses After age 65, there is no penalty if you use HSA money for anything other than health care. However, you will have to pay income tax, similar to withdrawals from your 401(k).

Tip: Generally, a person approaching retirement and planning to use their HSA for retirement medical expenses should consider investing somewhat less aggressively than they do for other retirement assets, given the shorter investment horizon.

Summary

HSAs offer several benefits, not only for short term spending, but also saving for longer-term qualified medical expenses, including those in retirement. The healthy habits outlined here can help you better understand how to take advantage of this growing health care savings opportunity.

Remember, if you have a Fidelity employer-sponsored HSA, you can log into NetBenefits® to access your account, pay medical bills, make investment decisions, and more.