For the past 4 decades, market-friendly long-term trends in population, policy, and productivity have helped stock and bond markets deliver returns for investors. Rising globalization, regulatory reforms, advances in information technology, and increased trade have all contributed to strong growth of the global economy and investment returns that have been higher than long-term historical averages.

According to Fidelity's Asset Allocation Research Team (AART), the favorable trends of past decades may be giving way to a new environment of slower growth, increasing geopolitical risk, and declining globalization in which investors may want to reconsider where they seek opportunities. AART expects economic growth will slow in the US and other developed economies during the next 20 years, with potential consequences for financial markets.

AART's researchers study productivity and population data from a wide variety of countries and they see demographic trends, including aging populations in developed economies, as key factors that imply slow growth ahead.

In this future, individual investors who need the sorts of returns that have been typical in the past may consider looking to global stocks and bonds from faster-growing countries as well as alternative investment strategies that have previously been utilized mostly by high-net-worth individuals and institutional investors.

Why economic growth matters for investors

Economic growth influences corporate earnings growth, interest rates, and many other factors that affect the long-term performance of stock markets. Since the end of World War II, and especially during the past 4 decades, the world's economies have become more closely linked as many barriers to the free movement of capital and people have been lowered. The result has been a long period of increased economic growth in much of the world which has helped lift stocks. If those long-term global growth trends are indeed slowing, it may mean less support for stock market returns over the next 20 years. Slower growth may also mean lower interest rates, which could affect income-seeking bond investors.

To be sure, while GDP forecasts can provide guidance for investors seeking to set realistic expectations for future returns from their portfolios, other factors, such as stock market leverage and valuation dynamics, will also play a role in how stocks perform. For bonds, GDP growth may affect interest rates, but investors should also bear in mind starting yields and other considerations. It’s also important to remember that in addition to long-term trends, economies experience regular patterns of shorter-term growth and contraction known as the business cycle will also move markets over the shorter term.

Why growth may slow

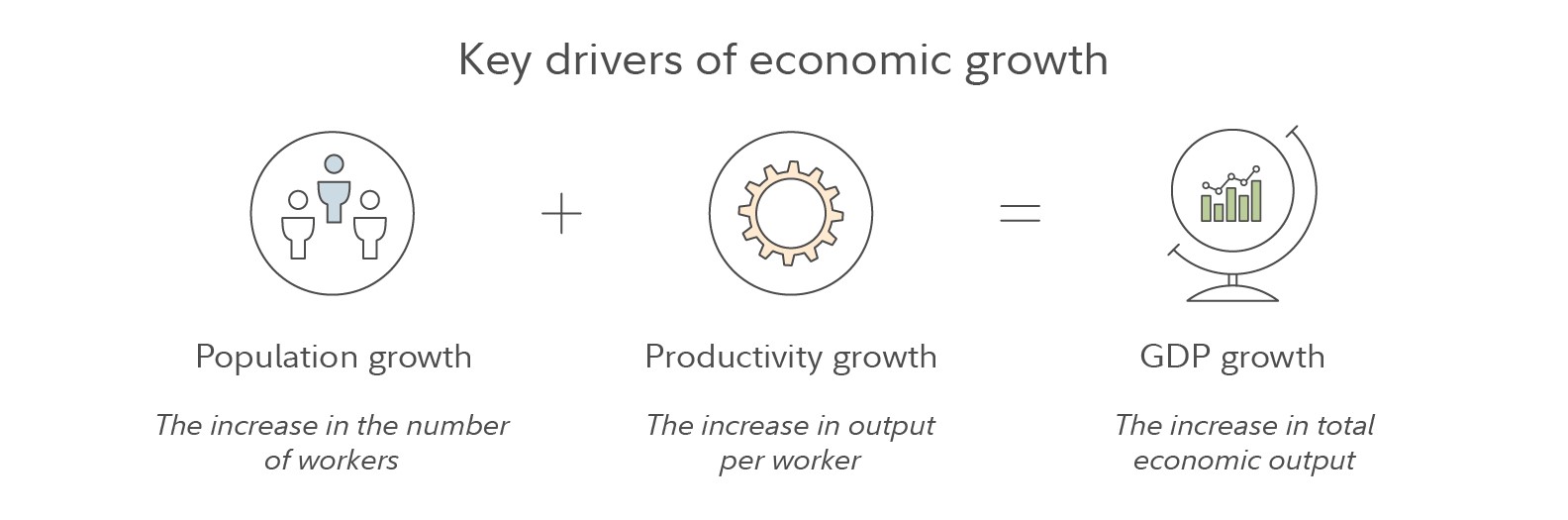

To understand why growth may slow, it's useful to consider why economies grow or shrink in the first place. Economic growth results from increases in the number of people working and in the amount of output those workers produce. That means that a country's labor force has a direct impact on GDP growth. It reflects the number of working-age people who live there and the percentage of them who are either working or seeking work. In advanced economies, longer lifespans and low birthrates are producing aging populations that grow more slowly and tend to participate in the labor force at lower rates. As a result, developed economies such as Japan and parts of Europe are likely to see their labor forces shrink over the next 20 years as people live longer and birth rates remain low.

Immigration policies, however, could have a notable impact on these forecasts. In Europe, an influx of relatively young people could help offset the aging of the population, while more-restrictive immigration policies could have the opposite effect.

While predicting population trends that affect GDP is relatively easy, making predictions about productivity is more complicated. For most of world history, productivity grew extremely slowly and economies generally expanded in line with their populations’ growth. In 1820, the largest economies were China and India, which also had the largest populations. After that, technological innovation powered rapid productivity gains and by 1900, the US was the world’s largest economy, despite having only one-fifth as many people as China.

Some economic forecasters believe the US possesses an inherent dynamism that will maintain this type of high productivity growth over the next 20 years, perhaps boosted by artificial intelligence, robotics, and other technologies.

Others believe the era of strong productivity growth is ending. They point out that per capita income has stagnated in the US and other developed economies, while technology seems less transformative than before. For instance, recent advances—such as mobile connectivity—have yielded consumer luxuries such as new smartphone apps rather than revolutionary innovations. Fidelity's analysts believe both perspectives suffer from a narrow focus on the US and do not reflect a global economy in which emerging countries account for a large share of output. Instead, they forecast productivity growth by looking at 3 proven drivers of productivity, which they call people, structure, and catch-up potential.

The educational and scientific achievements of a nation’s people are sometimes referred to as its human capital, and the higher the human capital, the more productive its economy.

Structurally complex economies tend to be competitive, use technology effectively, and possess healthy business climates and institutions. They also typically produce a greater and more sophisticated variety of products than other economies.

An additional driver of productivity growth is the ability of less-developed countries to grow quickly from low levels of development, adopt existing technologies, and catch up to the higher income levels of developed countries.

Some developing economies such as South Korea have grown greatly over the past 20 years, and their rapid increase in industrialization and income has left less catch-up potential for the years ahead. The silver lining, though, is that their increased complexity and human capital may boost their future productivity.

Meanwhile, poorer developing countries such as India and Indonesia have made relatively less progress and retain considerable catch-up potential.

In between lie countries such as China and Malaysia, which face the challenges of middle-income countries but with more sophisticated human capital and complexity than many others.

Investing ideas for a slower future

As an old saying goes, "It's tough to make predictions, especially about the future." However, those investors whose portfolios are well diversified across a broad, global opportunity set may be best positioned to take advantage of future growth, slower though it may be.

Mutual funds and ETFs can be used by investors who are interested in the diversification and long-term growth potential of global stocks and bonds and Fidelity's mutual fund screener1 can help you find global investment ideas. (Note: These results are illustrative and are not recommendations by Fidelity or the fund managers.)