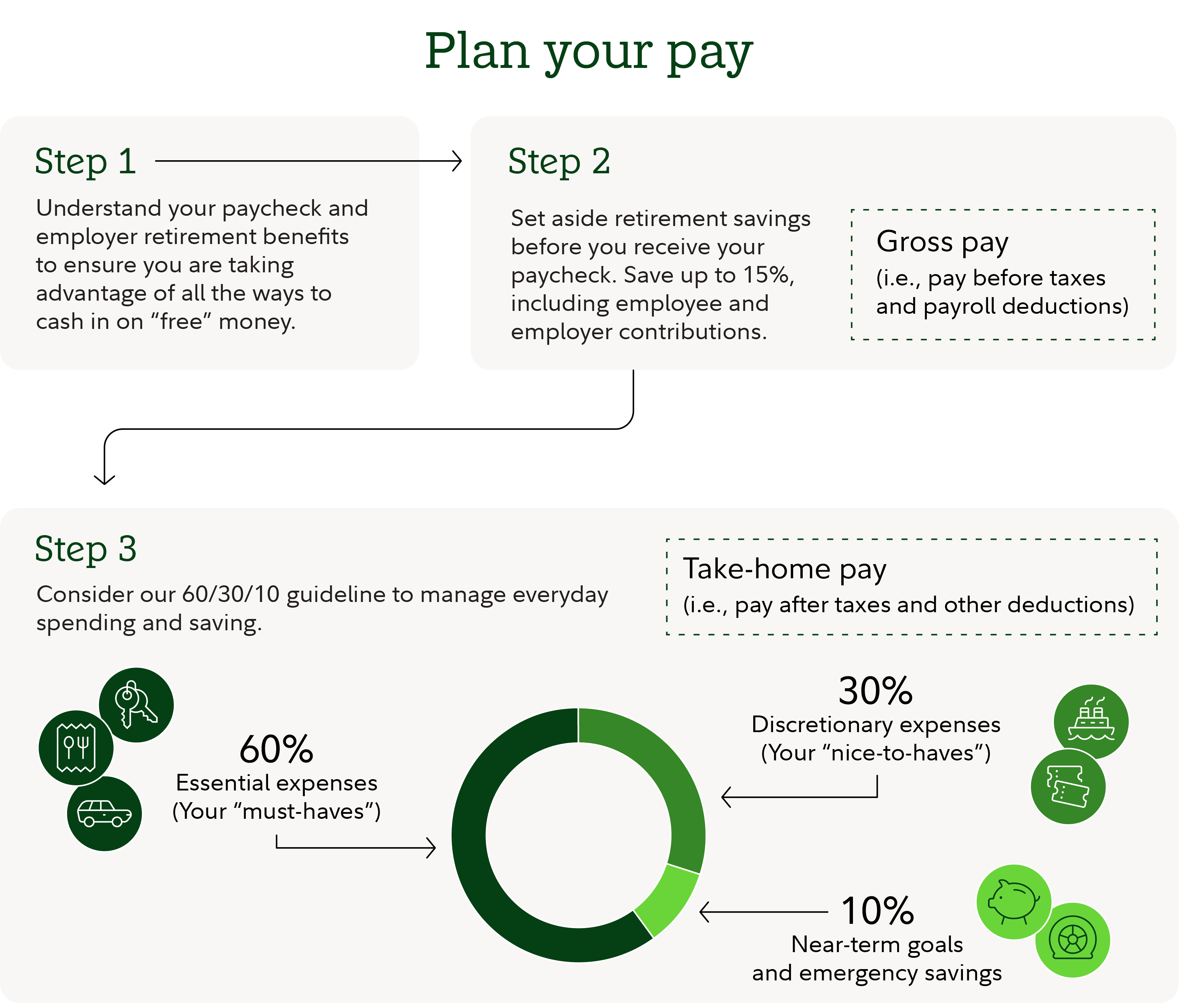

Managing your money doesn’t have to be complicated. Fidelity’s Plan Your Pay (PYP) guideline offers a simple starting point:

- 60% or less of your take-home pay for essential expenses

- 30% for nice-to-have extras

- 10% for near-term goals and emergency savings

And aim to save 15% of pre-tax income for retirement—including any employer match. Even small, consistent steps can make a big difference over time.

Because everyone’s situation is different, these numbers are goals—not hard rules. If you’re not there yet, that’s OK. PYP is a target you can work toward gradually to strengthen your financial foundation.

15%: Pay yourself first and save for retirement before you get your paycheck

We recommend saving 15% of pre-tax income for retirement. This includes your contributions plus any matching or profit-sharing contributions from an employer. Starting early, saving consistently, and investing wisely can be important to hitting your retirement goal, as is saving in tax-advantaged retirement savings accounts such as 401(k)s, 403(b)s, or IRAs. Read Fidelity Smart MoneySM: 9 types of retirement accounts

The easiest way to save before your get your paycheck is by contributing to an employer's workplace saving plan. Many employers match contributions up to a certain percentage of income, which is like “free” money—so saving at least up to the match makes good sense if you can. Whether you contribute before taxes are taken out (traditional account) or after taxes are taken out (Roth account), your retirement contribution to a workplace retirement plan is made before you get your paycheck.

But what if you don't have a retirement plan through your employer? You can still automate your savings. Consider setting up direct deposit to an IRA or schedule automatic transfers from your checking/spending accounts on the day you get paid. Read Fidelity Viewpoints: Help your money grow with automation

Is saving 15% too much to handle right now? Don't worry, simply start by saving what you can. Try to save at least enough to get any match offered by your employer and then aim to increase the amount you're saving just a little bit with every raise and promotion. It really can add up.

Read Fidelity Viewpoints: Just 1% can make a big difference

Must-have expenses: 60%

Some expenses simply aren’t optional—you need to eat and you need a place to live. Consider allocating no more than 60% of take-home pay to “must-have” expenses, such as:

- Housing—mortgage, rent, property tax, utilities (electricity, etc.), homeowners/renters insurance, and condo/home association fees.

- Food—groceries only; do not include takeout or restaurant meals, unless you really consider them essential; i.e., you never cook and always eat out.

- Health care—health insurance premiums (unless they are made via payroll deduction) and out-of-pocket expenses (e.g., prescriptions, copayments).

- Transportation—car loan/lease, gas, car insurance, parking, tolls, maintenance, and commuter fares

- Child care—day care, tuition, and fees.

- Debt payments and other obligations—credit card payments, student loan payments, child support, alimony, and life insurance. If you use your credit card to pay daily expenses that are already categorized in your budget, be sure to only count those once.

What if your essential expenses are more than 60% of your take-home pay?

Everyone's financial life is unique, and some life stages are more expensive than others. If your essential expenses consistently run over 60%, it can make sense to try to slim down some of them down so you can save more and have more money for fun. For example, saving some money by looking for bargains at the grocery store and bringing your lunch to work can help free up some money and may give you some breathing room.

For more tips, read Fidelity Smart Money:SM How to save thousands in a year and 13 ways to make money fast

It can also be a good idea to familiarize yourself with your employer benefits, if you have them. There can often be benefits that offer "free" money and discounted premiums so make sure you are taking full advantage of everything your employer offers. Read Fidelity Viewpoints: 4 ways employer benefits can help you save money

30%: Nice-to-have expenses

While not essential to your survival, these types of expenses make life a little better. We suggest putting 30% of monthly take-home pay toward things you choose to spend your money on, like restaurants, entertainment, hobbies, travel, subscriptions, and charitable donations.

10%: Near-term goals and emergency savings

Setting aside 10% of monthly take-home pay can help save for both significant events and smaller, unplanned expenses. Being financially prepared will help you feel more confident and less likely to pay for things by adding to an existing credit card balance.

For instance, if you're saving for a vacation or a new car, money in this category could help boost your efforts. You could also think about setting aside this money to help with "one-off" expenses like a new smartphone, car repairs and maintenance, buying holiday gifts, and so on. It's good practice to have some money set aside for random expenses so you won't be tempted to tap into your emergency savings or pay for one of these things by adding to an existing credit card balance.

If you would like to build up your emergency savings, you could consider using some money allocated here as well. If you're starting from scratch, aim to save $1,000 or one months' worth of essential expenses, whichever is more. Then gradually build up to saving enough to cover 3 to 6 months of essential expenses.

Read Viewpoints on Fidelity.com: How much to save for emergencies

What about other goals—like saving for a child’s education?

If you’re planning ahead for future education costs—say, college for a child—that savings would typically come from the 10% category for near-term goals. This bucket is designed for things you want to fund over the next few years, and education savings fits that description.

On the other hand, if you’re currently paying education expenses—such as tuition or fees—that’s more like an essential cost and would fall under the 60% category for must-have expenses. These are obligations you need to cover now, similar to housing or child care.

Why Plan Your Pay?

Separating retirement savings from your everyday budget helps you see two things clearly: what you’re setting aside for the future and what’s available for today. Our guideline breaks this into simple parts—covering daily spending, short-term goals, and long-term savings like retirement.

The underlying research and math supporting our guideline suggests that it can help you achieve financial stability today and maintain your current lifestyle in retirement.

Plan Your Pay with Fidelity's 60/30/10+15 guideline

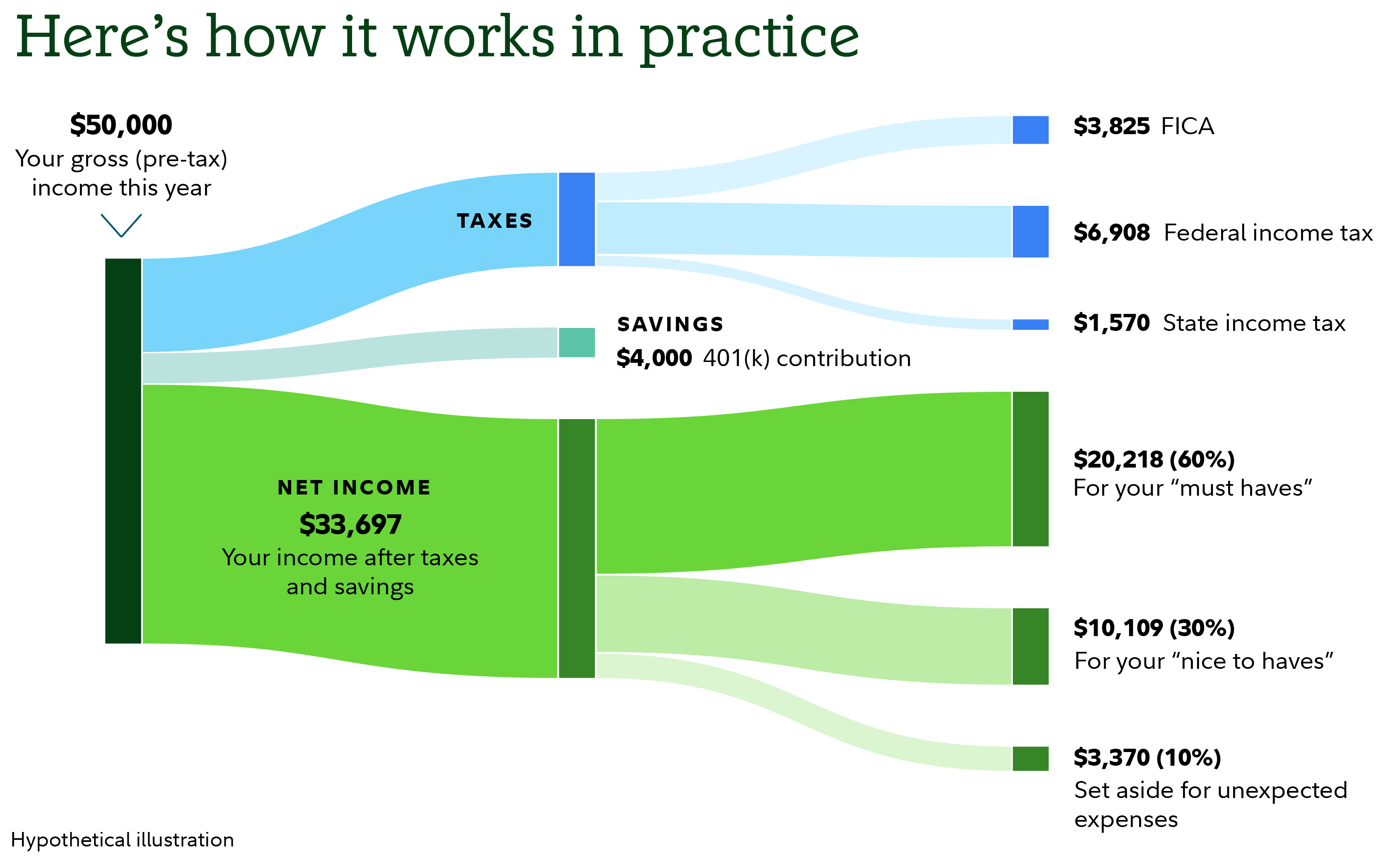

| Gross income | $50,000 | |

| FICA | 7.65% | $3,825 |

| Standard deduction | $14,600 | |

| 401(k) contribution (employee contribution) | 8.00% | $4,000 |

| Federal tax | 22% | $6,908 |

| State tax | 5% | $1,570 |

| Take-home pay | $33,697 | |

| Essential | 60% | $20,218 |

| Discretionary | 30% | $10,109 |

| Other | 10% | $3,370 |

For hypothetical illustration. Shows a hypothetical annual budget for a single filer in tax year 2024. Federal and state taxes may vary. Other deductions may apply depending on the state.

What's next?

Our guideline is meant to be a flexible starting point—not a substitute for a full financial plan. The good news is that it's not about tracking every penny, it's about feeling in control of where your money goes. Using the 4 categories can help you understand your spending and the flexibility you have in your finances. Life changes—new job, marriage, kids—can shift your cash flow, so be sure to revisit your budget regularly, especially after major events.

If you feel that you have a good grasp on the amount of money coming in and going out each month, you may be ready to start optimizing your finances and growing your wealth. If you’d like some help managing spending, consider using Fidelity’s free digital tools.