There are literally thousands of mutual funds—and there are more ways to measure and compare funds than most people even have time to consider.

For some investors, a single fund can help to simplify the process. Target date funds, target risk funds, and managed accounts are all single options that can provide diversified investments within and across multiple asset classes, including stocks, bonds, and cash. But for folks who are looking to evaluate individual fund options, as building blocks for a diversified investment strategy, there are still lots of choices.

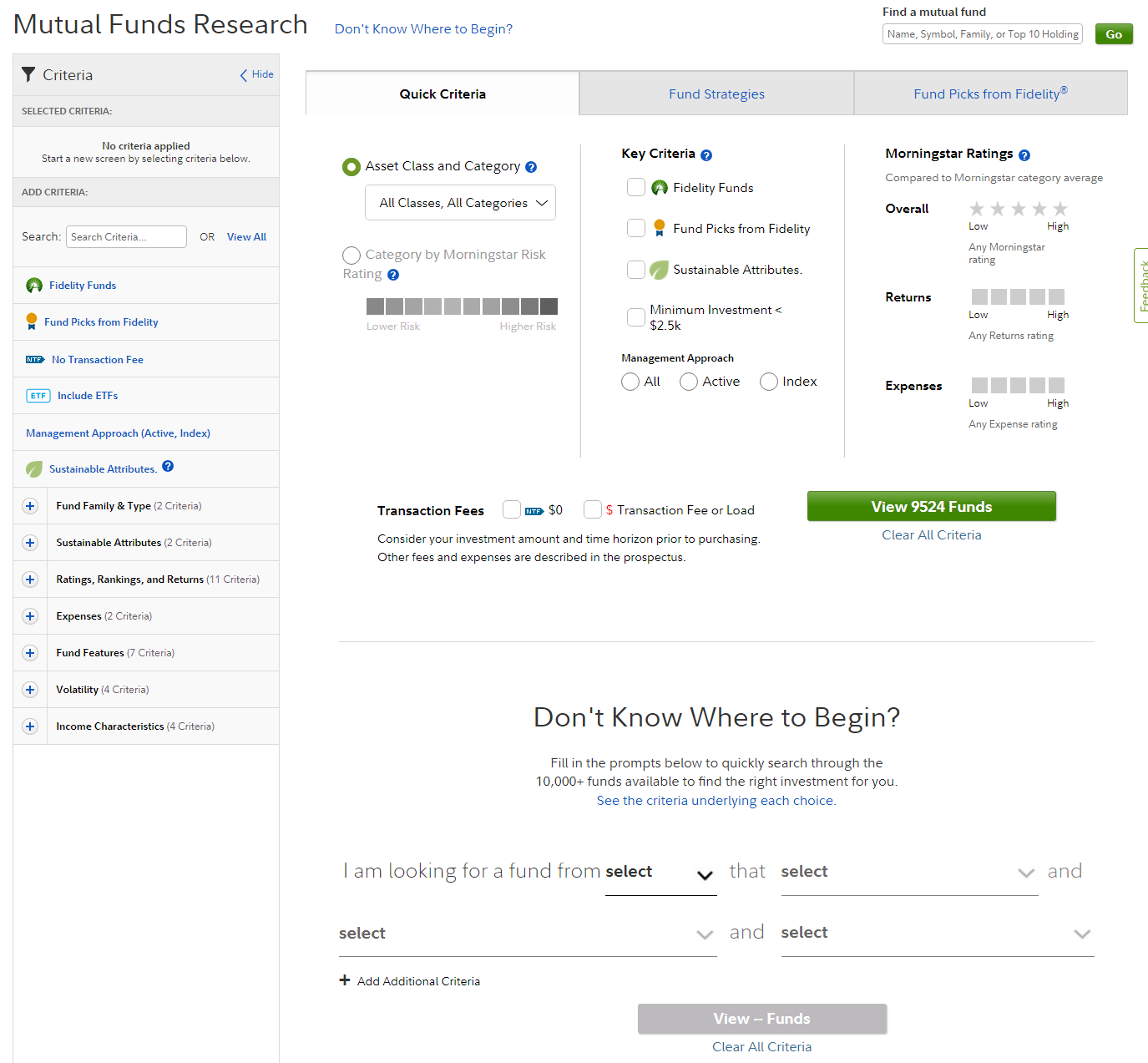

Fortunately, there are a few high-level criteria you can rely on to help narrow down the vast array of funds out there into a reasonable set of choices. Here are 3 key criteria used by the Fidelity Mutual Fund Evaluator, an online tool that can help you find fund ideas to research.

1. Start with your strategy

We think a good investment is one that makes sense for your financial situation, goals, timeline, and risk tolerance. So it makes sense to start with an overall asset mix that takes into account stocks, bonds, and cash.

Within those categories you will want to diversify among company size, style, issuer, credit quality, and other criteria. The Fidelity Mutual Fund Evaluator offers 10 top-level asset allocation choices, each broken down into more specific categories. A fund’s category and specific strategy matter a great deal because each category has a different risk profile. Adding higher-risk investments may or may not make sense for you, but the risk level is among the most important criteria to consider when you make an investment choice.

2. Consider performance

Performance is a bit tricky. Many investors look at past performance when trying to choose a mutual fund, but past performance is not a guarantee of future results. In fact, recent results are not typically a strong indicator of how a fund may perform in the future, as very few top-performing funds remain near the top for long. Similarly, while some poorly performing funds will improve, many others will continue to struggle.

Still, you may want to use a Morningstar rating or look at the long-term performance of a fund to help narrow down your field of choices. For instance, you might consider eliminating funds with a long track record of very poor performers, which may be at risk of being closed or merged into other funds, or funds that show excessive swings in performance, which may be riskier than you prefer. While the predictive power of performance is complex, measuring performance is pretty straightforward; performance is typically presented as the annualized rate of return over various periods of time. The Mutual Fund Evaluator allows you to screen for funds by quintile of performance, with a default setting of 3 years—so you could filter out the top 20%, 40%, or 60% of funds based on 3-year average annual performance.

The Morningstar rating is a little more complicated. A fund gets a Morningstar rating after 3 years of existence. However, the star rating takes into consideration account loads, sales charges, and redemption fees, looks back at the risk-adjusted performance of a fund for 3-, 5-, and 10-year periods, and weights the results across these time periods depending on the tenure of the fund. The star rating also weighs cost and the consistency of performance—a higher rating suggests that performance has been more consistent, with all else equal. Funds that have delivered bigger swings in performance relative to their peers are penalized, particularly if those swings are losses.

3. Think about costs

Costs are an important consideration when selecting a fund. Consider the expense ratio of the fund. It's the percentage of assets paid to run the fund. Many costs are included in the expense ratio, but typically only 3 are broken out: the management fee, the 12b-1 distribution fee (named after a section of the Investment Company Act of 1940), and other expenses.

Also, you may want to consider transaction fees. You could choose to eliminate funds with transaction fees, sometimes called loads. A transaction fee reduces your initial investment in the fund, and the impact of that initial cost can be long-lasting. However, in some cases, funds without transaction fees charge higher ongoing fees, so you may want to compare the total costs of your options.

A deeper look

These high-level criteria should help you narrow down your options and make a reasonable choice. You may want to dig deeper by researching the particular strategy of individual investment options, considering how much the manager has invested in the fund, how long the fund holds the securities it buys, how the fund's holdings compare to the benchmark it uses for performance tracking, and the capabilities of the company that manages the fund.

There are many other criteria you may wish to consider, and it's important to spend time doing your research before you pick a fund. But remember, among the most important factors to consider is how your investment fits into your overall strategy. If you start with your goals, financial situation, timeline, and risk tolerance to create an appropriate asset mix, then consider performance and look for low costs, you should be well on your way to finding an appropriate choice.