The S&P 500 is trading within close range of its all-time highs in late August, as investors have largely shrugged off tariff, interest rate, and economic slowdown worries.

What do the charts say? Investors that use indicators to help figure out which direction stocks may go over the short term can find that MACD, despite the rally in stocks, may be generating some conflicting trading signals recently—potentially signaling that investors are looking for market direction.

What MACD says now

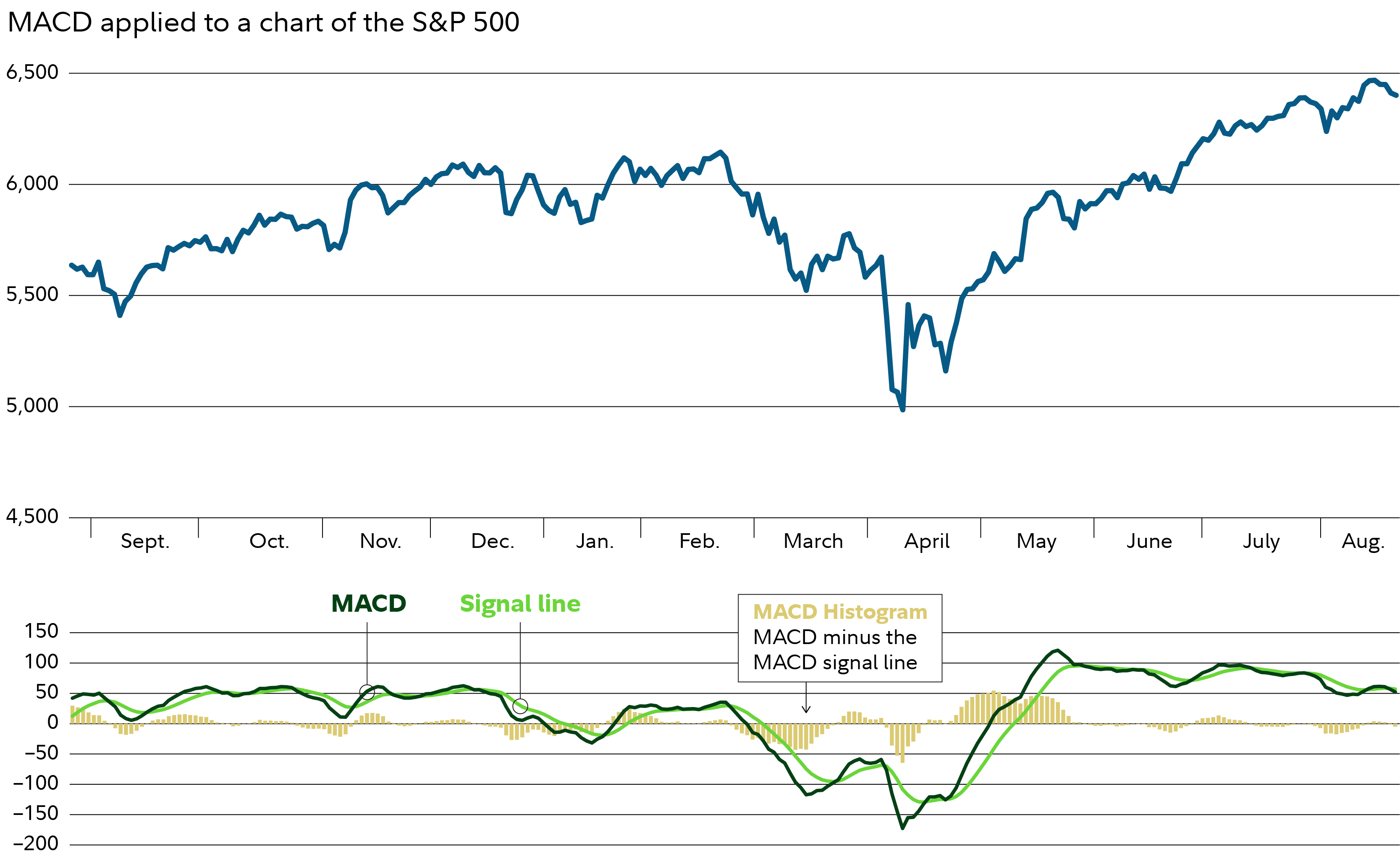

The Moving Average Convergence-Divergence indicator, commonly known as MACD, is a technical indicator consisting of 2 lines—the MACD line and the signal line—as well as a bar chart.1 It is used to generate buy-and-sell signals with readings that suggest something is overbought (i.e., potentially expensive) or oversold (i.e., potentially cheap). MACD is a momentum oscillator that is generally best employed in trending markets—where prices are trending in a particular direction. The chart below, which illustrates what MACD looks like under the price chart on top, shows how stocks have been trending higher since mid-April and are now near all-time highs.

Short-term buy-and-sell signals are generated by the MACD line and the signal line. If the MACD line crosses above the signal line, this may be interpreted as a buy signal. Alternatively, if the MACD line crosses below the signal line, this may be interpreted as a sell signal. This indicator has been generating frequent buy-and-sell signals over the past several months, as these 2 lines have been closely tracking each other. For example, a buy signal was generated on August 12 and a sell signal was generated on August 19.

These 2 lines fluctuate around the zero line. A sell signal is given when the signal line or the MACD line crosses below the zero line, and a buy signal is given when either cross above the zero line. The MACD line crossed above the zero line in early May, generating a buy signal. The zero line is also significant because it can act as support and resistance.

Some chart users think oscillators like MACD are most valuable when they reach their boundary's extreme levels (i.e., the MACD and signal lines are relatively far away from the zero line). The signals using this interpretation would be as follows: When the MACD line is well below the zero line in extremely negative territory, it can suggest an investment may be oversold (i.e., a buy signal). Alternatively, when MACD is well above the zero line in extremely positive territory, it can suggest an investment may be overbought (i.e., a sell signal). Currently, neither line is near what might generally be considered an extreme level. It's worth noting that MACD can theoretically rise or fall indefinitely.

The difference line, represented in the chart by the blue bars, is typically presented as a bar chart around the zero line. This bar chart represents the difference between the MACD line and the signal line. It helps depict when a crossover may take place. Recall that a crossover generates buy-and-sell signals. A narrowing of the difference line (i.e., when the bars decrease) illustrates the potential for a crossover. The current difference line highlights just how closely the MACD and signal line have been tracking one another for several months, which might suggest there may be indecision as to which direction investors generally think stocks are headed.

Confirming the trend

One technique that chart users may use to confirm the direction of the trend is to determine whether the MACD indicator is making higher highs or lower lows in conjunction with the price. Some traders that utilize this strategy wait for a "trigger," or some sort of confirmation of the divergence. While the S&P 500 has been making higher highs, MACD has not. This may suggest that there is some divergence between the bullish price action for stocks and where investors think the next move may occur.

In sum, the various conflicting signals generated by MACD may suggest a more neutral market that may not trend up or down. Of course, fundamental factors could quickly change this outlook. Keep an eye on the latest market developments, both in the charts and in other data, to stay ahead of the trend.