Some investors prefer to let experts manage their money, while others like to take a more hands-on approach. Many employ a combination—investing most of their portfolio in professionally managed products, and setting aside a portion to make their own investments. If you like to make some, or all of your own investing decisions, there are a number of tools that can help you.

Here are 5 ways you can research stocks and manage your investments using online tools—many of which you might already have at your disposal.

1. Research platform

One of the most helpful, do-it-yourself resources for investors is a research platform. A research platform can provide a wealth of information, such as quotes for individual stocks, company financial statements, key company statistics, and more. Even advanced investors and traders may be surprised to discover how extensive the tools and resources are that can be found in a particular platform.

Fidelity.com offers a powerful research platform within the News & Research tab. You can access information on not only stocks but sectors and industries, exchange-traded funds (ETFs), mutual funds, bonds, options, IPOs, and annuities.

You can also enter a company/security or its ticker symbol in the search bar. This will bring you to a specific company’s snapshot page where you can find a plethora of information that can help you research publicly traded companies or financial securities.

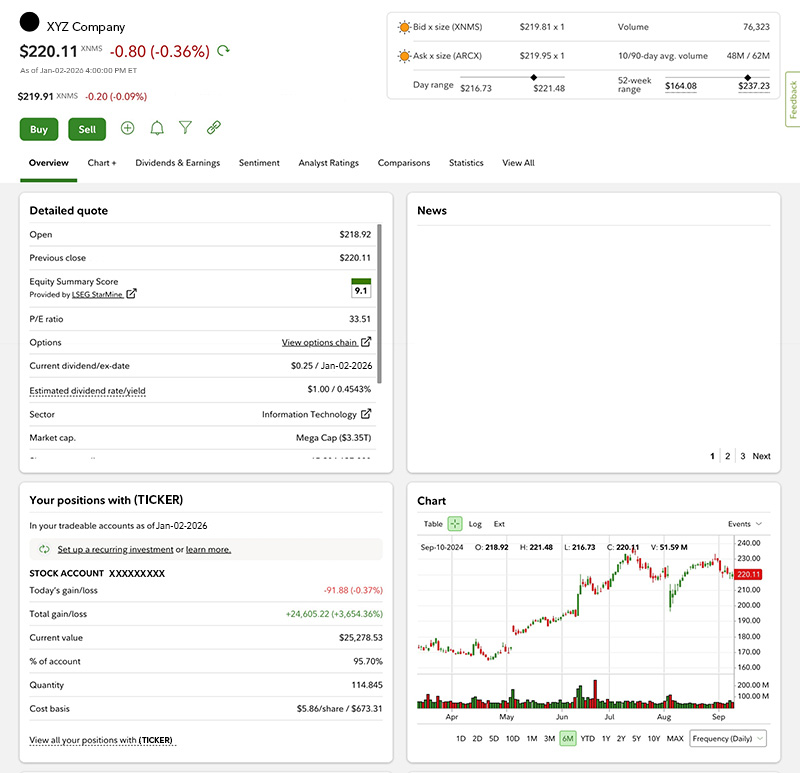

Suppose you were considering investing in a stock. On its snapshot page, you can find a detailed quote containing vital information such as the current stock price, average daily volume, and annual yield (see the example image below). You’ll also be able to look at a chart of the stock’s price, find the latest news and research reports, and see other key statistics.

A research platform can act as the gateway to the information needed to make informed decisions, and help determine how a potential investment fits with your time frame, investing objectives, and risk tolerance.

2. Assessing the essentials: fundamentals and technicals

If you're the type of investor who likes to dig into numbers, it helps to have easy access to this information. Fortunately, stocks listed on exchanges in most developed markets are required to release their financial statements to the public. This information is critical to performing fundamental analysis on a company to determine whether it’s a worthy investment.

Fundamental analysis is the process of evaluating a company's business performance and competitive positioning—such as revenues, expenses, earnings, and cash flow. This information can be found on Fidelity.com.

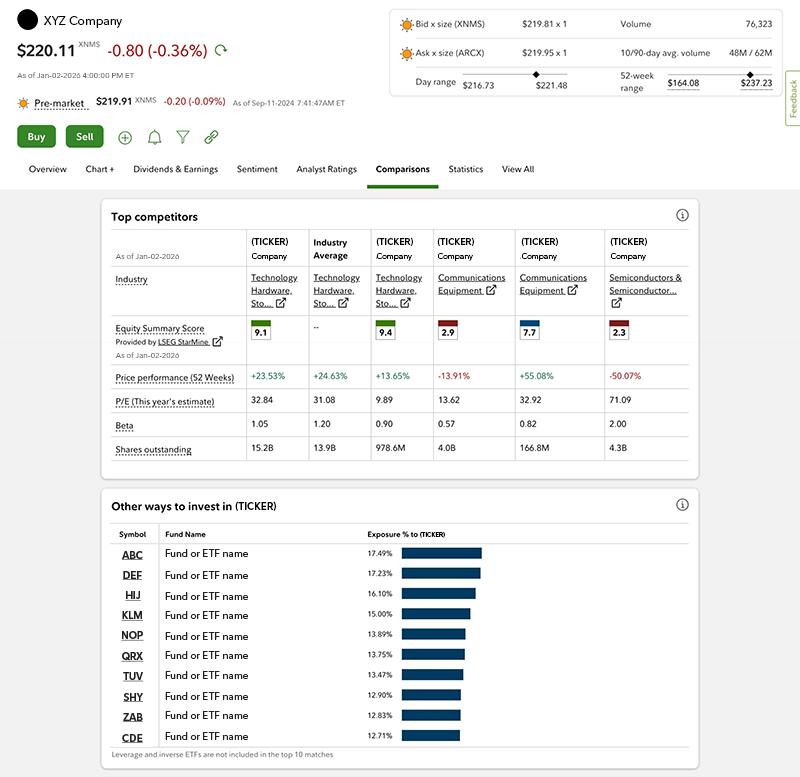

A stock's earnings, growth rates, dividend yield, and more can be found on its snapshot page, along with a helpful comparison against top competitors and industry benchmarks (see the example image below).

Another method of analysis, known as technical analysis, involves looking at charts to try to detect tradable patterns. You can also accomplish this on Fidelity.com, as well as on Fidelity's trading platform for active traders—Fidelity Trader+™ Desktop.

You can fully customize any chart on Fidelity Trader+™ Desktop with a number of indicators, change time frames, and more. Additionally, Fidelity.com offers advanced chart & technical analysis for listed companies on major exchanges (a login is required). This feature can be found above the chart on a stock's snapshot page.

3. News and research reports

Being aware of potentially market-moving news can make a big difference when you are deciding when to buy or sell stock. Major news reports that are released could have major impacts on the stock price—something that could affect your decision to buy or sell the stock.

Having easy access to news reports can be an invaluable resource. On Fidelity.com, there is a dedicated News & Events link for every listed company. A stock’s news feed can be found next to the chart. In Fidelity Trader+™ Desktop, you have the option of customizing a news feed for stocks you're watching on your interface—so you don’t miss anything.

Social media is increasingly being used by investors to get the latest information. To find out what is being said on social media, consider using the Social Sentiment indicator to see what news is trending.

Just as news reports can be a market-moving event, so can analyst research reports. Influential stock analysts—experts whose job is to focus entirely on a particular sector or industry of the market—often have a valuable understanding of a company. While you may be researching stocks when you have the time, analysts spend their working time evaluating these stocks. Consequently, their views can often carry significant weight. Analysts can move a stock with their recommendations alone, just like an important piece of news. For companies that have analyst coverage, you can find these ratings on the stock’s snapshot page.

If you'd rather not read through individual analyst research reports on a company, you can find a stock's Equity Summary Score (ESS) by LSEG StarMine from Refinitiv on Fidelity.com. This is a consolidated view of the ratings from a number of independent research providers, all in a single score. It allows you to quickly get a sense of how analysts view a stock at a given point in time. You can find a stock’s ESS on its snapshot page below the chart (a Fidelity.com login is required).

4. Screeners

When it comes to searching for investing ideas, filtering through all the opportunities available can be an arduous task—if you don’t have the right tools.

A screener is a tool that can help you quickly find investing candidates. Screeners sort through the market to find matches based on an array of characteristics, and can help you narrow the list of stocks that you want to do further research on—whether it's for stocks that have strong growth potential or those that generate a relatively higher income of payments. Fidelity.com offers a variety. You can screen for stocks, ETFs, and mutual funds.

While screeners are extremely powerful tools, it’s important to realize they do not replace the need for further analysis. Just because a stock or other security shows up in a screen you’ve run, does not mean it is worthy of an investment. Screeners can simply act as an efficient vehicle to look for opportunities in the market that meet your desired objectives and risk tolerance.

5. Practice and review

Understanding your investing goals and risk tolerance, and knowing how to research stocks and other investments that meet those objectives, is the first step. What matters is when you actually make an investment, and then how you manage that position over your investing time frame.

One way that you can learn how to make your investments is to practice trade. You can research how a stock or other security trades using a practice trading program.

Once you've made your investment choices, managing them is critical to being successful. You can use all the tools mentioned above to monitor and research your open positions. There are also ways to determine whether the stocks you’ve researched and chosen are a good mix when looked at as a whole.

Fidelity offers a Planning & Guidance Center, a guidance tool that compares your current portfolio with your target asset mix so you can evaluate areas that may need adjustment. This portfolio-level review can be a great way to see whether the stocks you've researched are collectively meeting your investing objectives. You may also want to consider Fidelity's Performance & Analysis experience, which can help you break down the investments in your portfolio and identify areas that may need more attention.