If you are an experienced options trader looking for a limited-risk strategy that can take advantage of low volatility, the iron condor might be the way to go.

How do you construct an iron condor?

The iron condor is generally considered a combination of two vertical spreads—a bear call spread and a bull put spread. This strategy has four different options contracts, each with the same expiration date and different exercise prices.

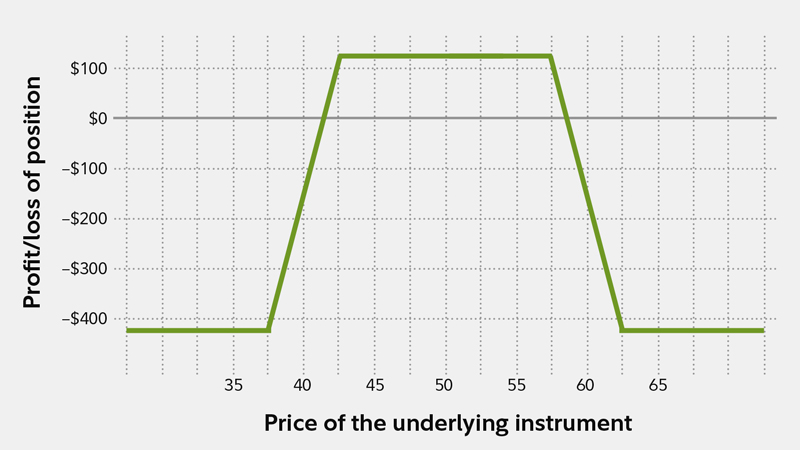

To construct an iron condor, a trader would sell an out-of-the-money call and an out-of-the-money put, while simultaneously buying a further out-of-the-money call and a further out-of-the-money put. Like the butterfly spread, the iron condor gets its name from the profit/loss diagram that resembles a large bird with wings.

The primary reason that a trader would consider the iron condor strategy, compared with other low volatility options strategies, is that it typically allows the trader to generate a larger net credit for the same risk. However, it's important to realize that there are additional costs associated with option strategies that call for multiple purchases and sales of options, as is the case with an iron condor—due to there being four "legs" of the trade.

Profit/loss diagram of an iron condor

The objective of the iron condor

Traders who think an underlying security’s price will not move much by expiration and want to limit their risk could consider constructing an iron condor. The benefit of this strategy, as previously stated, is that it generally allows a trader to generate a larger premium, while limiting potential loss. Additionally, the margin requirement to support the position is limited to just one spread, allowing for a higher potential return on investment.

The iron condor is a limited-risk, limited-profit strategy that benefits from low volatility in the underlying security while the strategy is open. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset does not move much (that is, it settles between the two inner sold options at expiration).*

A loss on an iron condor would be realized if the underlying security’s price did move and closed outside either of the break even prices. The maximum potential loss is calculated as the difference between the strikes of either spread, times the contract size, less the premium received at initiation which occurs when the underlying price is below the lowest put strike that was bought or above the highest call strike that was bought.

Understanding the maximum potential profit and loss is crucial to an iron condor trade. The strategy is designed to generate a small profit, and while the potential loss is larger than the profit potential, the loss is capped. Moreover, depending on how the iron condor is constructed, it is possible to increase the probability of a profitable trade, albeit at the expense of profit potential. So, you can trade off some profit potential for increasing the likelihood of a profitable trade.

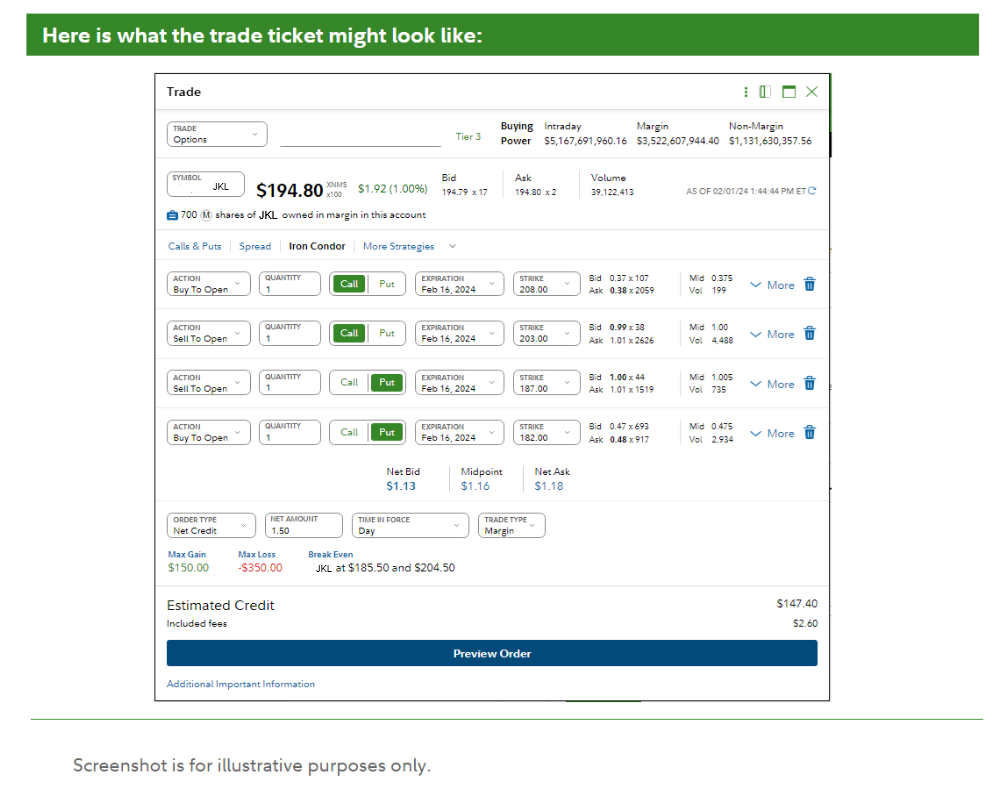

A hypothetical iron condor trade

Assume that on February 1st, JKL is trading at $194.80. To construct an iron condor, a trader would initiate a multi-leg options strategy. This could be done by purchasing one February 182 put with a $0.50 premium at a cost of $50 ($0.50 premium times 100 shares controlled by the one contract) and one February 208 call with a $0.50 premium at a cost of $50 ($0.50 premium times 100 shares controlled by the one contract). At the same time, to complete the iron condor a trader would sell one February 187 put with a $1.25 premium at a credit of $125 ($1.25 premium times 100 shares controlled by the one contract) and one February 203 call with a $1.25 premium at a credit of $125 ($1.25 premium times 100 shares controlled by the one contract).

In this scenario, the trader would receive $150 at the outset of the trade ($250 received from the sold 187 put and the 203 call, less $100 for the purchased 182 put and the 208 call). This $150 credit is also the maximum profit potential. If the underlying stock were to settle anywhere between the two inner sold options (the 187 put and the 203 call) at expiration, the maximum profit potential would be realized. This is because all four options would expire worthless, and so the trader would get to keep the premium received at the outset.

If JKL closes anywhere outside the breakeven points ($185.50-$204.50), a loss would be incurred. For example, if it moved below $182, a loss would be incurred because the call options would expire worthless, except the sold 187 put and the bought 182 put. The difference between the strikes would be worth $5 to the person you sold it to (187 minus 182, 100 shares controlled by the contract). Hence, the maximum loss of $350 is realized ($500 loss one the difference of the strikes, less the $150 credit received at initiation). Similarly, if JKL moved above $208 at expiration, the put options would expire worthless except the sold 203 call and the bought 208 call. Again, this would result in the maximum potential loss of $350. It is worth noting that, even if the underlying fell below $182 or rose above $208, the loss usually will not exceed $350 because of how the iron condor is constructed.

More tips

Choosing the proper strike prices is crucial to being successful with the iron condor. It is important to understand the trade-off between the probability of success and maximum profit potential. Traders will seek to position the sold strike prices close enough to produce a higher net credit, but far enough apart that there is a strong probability of the underlying asset’s settling between the two at expiration. By narrowing this range, a trader is reducing his or her probability of success. The further apart these strike prices are, the better the probability of the underlying security’s settling between the two prices at expiration.

One way to forecast this probability is by using delta. A short contract with a delta of 0.05, for instance, would be two standard deviations, representing a 95% probability of the contract’s expiring out of the money. The trade-off for this very high probability of a successful trade would most likely be a very small credit received. As previously mentioned, you can also adjust your desired profit in order to increase or decrease the probably of a profitable trade.

The most significant factor is your volatility expectation. If you do believe a low volatility environment will persist, iron condors can be a powerful, limited-risk tool.