Creating a chart can be a helpful way to visualize how well your portfolio is (or isn’t) performing against a benchmark. But are your charts optimally set up to help you make investing decisions based on your specific strategy, objectives, risk constraints, and time horizon? Here are 3 tips to consider when setting up your charts.

1. Choose a time frame that matches your investment horizon

When you first open up a chart, it will most likely be set to a default time frame (e.g., 6 months or a year). One of the first things you should do when setting up your chart is adjust the default time setting to your desired time frame.

Adjusting the time frame to align with your objectives is important because the trends that may be evident over the course of one period of time can appear much different when looking at another time frame. For example, a downtrend could clearly be present in a 1-month chart. However, if you were to change the time frame for the same chart to 1 year, that 1-month downtrend could look more like a minor correction amid a much longer-term bullish uptrend. Consequently, looking at different time frames can provide needed context.

Using Fidelity's brokerage platform Fidelity Trader+™ Desktop, for example, you can adjust the time frame using the preset options (e.g., 10 days, year to date, 1 year) on the bottom left of the chart or by manually entering a time frame on the bottom right. On a stock or ETF's snapshot page on Fidelity.com, you can select one of the preset options on the bottom of the chart or use the slider to change the time frame (see the chart below).

Adjust the time horizon on your charts to your desired setting

Choosing a time frame that aligns with your investment horizon is critical—for a number of reasons. If you are a longer-term investor with a 1- to 10-year time horizon, for instance, looking at an intraday or 1-week chart wouldn’t make much sense. Instead, you might choose to look at a 5- or 10-year chart so that you can get a broader sense of the long-term trend that more closely aligns with your investment time horizon. Alternatively, if you are thinking about a short-term momentum trade, for example, a multi-year chart would probably not be appropriate.

A potential solution is to look at multiple time frames all at once. In Fidelity Trader+™ Desktop, you can easily open up 4 windows in a single screen. If you were employing a sector rotation strategy, for instance, you might choose to look at 3- and 6-month time frames to get a sense of the shorter-term trends, as well as 1- and 5-year windows to evaluate the longer-term trends.

As previously mentioned, your investment horizon should be the primary time frame of your analysis. However, looking at different time frames can help you understand the whole picture.

2. Select the type of chart

Common charts are line charts or open-high-low-close charts (OHLC charts). OHLC charts are more commonly referred to as bar charts. On Fidelity.com, Candle charts are the default option. You can adjust the chart per your preference (see the chart below).

Selecting the type of chart depends on your desired granularity of price information

Each plot on an OHLC chart shows 4 pieces of price information, whereas a line chart—which is the most simplistic type of chart—plots just closing prices and connects each plot with a line.

On Fidelity.com, if you click Styles menu above the chart, it will allow you to change to a "mountain" or "candlestick" chart, in addition to an OHLC chart and a line chart. A mountain chart is similar to a line chart, with the exception that the area underneath each plot is shaded in, intending to help show trends more clearly. A mountain chart is not commonly used.

On the other hand, a candlestick chart quite dramatically changes the look of a chart and is popular among some advanced chartists. Candlestick charts combine elements of line and bar charts to depict how a stock or other security trades. Each individual candlestick shows a security’s open, high, low, and close for a day, week, or month, depending on the time frame you choose. Candlestick charts enable candlestick pattern analysis—a method of technical analysis that seeks to find identifiable and repeatable patterns based on charts consisting of Japanese candlesticks. Candlestick charts are most applicable for advanced chart users who are familiar with candlestick pattern analysis.

3. Select a comparable index and add technical indicators

Once you have the time frame and type of chart established, it may help to place the stock or other investment opportunity that you are looking at in the context of a relevant market index. One way to do this is to add a comparable index or security to the chart.

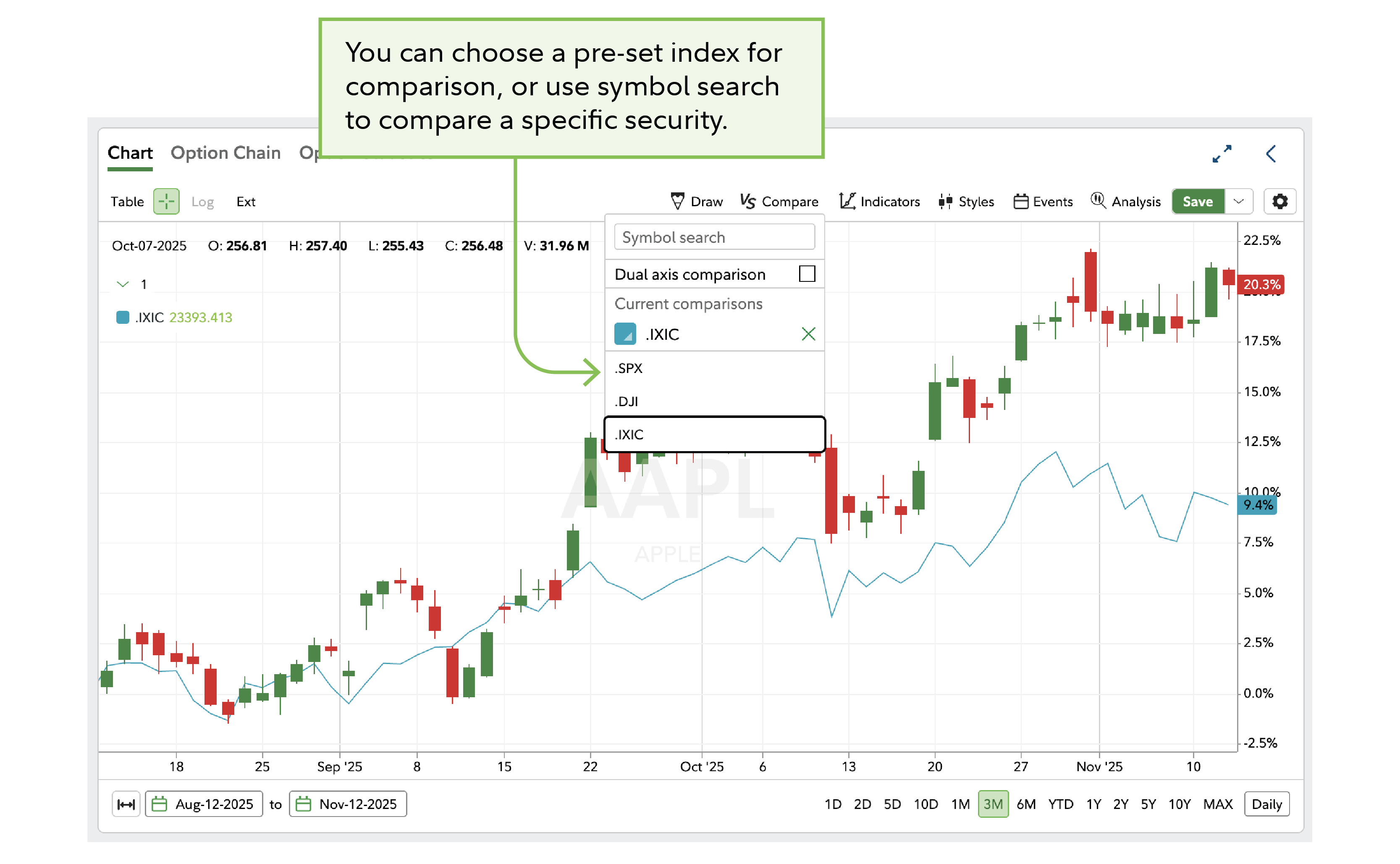

For instance, if you were analyzing a technology stock, it might be beneficial to add the S&P 500® Index or a technology index to compare it with. This can help add more context to the stock's performance by comparing its relative strength with the rest of the market or a comparable benchmark or stock. On Fidelity.com and Fidelity Trader+™ Desktop, you can easily do this by selecting Compare above the chart and entering an appropriate selection (see the chart below).

Add a comparable to your chart to get some context

Other components that you might consider adding to your charts are technical indicators—such as moving averages and support/resistance lines—that can help identify trends, help determine whether a market or individual investment is overbought or oversold, and help decide at what price level to buy or sell.

There are a number of indicators that you can add to your charts by selecting Indicators above the chart on Fidelity.com or in Fidelity Trader+™ Desktop. With that said, once you are familiar with using charts, you can experiment with these indicators, along with other chart settings, to help you best see the whole picture.