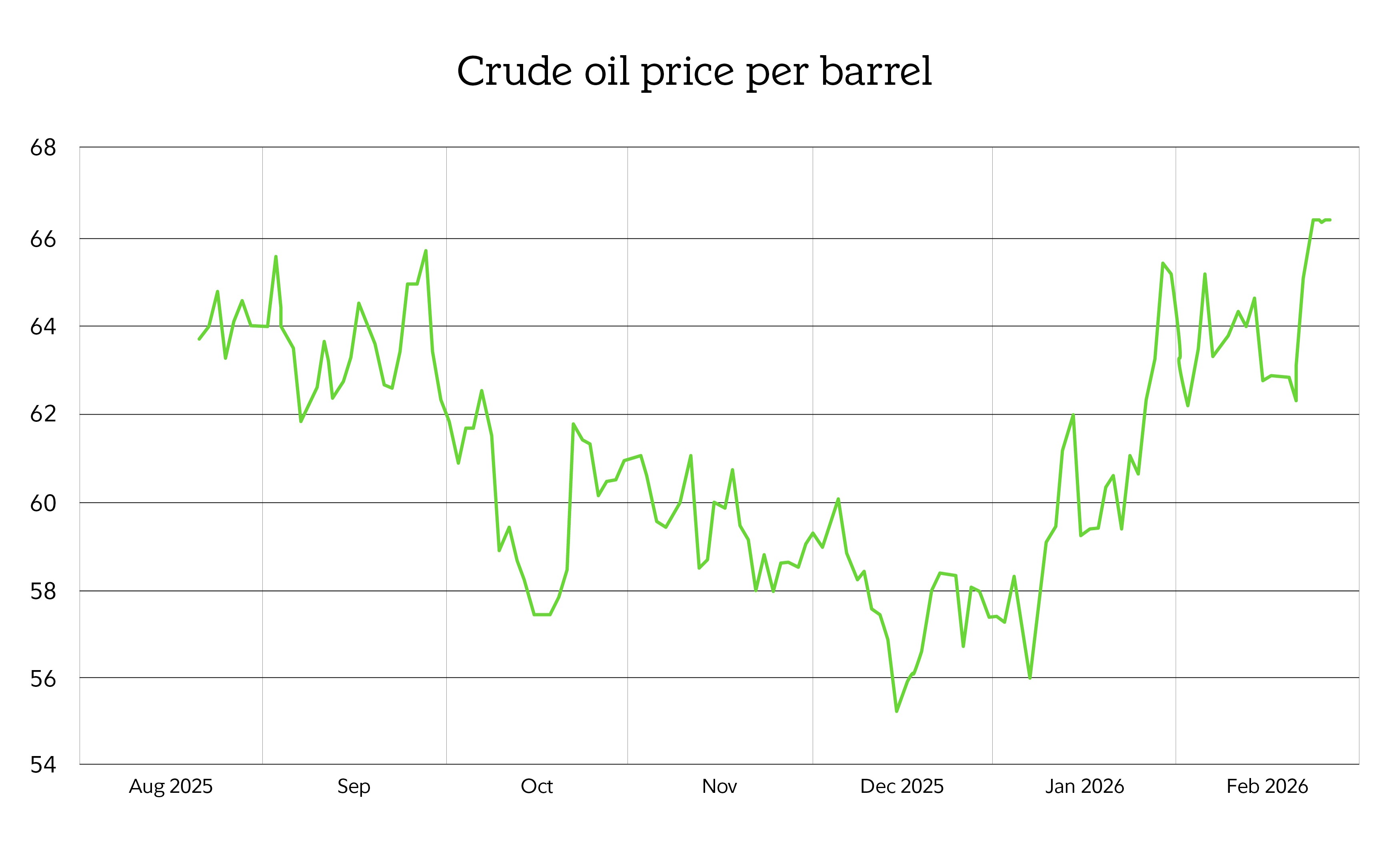

While investors have primarily been focused of late on the Supreme Court tariff ruling, the artificial intelligence wave, interest rates, and other factors, a major risk has percolated. Oil prices have climbed nearly 15% in 2026, driven in large part by short-term geopolitical conflicts that have countered longer-term structural factors that have kept prices lower. Relatively higher energy prices could threaten to undermine stocks by increasing operational costs across the economy.

Source: FactSet, as of February 24, 2026.