Women face different realities when it comes to their physical and mental health, so they need to plan differently too. There’s been a spotlight on women’s unique health considerations in recent years, with providers and startups working to close gaps in care. But we also need to talk about the costs that come along with these special considerations, from family planning to menopause, heart health, and more. Fortunately, the more you know, the more you can get ahead of your health costs, today and in the future. Here’s a guide to help you plan with confidence.

Women pay more for health care over their lifetime

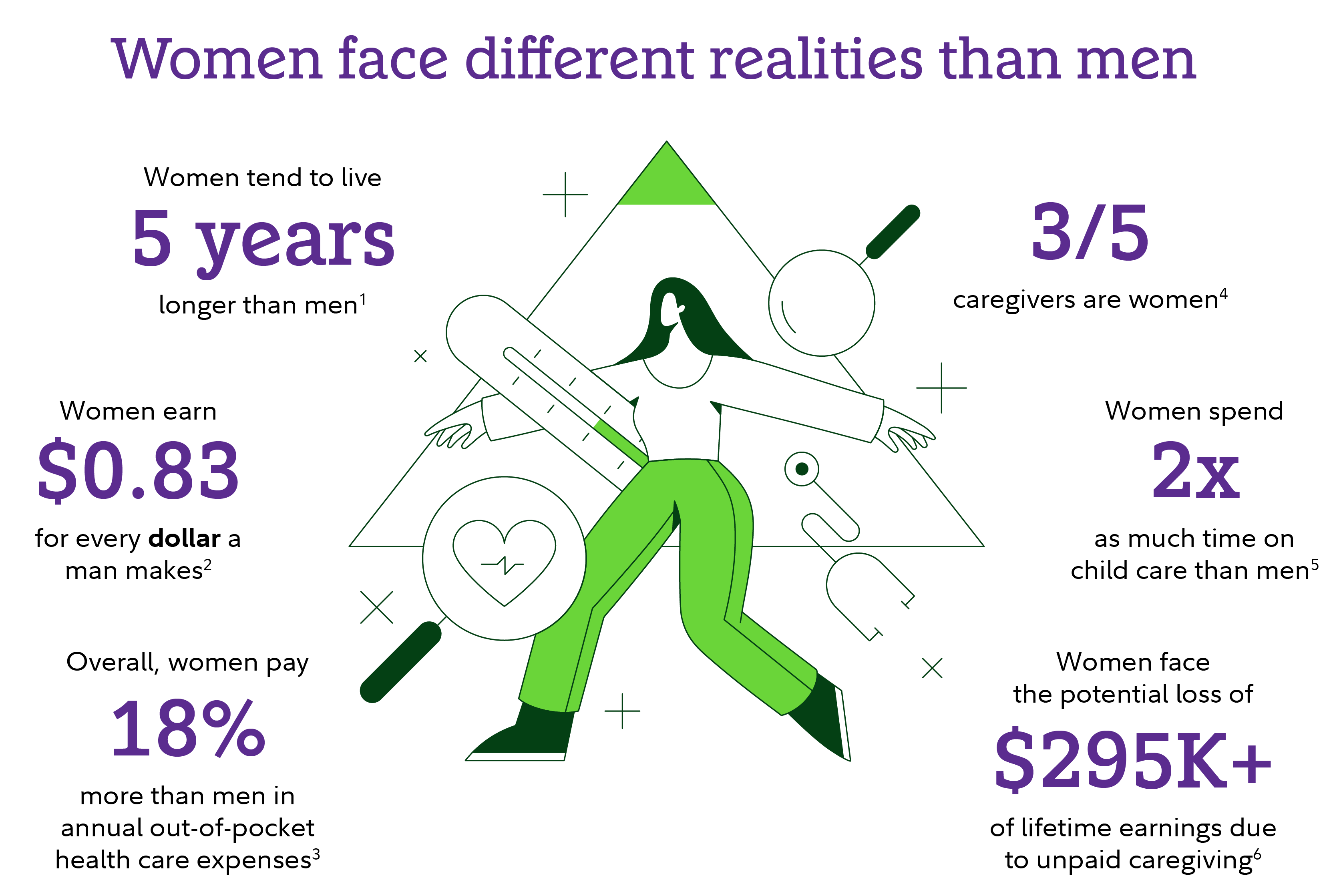

If it feels like your health care costs are piling up, you’re not alone. Women tend to pay almost 18% more for health care over their lifetime compared to men.1 Even when excluding maternity-related services, women’s costs are higher. This is in part because women tend to visit health care professionals more often and receive services that surpass deductibles. This can be a positive: Being proactive with your care can have long-term health benefits. But it can also mean paying more out of pocket, which can impact your savings over time.

“When we understand the unique realities women face, it helps us plan better and more efficiently.”

– Sasha Heathman, CFP®, Fidelity Workplace Financial Consultant

The costs aren’t just financial—they’re physical and emotional too

When it comes to women’s health, there are a variety of hidden financial, physical, and emotional costs to consider related to the following.

- Retirement: On top of the higher out-of-pocket costs, women tend to live about 5 years longer2 than men on average, which can mean a longer retirement. This can be great—more time to do what you love. But that longer retirement means you need more in savings to help it last for your lifetime. Plus, the gender pay gap—along with higher health care costs—can impact your ability to save and invest for the future.

- Physical health: Women have a higher risk of certain diseases, including breast cancer, certain heart issues, and Alzheimer's.3,4,5

- Family planning: Out-of-pocket family forming and postpartum journeys can add up, between in-vitro fertilization, surrogacy, adoption, legal fees, postpartum medications, counseling, and more.

- Menopause: Many women experience menopause-related challenges that can impact their career, yet many workplaces are still catching up when it comes to implementing policies that focus on and address this transition. In some cases, women leave the workforce during their peak earning years due to difficult-to-predict menopause symptoms, which can affect their savings and retirement plan.6

- Caregiving: Women are also more likely to take time off from the workplace to care for a child, adult, or aging family member. A career break can mean leaving money on the table, including potential raises, promotions, and bonuses, plus lost wages can affect Social Security and pension payouts. There’s also the money you might not be able to contribute to a retirement plan, and any employer matches. Read up on the emotional and financial costs of caregiving.

Both the hidden and more overt costs can add up and have real implications for your lifetime, not to mention your mental health. Women are often expected to navigate their personal and professional lives through these occurrences, all on top of being an advocate for themselves and their loved ones.

“The bottom line is being a woman shouldn’t come with hidden or higher costs. And no one should have to choose between the care they need and the care they deserve.”

– Karen Volo, Fidelity Head of Health and Benefit Accounts

Here are 4 ways you can help mitigate costs, create a plan, and make the most of any employer benefits you may have.

1. Use a health savings account (HSA) to save for health care costs—today and in the future

An HSA can be a powerful way to save. It’s the only account that is triple-tax advantaged,7 meaning:

- Contributions go in pre-tax and reduce your taxable income.

- Contributions can be invested and have the potential to grow tax-deferred over time.

- Withdrawals are tax free for qualified medical expenses.

Plus, the money in the account is yours forever—even if you don’t use it all by the end of the year, change health insurance plans or jobs, or move to a different state.

To be eligible to open and contribute to an HSA, you need to be enrolled in a high-deductible health plan. But your employer doesn’t need to offer an HSA for you to have one. So long as you’re eligible, you can open an account though any financial institution that offers it to individuals.

Not sure if you’re eligible? Try our tool.

HSAs can help you pay for more than you think. Here are some examples of qualified medical expenses that may be covered that you might be surprised to learn about:

- Family planning, including fertility treatments and pregnancy tests

- Postpartum care, including breastfeeding-related qualified medical expenses

- Menstrual-care products

Another tax-advantaged account that may be offered through your employer and can help offset health care costs is the flexible spending account, or FSA. It’s different from an HSA, including 2 key ways. First, funds are typically “use it or lose it” by the end of the year, although there are exceptions. And second, your contributions cannot be invested. Instead, your contributions go in pre-tax and can be used to help offset health care costs you expect to incur during the year.

Tip: Learn more about HSAs and whether one might be right for you.

2. Take advantage of your employer benefits

All employer benefits are different, so you’ll want to work with your Human Resources (HR) department to see what’s available to you, help compare different plans and options, and find creative ways to save.

In addition to HSAs or FSAs, your benefits might include a retirement savings plan, health insurance, student loan refinancing or repayment, counseling or mental health resources, and even shopping discounts. Depending on what stage of life you’re in, you may want to make sure to ask your benefits department about the benefits surrounding family planning, post-partum support, childcare, menopause, and caring for elderly, disabled, or ill family members. You might be surprised what is available to you. And if these benefits aren’t available today, ask if there is a plan in place to explore opportunities to increase their health benefits.

Tip: There are ways to help make better decisions during your enrollment window. Learn more.

You might be wondering, but what if I'm self-employed? There are options available for you too. You may not have an HR department, but you can put together a do-it-yourself package. Consider breaking it up into 3 sections: health insurance, retirement plans, and supplemental insurance. Learn more about creating your self-employed plan.

3. Consider your health care costs in retirement

Health care and long-term care are 2 of the biggest costs that many will face, and women are likely to spend more due to longevity and higher cost of care.

Your medical expenses in retirement may be made up of Medicare premiums, supplemental coverage, co-pays, co-insurance, deductibles, and prescription drugs—to name a few. A common misconception is that Medicare covers all your health care needs, but depending on your situation, that’s not true. You also may need to create a bridge for your coverage if you retire before age 65. Plus, most long-term care costs aren’t covered by Medicare.

There are a lot of factors to consider, but it’s never too early or too late to get started on a plan.

Tip: Use our calculator to estimate your health care costs in retirement.

4. Create a plan with the help of a professional

Creating a plan to accommodate the unique factors women experience can help you offset costs and give you confidence and peace of mind for your future. And you don’t have to do it alone. A financial professional can help you think about, save, and plan for your goals—whether you’re saving for a career break, retirement in general, long-term health care expenses, or anything else.

Tip: We’re here to help you plan. You can contact us at 1-800-FIDELITY (800-343-3548).

Want to learn more? Check out a replay of our Women Talk Money discussion about the real costs of women’s health.