"When you have 2 negative quarters of GDP growth, many news headlines will point to that as a sure sign of a recession," says Naveen Malwal, institutional portfolio manager with Strategic Advisers, LLC. But while GDP does provide some insight into the health of the US economy, it may not be the whole story. It's also not a clear-cut indicator of a recession.

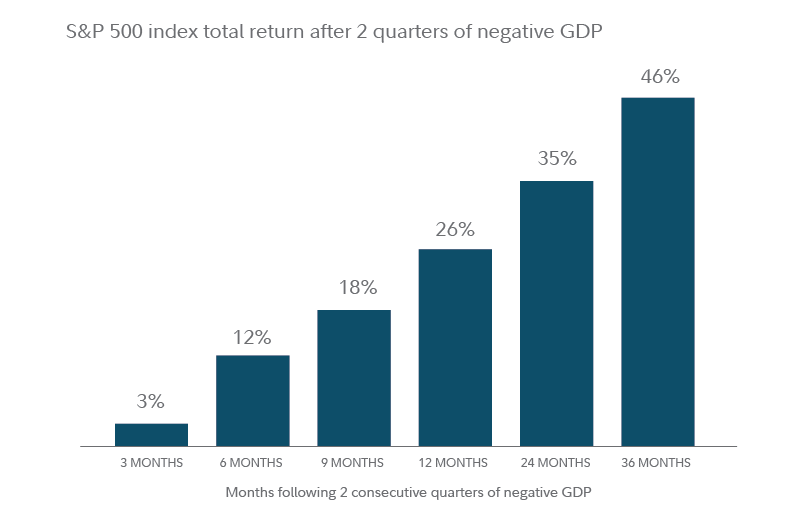

"One limitation of GDP is that it's a backward-looking indicator," says Malwal. "It tells us what happened during the most recent 3 months of the year. It doesn't tell us where we're headed in the future. In fact, the historical data shows that the stock market has generally risen after 2 consecutive quarters of negative GDP. So investors who make investment decisions based on GDP may miss out on stock market recoveries."

What makes a recession?

Who decides when a recession has started, and what criteria do they use to determine that? "The official organization that defines whether or not the US is in a recession is called the National Bureau of Economic Research (NBER)," says Malwal, "and they look at a range of indicators to gauge if the US is in recession. For example, they believed the 2020 recession took place from February to April of that year, which doesn't line up with 2 entire quarters of GDP. We'll have to wait and see what their views are if and when they decide to make an announcement." However, historically, NBER hasn’t announced the start or end of recessions until several months after the fact. For example, they didn’t announce the recession of 2020, which began in February 2020, until June of that year. By that time, the S&P 500 had already recovered a significant portion of its decline from earlier in the year. So NBER’s announcements may not prove that helpful for investors.

What can investors watch for?

"I'm often asked, ‘Is the recession here?' or ‘Is it coming soon?,'" says Malwal. "And the truth is that it's nearly impossible to predict the start or end of a recession. It's also exceedingly difficult to determine when stocks and bonds may find a bottom and start to recover. Maybe we will experience more market volatility. Or perhaps the worst is behind us."

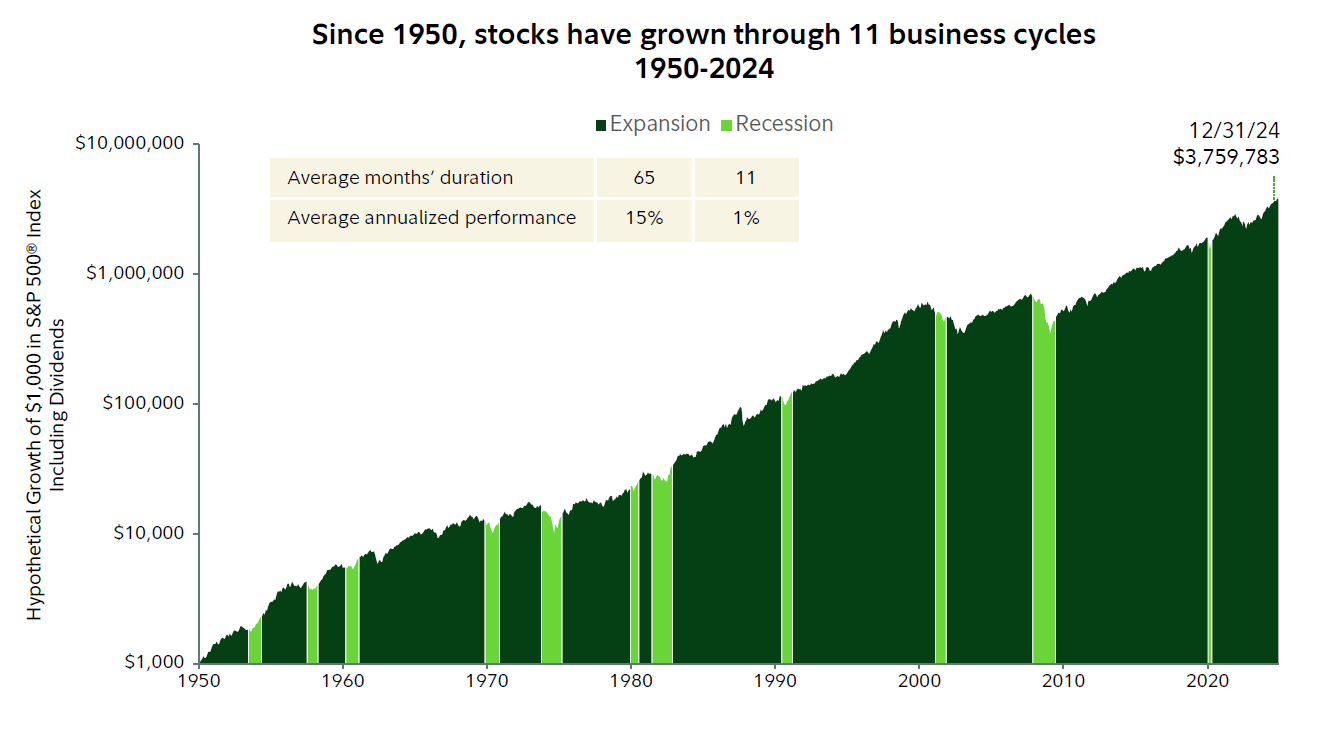

"What we know from history is that recessions come and go," says Malwal. "But stocks have historically risen over time. That's why I believe it's important that investors not react too strongly to predictions of what's going to come. In this kind of environment, I believe it's important to stay invested. Historically, when investors get out of the market at a time like this, it's rare for them to get back in at the right time, and this often leads to them missing out when things start to improve."

What might lead to a turnaround in the market? According to Malwal, anything that points to things not being as bad as investors fear. That could be a decline in the rate of inflation, corporate earnings exceeding expectations, or the Federal Reserve signaling that it doesn't feel the need to hike interest rates as much as previously thought. "The eventual recovery might take weeks or months to develop. But looking back through time, markets have eventually recovered from bear markets and recessions and gone on to make new highs."

Planning and diversification may help

Staying invested can be challenging for many investors when markets become volatile. One thing that can help is having a financial plan in place. Investors often find that a diversified mix of stocks and bonds may help them reach their financial goals without experiencing the full effects of stock market volatility. "Historically, well-diversified portfolios of stocks and bonds have usually experienced less volatility than investing solely in stocks," says Malwal.

The investment team at Strategic Advisers seeks to adjust the mix of stocks, bonds, and other investments within the client accounts that they manage as the US economy moves through different phases of the business cycle. In volatile market conditions, Strategic Advisers generally seeks to reduce risk in highly diversified client portfolios by reducing allocations to stocks and increasing exposure to bonds.

"When making these changes, we seek to reduce the impact of the potential volatility," says Malwal.

They also stand ready to act should the economy deteriorate. "If we do see meaningful contraction in areas like corporate profits, or the job market, or manufacturing activity, we would seek to further de-risk our client accounts in an effort to mitigate the volatility that could happen during a potential recession."

"But more importantly," says Malwal, "We've seen historically that stock markets often start to recover before the economy does. So we'll also be ready to increase exposure to stocks when we see early signs that an economic slowdown may be bottoming. We would do this in anticipation of strong stock market performance, which has often followed economic slowdowns or recessions."