Investing can, at times, seem complex and confusing, and you may often be wondering whether or not you're doing everything you can to help keep things on track—or whether something you're doing may be hurting your ability to achieve your goals.

Here are 5 things you may be doing that might be having a detrimental effect on your portfolio, and some thoughts on how you might be able to turn things around.

1. Getting out when the going gets tough

When markets become volatile or experience significant declines, it's natural to want to try to cut your losses and retreat to what seems like safe territory. But rather than preserving your wealth, you may actually be undermining the long-term growth potential of your portfolio.

"I've helped a lot of people with their financial plans," says Matt Bullard, a regional vice president for managed solutions at Fidelity, "and one thing that I've found is that big market events that drive headlines have generally had less of an impact on an investor's ability to reach their goals than the emotional decisions they make in response to those events."

In general, market declines have tended to be relatively shallow and short-lived compared to expansionary periods. Since 1950, markets have risen an average of 15% per year during expansions—and even 1% per year during recessions.1 So even when things seem most dire, there's still a chance for positive returns.

Furthermore, because it's not possible to predict exactly when the market may shift from negative to positive, there's a chance that you may end up missing out on a rally or recovery when it occurs if you were to take your money out of the market. Being uninvested for even a short time could have a profound impact: For instance, a hypothetical investor who missed just the best 5 days in the market since 1988 could have reduced their long-term gains by 37%.2

That's why it's so important to have a thoughtful, well-established plan in place to help you resist the urge to overreact to short-term volatility and uncertainty.

2. Taking on too much (or too little) risk

Though the very idea of "risk" can be scary, it's an essential part of investing. The amount of risk you decide to take on could determine how much growth you may be able to achieve in your portfolio and how much volatility you may need to endure to get there.

"Being far too conservative could be just as damaging as being far too aggressive," says Bullard. "If you're too conservative, you may not have the growth potential you need to reach your goals or even to outpace inflation. On the other hand, if you have too much risk, you'll potentially experience a lot more market volatility, which could lead you to jump out of the market at a bad time."

While there are no guarantees in investing, the key is to take on just enough risk to give your portfolio a chance of reaching your long-term goals, but not so much that it introduces enough volatility to scare you into withdrawing from the market. And one way to achieve that is by diversifying your portfolio, investing in a mix of different asset classes that may behave differently in different market conditions—that way, when some of your investments are down, others may be up, helping to smooth out the bumpiness in the market that can be so disconcerting.

How your assets are allocated across these different asset classes can provide a solid foundation upon which your portfolio may be able to grow over time. It can be a major factor in long-term performance: In fact, up to 90% of the variability of a fund's return over time can be explained by how its assets are allocated.3

3. Not rebalancing your portfolio regularly

Asset allocation is not a one-and-done exercise or something you can "set and forget." Over time, the appreciation and depreciation of your investments may result in your portfolio drifting from your initial allocation. As this happens, the amount of risk you're exposed to could change in ways you may not have expected.

For example, consider a hypothetical portfolio that begins with an asset allocation of 70% stocks and 30% bonds. If over the course of 6 months, stock values were to surge and bond values were to decline, that portfolio might end up closer to something like 80% stocks and 20% bonds—a much riskier allocation—just due to market activity. It can work the other way as well: Were stocks to dip to 60% and bonds to rise to 40%, the portfolio may end up being more conservative than the investor initially intended.

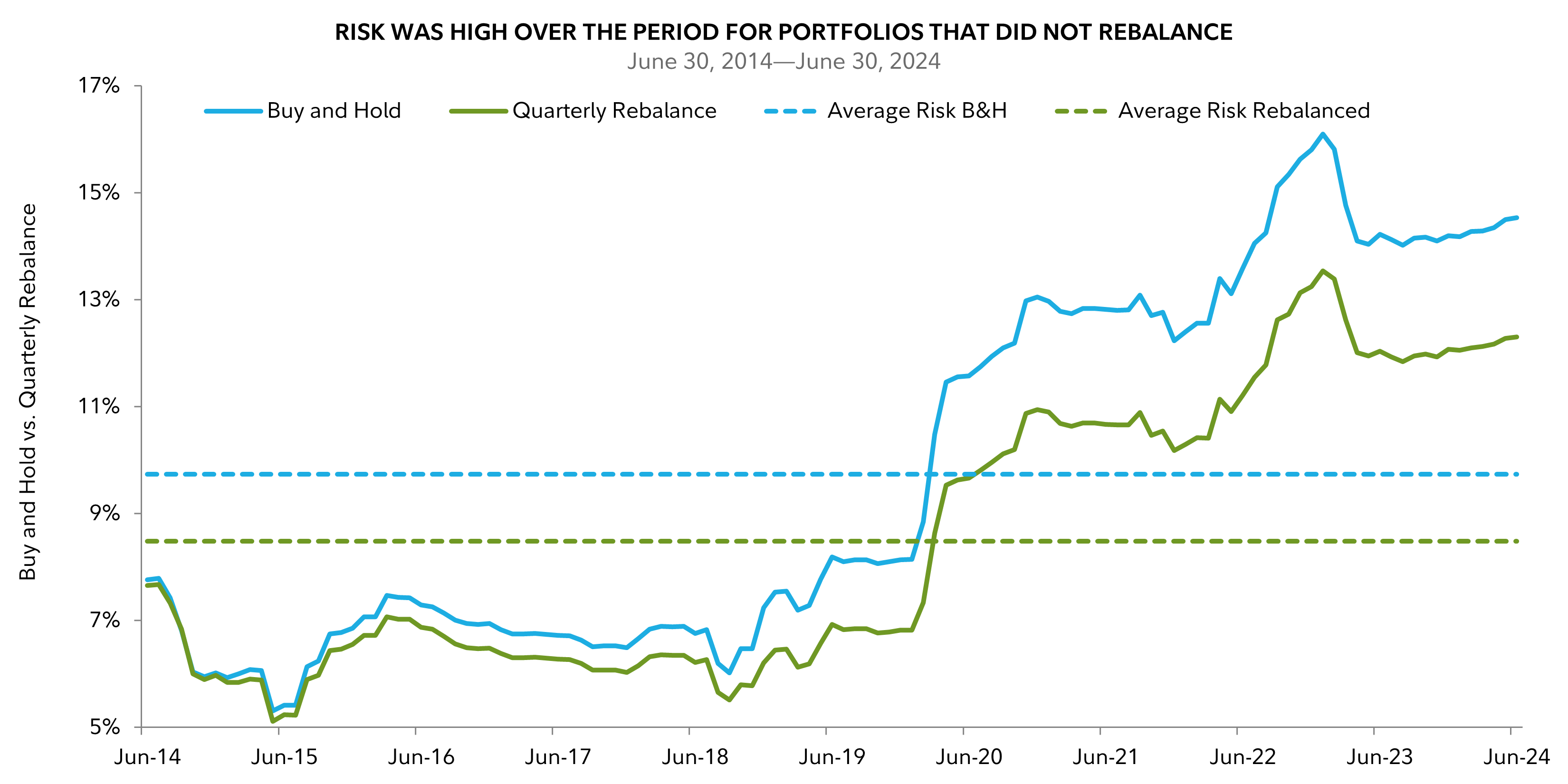

Hypothetical example. For illustrative purposes only. Actual performance results may vary, perhaps significantly, from the performance results shown. This chart's hypothetical illustration uses historical monthly performance from June 30, 2014 through June 30, 2024.

This chart is for illustrative purposes only and is not indicative of any investment. A portfolio that is not diversified within asset classes may experience different levels of risk. Portfolio risk is measured using standard deviation, which is a statistical measure of how much a return varies over an extended period of time. The more variable the returns, the larger the standard deviations. Investors may examine historical standard deviation in conjunction with historical returns to decide whether an investment's volatility would have been acceptable given the returns it would have produced. A higher standard deviation indicates a wider dispersion of past returns and thus greater historical volatility. Standard deviation does not indicate how an investment actually performed, but it does indicate the volatility of its returns over time. Standard deviation is annualized. The returns used for this calculation are not load adjusted.

Average risk for the Buy and Hold portfolio and the Quarterly Rebalanced portfolio is the average of the monthly rolling 3 year standard deviations for the period in the chart.

Portfolio allocations: U.S. Stocks: S&P 500 Index – 42%; International Stocks: MSCI ACWI ex USA Index (Net MA Tax) – 18%; Bonds: Bloomberg: U.S. Aggregate Bond Index – 35%; Short Term: Bloomberg U.S. 3‐Month Treasury Bellwethers Index – 5%. The holdings of the Quarterly Rebalance portfolio were rebalanced on a quarterly basis back to the Initial Index Weightings for each Primary Asset Class. The holdings of the Buy and Hold portfolio were never rebalanced.

Unless the investor proactively monitors and reallocates assets, perhaps by adding more funds to the account in the desired asset class or moving assets from one class to another, they could potentially experience more volatility than they are comfortable with or less growth than they need to help achieve their goals.

"Being in charge of your own investment strategy is an important responsibility," says Bullard. "Time goes by very fast. You may look at your portfolio today and see your ideal asset allocation, but by the end of the month things may have changed, because the markets are moving. Nothing in life is maintenance-free—especially our investment portfolios. It can take a lot of work."

4. Paying too much in taxes

Taxes are a part of life, but nothing says you need to pay any more than is required of you. And yet, many investors may do just that because they don't realize that there are techniques they can employ to help invest more efficiently and potentially reduce their overall tax burden.

"Most investors don't realize how much they're paying in taxes," says Bullard. "Capital gains distributions from mutual funds, for example, can surprise investors when the tax bill arrives."

Cutting your tax bill can have a big impact on your portfolio over the long term, by allowing you to keep more of your money and keep it invested, where it can potentially benefit from compounding growth in the market.

Techniques such as tax-loss harvesting or tax-efficient asset location, which places particular types of investments in the accounts most suitable for their tax treatment, can potentially pay off. In fact, the average client with a Personalized Portfolios professionally managed account using tax-smart strategies4 could have save $4,126 per year in taxes.5

5. Not seeking help when you need it

Self-directed investing works for many people, but if you’re having trouble staying the course and keeping your emotions in check, consider working with a trusted professional. Doing so may be more likely to lead to a better outcome in the long term. For example, studies have estimated that professional financial advice can add up to 5.1% to portfolio returns over the long term, depending on the time period and how returns are calculated.6

The truth is, mismanaging your portfolio has a cost. And whether the mismanagement is the result of an honest mistake, an understandable overreaction, or a simple oversight, ultimately the cost is coming out of your pocket. That's why some investors are more comfortable engaging with a professional investment manager who, for a fee, can oversee many of these important investing duties and provide investors with a backstop of support and guidance that may be able to help them weather the difficulties they encounter on their path to their goal.

"You really need to ask yourself 3 questions," says Bullard. "Do I have the skills to do this? Do I have the time to do this? And, maybe most importantly, do I want to do this? If the answer is 'no' to any or all of those, it may be worth seeking professional help. Your family and your goals deserve it." Even if you feel more comfortable managing your portfolio yourself, you may still benefit from meeting with a financial professional from time to time to get another perspective on your approach to investing.

Don't overcomplicate things

Life is complicated enough as it is. There's no need to make it any more complicated than it needs to be. With just a little more attention to these important portfolio practices and reaching out for professional help when you need it, you may be able to help ensure that these potential mistakes don't keep you from reaching your important investing goals.