What is limited margin?

Trading on margin enables you to borrow against the value of securities you own in your brokerage account and use those funds to buy additional securities. Margin accounts also enable you to sell securities short, execute complex options strategies, and access a line of credit.

If you are looking to trade on margin within a brokerage IRA, you will not be able to access the full range of margin trading features noted above. However, IRAs do offer what’s known as "limited margin."

Limited margin means you can use unsettled cash proceeds in your IRA to trade stocks and options actively without worrying about cash account trading restrictions or potential good faith violations. Unlike a nonretirement account that has full margin trading privileges, limited margin doesn’t allow you to borrow against the value of existing holdings to create cash or margin debits, sell securities short, or establish naked options positions.

Limited margin is available for most types of IRAs, including traditional IRAs, rollover IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. In order to qualify for limited margin, you must meet eligibility requirements, and read and agree to a limited margin account supplement.

Limited margin eligibility requirements

At Fidelity limited margin will add the pattern day trader designation, so you must also maintain minimum equity of $25,000 or more within your account. Some brokerage firms, including Fidelity, have additional requirements. For example, at Fidelity you cannot select an FDIC-insured vehicle as your core account option within your account. Other restrictions may apply, so be sure to check the eligibility requirements on your broker dealer’s website.

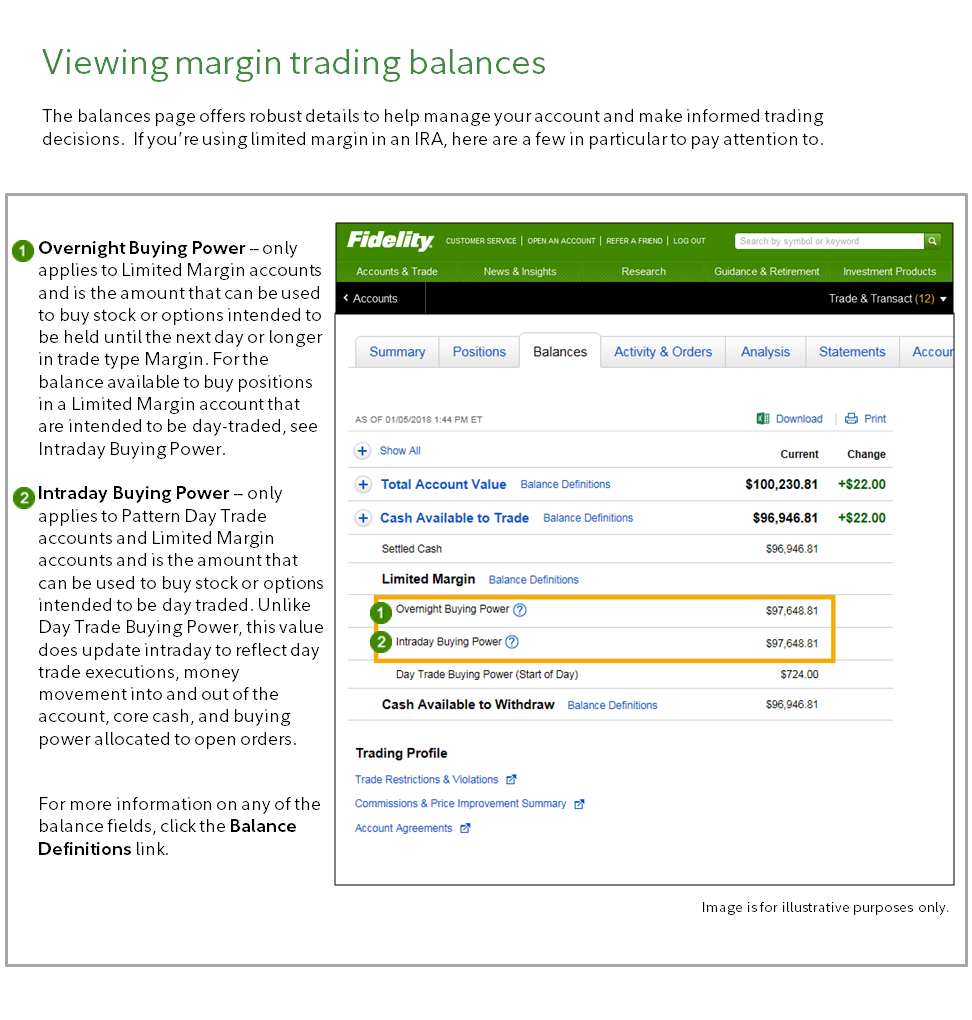

Once your IRA is approved for limited margin, trades in your account will default to the margin account type to fully utilize this feature. However, you will need to contact a representative to transfer your current positions to margin. If you intend to trade stocks or options actively, you should refer to your intraday buying power balance. This balance updates throughout the trading day to reflect trade executions, money movement into and out of the account, core cash, and buying power allocated to open orders. See Viewing margin trading balances for more information.

Margin calls within IRAs

As noted above, with limited margin the full range of margin trading is not available. Although this eliminates the general risk of standard margin calls, it is important to be aware of day trading related calls.

Day Trade Minimum Equity: If the equity in your IRA falls below $25,000 at any point, a day trade minimum equity call will be issued. Until you add more funds to meet the minimum equity requirement, you will be limited to closing transactions only (sell orders) in your margin account. You will have 5 business days to restore your account to the $25,000 minimum with a deposit of cash or marginable securities.

Day Trade Calls: A day trade call is generated if day trades are done with requirements in excess of the account’s intraday trade buying power. To satisfy the call you can make a deposit of cash or liquidate position(s) that were established before the day trade call was issued.

Note: Closing positions to meet a day trade call instead are considered a day trade liquidation.

Keep in mind that annual IRA contribution limits will put a cap on the amount you can deposit to your account to meet a day trade call or minimum equity call. If you are unable to meet a call, your day trade buying power will be restricted for 90 days. This means your account will be limited to closing transactions only (sell orders) in the margin account type. Buy orders in the cash account may be permitted, but will be subject to normal cash trading rules. To avoid such restrictions, it is important to be aware of the equity in your account and consider it before placing trades.

Placing trades using limited margin

Remember, once you've been approved for limited margin, future trades will automatically be placed within the margin account type, unless you opt to place trades in your cash account type. This is an important point because if you day trade within your cash account type, these transactions will be subject to cash account trading restrictions and potential good faith violations.

Avoiding good faith violations with limited margin

A good faith violation occurs when you buy a security in your cash account and sell it before paying for the initial purchase in full with settled funds. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds."

The following example illustrates how a hypothetical trader could incur good faith violations within an IRA that has NOT been approved for limited margin:

Good faith violation example:

Cash available to trade = $10,000, all of which is settled.

- On Monday morning, the customer purchases $10,000 of XYZ stock.

- On Monday at midday, the customer sells the XYZ stock for $10,500.

- At this point, no good faith violation has occurred because the customer had sufficient funds (i.e. settled cash) for the purchase of XYZ stock at the time the purchase was made.

- Near market close, the customer purchases $10,500 of ABC stock.

- A goodwill violation will occur if the customer sells the ABC stock prior to Tuesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock.

A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account.

As this example illustrates, if you trade actively within the cash portion of your IRA, there is a higher chance that you may execute a trade using unsettled funds. This would cause you to incur a cash trading violation, such as a good faith violation.

However, if you trade with limited margin—keeping a minimum of $25,000 equity in your account—you can avoid trading restrictions or potential good faith violations. That's because limited margin allows you to trade unsettled proceeds to buy and sell securities in your IRA.