2026 is shaping up to potentially be a record-setting year for IPOs—led by some leading AI companies. Goldman Sachs recently forecast that IPO proceeds might quadruple to $160 billion this year as more companies look to go public amid rising stock prices and potentially more favorable financial conditions.

Here's what's happened in the IPO market, plus a look at some of the biggest names that may go public this year.

2026 IPOs

Several high-profile companies have already debuted this year, including AI equipment maker Forgent (

Goldman expects artificial intelligence companies could represent the healthiest portion of IPO proceeds, while software and health care firms could account for the largest number of IPOs. Key factors that could bring the IPO pipeline to a boil include less stock market volatility and continued corporate confidence in favorable market conditions.

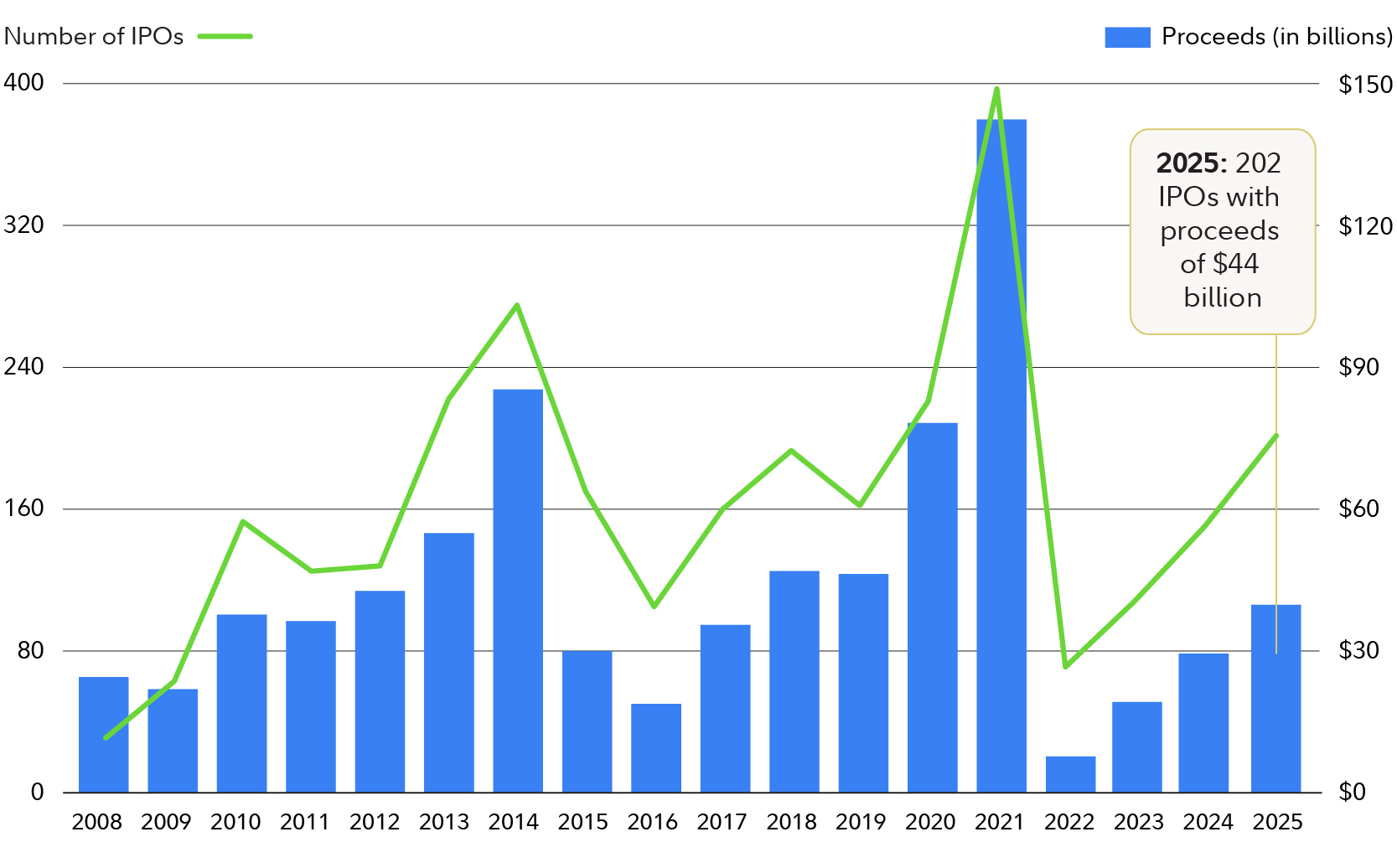

US IPO activity

While IPO activity has picked up over the last several years (see chart above), IPO performance has lagged the broad market. The Renaissance IPO Index has gained 57% over the past 3 years, compared with a 77% increase for the S&P 500.1

IPO investing

Is investing in IPOs right for you? Of course, it depends on your investing objectives and risk tolerance. With that said, if you have an interest in IPOs, you should proceed with caution.

IPOs can generate buzz among investors, particularly for so-called "hot issues" that garner a lot of interest. But beware of getting caught up in the hype. IPO investing can be complex and may be suitable only for experienced investors.

There are unique considerations to keep in mind when it comes to investing in IPOs. For example, the stock of an IPO can be particularly unpredictable on its first day—and also in the first few months—of trading.

There is also the issue of access to IPOs. For individuals, getting shares of an IPO at the stated initial offering price may be hard, since the majority of the shares are typically acquired in large blocks in advance by institutional investors. As a result, the closing price after the first day of trading may be a more accurate price at which individual investors may be able to get shares.

Moreover, extracting long-term value out of IPOs, even successful ones, can be tricky for a retail investor. For example, suppose you identify an IPO that you find attractive as a long-term investment, and the price at which it begins trading on the IPO date is $20 (which is by no means a given). If you were to buy the shares at around this price, and by the end of the IPO day the stock price had risen to $30, you might think this is a winning trade.

But take a step back. This means that the company and its underwriters (a financial group, typically a bank that is responsible for determining the market price of an IPO) underestimated demand for the company's stock. Therefore, the company lost out on the opportunity to raise more money to grow its business, because the IPO was mispriced (i.e., instead of receiving, let's say, $30 a share from the public, it will have received only $20 a share). In this scenario, if you were looking for short-term profits, great. If you are a long-term investor, however, a mispriced IPO may not be in your best interest.

Do your homework

IPOs and you

One of the primary difficulties that some investors face when it comes to researching companies that have not yet become public is the extent to which there is access to information. Publicly traded companies in the US, for example, are required by the Securities and Exchange Commission (SEC) to disseminate financial information quarterly. Private companies are not required to do the same (although they do have SEC-mandated disclosure requirements that must be made available to prospective investors in advance of an IPO, a key source of information for an IPO investor being the prospectus).

Perhaps more importantly, individual investors may not have the time or skill needed to evaluate all of the available financial data and to consider the implications to future operating results of the transition from a private to a public company. Consequently, for those investors who do not have access or the skill to analyze all of the financial information necessary to build an informed view of a potential IPO opportunity, it may be hard to fully assess the company's merits as a sound investment.

One way that you might be able to navigate the intricate IPO waters is to consider a managed fund. Most investment management companies have the research capabilities and resources needed to conduct this analysis, which many individual investors are not able to do. And, as always, it is important to build a diversified portfolio, given that one of the risks of IPOs is the stock-specific risk that is present in any concentrated, individual investment.