Description

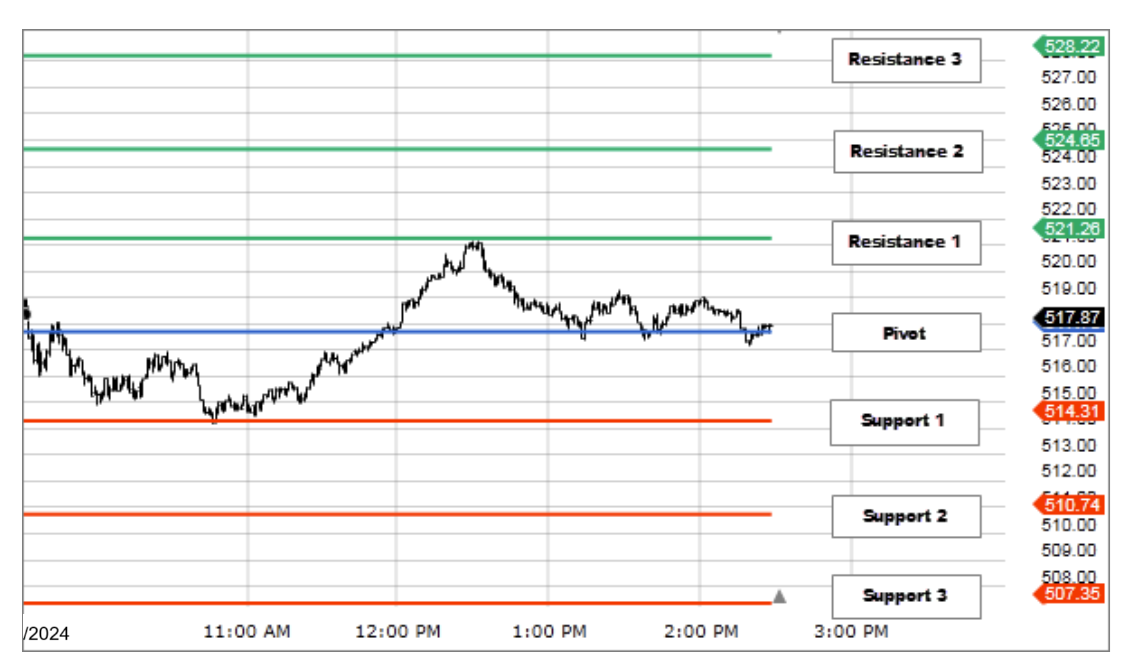

Pivots Points are price levels chartists can use to determine intraday support and resistance levels. Pivot Points use the previous days Open, High, and Low to calculate a Pivot Point for the current day. Using this Pivot Point as the base, three resistance and support levels are calculated and displayed above and below the Pivot Point.

How this indicator works

- Pivot Point support and resistance levels can be used just like traditional support and resistance levels. As with all indicators, it is important to confirm Pivot Point signals with other aspects of technical analysis.

Calculation

Resistance Level 3 = Previous Day High + 2(Pivot – Previous Day Low)

Resistance Level 2 = Pivot + (Resistance Level 1 – Support Level 1)

Resistance Level 1 = (Pivot x 2) – Previous Day Low

Pivot = Previous Day (High + Low + Close) / 3

Support Level 1 = (Pivot x 2) – Previous Day High

Support Level 2 = Pivot – (Resistance Level 1 – Support Level 1)

Support Level 3 = Previous Day Low – 2(Previous Day High – Pivot)