Description

The Chande Momentum Oscillator (CMO) is a technical momentum indicator developed by Tushar Chande. The CMO indicator is created by calculating the difference between the sum of all recent higher closes and the sum of all recent lower closes and then dividing the result by the sum of all price movement over a given time period. The result is multiplied by 100 to give the -100 to +100 range. The defined time period is usually 20 periods.

How this indicator works

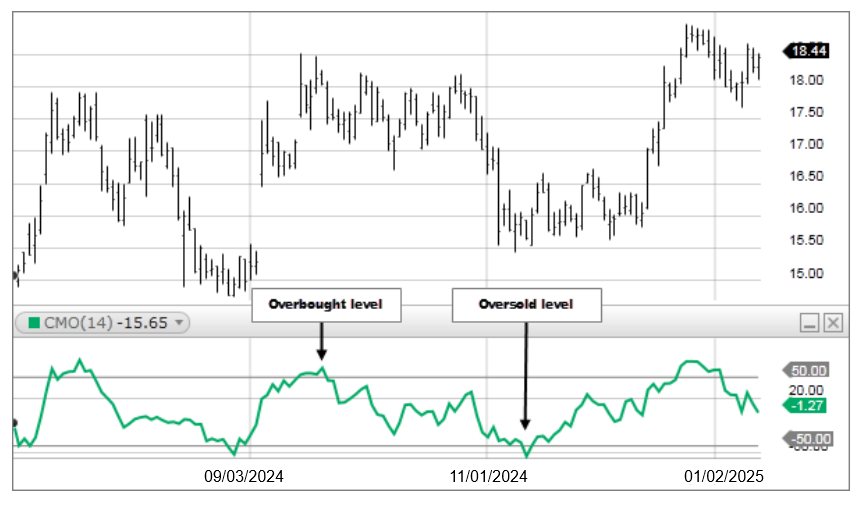

- CMO indicates overbought conditions when it reaches the 50 level and oversold conditions when it reaches −50. You can also look for signals based on the CMO crossing above and below a signal line composed of a 9-period moving average of the 20 period CMO.

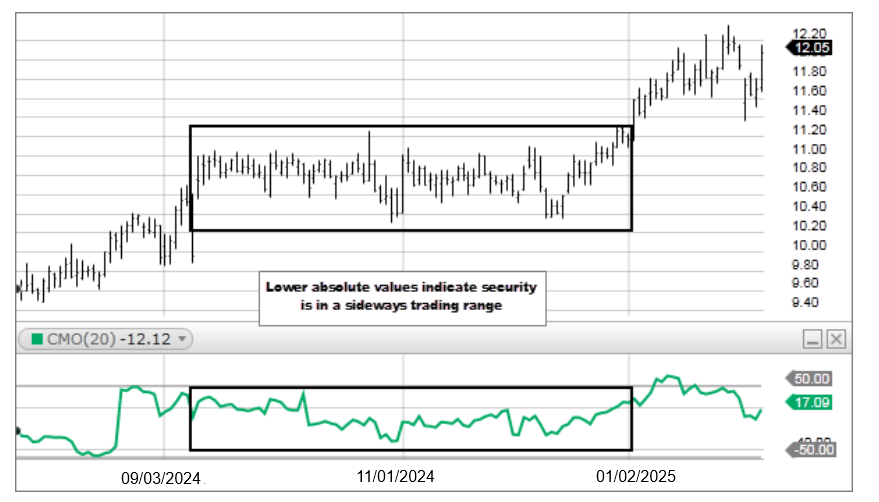

- CMO measures the trend strength. The higher the absolute value of the CMO, the stronger the trend. Lower absolute values of the CMO indicate sideways trading ranges.

- CMO often forms chart patterns which may not show on the underlying price chart, such as double tops and bottoms and trend lines. Also look for support or resistance on the CMO.

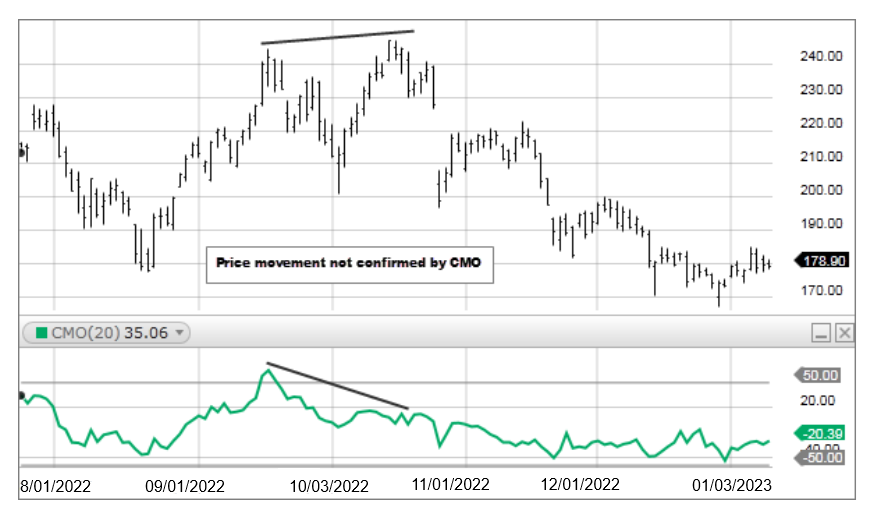

- If underlying prices make a new high or low that is not confirmed by the CMO, the divergence can signal a price reversal.

Calculation

CMO = 100 * ((Su - Sd)/ ( Su + Sd ) )

Where:

Su = Sum of the difference between the current close and previous close on up days for the specified period. Up days are days when the current close is greater than the previous close.

Sd = Sum of the absolute value of the difference between the current close and the previous close on down days for the specified period. Down days are days when the current close is less than the previous close.

When the current close equals the previous close it is ignored.