Description

The Bollinger Band Width is the difference between the upper and the lower Bollinger Bands divided by the middle band. This technical indicator provides an easy way to visualize consolidation before price movements (low bandwidth values) or periods of higher volatility (high bandwidth values). The Bollinger Band Width uses the same two parameters as the Bollinger Bands: a simple moving- average period (for the middle band) and the number of standard deviations by which the upper and lower bands should be offset from the middle band.

How this indicator works

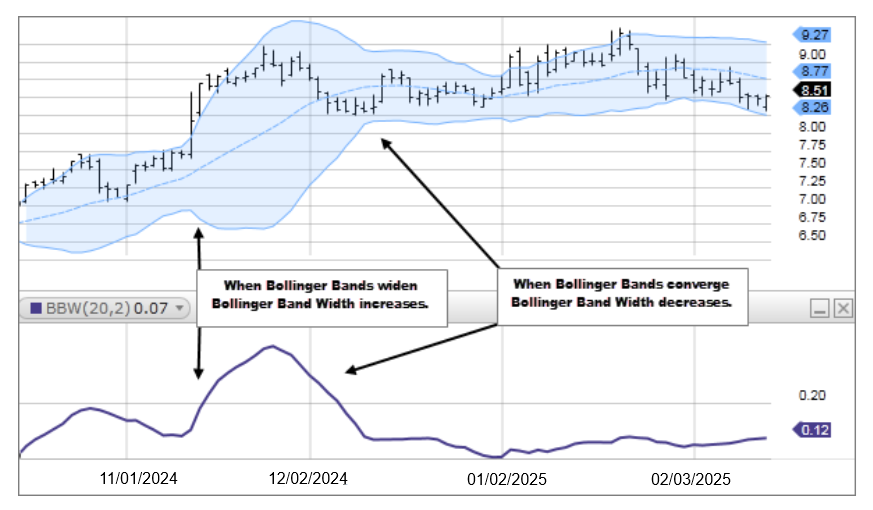

- During a period of rising price volatility, the distance between the two bands will widen and Bollinger Band Width will increase. Conversely, during a period of low market volatility, the distance between the two bands will contract and Bollinger Band Width will decrease. There is a tendency for bands to alternate between expansion and contraction.

- When the bands are relatively far apart, that is often a sign that the current trend may be ending. When the distance between the two bands is relatively narrow that is often a sign that a market or security may be about to initiate a pronounced move in either direction.

Calculation

Band Width = (Upper Bollinger Band - Lower Bollinger Band) / Middle Bollinger Band