A stock chart is simply a visual representation of a security’s price or index over a set period of time. Any security with price data over a period of time can be used to form a chart for analysis.

On the chart, the y-axis (vertical axis) represents the price scale and the x-axis (horizontal axis) represents the time scale. Prices are plotted from left to right across the x-axis with the most recent plot being the furthest right.

Types of charts

Technical analysts use a variety of charts to analyze price movements. The three main types are:

- Line charts

- Bar charts

- Candlestick charts

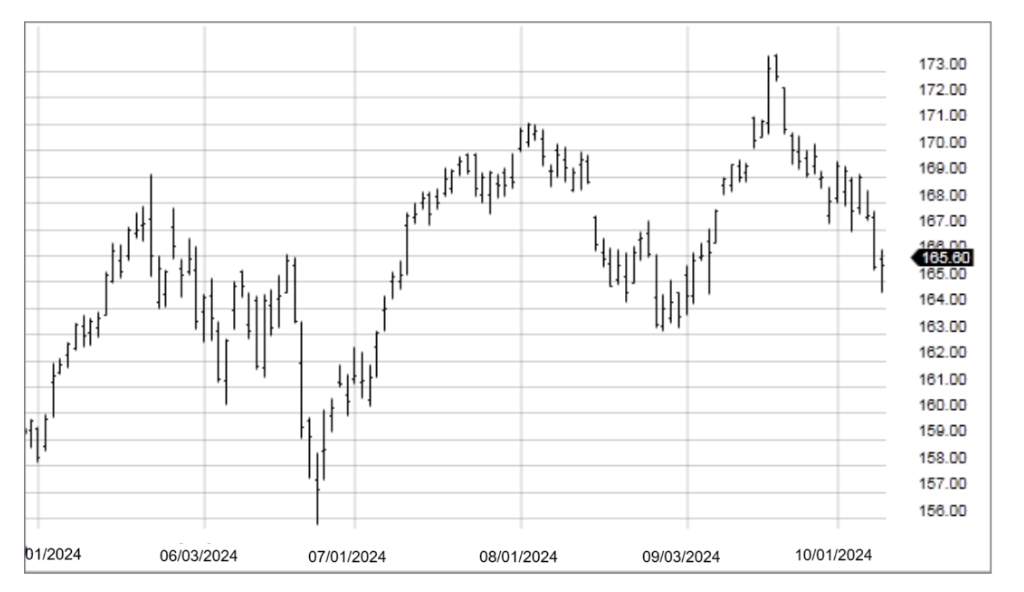

Line chart

This type of chart is usually used to get a “big picture” view of price movements. The line chart is formed by connecting the closing prices over a specified time frame. Some investors and traders consider the closing level to be more important than the open, high, or low. By paying attention to only the close, intraday swings can be ignored. Today, this type of chart is most commonly seen with mutual fund charts, since they have only closing prices and no intraday movement.

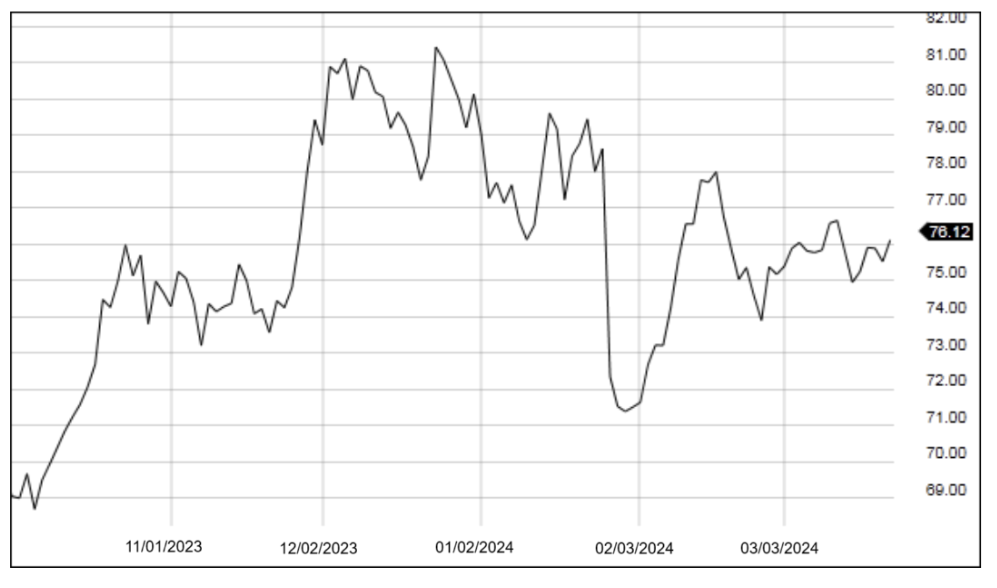

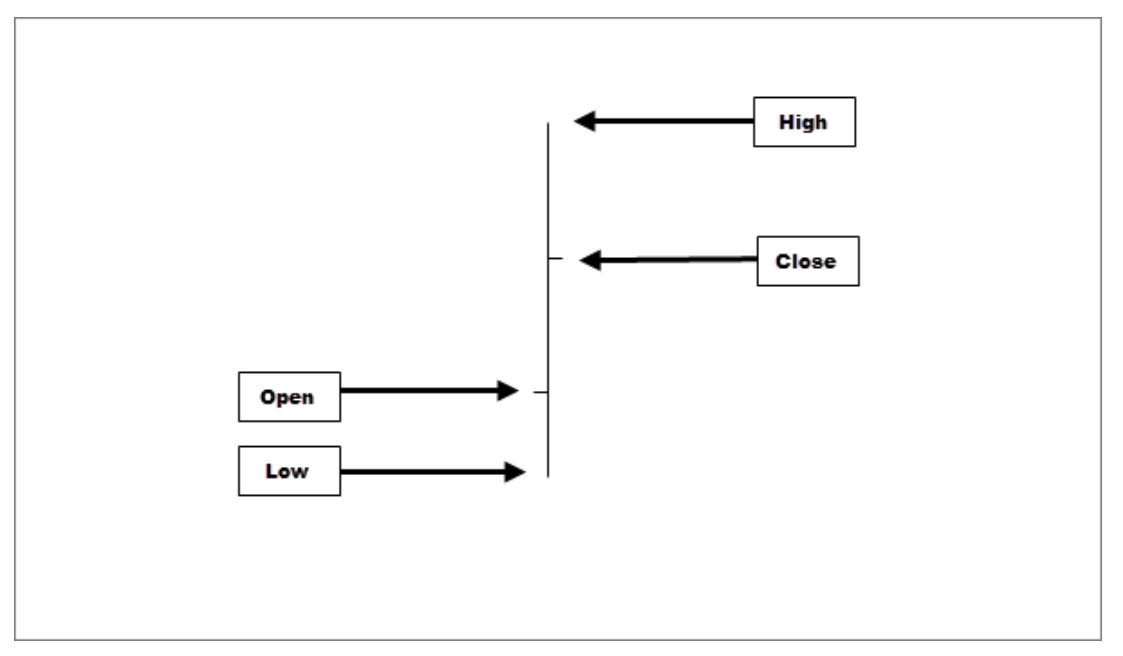

Bar chart

Perhaps the most popular charting method is the bar chart. This type of chart can show the opening, high, low, and closing price of a particular security on a particular day. This can give traders a better idea of how the stock traded throughout the day, or its daily volatility.

The open, high, low, and close are required to form the price plot for each period of a bar chart. The high and low are represented by the top and bottom of the vertical bar. The open and close are represented on the vertical line by a horizontal dash. The opening price on a bar chart is illustrated by the dash that is located on the left side of the vertical bar. Conversely, the close is represented by the dash on the right. One of the main differences between a line chart and an OHLC (open, high, low, and close) chart is that the OHLC chart can show volatility.

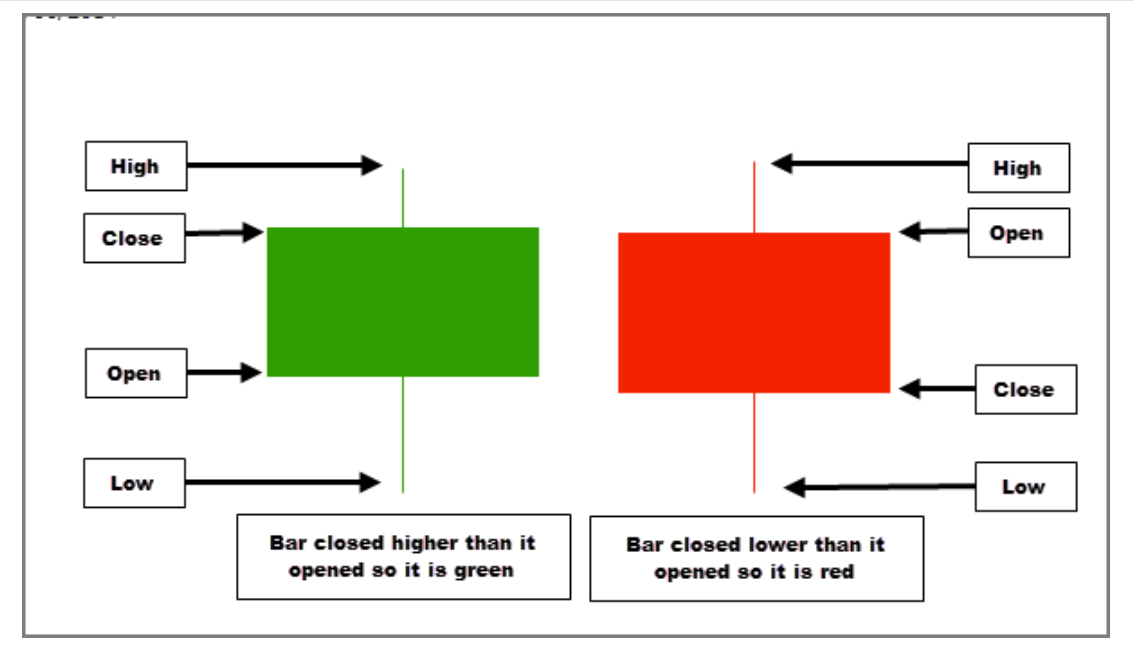

Candlestick charts

The third common chart type is the candlestick chart. Many traders like this type of chart because it is similar to an OHLC chart but it can present the information on one particular day’s trading in a quicker, easier-to-read format.

Candlestick charts are very similar to OHLC charts in that they provide the same information, just in a different format. The candlestick is constructed using a horizontal line to indicate the open and close, and a vertical box is made connecting these two lines to form the “body” of the candlestick. A single vertical line is drawn in the middle above the box to show the high and a single vertical line is drawn in the middle below the box to show the low. These are called the “wicks” or “shadows.” The next difference is the color of the body or whether it is filled or not. In traditional candlesticks, if the close is higher than the open, then the body is left hollow (white or green) to indicate an up day in that day’s price action. If the close is lower than the open then the body is closed (black or red) to indicate a down day.

Conclusion

There are many different types of charts available, and one is not necessarily better than the next. The data may be the same to create the chart, but the way it is presented and interpreted will vary. Each will have its own benefits and drawbacks. You can choose any type or use multiple types of charts for analysis; it depends on your personal preferences and investing styles.