Taxes can quietly erode your investment income—but they don’t have to. With a few smart strategies, you may be able to build a stream of income that receives preferential tax treatment.

These 6 tips can help you make your income portfolio more tax-efficient, whether you're investing in bonds, dividends, or managed accounts.

1. Municipal bonds

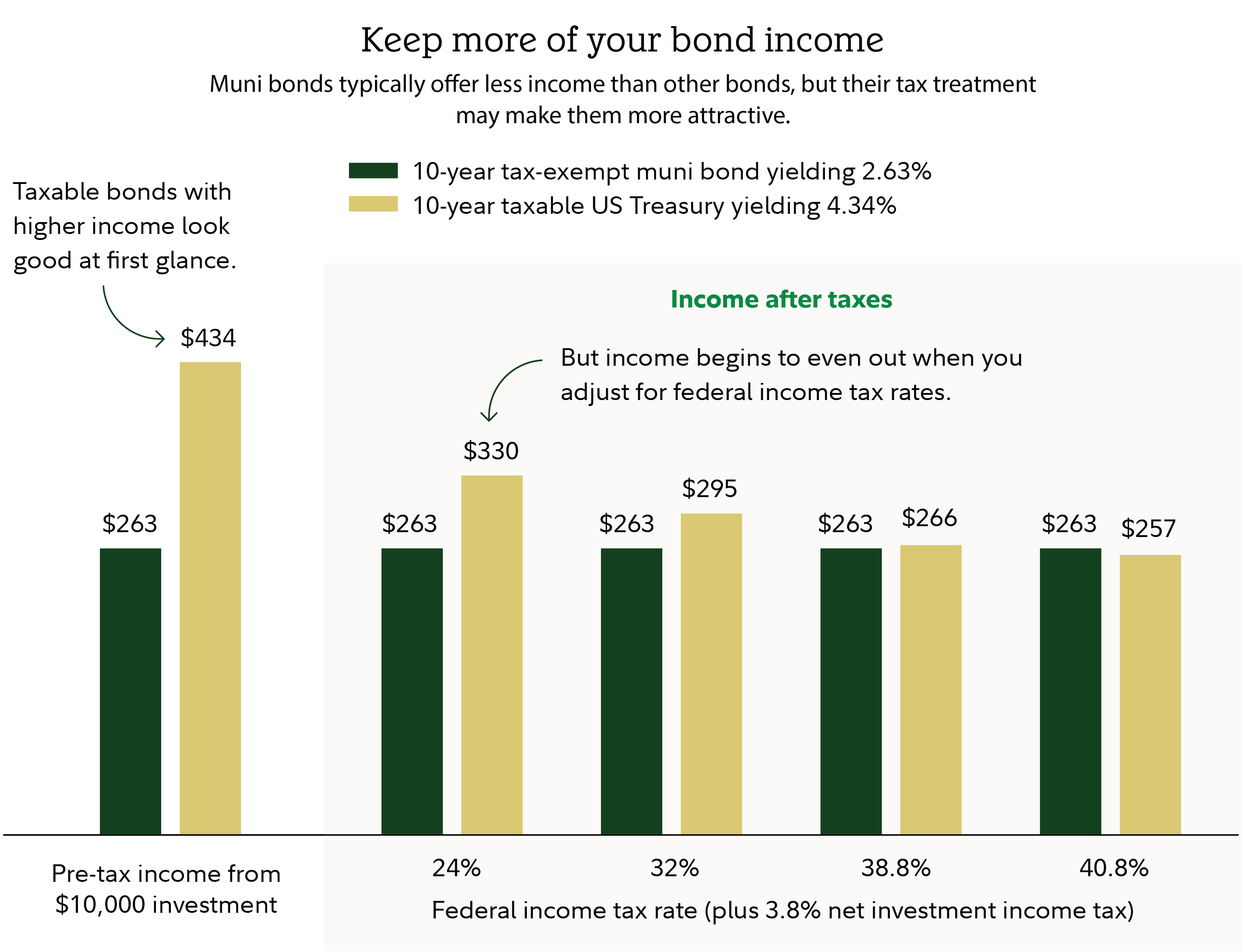

Municipal bonds, or "munis," offer interest income that is generally exempt from federal income tax, and often from state and local taxes if you reside in the state that issued the bonds. This makes them especially attractive for high-income investors, and those in states with higher tax rates. While muni coupon yields may be lower than those of taxable bonds, the difference in tax treatment may help offset those lower yields. To see how yields compare, try Fidelity’s taxable equivalent yield calculator.

You can invest in munis by buying individual bonds, bond funds, or ETFs, or through separately managed accounts. Learn more about Fidelity’s municipal bond SMAs: Fidelity’s Intermediate Municipal Strategy and Fidelity® Limited Duration Municipal Strategy.

Read more in Fidelity Viewpoints: Your complete guide to municipal bonds.

2. US Treasurys

US Treasury securities are exempt from state and local taxes, though they are subject to federal taxes on ordinary income and net investment income. For investors in high-tax states, this can make Treasurys a more efficient fixed income choice. They also offer safety and liquidity, making them a solid core holding in tax-aware fixed income portfolios. (Read more about the best states for taxes and the best states for taxes in retirement.)

Newly issued Treasurys can be purchased at auctions held by the government, while previously issued bonds can be purchased on the secondary market. Both types of orders can be placed through Fidelity.

Types of Treasurys

| Treasury | Minimum denomination | Sold at | Maturity | Interest payments |

| US Treasury bills | 1 bond ($1,000 face value) | Discount | 4-, 6-, 8-, 13-, 17-, 26-, and 52-week | Interest and principal paid at maturity |

| Cash management bills | 1 bond ($1,000 face value) | Discount | Variable and not issued on a regular schedule | Interest and principal paid at maturity |

| US Treasury notes | 1 bond ($1,000 face value) | Coupon | 2-, 3-, 5-, 7-, and 10-year | Interest paid semi-annually, principal at maturity |

| US Treasury bonds | 1 bond ($1,000 face value) | Coupon | 20-year, and 30-year | Interest paid semi-annually, principal at maturity |

| Treasury inflation-protected securities (TIPS) | 1 bond ($1,000 face value) | Coupon | 5-, 10-, and 30-year | Interest paid semi-annually, principal redeemed at the greater of their inflation-adjusted principal amount or the original principal amount |

| US Treasury floating rate notes (FRNs) | 1 bond ($1,000 face value) | Coupon | 2 years | Interest paid quarterly based on discount rates for 13-week Treasury bills, principal at maturity |

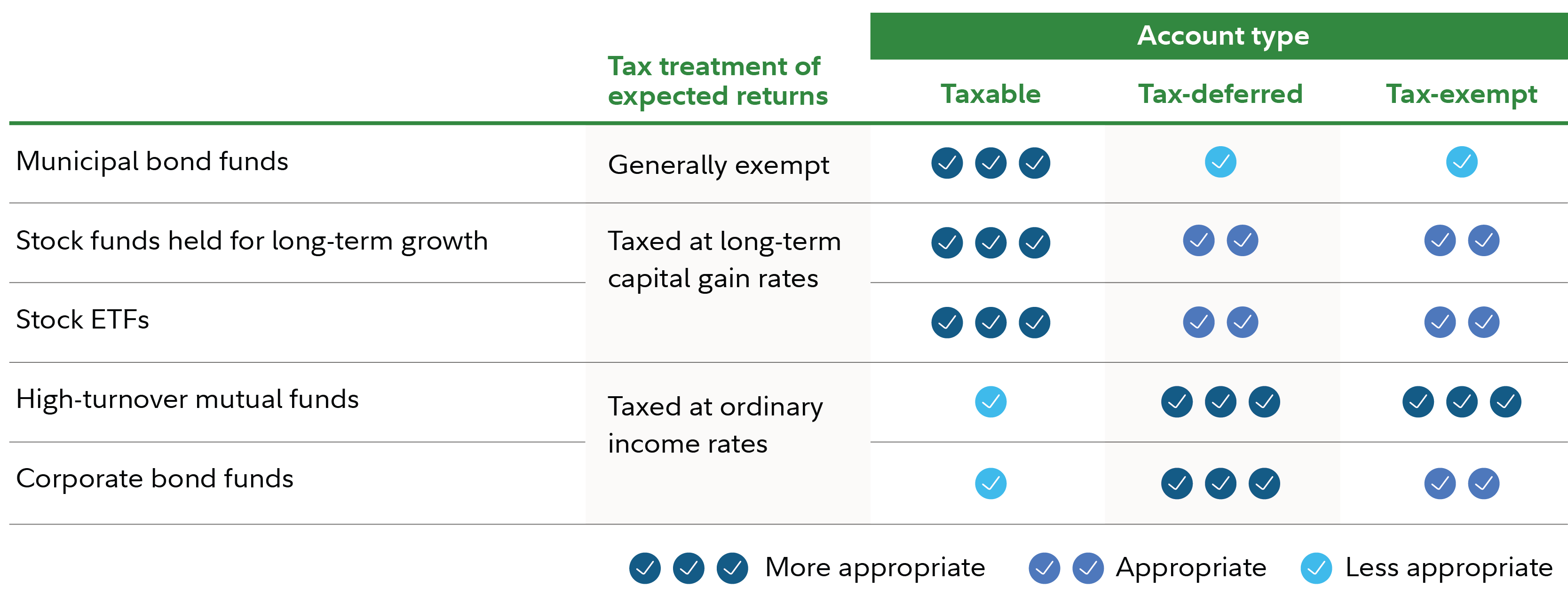

3. Taxable bonds and CDs in tax-advantaged accounts

Placing taxable bonds and CDs in tax-advantaged accounts like IRAs or Roth IRAs can shield interest income from immediate taxation. This strategy helps maximize the compounding effect of any reinvested interest and avoids the drag of annual tax payments. Conversely, consider using tax-efficient assets like index funds in taxable accounts, which may help optimize your overall portfolio.

Read more about tax-smart asset location.

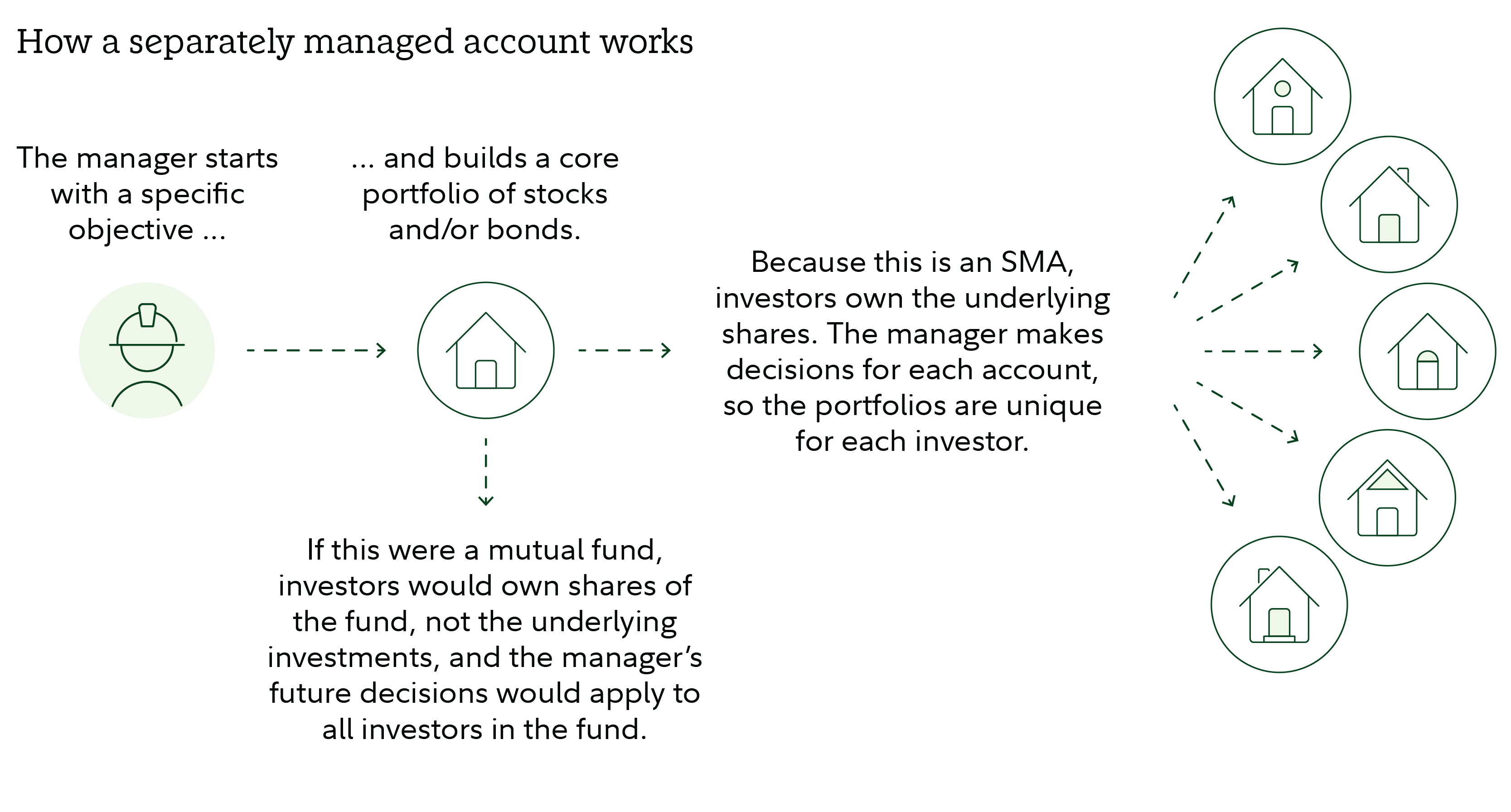

4. Separately managed accounts

Separately managed accounts (SMAs) may use a range of tax-efficient investment techniques in an effort to increase after-tax returns.1 This includes tax-loss harvesting, a method for reducing annual capital gains tax by selling holdings that have lost value to offset realized taxable gains. If you have a net realized loss at the end of the year, you can deduct up to the lower of either $3,000 ($1,500 if married filing separately) or your total net realized losses from your ordinary income and carry forward any remaining unused losses to future years. Net result: Less money goes to taxes today.

For investors who aren’t interested in doing the work of tax-loss harvesting themselves, an SMA makes it possible to better manage taxable gains. SMAs also offer transparency and control over the timing of taxable events.

Investors with Fidelity can consider either a traditional separately managed account, which pairs you with an advisor to develop your strategy, or an online-only option.

Read more about SMAs or digital managed accounts.

5. Qualified dividends

Not all dividends are taxed equally. Qualified dividends—typically paid by US corporations and held for a minimum period—are taxed at long-term capital gains rates, which are lower than ordinary income rates. Investing in companies with a history of paying qualified dividends can enhance after-tax returns, especially in taxable accounts.

See which stocks may pay the highest dividends.

What are qualified dividends?

| Required holding period | Common stock: 61+ days during the 121 days beginning 60 days before the ex-dividend date. Preferred stock: 91+ days during the 181 days beginning 90 days before the ex-dividend date. |

| Payer | Must be a US corporation, foreign corporation whose country qualifies with the tax treaty with the United States, or foreign corporation whose stocks, such as ADRs, are readily traded on established US stock exchanges. |

| Exceptions | Dividends paid by real estate investment trusts (REITs), master limited partnerships (MLPs), employee stock options, and tax-exempt companies are typically not considered qualified dividends. |

| Taxation | Taxed at lower capital gains tax rates, which range from 0% to 20%. Ordinary dividends are subject to income tax rates, which can be as high as 37%, depending on your income. The 3.8% net investment income tax may also apply. |

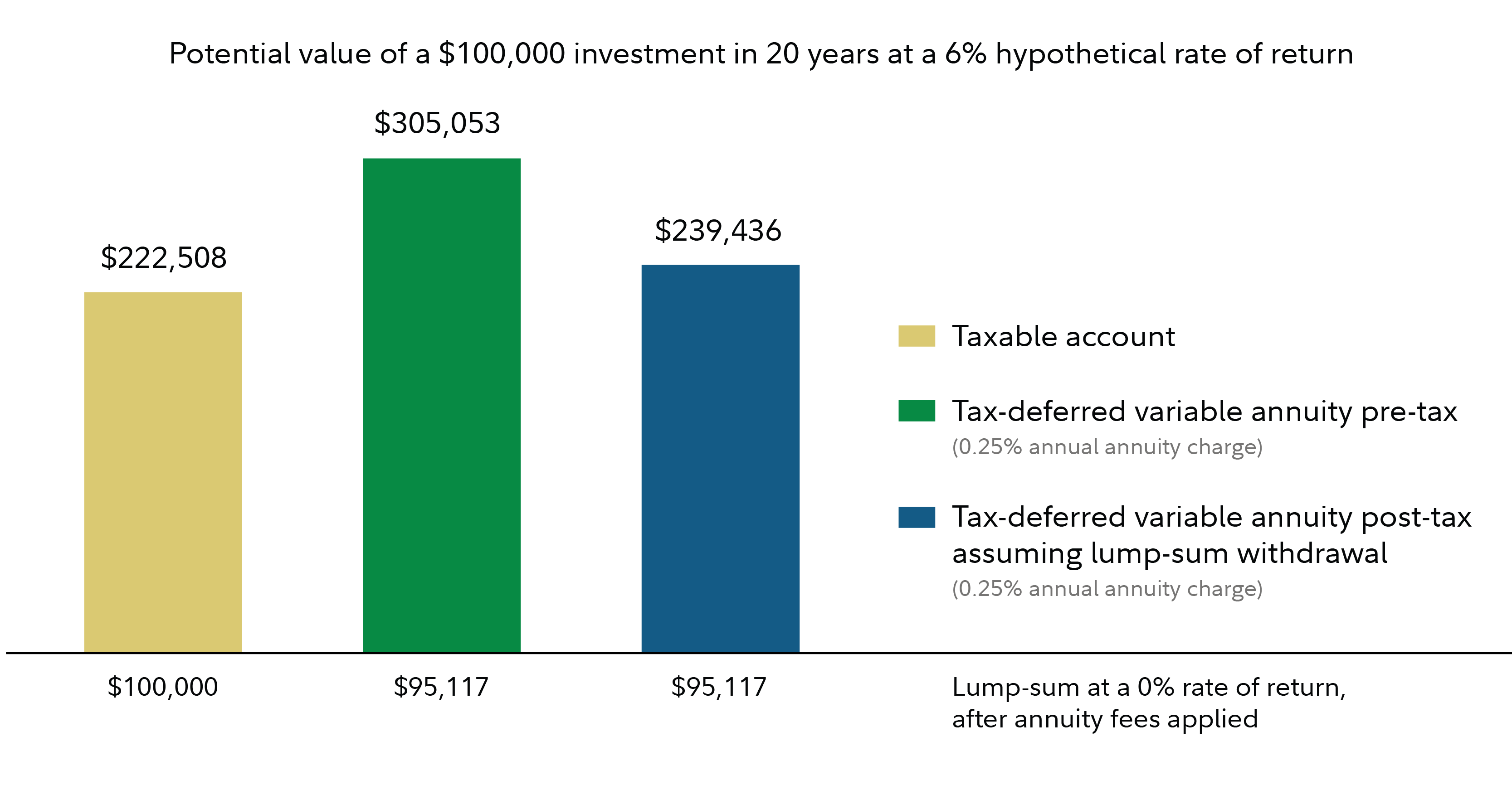

6. Tax-deferred annuities

While not for everyone, tax-deferred annuities can be useful for investors looking to defer taxes on investment gains—particularly for high-income investors who already contribute the maximum to tax-advantaged retirement accounts.

When you put a portion of your savings into a tax-deferred variable annuity, any earnings are tax-deferred.2 At a future date, you can convert to an income annuity to create a regular income stream or take withdrawals as you need them. At that point any earnings will be taxed as ordinary income.

Tax-deferred annuities are best used when other tax-advantaged accounts, like your 401(k) or IRA, are maxed out, and when paired with a clear plan for withdrawal timing and income needs.

Read more about tax-deferred annuities.

Hypothetical example: The power of tax deferral 3, 4

The bottom line

Whether you're just starting out or managing a complex portfolio, tax-aware investing can help you make the most of your money. By aligning your investment strategy with smart tax practices, you can build a portfolio that’s both efficient and resilient.