Many investors subject to relatively high marginal tax rates take advantage of tax-deferred vehicles such as IRAs and 401(k)s for their retirement savings. But those who hold the bulk of their liquid investments in taxable accounts that generate large distributions may still find themselves facing a large tax bill every year.

To the extent that you can fund employer plans, IRAs, and similar accounts, you should generally do so before considering other options. However, tax-advantaged accounts have limitations. In 2025, the maximum an individual can contribute to a 401(k) or similar employer plan is $23,500 (those 50 and older can contribute an additional $7,500, plus an additional $3,750 for those ages 60—63); the maximum IRA contribution is $7,000 ($8,000 for those 50 and older). For investors seeking additional tax deferral, one option is a tax-deferred variable annuity.

How does a tax-deferred variable annuity work?

When you put a portion of your savings into a tax-deferred variable annuity, any earnings are tax-deferred.1 At a future date, you can create a regular income stream or take the assets as you need them. At that point any earnings will be taxed as ordinary income.

A tax-deferred variable annuity has underlying investment options, typically referred to as subaccounts, that are like mutual funds. There are no IRS annual limits to contributions,2 and you choose how you’d like to allocate money among different investments to potentially benefit from market growth. You can also reallocate assets or trade among subaccounts within the annuity, tax-free. "Unlike other tax-deferred vehicles like an IRA, annuities funded with after-tax dollars aren’t subject to required minimum distribution (RMD) rules, which allows for more time to reap the benefits that compound growth can provide,” says Christian Jeeves, a regional vice president in the planning solutions division of Fidelity.

Tax-deferred variable annuities aren’t the right choice for everyone, however. Money invested in a tax-deferred annuity is designed to be used in retirement; upon withdrawal, taxable amounts will be subject to ordinary income tax and if taken prior to age 59½ may also be subject to a 10% tax penalty. You’ll also be subject to an annual annuity charge, which can vary depending on the annuity product and any specific benefits you choose. If you are focused solely on tax deferral and are not interested in additional benefits such as a guaranteed minimum death benefit, you may want to consider a low-cost deferred variable annuity.

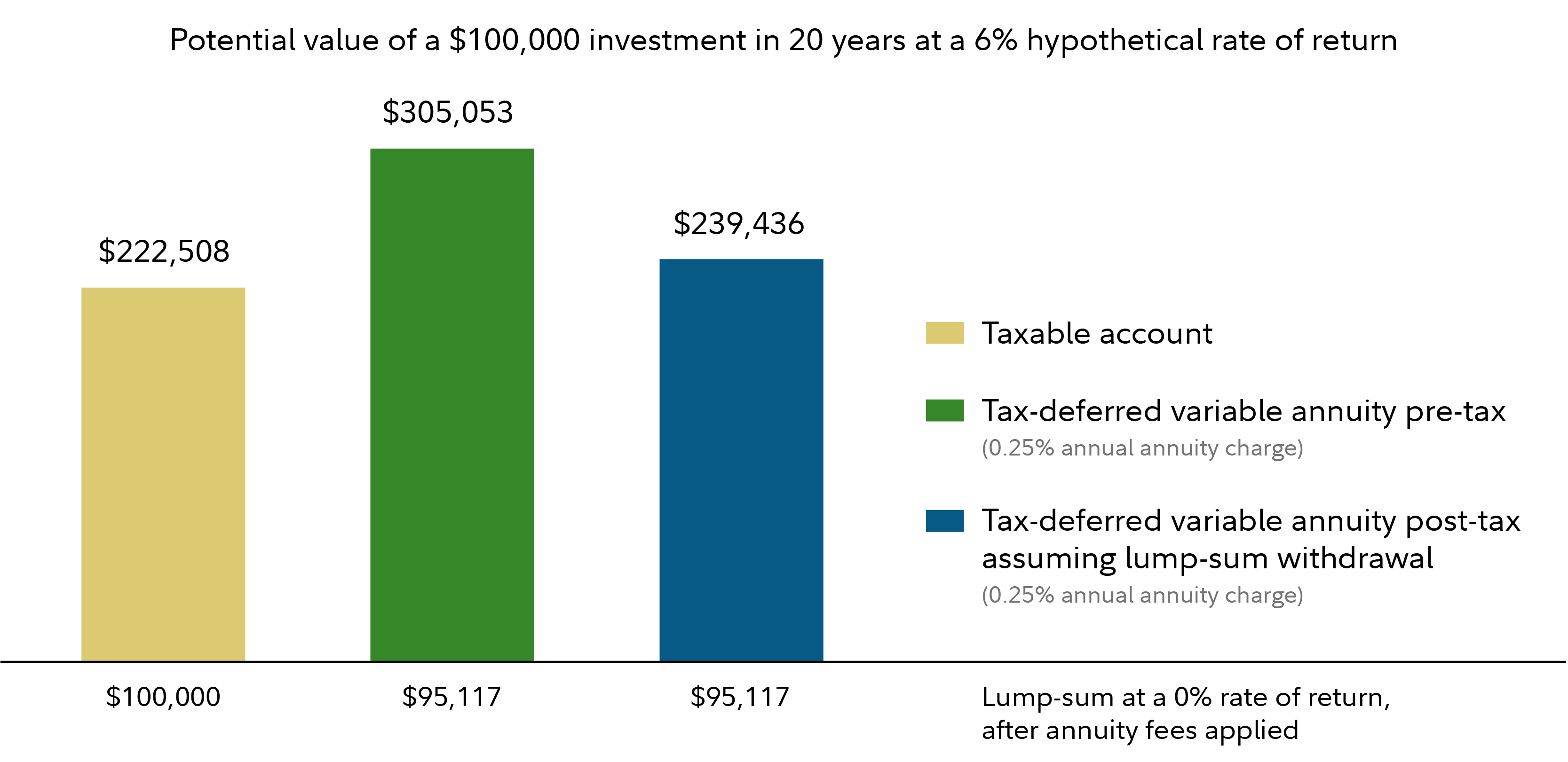

Fidelity’s Personal Retirement Annuity®, 3 for example, charges 0.25% per year, well below the industry average of 1.03%.4

Who should consider a tax-deferred variable annuity?

Answering these 5 questions can help you determine if a tax-deferred variable annuity may be a strategy for you to consider.

4. Do you have a long window before taking income in retirement? The advantage of tax deferral is proportional to the amount of time available before the assets are withdrawn from the deferred account. In general, if you won’t need access to this money for at least 10 years, you may be a good candidate for a low-cost tax-deferred variable annuity. However, a shorter time frame may still make sense, depending on other considerations such as the tax-efficiency of your overall holdings and your tax bracket.

5. Might your estate be subject to estate and gift taxes? Should you die while owning a tax-deferred variable annuity, the surrender value of the annuity contract would be included in your estate, so if you think your estate may be subject to gift and estate taxes, you may want to consider planning strategies to reduce or defer your tax liability. For example, you may want to consider distributing the gains during your lifetime and paying income taxes. Also consider advantageous post-death distribution options, which include leaving the annuity to a spouse, who can continue tax deferral, generally until age 95, naming a non-spouse beneficiary, who may be eligible to elect to take distributions over their life expectancy and stretch out the income tax, or naming a charity as beneficiary. Talk to your attorney or estate planning professional about the best ways to manage the income and estate tax implications of a tax-deferred variable annuity.

Additional tax-deferred variable annuity considerations

No matter which provider you choose for a tax-deferred variable annuity, you will generally pay more if you need to address a specific risk with a guarantee, such as a guaranteed living benefit. This could potentially provide income or asset protection from down markets. “It’s important to ensure that you understand the features of an annuity, and aren’t paying for features you don’t need,” explains Jeeves.

It's also critical to choose a provider in sound financial health. “If you are planning to enter into a multi-decade contract with a provider, you want to make sure they will be there to pay out the obligations,” Jeeves says.

The bottom line

Annuities can be powerful tools for tax-deferred savings and offer guaranteed income that can potentially improve your confidence in retirement. However, they are not for everyone, so it's important to consider all the different pros and cons an annuity may provide for achieving your personal goals. If you’re considering a tax-deferred variable annuity, talk to a financial professional who can assess how it might fit into your unique retirement savings plan.