Imagine you’re about to wrap up your career after decades of hard work, and you’re looking forward to the freedom of retirement, including choosing where you’d like to live.

That might mean moving closer to your children, who may live in different states, or maybe you’re considering trading cold Northeast winters for retirement in the warmer climate of the Sunbelt. But as you research your options, you quickly realize that tax rates on retirement income can vary widely by state—and that where you decide to live could have a dramatic impact on your retirement nest egg.

Suddenly, choosing where you'll spend your retirement years becomes more of a strategic financial decision and less about lifestyle. The difference between retiring in a lower-tax state versus a higher-tax one could potentially result in thousands of dollars of savings each year.

While income from Social Security is generally exempt from state taxes in all but 9 states, income from workplace retirement accounts, traditional IRAs, and pensions is subject to income taxes in most states, in addition to federal taxes. Other state taxes to consider in retirement include property, sales, estate, and inheritance taxes. If you’re considering relocating in retirement, understanding how these taxes affect your bottom line could help your income go further—and your retirement last longer.

To help you decide where you might live in retirement, we’ve crunched the numbers on each state if you’re making traditional IRA withdrawals of $100,000 annually in retirement. We examined the combined current effective federal and state taxes imposed on withdrawals from traditional IRAs, factoring in exemptions, deductions, and credits on those withdrawals. We do not consider state standard deductions and exemptions; instead, we use the federal standard deductions. All state tax information is for tax year 2024.

The following are the best and worst states for taxes on IRA withdrawals of $100,000 annually. Note: While Washington, DC, is not a state, it is included in our analysis.

What are the best states to retire for taxes on retirement withdrawals?

Nine states have no income tax. These are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. An additional 4 states do not tax income from IRAs. These are Iowa, Illinois, Mississippi, and Pennsylvania.

Imagine a married couple with $100,000 in withdrawals from IRAs in high-tax Oregon would pay a 12.98% effective state and federal income tax rate. That same couple would pay a 7.66% effective tax rate if they moved to Iowa.

Although Iowa has a tax rate of 4.82% on income between $12,420 and $62,100 and 5.7% on amounts greater than that, it does not tax withdrawals from IRAs for people who are 55 years of age or older by the end of the year. Although the couple would still owe effective federal income tax on the $100,000, the 5.32-percentage-point reduction in the effective income tax rate due to the state treatment of IRA withdrawals could really add up. Invested for 10 years at a 7% rate of return, the $5,320 saved at the end of each year could leave them with more than $73,000 in additional savings.1

An effective tax rate that includes federal income brackets and state income tax brackets as well as state income tax treatment of IRA withdrawals is used. We assume that state adjusted gross income (AGI) is the same as the federal AGI and that the only deduction that applies is the federal standard deduction based on filing status ($29,200 for married filing jointly (MFJ) or $14,600 for single). We assume further that the additional federal standard deduction for age is included ($1,550 for both members of an MFJ household, or one deduction of $1,950 for single filers) and no federal tax credits are claimed. Note that while we model 2 additional standard deductions for MFJ filers, households may have only one or none, depending on the age of each spouse. All data is as of 2024. Tax law may have changed between 2024 and the publishing date of the article.

For states with AGI-based phaseouts on IRA exemptions, such as Virginia and New Jersey, the phaseout is not considered and the exemption is fully applied. For certain states, such as Connecticut, Rhode Island, Wisconsin, and Montana, no exemption is applied. Where a maximum exemption amount differs by filing status, the maximum for a single filer is used.

For Connecticut, the analysis does not account for the phaseout of the lowest bracket or either of the benefit recaptures when calculating the tax liability. For Arkansas, the analysis blends the lower-earning tax rate schedule with the higher-earning schedule for the purposes of calculating tax liability.

States with the highest and lowest effective tax rates for retirees

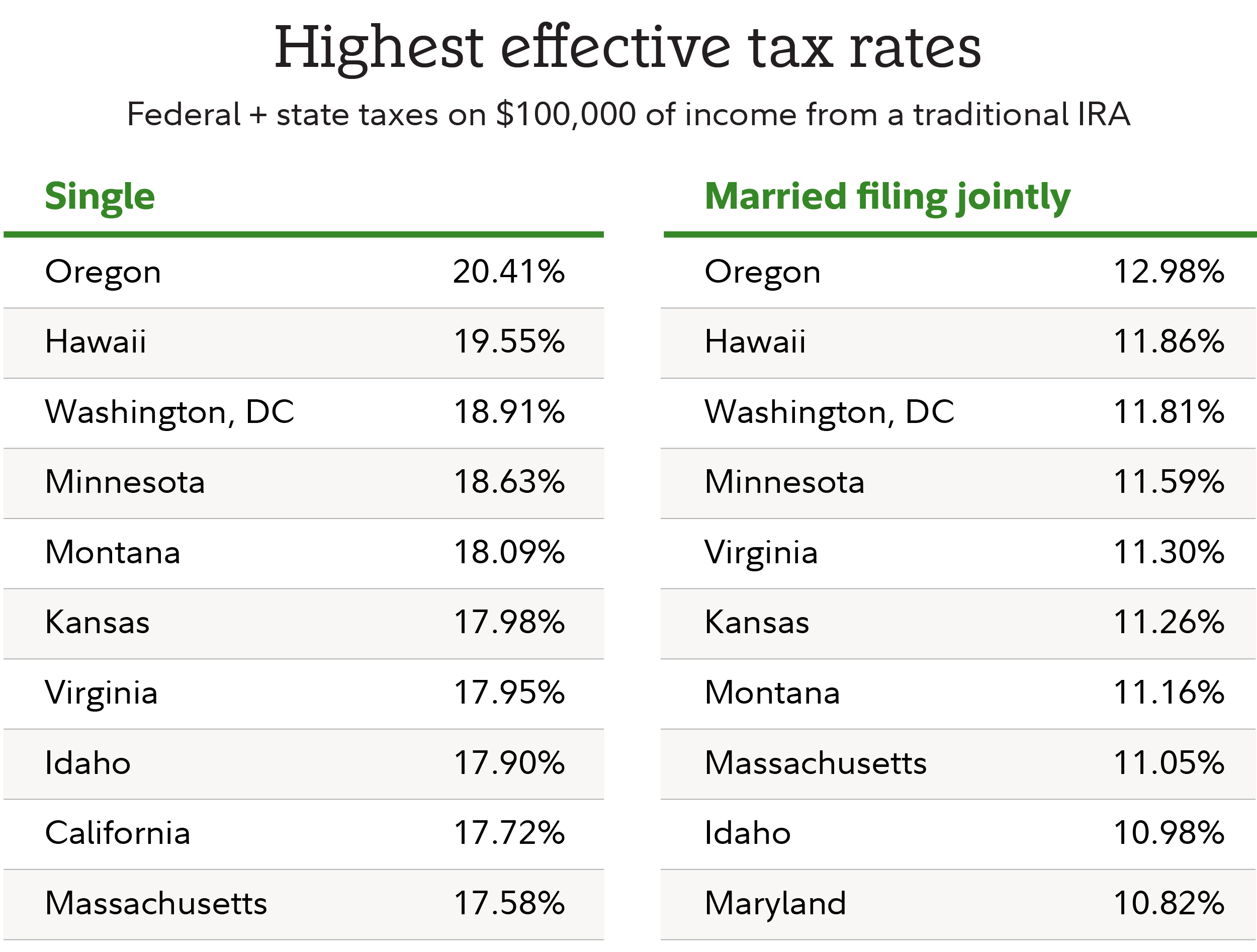

In the 2 graphics below, we illustrate the range of these effective income tax rates for both single people and married couples with $100,000 in taxable IRA income. You may be surprised about some of the best and worst states for taxes on retirement income, particularly when it comes to marital status.

Among the 37 states and Washington, DC, that do tax IRA income, the effective state and federal tax rate ranges from a high of 20.41% for Oregon to a low of 13.93% for New Jersey for single filers with $100,000 of IRA distributions. For married filers with the same amount of withdrawals, the rate ranges from a high of 12.98% for Oregon to a low of 7.81% for Georgia.

Charts assume IRA withdrawals of $100,000, which is generally subject to income taxation, unless a state has a specific treatment. An effective tax rate that includes federal income brackets and state income tax brackets as well as state income tax treatment of IRA withdrawals is used. We assume that state adjusted gross income (AGI) is the same as the federal AGI and that the only deduction that applies is the federal standard deduction based on filing status ($29,200 for married filing jointly (MFJ) or $14,600 for single). We assume further that the additional federal standard deduction for age is included ($1,550 for both members of an MFJ household, or one deduction of $1,950 for single filers) and no federal tax credits are claimed. Note that while we model 2 additional standard deductions for MFJ filers, households may have only one or none, depending on the age of each spouse. All data is as of 2024. Tax law may have changed between 2024 and the publishing date of the article.

For states with AGI-based phaseouts on IRA exemptions, such as Virginia and New Jersey, the phaseout is not considered and the exemption is fully applied. For certain states, such as Connecticut, Rhode Island, Wisconsin, and Montana, no exemption is applied. Where a maximum exemption amount differs by filing status, the maximum for a single filer is used.

For Connecticut, the analysis does not account for the phaseout of the lowest bracket or either of the benefit recaptures when calculating the tax liability. For Arkansas, the analysis blends the lower-earning tax rate schedule with the higher-earning schedule for the purposes of calculating tax liability.

Surprising takeaways for retirees

- Oregon is the most expensive state for both single people and those who are married filing jointly, followed by Hawaii, Washington, DC, and Minnesota.

- New Jersey, otherwise a high-cost, high-tax northeastern state with high sales and property taxes, is one of the most favorable states of those that tax IRA withdrawals, for both single and married joint tax filers making withdrawals from IRAs. A single filer taking $100,000 in withdrawals from an IRA would pay a state and federal effective tax rate of 13.93%, while those who are married and filing jointly pay 7.91%, or nearly half the single effective tax rate.

- Quite a few states known for high income taxes in general are somewhat more favorable for retirees who are taking $100,000 in retirement account withdrawals, particularly those who are married. California, for example, with a tax rate of 9.13% for joint filers ranks sixth nationally for such filers (but it is in the bottom 9 for single filers).

- Similarly, some Sun Belt states may have relatively higher effective tax rates on $100,000 of withdrawals from an IRA than their reputations for retirement affordability might suggest. For example, New Mexico, with an effective tax rate of 10.57% for married filers and 17.22% for single filers ranks near the bottom third of states.

- Contrary to preconceived notions about affordability in general, some midwestern states also have surprisingly high tax rates for people taking $100,000 of withdrawals from an IRA. Kansas, with an effective tax rate of 11.26% for married filers and 17.98% for single filers, has higher tax rates than Massachusetts, Connecticut, and Maryland for both single and married filers living on retirement income.

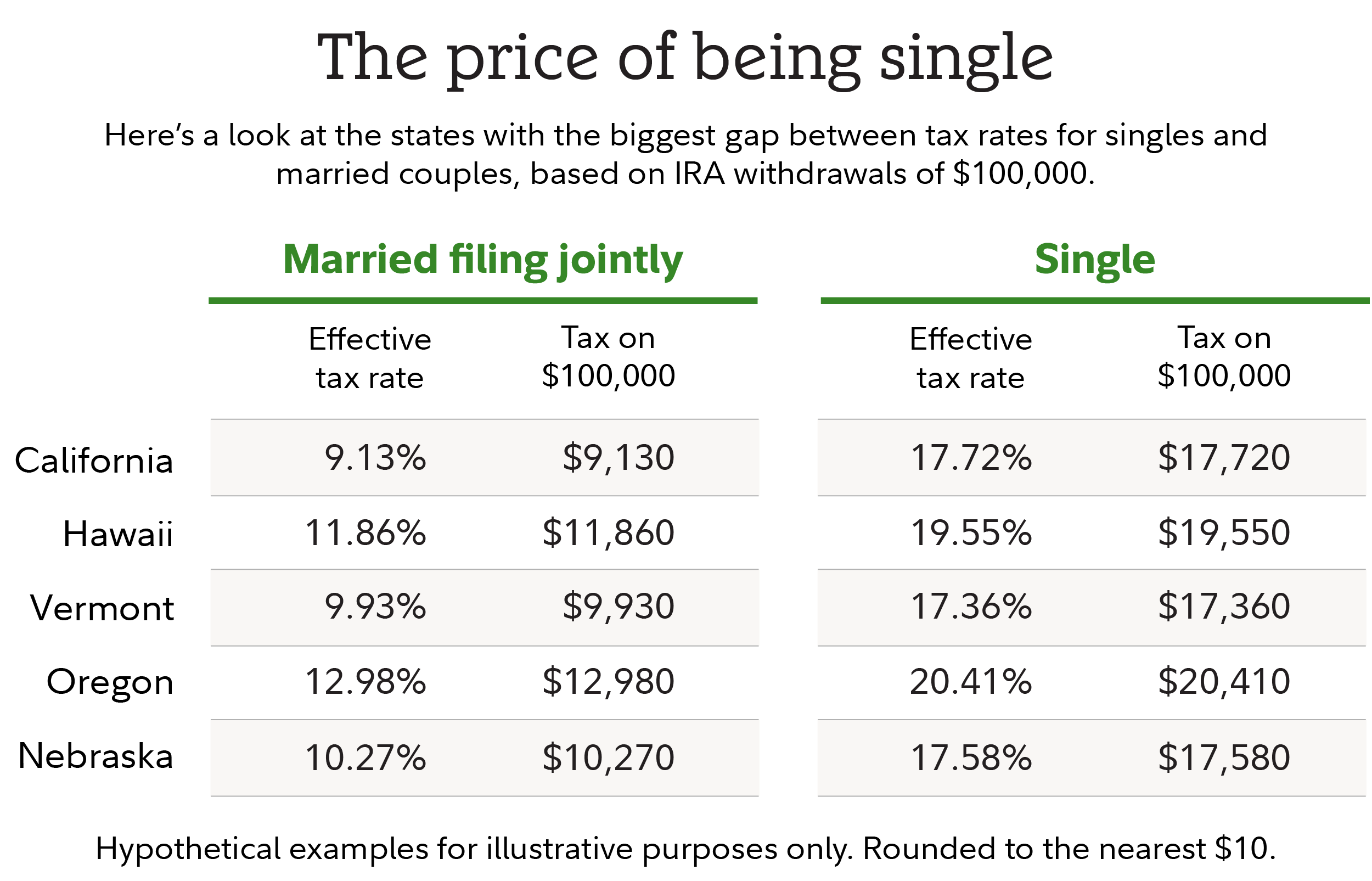

Differences by marital status

Across all states, married people filing jointly have an advantage over single filers, with combined federal and state tax rates for someone taking $100,000 in IRA withdrawals that are about 6 percentage points less than their unmarried counterparts. That could be a particularly important consideration if you are recently separated or widowed, in which case you could experience a sharp increase in your effective tax rate. Note: Federal tax law allows a recently widowed person to file as qualifying surviving spouse in the year of their spouse’s death, essentially preserving their joint filing tax status during this time period. The steps to claim qualifying surviving spouse status after that primarily require having a dependent child.

Charts assume IRA withdrawals of $100,000, which is generally subject to income taxation, unless a state has a specific treatment. An effective tax rate that includes federal income brackets and state income tax brackets as well as state income tax treatment of IRA withdrawals is used. We assume that state adjusted gross income (AGI) is the same as the federal AGI and that the only deduction that applies is the federal standard deduction based on filing status ($29,200 for married filing jointly (MFJ) or $14,600 for single). We assume further that the additional federal standard deduction for age is included ($1,550 for both members of an MFJ household, or one deduction of $1,950 for single filers) and no federal tax credits are claimed. Note that while we model two additional standard deductions for MFJ filers, households may have only one or none, depending on the age of each spouse. All data is as of 2024. Tax law may have changed between 2024 and the publishing date of the article.

For states with AGI-based phaseouts on IRA exemptions, such as Virginia and New Jersey, the phaseout is not considered and the exemption is fully applied. For certain states, such as Connecticut, Rhode Island, Wisconsin, and Montana, no exemption is applied. Where a maximum exemption amount differs by filing status, the maximum for a single filer is used.

For Connecticut, the analysis does not account for the phaseout of the lowest bracket or either of the benefit recaptures when calculating the tax liability. For Arkansas, the analysis blends the lower-earning tax rate schedule with the higher-earning schedule for the purposes of calculating tax liability.

A penalty for single people

The difference in tax rates based on marital status could have a substantial impact on savings. For example, a married couple filing jointly with $100,000 in taxable retirement income and living in high-tax Hawaii would pay approximately $7,690 less annually than a single filer. Invested at the end of each year for 10 years with a 7% return, that would amount to more than $106,000.2

Nevertheless, if they have a relatively higher amount of retirement income, both the single and married filers might consider moving to a state where IRA withdrawals are fully exempt, such as Iowa or Pennsylvania, where state taxes are lower in general, and the average cost of living is also moderate.3 The married couple filing jointly might also consider California, where taxes on retirement income are lower than most other states. And there are always the no-tax states to consider.