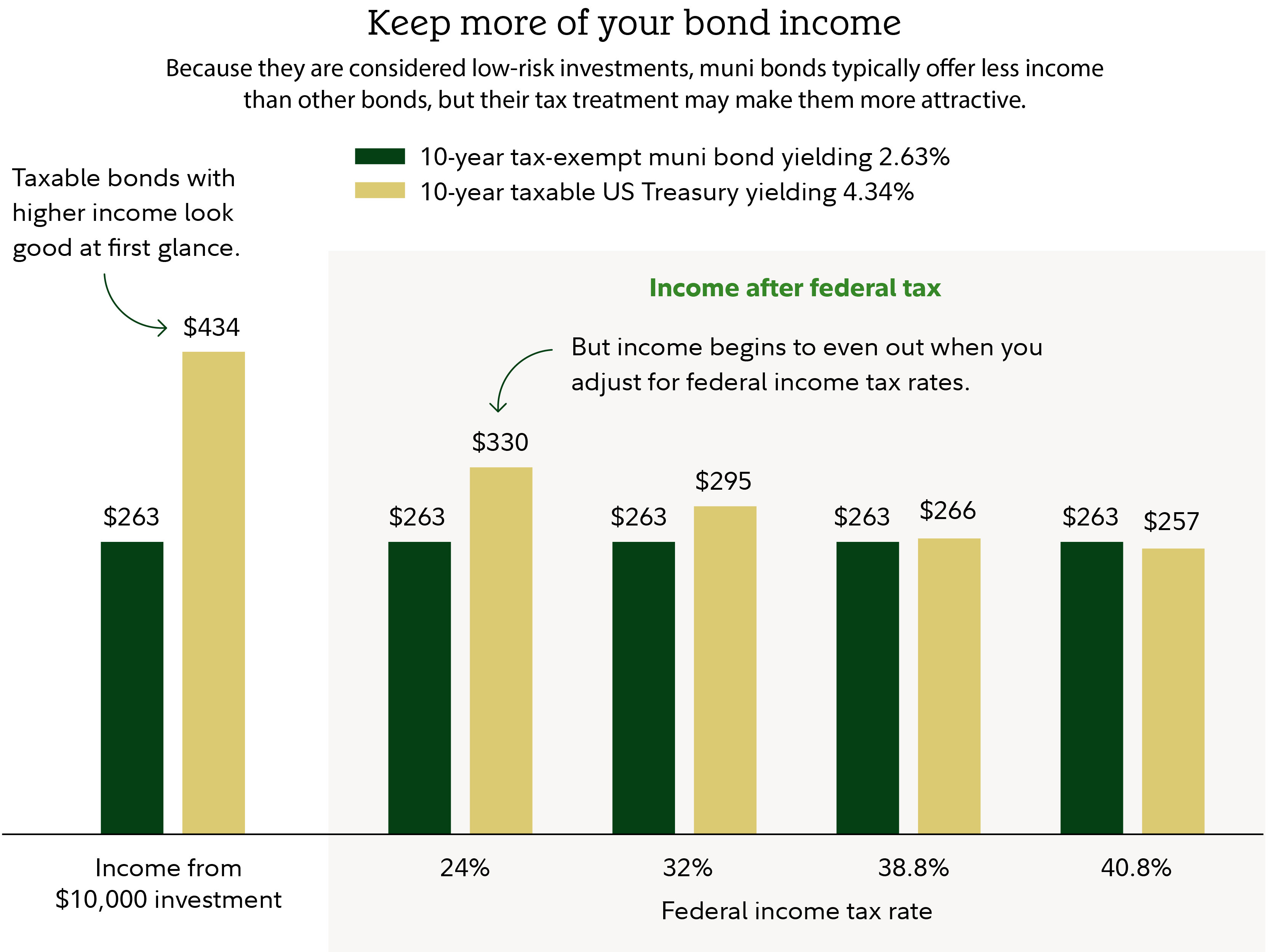

Municipal bonds, or “munis,” offer a unique combination of tax advantages, income stability, and relatively low risk, making them a popular choice for investors who are interested in regular income—especially those in higher tax brackets.

“While municipal bonds might seem intimidating to investors who have never invested in them before, their ability to provide a predictable stream of tax-exempt income offers a unique and potentially powerful capability, especially useful for high-income earners in high-tax states,” says Richard Carter, Fidelity vice president of fixed income strategy.

Here’s a look at how municipal bonds work, their pros and cons, and the different ways to invest in munis.

What are municipal bonds?

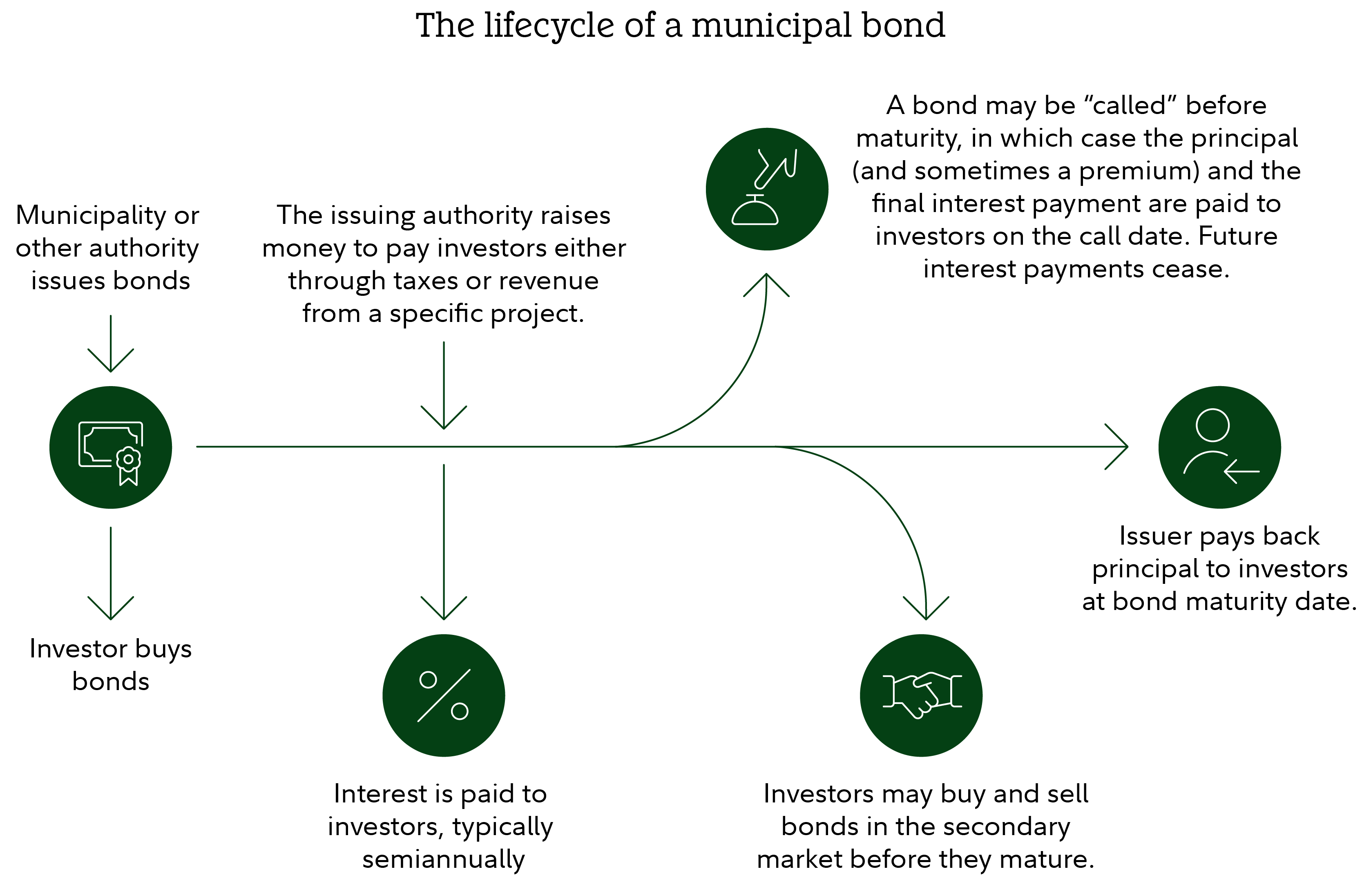

When you buy a municipal bond, you are essentially loaning money to the issuing authority—whether it is a state, local government, school district, or something else—to fund public projects such as the construction of schools, hospitals, and highways. In return, the issuing authority agrees to pay you interest for the duration of the bond, and return the principal to you when the bond matures.

How do municipal bonds work?

Like bonds issued by the federal government or corporations, municipal bonds are simply debt instruments—money lent by investors to states, counties, cities, and nonprofit organizations to pay for public projects or to refinance existing debt.

In return for an investor’s loan, the municipality promises to pay the investor interest—usually semiannually—and to return the investor’s principal on a specified date, often referred to as the maturity date (assuming no default).

Types of municipal bonds

In general, municipal bonds fall into 1 of 2 categories, based on the source of their interest payments and principal repayments. However, within these categories, a municipal bond can be structured in different ways, with each variation offering different benefits, risks, and tax treatments.

General obligation bond

These bonds are issued by states, cities, or counties and are backed by the government’s power to tax residents to pay bondholders.

Revenue bond

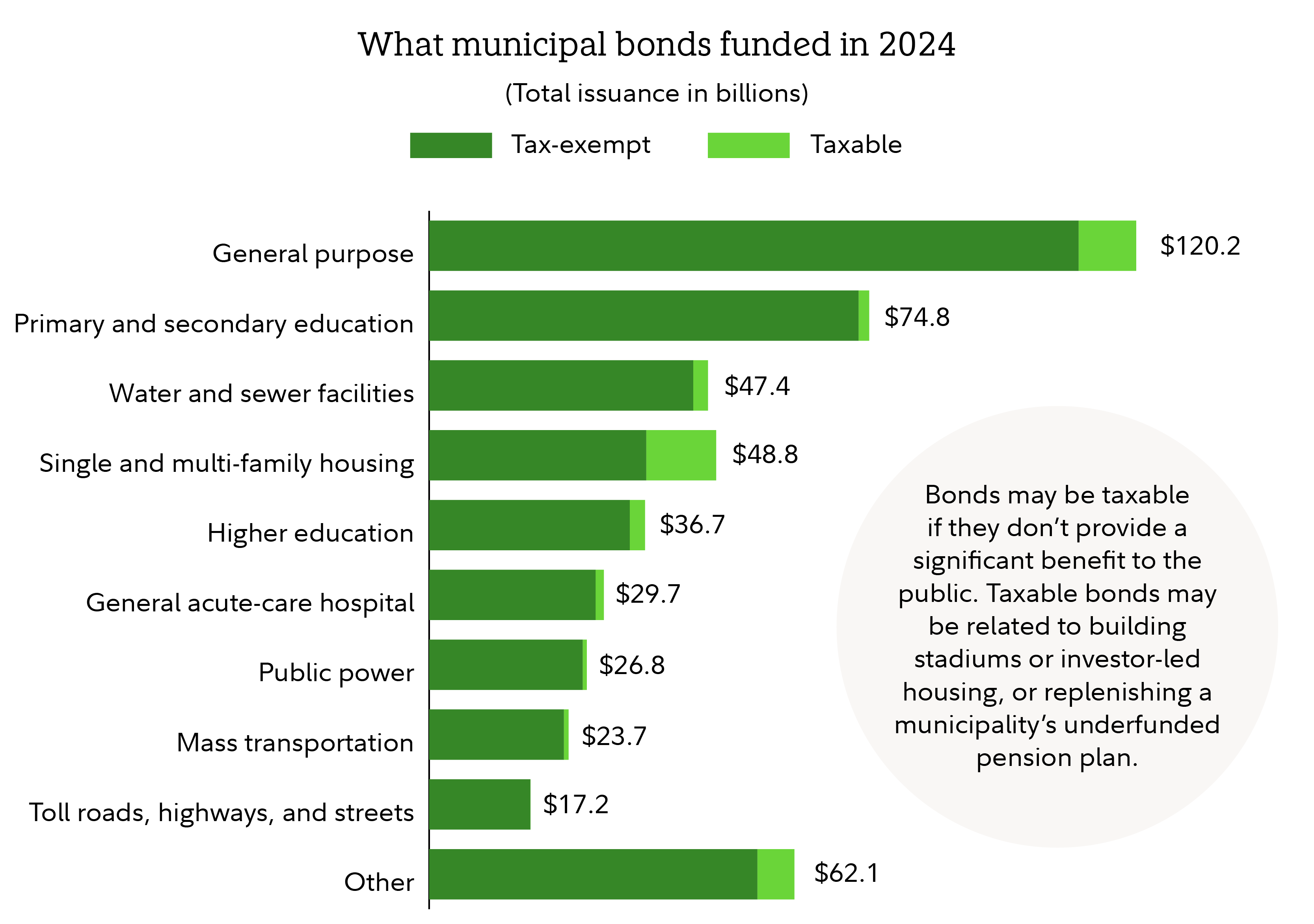

These bonds are backed by revenues from a specific project, such as a toll road or a utility project.

Advantages of municipal bonds

Municipal bonds offer several appealing benefits, especially for income-focused investors seeking tax efficiency.

Tax advantages

The interest you earn from most muni bonds is typically exempt from federal income tax and may be exempt from state or local income tax, depending on whether you are a resident of the state that issued the bond. A small percentage of municipal bonds are taxable at the federal level.

Low level of default risk

Credit risk is the risk that the issuer will default or be unable to make required principal or interest payments. Despite the fact that many municipal bonds have high credit ratings and their default risk has been historically low compared to corporate bonds, credit risk still increases with lower-rated municipal bonds.

Disadvantages of municipal bonds

While municipal bonds offer tax advantages and stability, they also come with trade-offs that investors should carefully consider.

Interest rate risk

Like all fixed income securities, the market prices of municipal bonds are susceptible to fluctuations in interest rates. If interest rates rise, market prices of existing bonds will typically decline, despite the lack of change in both the coupon rate and maturity. Bonds with longer maturities are generally more susceptible to changes in interest rates than bonds with shorter maturities.

Call risk

Many municipal bonds carry provisions that allow the issuer to call or redeem the bond prior to the actual maturity date. An issuer will typically call bonds when prevailing interest rates drop, allowing the entity to reissue bonds at a lower borrowing cost. In this circumstance, the action makes reinvestment less desirable for the holder.

Liquidity risk

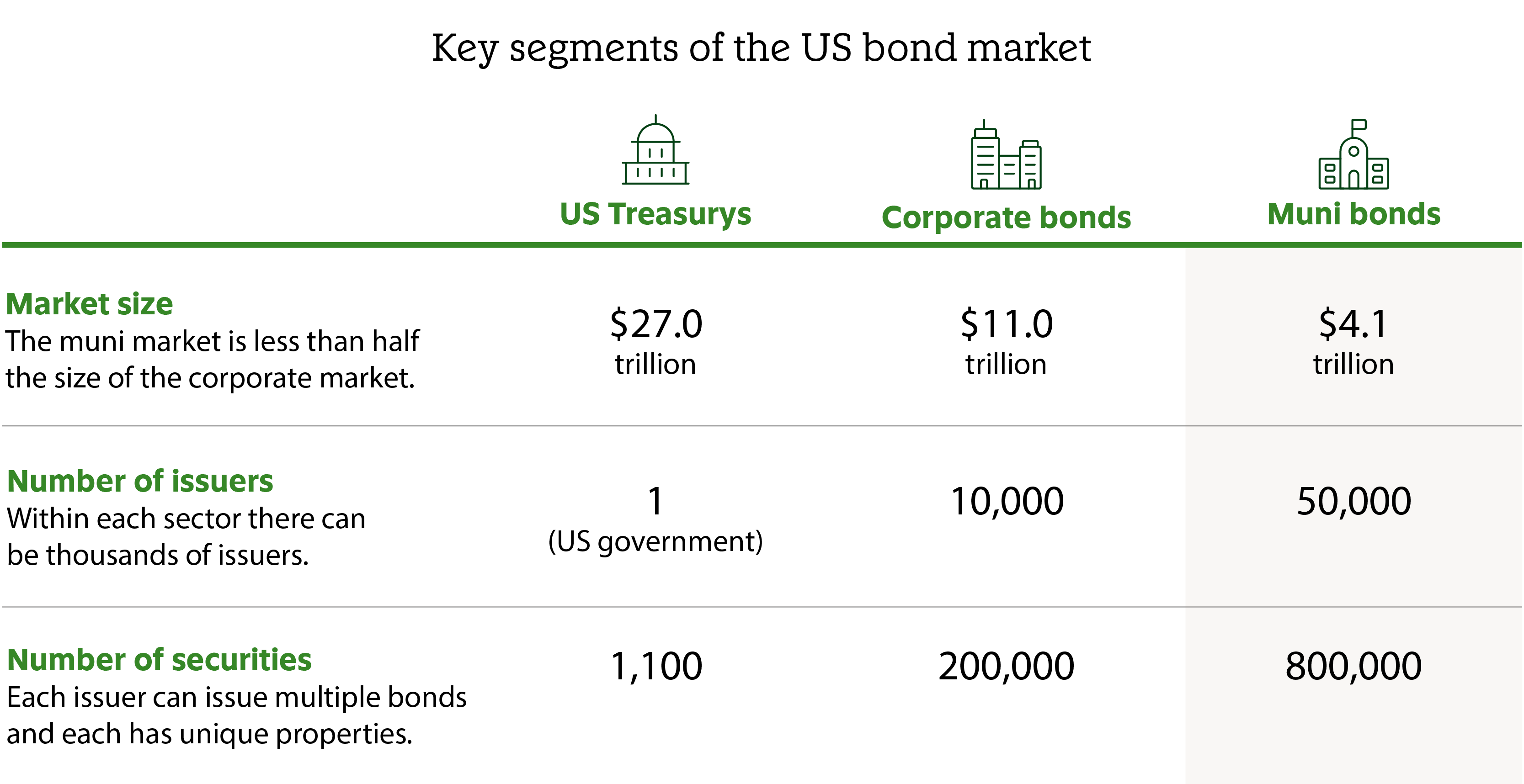

The bond market is large and fragmented, with more than 50,000 entities issuing a million different bonds, which represent trillions of dollars in the market. For that reason, the vast majority of municipal bonds are not traded on a regular basis, so the market for a specific bond may not be particularly liquid.

How to buy municipal bonds

There are 3 ways investors generally gain exposure to muni bonds.

Individual bonds

You can buy a single municipal bond for as little as $5,000, but it may take much more than that to build a complete portfolio of bonds.

There are 2 ways to buy individual bonds.

- New issues: These are municipal bonds that are being sold for the first time. For example, a city issues bonds to fund a new school. These bonds are offered to investors as a new issue. Investors buy directly from the issuer or through a broker, and can invest at the same price as large institutions are paying for the same new issue.

- Secondary market: This is where existing municipal bonds are bought and sold after the initial issuance. For instance, an investor buys a 10-year municipal bond from another investor 5 years after it was issued. Prices in the secondary market fluctuate based on interest rates, credit ratings, and market demand. Investors can buy or sell bonds through brokers at prices at or above par, and include the broker’s trading fee known as a markup for a purchase and markdown on when a customer sells.

Buying munis one-by-one means assessing the value of individual bonds and choosing from different issuers, yields, durations, and risk profiles.

If you want to build a portfolio of individual bonds, you can search for new issues or secondary market bonds with Fidelity’s research tools.

Bond funds and ETFs

Bond funds offer you the ability to invest in a broad portfolio of bonds for a low minimum investment. Mutual funds and ETFs that focus on munis generally fall into 3 categories:

- National municipal funds invest in municipal bonds issued by various state and local governments. The income from these funds is generally free from federal taxes, although a portion may be subject to state and local taxes, as well as the federal alternative minimum tax (AMT).

- State municipal funds invest primarily in bonds issued in a specific state. Each state-specific category includes long, intermediate, and short duration bond funds. The income from state-specific funds is generally exempt from federal taxes and may also be exempt from state taxes, depending on where you live.

- Municipal money market funds invest at least 80% of assets in municipal securities whose interest is exempt from federal income tax.

Try Fidelity’s mutual fund screener or ETF screener to search for municipal bond funds.

Separately managed account

A separately managed account (SMA) offers professional active management along with the benefits of direct ownership. Unlike mutual funds, where your money is pooled with other investors and you own shares of the fund, SMAs provide you with direct ownership of the individual bonds in your portfolio. This means greater transparency, more control, and a personalized investment experience tailored to your financial goals.

Learn more about Fidelity’s municipal bond SMAs: Fidelity’s Intermediate Municipal Strategy and Fidelity® Limited Duration Municipal Strategy.

How to decide

The most appropriate way for you to invest in munis, if you choose to include them in your portfolio, will depend on your financial goals, risk tolerance, investment knowledge, and how much control you want over your portfolio. Here are some of the key factors to consider:

| Individual bonds | Bond funds/ETFs | SMAs | |

|---|---|---|---|

| Minimum investment | Typically $5,000 per bond, but building a diversified portfolio may require $100,000+. | Low minimums (as little as $100 or less). | High minimums (Fidelity’s SMA offering has a minimum investment of $350,000). |

| Liquidity | Less liquid; may be hard to sell at a fair price before maturity. | Highly liquid; can be bought/sold daily at NAV. | Less liquid than funds, but more flexible than individual bonds. |

| Transparency | Full transparency—you know exactly what you own. | Less transparent; holdings change frequently. | High transparency; you can see all holdings. |

| Cost | No ongoing fees, but may have small markups, such as $5 per $5,000 bond in the secondary market. | Expense ratios (typically 0.1%–1% annually). | Management fees (often 0.35%–0.40% annually) but may offer institutional pricing on bonds. |

| Expertise needed | Requires knowledge of credit risk, duration, and market conditions. | Professionally managed—good for hands-off investors. | Professionally managed but tailored to your preferences. |

Municipal bonds and bond funds are most effective when held in taxable accounts, such as brokerage accounts, because their primary advantage is tax-exempt interest income. Holding them in tax-advantaged accounts like IRAs or 401(k)s can negate this benefit, since those accounts already have tax advantages.

For this reason, most muni bonds are generally better suited for brokerage accounts, though there may be times when taxable muni bonds are appropriate for retirement accounts.

The bottom line

Municipal bonds can play an important role for certain investors, including:

- Retirees or near-retirees who are seeking tax-exempt income with low risk.

- Those who have maxxed out their tax advantaged accounts—IRAs and 401(k)s—and are looking for additional tax benefits.

- Residents of high-tax states, where tax-exempt income can have a big impact.

Ultimately, consider whether municipal bonds align with your overall investment strategy, risk tolerance, and tax situation before adding them to your portfolio.

“Not only can investors tap into a valuable source of return and diversification from municipal bonds,” Carter said, “but they can also derive a sense of pride and satisfaction in knowing that their investments are supporting local schools, hospitals, and essential services that benefit from the funding they raise from municipal bond investors.”