When you're new to investing, it can be rewarding to set goals and learn how to invest your money in order to achieve them. But it also can be intimidating.

If you'd rather leave it to the professionals, you may want to consider digital investment management. With this type of account, experienced investment managers are in charge of your portfolio. They make trading decisions and may even keep an eye on tax management, depending on the type of account.

Digital investment management generally offers lower costs and account minimums compared to traditional, full-service managed account options, making them more accessible for new investors. However, fees vary among digital platforms, so it's essential to compare costs before investing.

“New investors don’t have to navigate the markets alone—professionally managed portfolios are more accessible than ever and can offer a simple, low-cost way to start investing," says Shannon Bouchard, vice president of managed solutions at Fidelity.

Here’s a look at 2 kinds of digital investment management offerings that may help you decide which might be right for you.

Digital managed accounts

Commonly known as a robo advisor, digital managed accounts allow you to work with your advisor online to get the type of money management you need. Most robo advisors use information you provide—including your time horizon, financial situation, and risk tolerance—to suggest an investment strategy, then create and maintain a portfolio of mutual funds aligned with that strategy. Those funds may be invested in stocks, bonds, and cash.

No, it's not an actual robot advisor and, yes, there are still humans involved. "Robo" refers to these services being almost completely digital. "Advisor" covers all the human advisors behind the scenes who offer digital investment advice and account management services for investors.

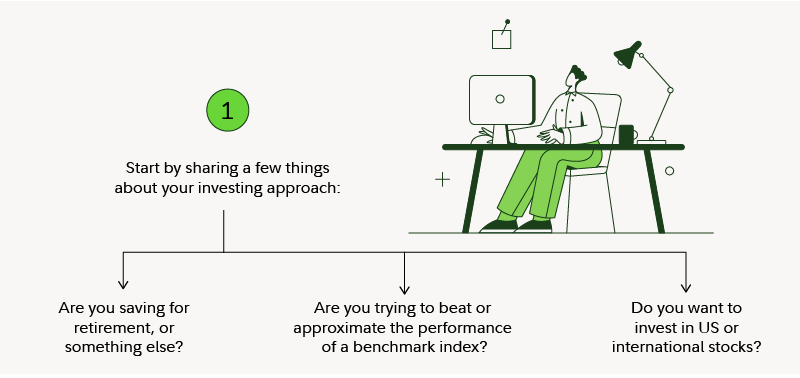

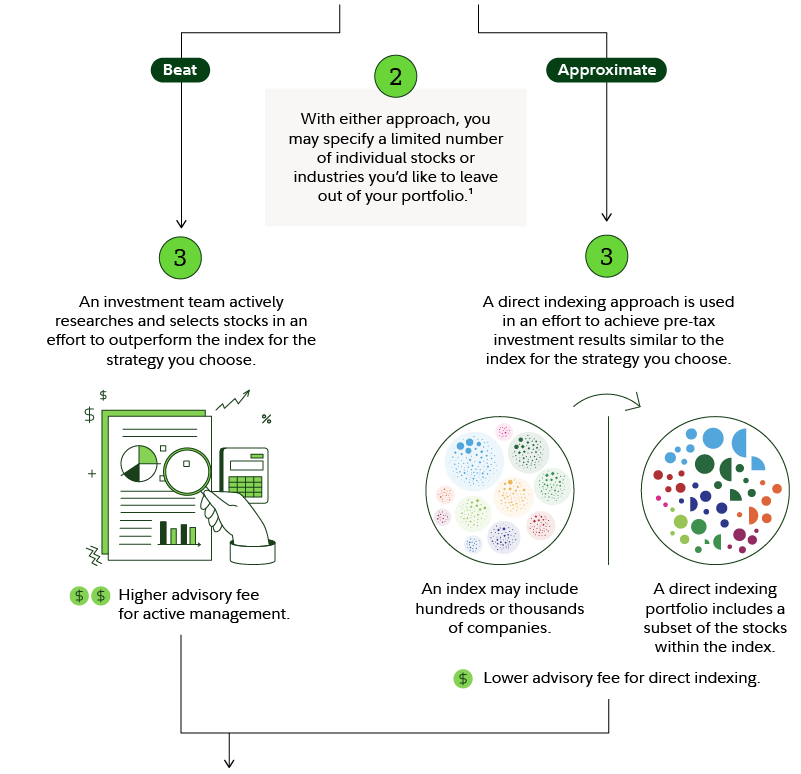

Here’s how these accounts work:

Fidelity's robo advisor, Fidelity Go®, offers you the option of adjusting your investment mix as you get closer to your goal.

Some robo advisors offer a hybrid option that combines a robo advisor with live, personalized financial coaching. This means you'll have a chance to ask questions, exchange ideas, and discuss your goals with a real person, typically by phone.

With Fidelity Go®, there is no minimum to open an account and your balance may be as little as $10 for your money to be invested for you. There are no advisory fees for balances under $25,000. When your account reaches $25,000 or more, you gain access to financial coaching from a team of Fidelity professionals. The annual advisory fee for balances of $25,000 and over is currently 0.35% per year.

Digital separately managed accounts

A digital separately managed account (SMA) is a professionally managed portfolio of investments that seeks to meet a specific investment objective.

In most cases, a digital SMA gives you exposure to a single asset class, such as stocks of large US companies. Professional managers diversify within that asset class. A digital SMA should be considered within your entire investment portfolio in order to maintain your overall asset allocation and diversification.

You will typically open and monitor your account online. Unlike investing in a mutual fund or ETF, when you invest in an SMA you own the underlying securities in an account, which may allow for more personalization1 and tax management2 compared to a mutual fund or ETF. Mutual funds and ETFs, on the other hand, typically have lower fees and expenses than a managed account.

With Fidelity Managed FidFolios®, Fidelity’s digital SMA, clients can choose one of several all-stock strategies which require a minimum investment of $5,000.3 Actively managed strategies have an annual advisory fee of 0.70%, or $35 for every $5,000 you have invested. Direct indexing strategies have an advisory fee of 0.40%, or $20 for every $5,000 you have invested.4

With lower minimums, these accounts are more accessible than Fidelity’s separately managed accounts, which have investment minimums ranging from $100,000–$350,000.

How these accounts compare

These types of accounts have some important things in common: They are managed by investment professionals, and they have low barriers for entry, which may be important for investors who are just starting out.

But they may appeal to different types of investors.

- A robo advisor may appeal to someone who wants a diversified portfolio of stocks, bonds, and cash aligned with a specific goal, such as retirement.

- A digital SMA may appeal to someone who wants more customization, potential for tax management, or more focus in a specific asset class.

The 2 types of accounts can even be complementary: You may want to use a robo advisor for your retirement savings, but a digital SMA for another goal.

Here’s a look at how Fidelity’s digital managed account offerings compare:

| Fidelity Go | Fidelity Managed FidFolios | |

| Holdings | A diversified portfolio of mutual funds allocated in stocks, bonds, and short-term investments. | Invests in many individual stocks to implement a targeted objective (such as outperform the S&P 500). Because it is a stock portfolio, it may have higher risk than a diversified portfolio with exposure to multiple asset classes. |

| Management | Professionally managed | Professionally managed |

| Coaching | Once your account reaches $25,000, you have access to a team of advisors for conversations on managing debt, retirement planning, and more. | Not available. All account activities take place online. |

| Features |

|

|

Source: Fidelity Investments.

The bottom line

If you’re just getting started investing, you don’t have to go at it alone. There are options for professional management that have a low barrier for entry and are low cost compared to traditional full service advisory offerings.

“Investing begins with setting clear goals and understanding how to reach them,” Fidelity’s Bouchard says. “No matter your starting point, professional support is available to help you build a strategy that fits your needs.”