For most people, stock market drops create uncertainty, sometimes even anxiety. It's natural to wonder if you should try to pull out of the market to avoid losses, or if the investments you hold are just too risky for you.

Market timing, trying to buy and sell based on short-term moves in the market, is not the answer. It's almost impossible to know when to sell to avoid a loss or when to re-enter the market after selling. For most people, a better approach is to have a financial plan for your particular goals, stick to that plan regardless of the short-term moves in the market, and periodically review your plan to keep it up to date.

But there are some times when it might make sense to adjust the risk level of your portfolio. Namely, if you have changes in your financial ability (risk capacity) or willingness (risk tolerance) to deal with your portfolio's level of market risk.

"The amount of risk that's appropriate for a person's portfolio isn't set in stone. Your risk tolerance is dynamic and changes over time along with changes in your situation," says Maura Humphreys, senior vice president of Financial Solutions at Fidelity.

Fidelity thinks you should choose an investment mix that works for your goals, how long you expect to remain invested, your financial situation, and your feelings about risk. But those things can change. Here are 3 situations where it may make sense to take a look at your portfolio and consider reducing your risk.

1. It's been a while since you chose your investment mix

Markets tend to bounce back. Even dramatic selloffs like those during the dot-com bubble, the financial crisis, or the Depression have eventually become downward blips on a long-term uptrend for the US stock market. But in order to ride out those down periods, you need to be able to stay invested. That's why time is such a key part of your risk level.

If you chose an investment mix years ago and the time you can remain invested is shorter, your mix may not make sense anymore. You may also need to rebalance if the relative performance of different types of investments has moved your investment mix away from your plan. That's why a regular portfolio review is an important part of your financial life—in good, bad, or flat markets.

"We think you should look at your investment plan at least once a year," says Michael Christy, vice president of Advanced Planning at Fidelity. "If it's been a year or longer, you should review your strategy and investment mix in light of changes in your life. It may be time to make some changes."

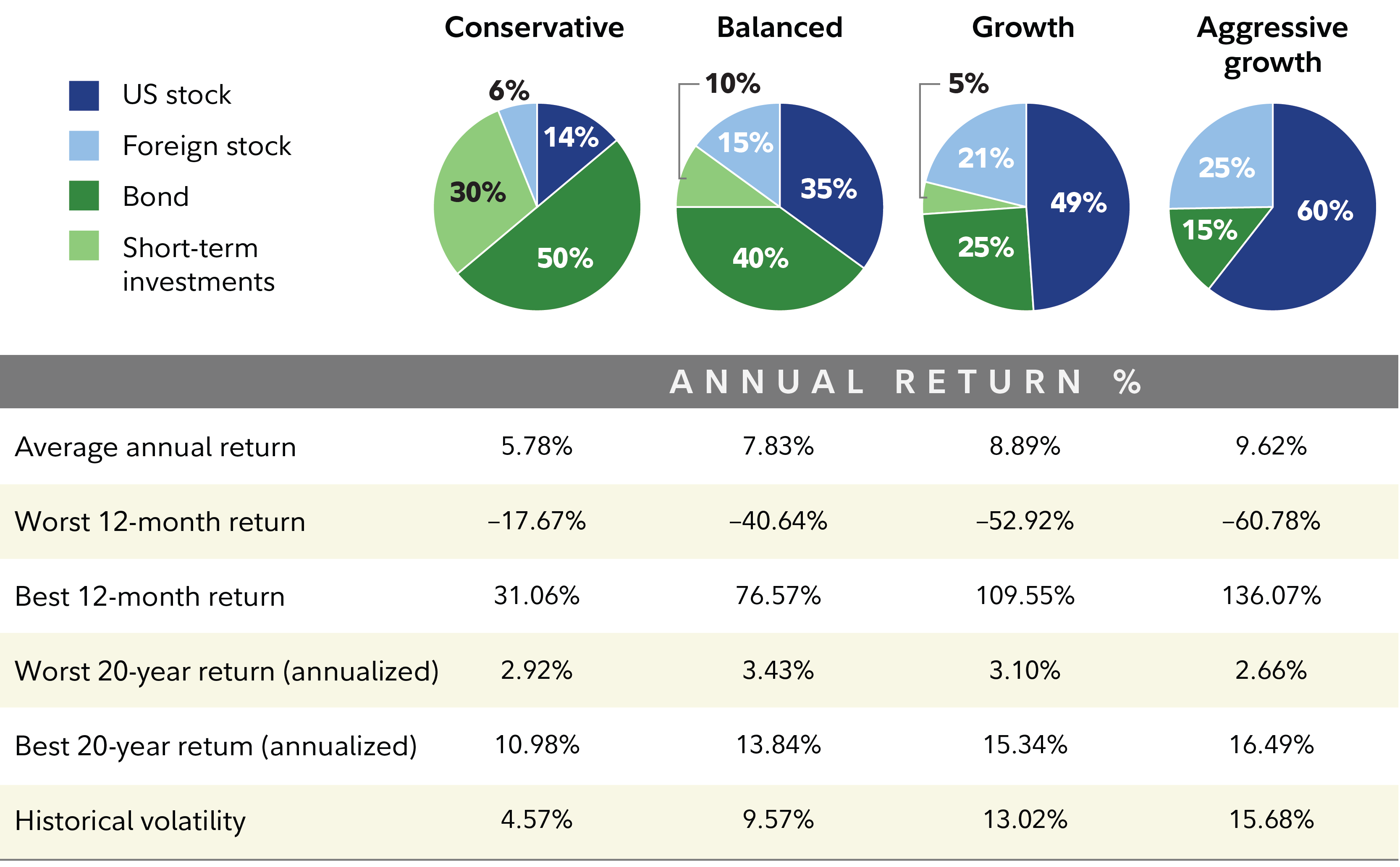

If you are starting to approach your goal, say entering retirement, and will need to draw from your portfolio to cover living expenses, it may make sense to adjust your portfolio to become less risky. For example, you may want to be less invested in stocks and more in high quality bonds, or more cash savings to help cover your expenses without selling securities. See below to see how different investment mixes have performed historically.

2. You've had a big change in your life

Everyone faces big changes from time to time. Maybe you adopted a child, or your child moved out and got a job. Maybe you quit your job to start a new business, or spent some of your emergency savings when you needed a new car. Whatever the reason, major financial changes can have a big impact on your financial ability to handle the risks that come with investing.

Why? Well, just like you need time to be able to ride out down periods in the markets, you need the financial ability to leave your money invested. If you lose your job in a recession, you may need to tap into your savings sooner than you expected, and you don't want the mortgage money tied up in stocks. As legendary investor Peter Lynch told Viewpoints: "If you need your money in less than 3 years, it shouldn't be in stocks."

So every time you have a major life event, it's worth a check-in with your investment plan. If things have changed for you or your family since you created your strategy, it may be time to take a look and make some adjustments.

3. Your feelings about risk have changed

How you feel about risk also plays a big part in being able to stick with your plan. And your feelings may change over time. For some folks, a 20% drop in the markets seems like no big deal when their goal is still many years away. But when retirement is around the corner or tuition bills start, that same market move may keep them up at night.

It's important to check in on how you feel about risk and how those feelings have changed over time. Of course, most people feel some discomfort during market downturns; that's natural, but most people need some growth potential in their portfolio. That potential may make it worth living with some discomfort and you may not require a change in your plan. But if you can't tolerate the volatility of your portfolio it may be time to turn down the percentage of stocks in your investment mix. That means you might not be as involved in any potential market recoveries down the road, but it should reduce the risk level of your portfolio.

Chart a new path, don't start to wander

For many other people who already have a solid plan in place, simply sticking with the plan might be the right move. For others, taking the time to revisit their plan makes sense, and for some people, reducing the risk in their portfolio may be the right move. But that doesn't mean you should react to every economic report or each time the market goes up or down.

"Volatility can be a good reminder to give your strategy a checkup, but instead of reacting to short-term moves, think of trying to find a new normal," says Christy. "You don't want to sell because the markets hit a rough patch, or buy stocks because the market is going up, but you do want to regularly check in to make sure you have an investment mix that you can live with and will help you achieve your long term financial goals."