US and global stocks are down roughly 6% since hitting all-time highs in mid-July. Over the same timeframe, oil and bitcoin have plunged more than 10%. Meanwhile, the CBOE Volatility Index—commonly known as the VIX or “fear index”—has nearly doubled. While stocks recovered some of those losses on Tuesday, you may be wondering if the market may be melting down.

Now, take a step back and consider that:

- Stocks and a number of other investments are still up big over the long run.

- Market corrections are completely normal.

- Economic data remains mostly strong.

- There may be several silver linings from the recent downturn.

With that context, here’s a look at some things that have shaped the market lately—plus reasons why you shouldn’t panic.

Why stocks sold off

Several factors appear to have helped accelerate some of the global market selling in recent weeks. They include:

- Expensive stock prices. Stocks can’t perpetually rise. That may particularly be the case for parts of the market, like the AI trade, where some investors could be looking for earnings to catch up to valuations. Selling pressure for several market-moving companies, such as the Magnificent 7, helped trigger a correction in the tech-heavy Nasdaq. It’s crucial to remember that market corrections happen with some frequency, and they even occur within bull markets. While indexes like the S&P 500 and Nasdaq are down sharply over the past several weeks, they are still positive year-to-date and are way up over the longer term.

- Some economic data has weakened. An uptick in the US unemployment rate and jobless claims has renewed some fears of a potentially mild recession. But there is also data suggesting the US economy is still relatively healthy and in a mid-cycle expansion. And even though jobless claims increased recently, they are still relatively low historically speaking, and factors like US GDP growth (which surprised everyone last quarter with a stronger-than-expected 2.8% year-over-year increase) remain solid.

- Carry trade reverses. There’s evidence that some of the global carry trade (where investors borrow in relatively low-yielding currencies—such as the Japanese yen and Swiss franc—and reinvest in higher-yielding investments like global stocks) has reversed course. The yen has risen sharply against currencies like the US dollar in recent weeks, hinting that some investors may be repositioning in more “safe-haven” investments. Of course, it’s not the case that investors are broadly thinking about going to more defensive investments over fears of an economic slowdown. To that point, the yield curve (which measures bond investors’ feelings about risk) recently un-inverted for the first time in 2 years. An inverted yield curve may be viewed as a potential harbinger of a recession.

- Major investors making news. Warren Buffett’s Berkshire Hathaway, for example, has been in the news lately for selling large positions in some mega-cap companies. Of course, Buffett is perhaps the most well-known investor who advocates for staying invested over the long term, rather than focusing on short-term market fluctuations—advice that investors should consider while volatility is elevated.

- Inflation. While prices for a range of goods have come down dramatically over the past couple years, many remain elevated compared to prior years. A silver lining here may be that prices for some goods (such as gas) may decline over the near term, given that oil prices have come down from recent peaks, and that may help further cool inflation (although ongoing tensions in the Middle East have the potential to push energy prices higher). Also, an improving inflation picture has the market now pricing in 3 rate cuts this year, which many view as being stimulative for stocks.

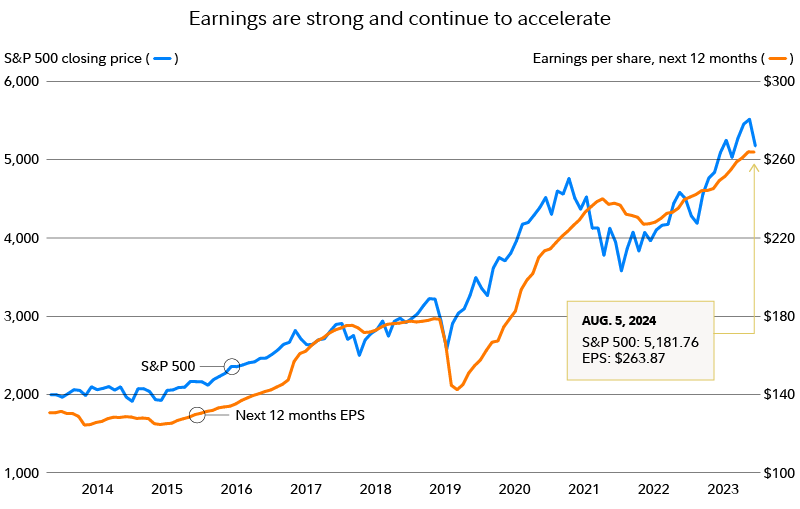

While these factors may continue to influence markets over the short term, the key factor for stocks over the long run remains earnings strength—which continues to be resilient. US corporate profits, for example, have risen this year and are expected to grow in 2025. That’s a big part of the reason why stocks are still up in 2024 and have climbed so dramatically during this bull market.

What you can do amid the selloff

First and foremost, it’s important for investors to understand that investing involves risk. Times like these are a good reminder that you can benefit from having a financial plan that takes into account strategies for volatile markets.

It’s possible to manage your risk. Now might be a good time to look at your investment mix to see if you are comfortable with the level of risk. If you were looking to reduce the amount of risk in your portfolio, you could consider several strategies.

- Ensure you are diversified. If you have owned tech stocks over the past several years, there is a strong chance that they have grown to a larger percentage of your overall investment mix because of how well they have performed relative to the rest of the market. You could consider rebalancing your investment mix to make sure that you are diversified across and within asset classes.

- Consider defensive investments. There are a variety of investments that can help you reduce your risk exposure. Sector rotation is a strategy that you could consider—allocating a greater percentage of your investments to those sectors that have more defensive characteristics compared with more cyclical, growth sectors.

- Find opportunities. During market selloffs, some active investors may use the selloff to get into investments at more attractive prices. Fidelity’s Denise Chisholm suggests exploring interest-rate sensitive sectors as well as small- and mid-cap companies.

- Stay invested and remain calm. Another strategy is to simply wait out the market volatility. If you are comfortable with your plan and your investments, you might choose to rely on the historical proclivity for stocks to rise over time. Market corrections are normal, and while it’s possible volatility could persist, markets have a long history of recovering short-term losses over the longer term.