You’ve probably heard of a Roth IRA. It’s a popular way to help save for your retirement outside of your work plans.

The idea is simple: you contribute money you’ve already paid taxes on to your account, invest it, and it has the potential to grow tax-free over time. But the best part? Once you’re 59½ years old, and your account’s been open for at least 5 years, you can usually take out your money—including earnings—tax-free.

A Roth IRA can be a smart way to help build your savings now and save on taxes later. If you’re wondering how to start, don’t worry—we’ve got you. We’ll first guide you through the steps to open a Roth IRA. Then, we’ll show you exactly how to do it with Fidelity® so you can start putting your after-tax dollars to work.

6 steps to open a Roth IRA

Follow these 6 steps when you’re ready to open a Roth IRA.

1. Pick where you want to open your account

Start by checking out different companies. Think about what matters most to you—great customer service, an easy-to-use app or website, and whether they charge any account fees. If you already have a 401(k) or another retirement account through a certain provider, it might be convenient to go with them. Want a company with no account fees or minimums? Check out opening a Roth IRA at Fidelity.®

2. Choose the right type of IRA

There are different types of IRAs, with the most well-known ones being the Roth and traditional IRAs. Each IRA has its own rules around eligibility and how much you can contribute. Take some time to figure out which one fits your situation best—Roth IRAs are popular, but it’s important to know all your options, especially when it comes to the eligibility and contribution limits. And you may find out you're eligible to contribute to more than one type of IRA.

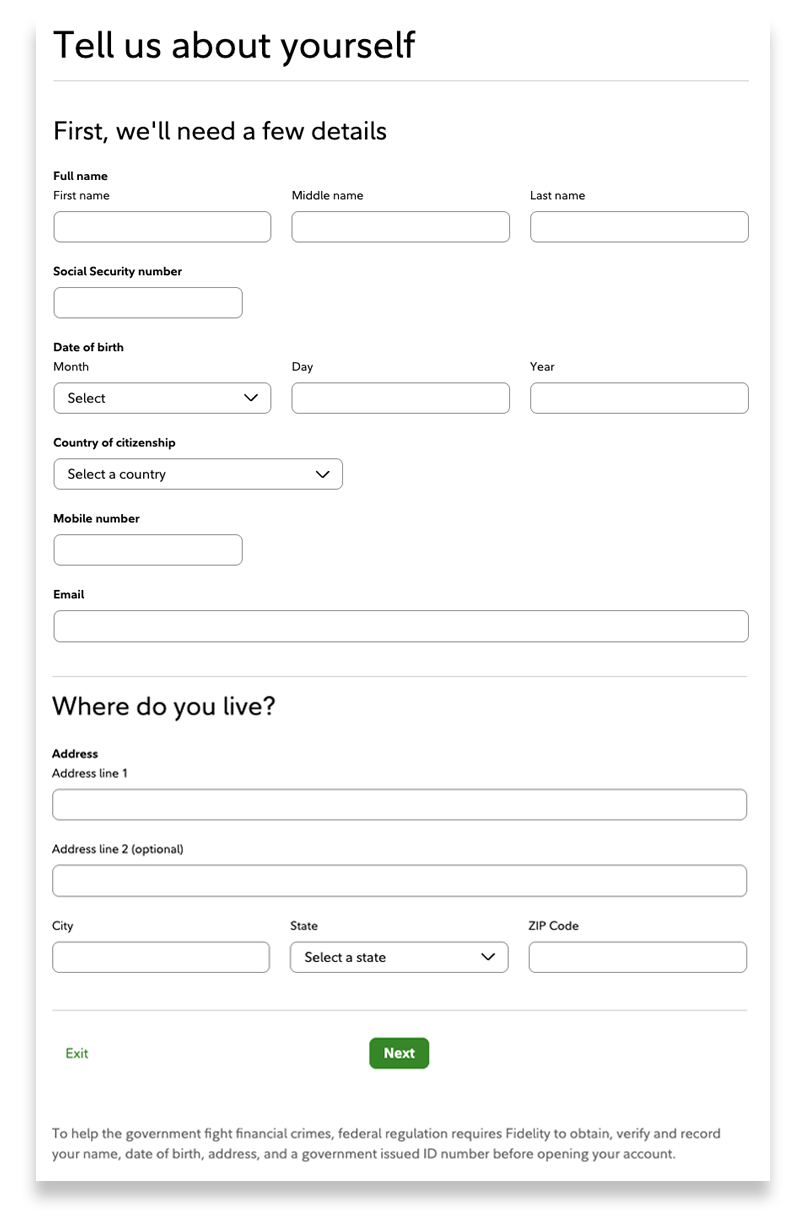

3. Gather your information and fill out the application

When you open an account, you usually have to complete an application. Save time and make the process easier by having this information ready:

- Your Social Security number or tax ID

- Information for any beneficiaries (names, addresses, birthdates, and Social Security numbers)

- The investment or bank account details (routing and account numbers) to fund your IRA

- A government-issued ID (like a driver’s license or passport) may be needed to verify identity

This information helps confirm your identity and makes sure you’re eligible to open the account. You need to earn income to contribute to your Roth IRA.

4. Decide how much you want to contribute—and how often

You’re in control when it comes to deciding how much and how often you want to contribute to your Roth IRA. Recurring investments, an investment you make on repeat, can be a great option for investors who wish to regularly contribute to their Roth IRAs.

And if you ever find yourself in a situation where you need money, contributions that you’ve added to your Roth IRA can be withdrawn at any time. There are even times where earnings on those contributions can be withdrawn penalty-free (taxes may still apply). Cases can be withdrawals up to $10,000 for a first home purchase, if you become permanently and totally disabled, or for qualified higher educational expenses. Learn more about how a Fidelity Roth IRA gives you flexible access to your money.

Keep in mind, the Internal Revenue Service (IRS) does have contribution limits, so check how much money you’re allowed to invest in a Roth IRA.

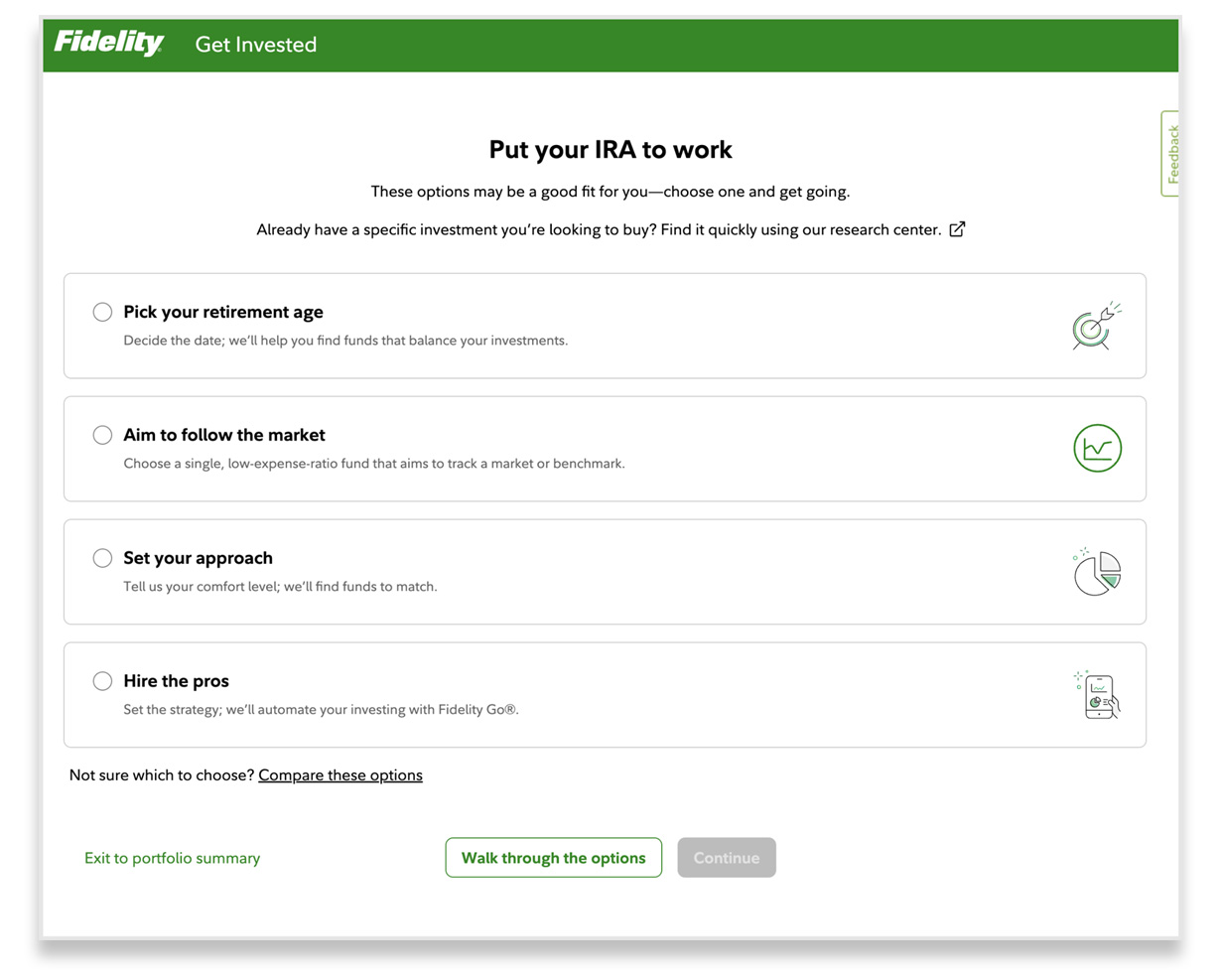

5. Choose your investments

Once you fund your account, it’s time to put that money to work. You’ll need to choose the investments you want—like stocks, ETFs, mutual funds, and more. If you’re not sure where to start, many providers offer an option for professional investment management,1 so you don’t need to do it on your own.

6. Set a check-in schedule

Life gets busy, so set a reminder to check in on your Roth IRA every now and then. It’s also important to check if the annual contribution limits have changed and adjust your plan accordingly. You can also set up automatic contributions to keep things simple and consistent.

How to open a Roth IRA with Fidelity®

If you’ve decided that opening a Roth IRA with Fidelity is the right move for you, here’s how to get started.

1. Visit fidelity.com.

2. Select Open an account.

3. Find Retirement & IRAs and select Open an account.

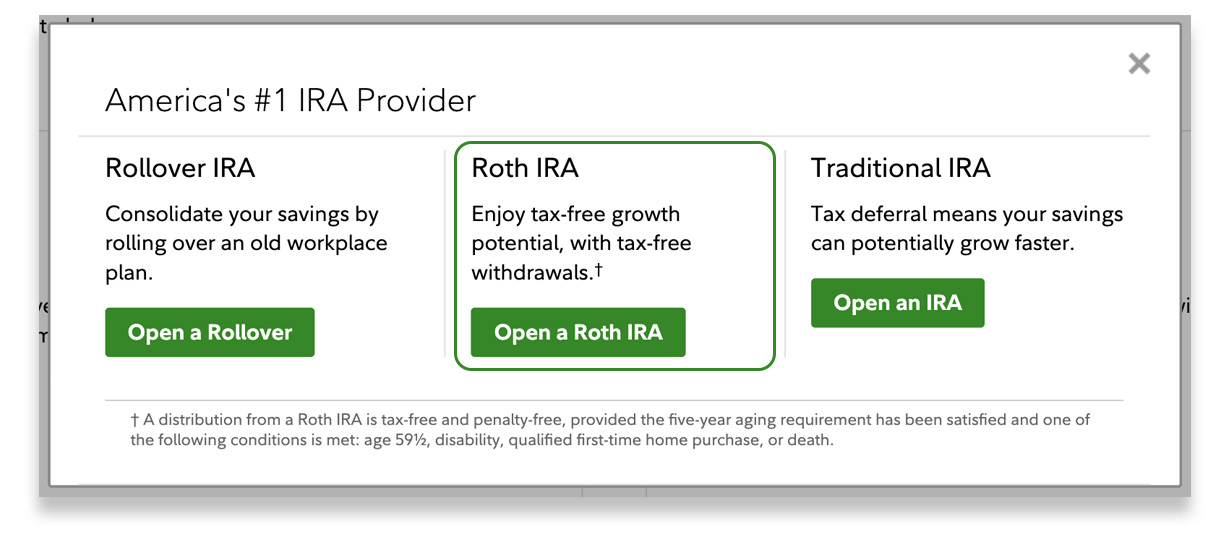

4. From the list of options, find Roth IRA and select Open a Roth IRA.

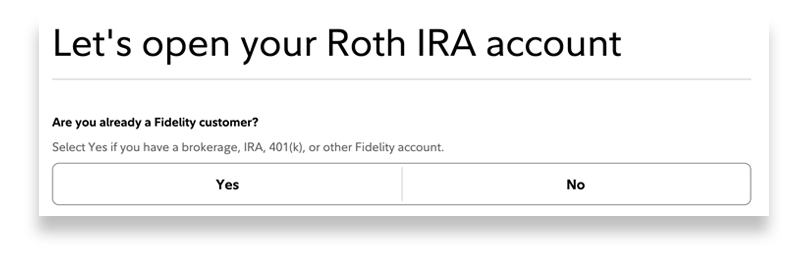

5. Answer yes or no to the question about whether you’re already a Fidelity customer.

Already a Fidelity customer? Just log in and skip ahead to step 8.

6. Fill in the required personal information.

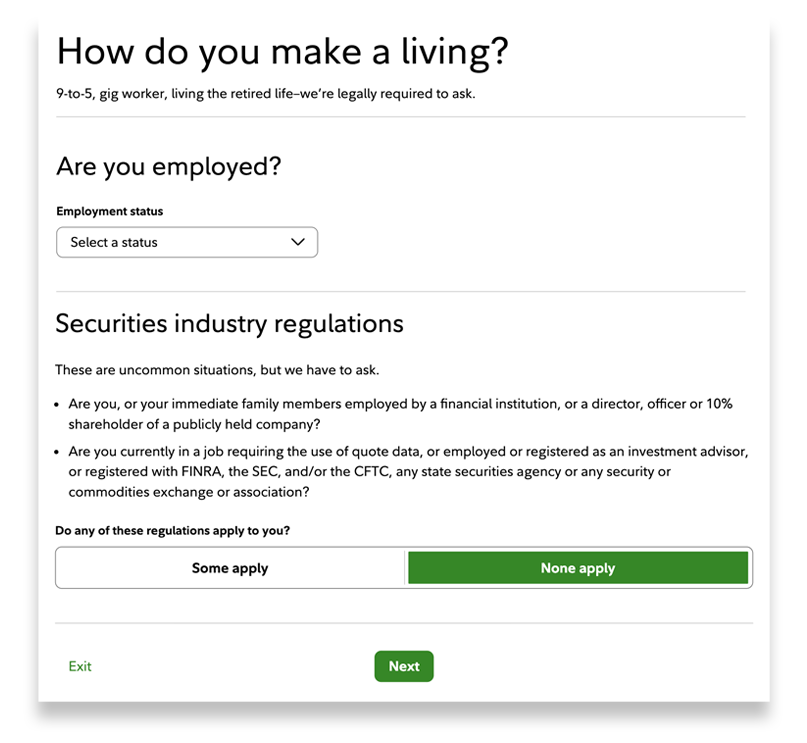

7. If you’re new, you’ll be asked for some employment details.

8. Review your information to make sure it’s correct.

9. Select Open an account—and you’re all set!

What to do next after you’ve opened your Roth IRA

If you’re new to Fidelity, you’ll need to create your login so you can access your Roth IRA. Once your login is set up, the next steps are to fund the account and invest the money you’ve added.

Not sure what to invest in? You can always reach out to a financial pro for guidance or check out these investment ideas that might be a good fit for your IRA.

If you want to make things even easier, you can set up recurring investments with Fidelity so your money gets invested on a regular schedule.

Opening your Roth IRA and choosing investments puts you on the path towards saving for retirement. But it’s not the only way to do so. Learn about other ways you can contribute to your Roth IRA and other retirement accounts you can open, so you can take advantage and build your savings now and possibly save on taxes later.