Up more than 24% year to date, gold is on track for one of its best years ever. A combination of growing global demand, economic worries, and other factors have propelled the precious metal near record highs. Can this gold rush continue?

The gold boom

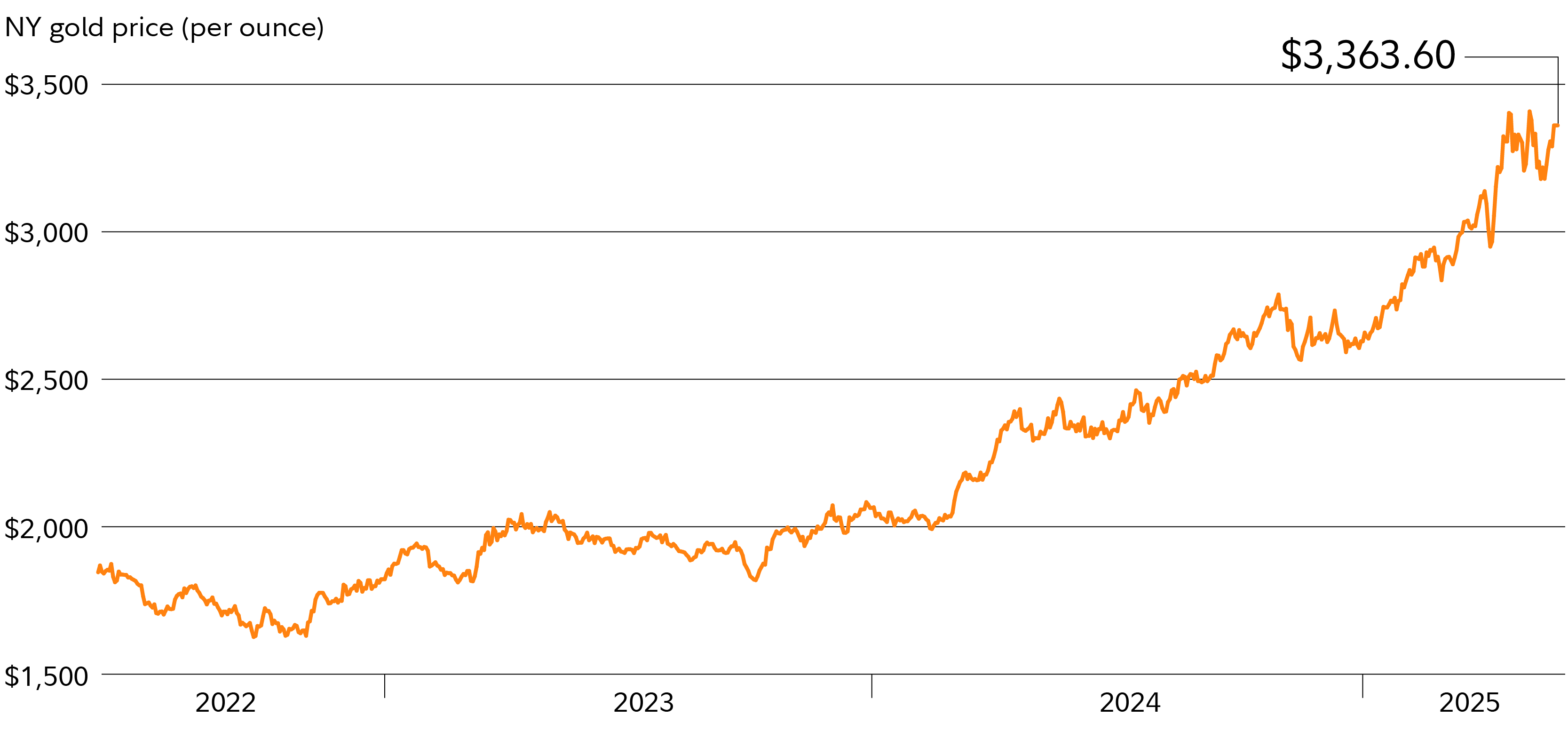

The beginning of this latest golden age for gold stretches back to the fall of 2022, when it was trading near $1,670 per troy ounce. Since then, gold prices have roughly doubled.

Strong demand has been an underlying factor that’s helped drive gold prices. Central bank gold purchases by countries outside of the Organization for Economic Cooperation and Development (OECD) have been particularly notable.

“There’s been a shift away from the dollar by some central banks that’s helped increase gold purchases to over 1,000 metric tonnes per year from 2022 to 2024,” notes Boris Shepov, co-manager of the Fidelity® Select Gold Portfolio (

Also consider demand out of China, the world’s largest consumer of gold, which despite record-high prices recently touched an 11-month high. Total Chinese gold imports hit 127.5 metric tonnes in April, according to customs data. The domestic demand was so strong that China’s central bank was prompted to ease restrictions on bullion inflows.

Economic worries have been another long-term factor helping press gold prices higher. Lingering recession worries over the past couple years contributed to “safe-haven” gold buying that helped gold surmount the technically significant $2,000 price level (which many chart users think acted as a resistance point for much of the early 2020s). As US recession risks have grown—the latest of which was US GDP swinging to a contraction in Q1 and credit rating agency Moody’s cutting the US credit rating from “Aaa” to “Aa1”—the rally has accelerated, pushing gold past $3,000.

Is this gold run like others?

There are some historical parallels when gold prices posted big gains over the past 50 years to this current gold boom—along with some notable differences.

Late 1970s. Gold benefited from widespread inflation in the late 1970s, soaring from above $100 to over $800 by the end of 1979. Gold prices climbed largely due to investors’ expectation that real assets might hold their value better than others amid historically high inflation. While the late 1970s inflation was driven by an energy crisis, the inflationary regime of the past several years has been more widespread.

2007. In the runup to the financial crisis, investors increasingly turned away from riskier investments in favor of perceived safe-haven assets like gold and the US dollar. During this most recent gold boom, the US dollar has actually weakened—especially this year. Gold and the dollar have historically had a mostly inverse relationship: Gold tends to fall when the dollar strengthens and it tends to rise when the dollar weakens.

2010s. The post-financial crisis years were a somewhat atypical backdrop for bullish gold prices. After stocks hit rock bottom in March 2009, they began a bull run more than a decade long as economic conditions gradually improved. At the same time, gold prices also steadily climbed: Gold increased from under $900 in 2010 to over $1,500 by the beginning of the 2020—perhaps coinciding with a substantial increase in global money supply over the same period.

2020. When the COVID pandemic unfolded during March 2020, gold prices quickly shot up in the following months. However, they peaked in August 2020 and trended sideways for a couple years. It's worth noting that global money supply increased dramatically during the pandemic and the pace of that growth substantially slowed in recent years.

Which brings us to today’s bull gold market. Gold prices started to gain steam in the fall of 2022, and once they surmounted $2,000 in late-2023, a mostly uninterrupted run higher has pushed the precious metal’s price well past $3,000. It’s now trading close to record highs near $3,300, as of late May 2025.

What’s next for gold prices?

Ryan Oldham, who co-manages the FSAGX, thinks investors should manage short-term expectations, given how much gold has run up recently.

“I do think investors should be careful at these prices, as gold may be a little ahead of the real-rates-driven fundamentals,” Oldham notes. “To me, there are 2 primary countervailing forces at work: Inflation and real rates on one side and a potential US dollar reorientation among some market participants on the other.”

Shepov also thinks gold investors should keep perspective. “I think the long-term path for gold prices is higher,” Shepov says. “Increasing money supply and fiscal deficit issues are long-term gold drivers. But it’s important to remember that gold can be a volatile asset that routinely experiences 10% to 15%+ corrections.”