The current turbulence in US stocks is providing investors with a reminder of why diversification is important for managing risk. As the S&P 500 was rising over the past 5 years, many who got their exposure to stocks through low-cost index funds may have lost sight of the risks of having a relative handful of companies leading the market higher and higher. Until those same stocks started dropping.

Institutional Portfolio Manager Naveed Rahman explains how passive strategies that track indexes may be making market turmoil feel worse for those who rely on them. “Today, the tech sector and communications companies like Meta and Alphabet account for more than 40% of the value of the S&P, even though they are only a fraction of the total number of companies the index represents," he says. That means many investors now may have more of their money in fewer companies than they realize.

Why it matters

A portfolio with a large exposure to a relatively small number of expensive stocks contains the risk that these stocks’ prices could decline significantly. That’s because there may be limited room for them to rise above price/earnings ratios that are already historically very high, but lots of room for them to fall.

To be sure, that doesn’t mean that the so-called Magnificent 7 companies are likely to run into trouble. They are well-run businesses with strong earnings. However, says Rahman, “History shows that even a moderation in their rate of earnings growth could be enough to cause their prices to fall. Very expensive stocks don't have to become unprofitable or blow up; they can underperform simply by delivering decelerating earnings growth that disappoints relative to lofty expectations. The earnings growth gap between the Magnificent 7 companies and the rest of the market is closing; their growth has been slowing and the rest of the market's growth has been accelerating in the context of a very different valuation profile.”

If that combination of concentration risk and potentially slowing earnings growth concerns you, this may be a good time to consider rebalancing your stock portfolio to manage risk by reducing your exposure to that relative handful of pricey names and adding a wider variety of stocks.

Why diversify with dividend stocks

Diversification—the practice of spreading your money across a wide variety of investments, rather than just a few—has historically been among the best ways to manage the risks of losing money, as the prices of various assets do not typically all rise and fall at the same times.

One way to diversify away some of the risks of having lots of exposure to a few expensive stocks is to add stocks that have reasonable prices and that also make regular dividend payments to shareholders. Diversifying with dividend stocks will keep you invested in stocks while it potentially diversifies away some of the concentration and valuation risk that passive investing may have unintentionally produced. However, remember that diversification and asset allocation do not ensure a profit or guarantee against loss. Consider reasonably priced, dividend-paying stocks of companies that can grow their free cash flow and earnings, which in turn could enable them to increase the dividends they pay.

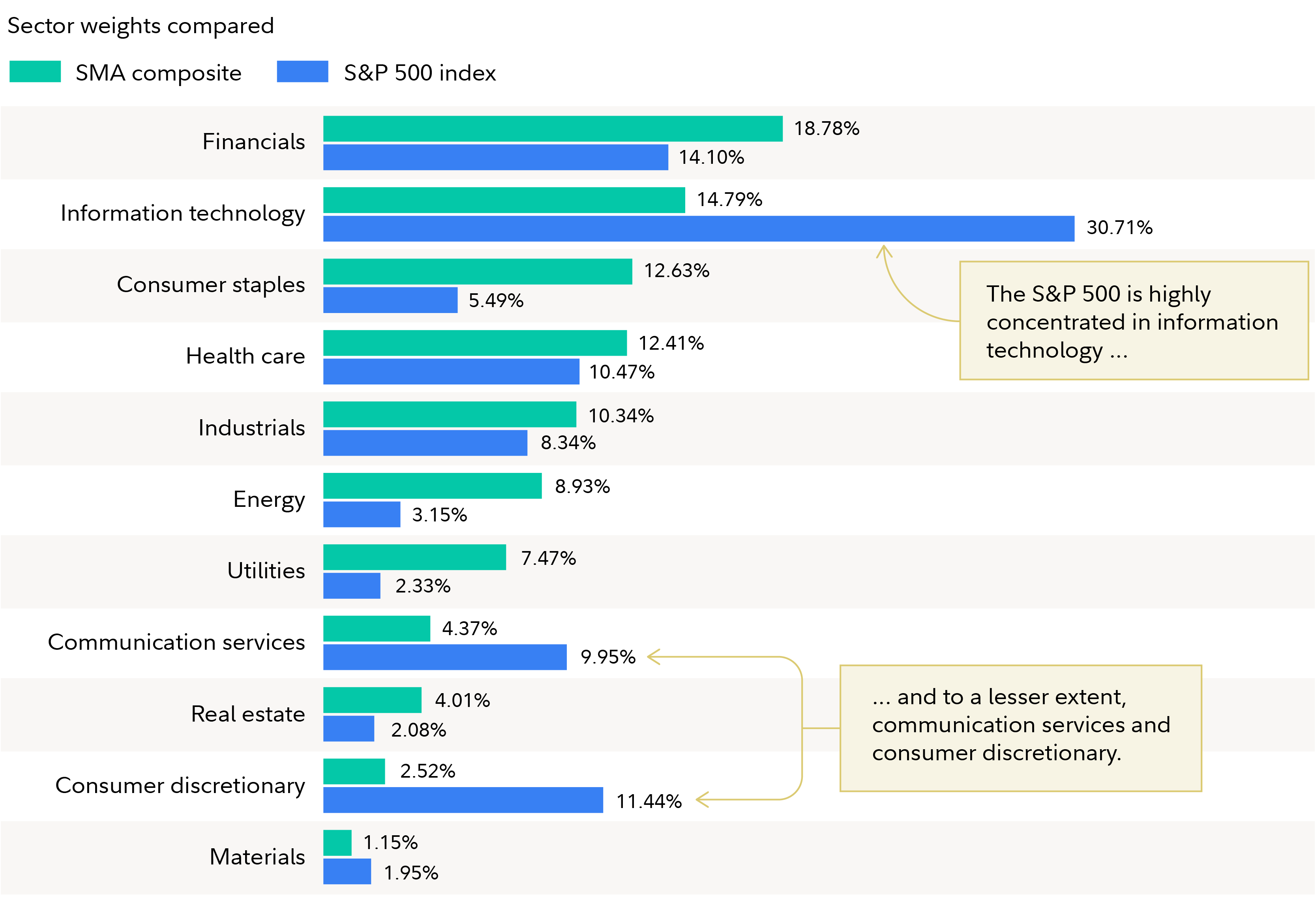

Other types of investments such as bonds can also provide diversification and reduce the risks posed by concentration in expensive stocks. Historically, though, stocks have been among the best-performing investments in times of persistent inflation, which recent data suggest continues in the US. That means your best inflation hedge may be continuing to invest in stocks, even as you seek to reduce the risks posed by doing so. As the chart below shows, an actively managed stock portfolio such as the Fidelity® Dividend Income Strategy (SMA composite) may offer a more diversified allocation to stocks than would a passive strategy that seeks to track the S&P 500 index.

How to diversify with dividend stocks

Indexing is popular because it can offer an easy and inexpensive way to gain exposure to the returns that US stocks deliver in what has become a very efficient market. However, it doesn’t provide an easy way to diversify an unbalanced portfolio. Instead, it will likely expose you to the historical pattern where the market eventually “corrects” itself as shares drop in value during a selloff.

Rahman believes that professional investment management can provide insulation against those natural but potentially uncomfortable market moves, which can lower the value of your portfolio. He explains that Fidelity’s Dividend Income Strategy investment team “seeks to diversify you away from concentration risk, valuation risk, and inflation risk. When we select stocks for the portfolio, we try to understand what the drivers of free cash flow, earnings, and profitability are for each company through a period of elevated inflation. In my opinion, the best dividend-paying companies have competitive advantages, such as their brand, their distribution, their technology or their intellectual property. These can enable the companies to pass on higher costs to consumers in the form of higher prices which can help maintain earnings growth, even with inflation growth.”

Rahman currently sees opportunity in dividend-paying consumer staples stocks. “Personal health and oral care company stocks are really boring but very protected businesses with amazing growth over the past 20 years. They can benefit from the fact that most developed countries are aging."

He also points to beverage companies as current potential sources of opportunity. “That's an interesting part of the market because I see sustainable top line and earnings growth potential. It's dominated by a handful of large companies with distribution prowess and excellent brands that they market in an opportunistic way. These companies have really attractive valuations with dividends that I think can grow over time.”

Finding ideas

You can gain exposure to divided-paying shares in 3 primary ways:

- Separately managed accounts (SMAs). The managers of these portfolios seek to deliver long-term growth and dividend income greater than the S&P 500® Index, with potentially lower volatility than the index. These professionally managed strategies are designed to serve as a key component of your overall investment portfolio, providing tax-smart investing strategies to help keep more of your money invested and working for you. SMAs are generally built around a single asset class and focused on a targeted objective and can be personalized around your preferences and tax considerations.

- Individual dividend-paying stocks. Check their dividend policy statement so you know how much to expect and when. In order to diversify to help manage risk consider a portfolio of individual stocks. It may be advantageous to invest across sectors rather than concentrating on those with relatively high dividends, such as consumer staples and energy. High dividends can be a sign that a troubled company believes it needs to entice investors to buy a stock they would otherwise avoid.

- Actively managed mutual funds and ETFs. In today's markets, professional managers may be able to identify companies that are likely to increase their dividends and avoid those likely to cut them. Rahman says active management offers a similar advantage when looking to stay ahead of inflation: "To know if a company can raise its dividends faster than inflation, you have to understand business fundamentals like brand equity and pricing power. You can only do that stock by stock."

Below are some examples of mutual funds and exchange-traded funds that give exposure to dividend-paying stocks. The Mutual Fund Evaluator and ETF Screener on Fidelity.com can help you find more ideas.

For a more hands-off approach, Fidelity also offers targeted stock portfolios built around specific investment strategies: Fidelity® Equity-Income Strategy.

Mutual funds

Fidelity® Growth and Income Fund (

Fidelity® Multi-Asset Income Fund (

Fidelity® Dividend Growth Fund (

Fidelity® Equity Dividend Income Fund (

Fidelity® Equity-Income Fund (

Vanguard High Dividend Yield Index Fund Admiral (

Columbia Dividend Opportunity Fund Class A (

T. Rowe Price Dividend Growth Fund (

Exchange-traded funds

Fidelity® High Dividend ETF (

Fidelity® Dividend ETF for Rising Rates (

Invesco S&P Ultra Dividend Revenue (

Proshares S&P 500 Dividend Aristocrats ETF (