Some financial institutions are now allowing customers to hold cryptocurrency directly in their individual retirement accounts. Does this make sense for you? Let's explore a few considerations below.

What is a crypto IRA?

Note:

There are different types of individual retirement accounts, each with potentially unique tax implications, withdrawal rules, and other important characteristics. Make sure to review the key differences before proceeding.

For most, the purpose of storing assets in IRAs and other retirement accounts is to save for retirement. Like other investment types, if crypto experiences a large drop at an inopportune time, those who have crypto in a retirement account may be forced to delay their retirement and work for longer than originally planned. Across the board, it's a good idea to evaluate your risk tolerance and personal investment goals before investing.

Three potential advantages of holding crypto in IRAs

1. May help you achieve investing objectives.

Historical data shows that during specific periods in the past, adding certain cryptocurrencies (for example, bitcoin) to a portfolio may boost a portfolio's returns, though it also could come with substantial volatility. Investors should keep in mind that crypto is highly volatile, can become illiquid at any time, and subject to total loss. Also, past performance is no guarantee of future results.

2. May increase your portfolio diversification.

Fidelity research has found that cryptocurrency can potentially help diversify a multi-asset portfolio. Remember, each cryptocurrency is unique and has unique investment characteristics. Again, however, remember that past performance is no guarantee of future results. It's a good idea to evaluate your personal risk tolerance (and your comfort level with volatility) first.

3. May simplify taxes involved with cryptocurrencies.

Just as with other non-crypto assets held in tax-advantaged retirement accounts, crypto investments in retirement accounts have the potential to grow tax-deferred or even tax-free.* As always when considering taxes and crypto taxes, consult with a tax advisor to accurately manage your tax bill.

Three potential cons of crypto IRAs

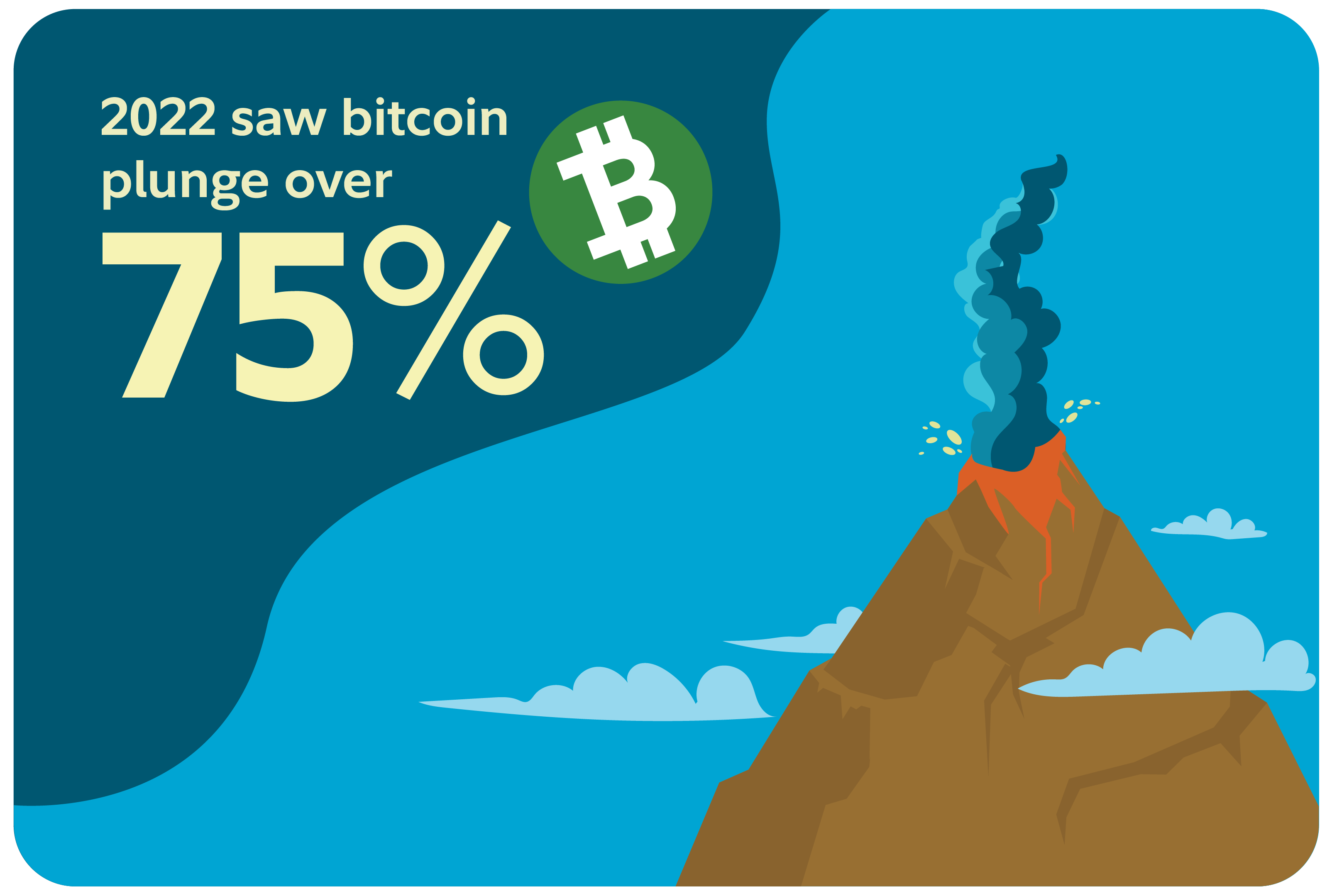

1. Crypto is highly volatile.

The price of crypto assets has dropped significantly during previous bear markets. For example, 2022 saw bitcoin plunge over 75% from its highs. Given the volatility, only invest an amount you can afford to lose.

2. Could miss tax-loss harvesting opportunities.

Since IRAs can be tax-deferred accounts, note that tax-loss harvesting opportunities typically do not apply (like other retirement accounts). Tax-loss harvesting allows investors to sell their holdings at a loss – then off-set those losses against gains elsewhere. This can be a potentially beneficial strategy given crypto's volatility.

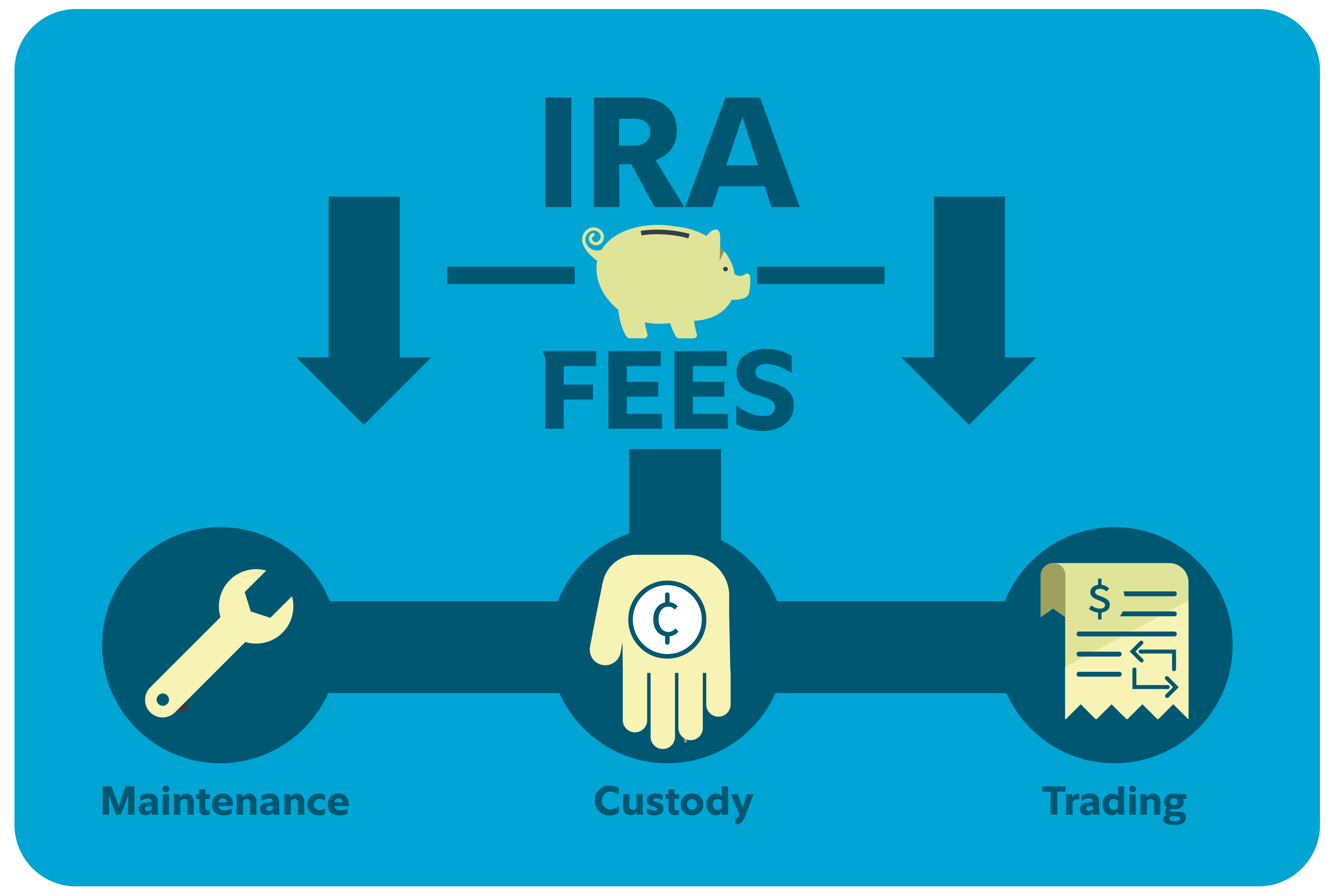

3. May incur fees.

Some providers may charge to set up a crypto IRA, which can include initial setup fees, annual maintenance fees, and custody and trading fees, among others.

The bottom line

Still unsure about whether crypto is right for your retirement account? First, carefully determine your investing goals. While cryptocurrencies may offer the possibility of achieving your investing objectives, they may also expose portfolios to significant downside. If you do decide that crypto is right for your retirement account, consider limiting your investments to an amount you can afford to lose. Continue learning about Crypto IRAs here.