Changing chart types

Chart+ currently has 13 different charts. They use similar data, but each chart displays information uniquely. Familiarizing yourself with the most common charts is where it all begins.

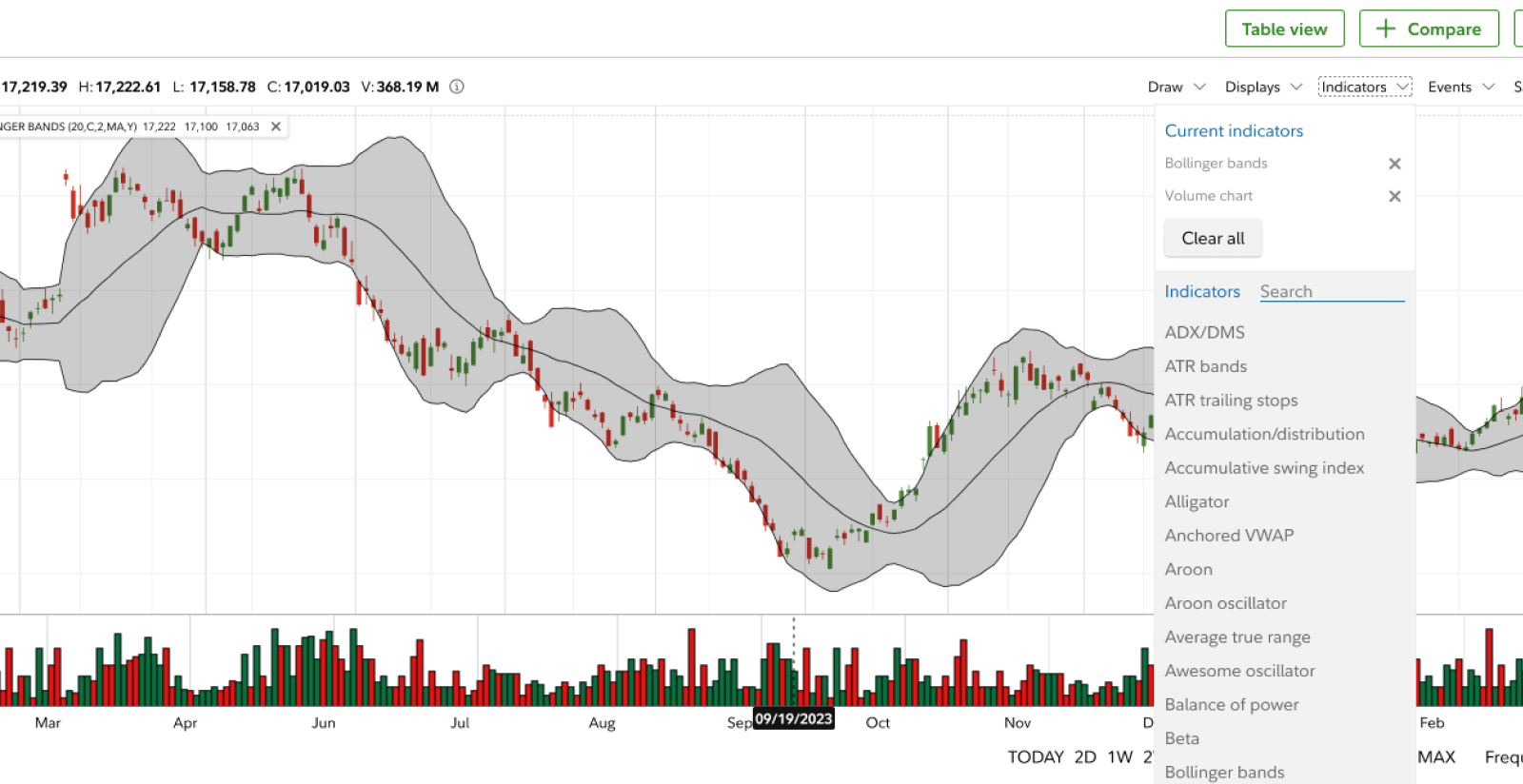

Using different indicators

Chart+ has over 100 indicators to help you view an asset’s performance. Indicators are calculated over a period, periods are defined by the number of intervals, and the length of an interval depends on the chart’s span. Certain indicators also include measurements in days per year.

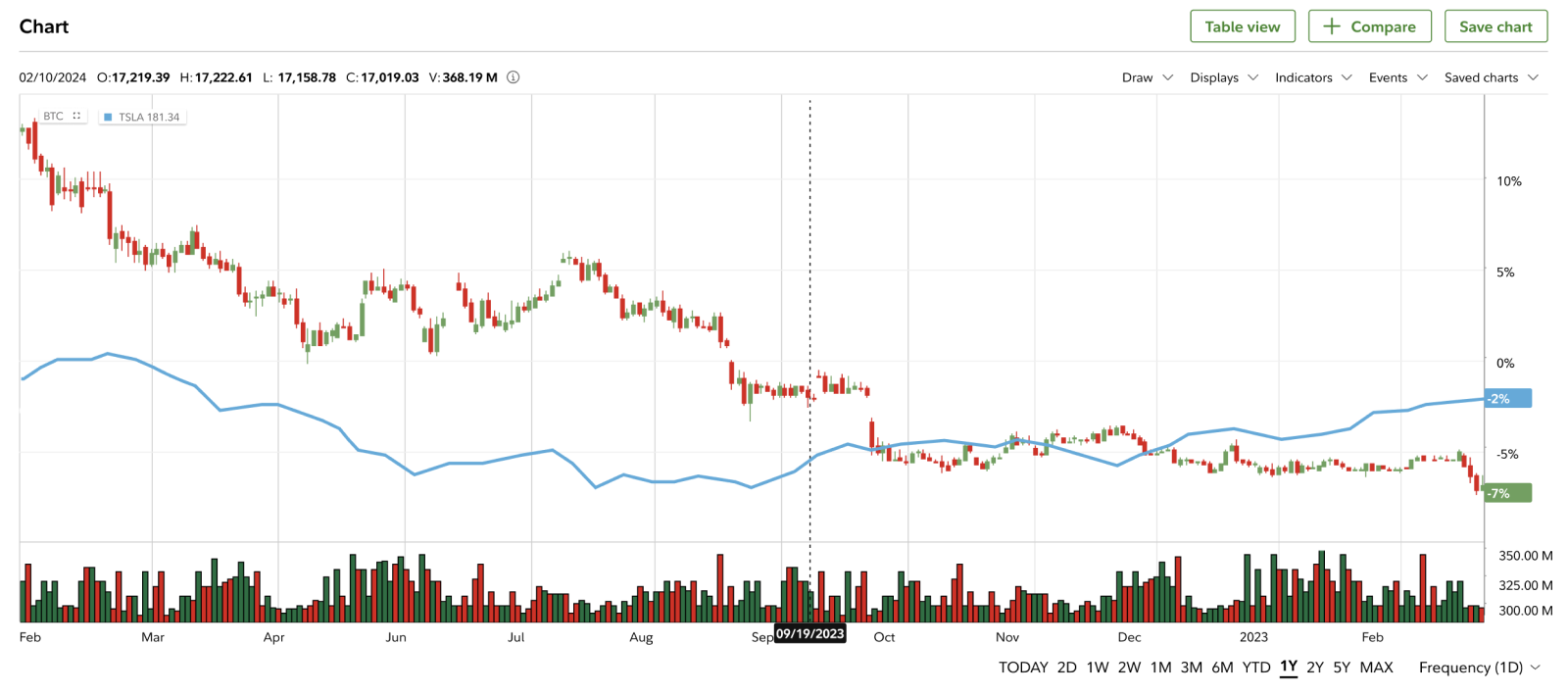

Explore the compare tool

The compare tool can give you a side-by-side look at different digital assets. You can also compare a digital asset to stocks or ETFs (certain types of assets may be held by different custodians). Comparisons are plotted in different colors over the same time frame. Since digital assets trade 24/7, and non-digital assets don’t, you may see data gaps when comparing them to each other.

Fidelity Crypto® is offered by Fidelity Digital Assets®.