The AI boom has come a long way from its unassuming origins as a novel variety of chatbot.

Far from just a story about new ways to generate images or get answers online, AI has evolved into the story of a profound long-term infrastructure buildout—drawing parallels to the construction of the transcontinental railways in the 1800s, the interstate highway system in the 1950s, and the backbone of the internet in the 1990s.

This tech and infrastructure arms race accelerated in 2025 as tech giants, chipmakers, and cloud providers struck multibillion-dollar deals to lay the foundation for AI’s next era. From rare earth minerals to energy infrastructure to data-center real estate deals, the AI boom is now touching nearly every US market sector, and has accounted for roughly 60% of recent economic growth, according to estimates by Fidelity’s Asset Allocation Research Team.1

“AI is the most powerful and far-reaching of all the cycles of innovation and disruption I’ve seen in my 25 years following tech,” says Adam Benjamin, manager of Fidelity® Select Technology Portfolio (

Yet for investors, the question for 2026 isn’t just whether AI will be disruptive. It’s whether the eventual profits will justify the cost of the current buildout. It’s whether the winners of today will still be the winners of tomorrow. And perhaps most of all, it’s whether today’s prices for AI stocks will one day look like a bargain or a bubble.

Big tech still dazzles

These questions are playing out amid the massive capital spending cycle now unfolding across the largest tech companies. Collectively, Amazon (

The Magnificent 7 have defined the AI trade ever since OpenAI first launched ChatGPT in late 2022. The group—typically considered to include NVIDIA (

Bakshi says this group still appears to offer sound long-term prospects. Earnings for this cohort have generally been clocking in the mid-20% range, compared with flat or mid-single-digit growth for the rest of the S&P 500, he notes. Given that growth differential and their strong competitive moats, he views their recent mid-20s price-to-earnings (PE) valuations as fair.

Among Bakshi’s largest holdings are Meta and Alphabet, both of which are not only investing heavily in AI, but already seeing early benefits of AI in improving ad sales. Together the companies have been generating close to $500 billion annually in digital ad revenue. AI has been helping to boost efficiency of ads and could continue to do so, through a deeper understanding of each user’s real-time behavior, leading to better personalized ad targeting. “I believe there’s still a lot of runway for improvement,” he says.

Captains of compute

Despite AI’s early successes, Chris Lin, manager of the Fidelity® OTC Portfolio (

At this stage, Lin points to the semiconductor companies creating the computing power behind AI as some of the clearest potential beneficiaries. He believes NVIDIA and Taiwan Semiconductor Manufacturing Co. (

Lin says AI is still in the investment phase, and monetization of AI—i.e., making money from AI itself rather than from its buildout—is still nascent. “Companies are monetizing it today, but still at a relatively small scale.” He views today’s heavy spending as a necessary step, laying the groundwork for future revenue and earnings growth as AI applications expand.

To train, run, and scale the next generation of AI models, developers need vast amounts of computational power. Unlike earlier phases focused mainly on pattern recognition, the latest AI models are designed to reason before responding—the same way a person might think before answering a question. “We’re really trying to recreate human intelligence,” says Benjamin. “And that requires multiples of higher compute intensity.”

Crucial in the race to make this possible, says Benjamin, is the expanding group of companies supplying the hardware capable of conjuring up this large-scale computing—chips, but also memory, interconnects, networking, and advanced packaging.

“NVIDIA isn’t just a chip company anymore,” he says. “They’re selling full rack-scale systems—essentially complete supercomputers designed to train and run AI models.” Achieving further gains in computing power relies less on producing ever-more-powerful chips, and more on improvements in that full system. “The next wave of gains is happening at the system level, not the chip level. This is a rack-scale problem now,” he says.

That evolution is broadening opportunities across semiconductors, from high-bandwidth memory suppliers like Micron Technology (

Benjamin takes what he calls an “AI-basket” approach in his funds, evaluating risk-adjusted exposures across semiconductors, hardware, software, and services in seeking to capture both the beneficiaries and the potential disruptors as the AI ecosystem evolves.

A power renaissance

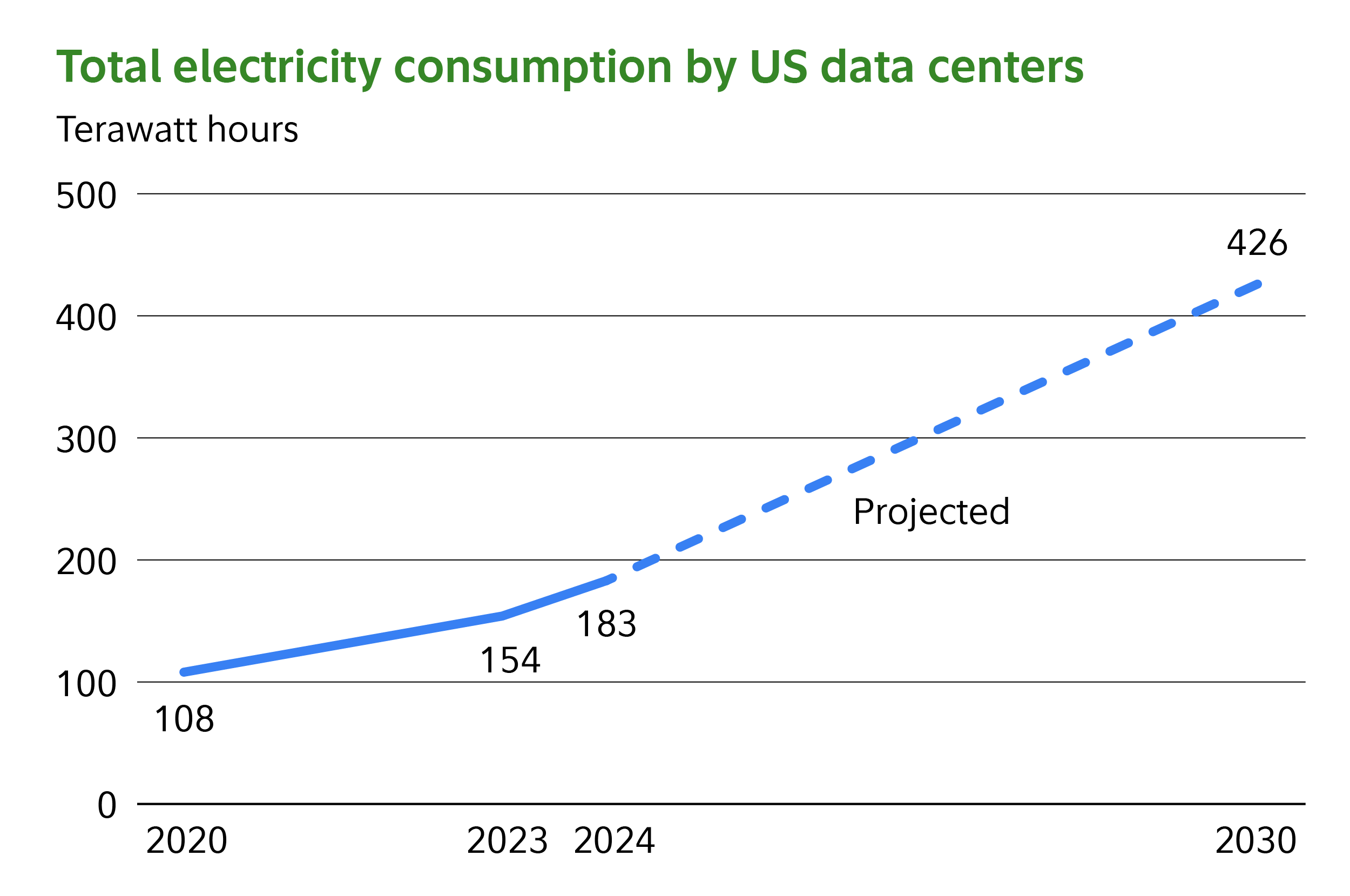

The growth in AI-driven CapEx is rippling across sectors as companies race to build and connect mega-scale data centers needed to train and run AI systems.

Surging energy demand is fueling a “power renaissance,” says Clayton Pfannenstiel, co-manager of the Fidelity® Select Industrials Portfolio (

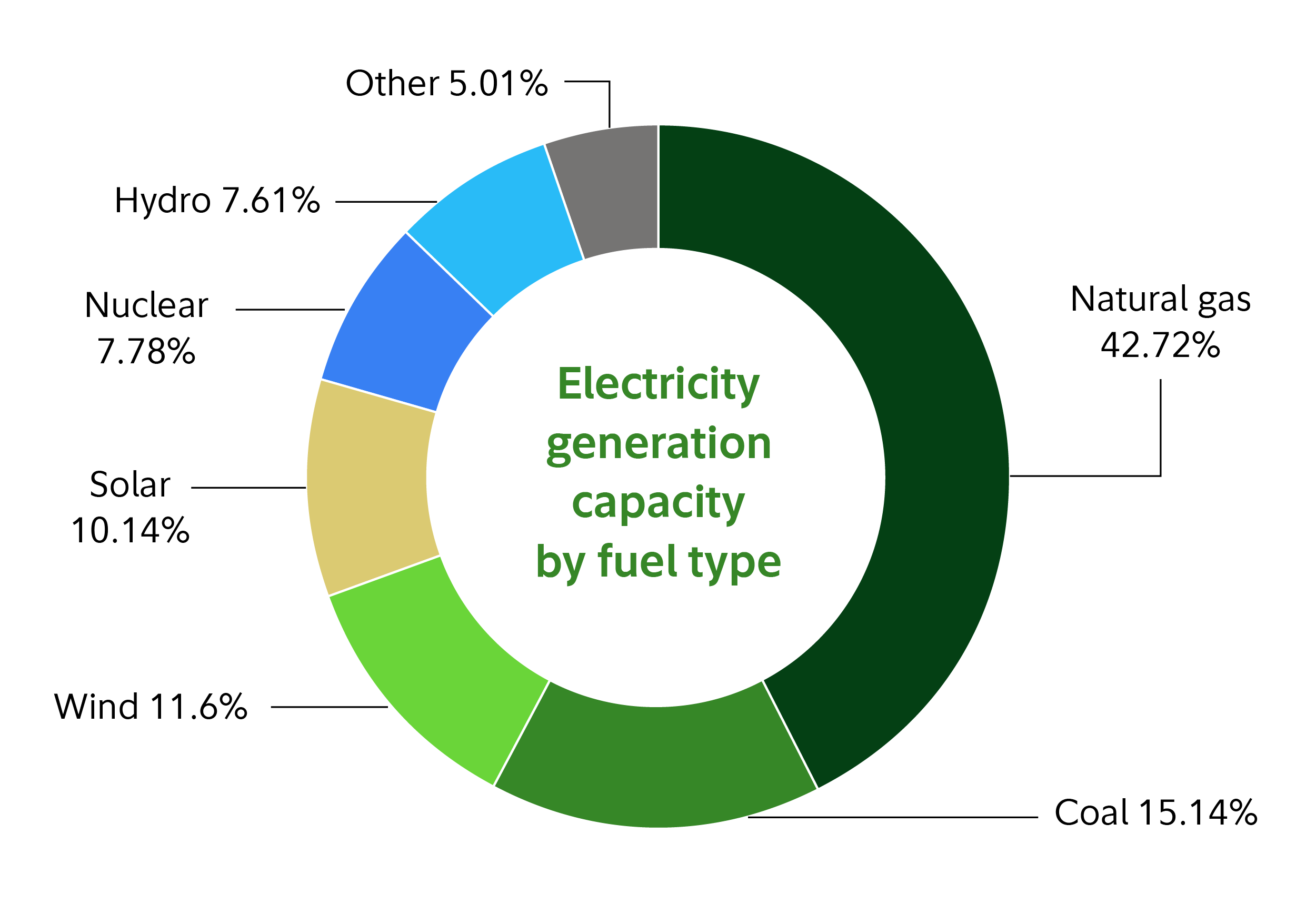

While data centers are expected to rely on a mix of energy sources, natural-gas turbines have emerged as the most practical option to meet near-term additional demand, Pfannenstiel says. Renewables continue to expand, but their output is still too variable to meet the uninterrupted power demands of these facilities, he says. Nuclear power could eventually help meet that need, Pfannenstiel notes, but US deployment remains a long-term prospect. Pfannenstiel sees promise in small modular reactor designs such as those from Rolls-Royce (

“If we need power now, the main source is gas turbines,” Pfannenstiel says. Among industrial manufacturers, he highlights GE Vernova (

Pfannenstiel has found other potential AI beneficiaries across the power and infrastructure chain, including Eaton Corp. (

Kristen Dougherty, manager of Fidelity® Select Energy Portfolio (

“AI is the single biggest contributor to rising power demand in the US, reversing years of gradual decline,” she says.

Like Pfannenstiel, she expects natural gas—not renewables or nuclear—to be the main near-term power source for AI data centers, given their need for constant, reliable electricity. Still, Dougherty says she’s cautious about chasing the AI theme broadly. She notes that US natural gas supply is abundant and can grow quickly to meet demand, making it harder for prices to rise as power demand grows. Much of the enthusiasm around AI-driven energy demand, she adds, might already be reflected in stock prices. “It will be a growth driver,” she says, “but the key is being selective and sticking to fundamentals.”

One potential beneficiary that has met that selective process is Vistra (

Utilities step into the limelight

As data centers come online, utilities face the challenge of adding new power generation and interconnecting large loads to the grid.

“Power is the feedstock for AI,” says Pranay Kirpalani, manager of the Fidelity® Select Utilities Portfolio (

Most US utilities are regulated, earning a set return on the capital they invest. “For that portion of the industry, this represents a capital-deployment opportunity, meaning the ability to deploy more capital at regulated rates of return,” he says. By contrast, independent power producers can sell power at market prices—providing the opportunity to benefit from rising prices when power demand rises.

Kirpalani has been finding potential opportunity in both groups—focusing on fundamentals and 3- to 5-year earnings potential. Potential beneficiaries he’s found have included Entergy (

He's also bullish on nuclear energy as a longer-term story, given its ability to provide reliable, consistent power. One company that’s exemplified this theme is Constellation Energy (

Selling “picks and shovels” in a gold rush

The “picks-and-shovels” aspect of the AI infrastructure buildout also includes companies involved in wiring, building roads, transportation, and data-center site preparation, says Shilpa Mehra, manager of the Fidelity® Growth Strategies Fund (

She cites companies such as Comfort Systems USA (

“These companies are in a powerful cycle,” says Mehra. “Demand is significant and appears likely to continue for years.” Tight skilled-labor markets are also having an impact. With electricians and technicians in short supply, she notes, these companies have improved pricing power and the ability to be selective on bids.

But is it a bubble?

As mega-cap tech firms ramp up spending on data-center infrastructure, and AI startups strike multibillion-dollar partnerships to secure computing power, many investors are asking a broader question: How much of this growth is sustainable—and are markets in a speculative bubble?

“The market can get ahead of itself,” says Benjamin. “At times it can oversimplify, get overly excited, and assume things will happen faster than they actually will.”

It's no secret that AI hype has been propelling markets, and that companies perceived as “AI stocks” have generally been enjoying higher valuations. Some signs of froth have emerged, says Mehra, such as startups receiving high valuations based on the speculative potential for AI benefits down the road. Companies are investing today in the faith that highly profitable business applications of AI will eventually emerge, but if the timing or magnitude of those profits disappoint, the AI trade could be susceptible to pullbacks.

While the excesses of the late 1990s internet boom have been top of mind for many wary investors, there are also key differences between the current buildout and the overbuilding of that period. Chief among them: Today’s AI spending is overwhelmingly being funded with cash, not debt, by companies that regularly generate high volumes of free cash flow. And from a historical perspective, “valuations today are not even close to what’s been experienced during bubble extremes of the past,” says Jurrien Timmer, Fidelity’s director of global macro.

Investing in AI today might be a leap of faith. And yet—betting on the ingenuity and dynamism of technological innovators has, at times, worked out well for investors who took the leap. Just look at where companies like Alphabet, Amazon, and Meta were 2 decades ago.

“In the grand arc of time, I believe AI has the potential to be one of the most profound technologies that mankind has ever created,” says Lin. “Everything starts with intelligence.”

More on the funds mentioned above

Investors can learn more about the mutual funds mentioned in this article, including fund objectives and most recent complete holdings, by visiting the fund summary pages on Fidelity.com:

- Fidelity® Disruptive Communications ETF (

) - Fidelity® Disruptive Technology ETF (

) - Fidelity® Growth Strategies Fund (

) - Fidelity® Infrastructure Fund (

) - Fidelity® OTC Portfolio (

) - Fidelity® Select Communication Services Portfolio (

) - Fidelity® Select Energy Portfolio (

) - Fidelity® Select Industrials Portfolio (

) - Fidelity® Select Semiconductors Portfolio (

) - Fidelity® Select Technology Portfolio (

) - Fidelity® Select Utilities Portfolio (

) - Fidelity® Trend Fund (

)