A health savings account (HSA) has potential financial benefits for now and later. Depending on your situation, you can save pre-tax dollars in this account to pay for qualified medical expenses or deduct your contribution when you file your taxes. HSAs can also provide valuable retirement benefits.

Here's how to take full advantage of HSAs.

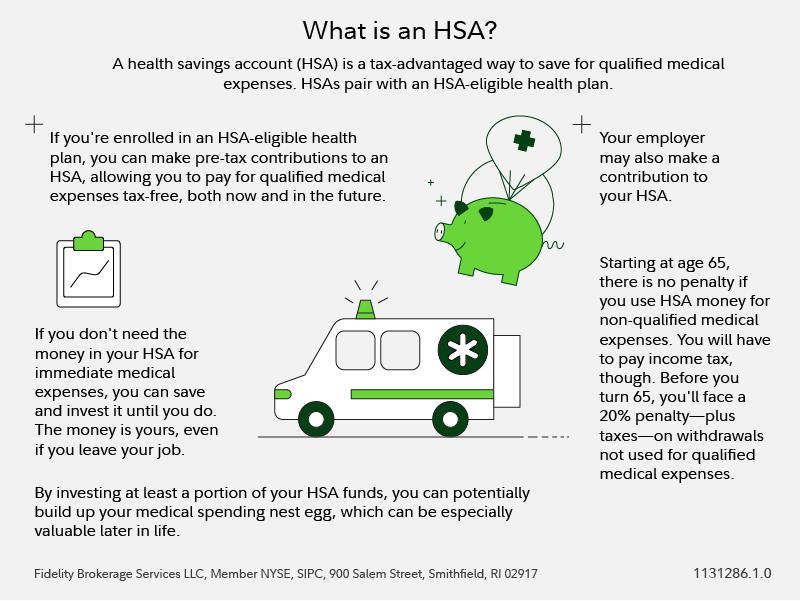

What is an HSA?

An HSA is a tax-advantaged account that can be used to pay for qualified medical expenses, including copays, prescriptions, dental care, contacts and eyeglasses, bandages, X-rays, and a lot more. It’s "tax-advantaged" because your contributions reduce your taxable income, and the money isn't taxed while it’s in the account—even if it earns interest or investment returns. Bonus: As long as you use your HSA funds for qualified medical expenses, you won't owe taxes when you take money out of the account. These 3 reasons are why HSAs are considered "triple-tax advantaged."1 This means they provide more tax advantages than retirement accounts, such as 401(k)s or IRAs.

How does an HSA work?

HSAs work together with an HSA-eligible health plan, aka a high-deductible health plan (HDHP). If you're enrolled in this type of health plan, you can make pre-tax contributions to an HSA (or tax-deductible ones, depending on your situation) and, consequently, pay for qualified medical expenses tax-free. Making HSA contributions can help create a cash cushion to offset the higher deductibles that HSA-eligible health plans typically have.

If you don't need the money in your HSA for current medical expenses, you can save and invest it until you do. This sets HSAs apart from another popular account, the health care flexible spending account (FSA). Unlike an FSA, an HSA is not "use-it-or-lose-it" (see below), can be invested, and you can take it with you when you leave an employer.

Who can contribute to an HSA?

Not everyone is eligible to contribute to an HSA, even if they are enrolled in an HSA-eligible health plan. You can only contribute to an HSA if:

- You aren't covered by a non-HSA-eligible health plan through your spouse or parent.

- You're not enrolled in Medicare.

- You can't be claimed as a dependent on someone else's tax return.

Read more: 6 benefits of an HSA in your 20s and 30s

More on HSA benefits

Here's more about what you need to know about the financial advantages of HSAs.

You can deduct your contributions from your taxes HSA contributions are typically made with pre-tax income from your paychecks, similar to the way 401(k) contributions are set up. If you fund your HSA with after-tax dollars instead, you may be able to take a tax deduction on your personal taxes when you file.

HSA contributions can have powerful benefits: For instance, someone in the 22% federal income tax bracket could potentially save nearly 30% in taxes (federal income + FICA + potentially state income) on every dollar contributed to the HSA. That could mean more money for medical spending. But it's important to keep in mind, contributing via payroll deductions will lead to the most tax savings. Only contributions made with payroll deduction avoid Medicare and Social Security taxes, aka FICA taxes.

Your employer may make contributions to your HSA About 84% of employees covered by an HSA-eligible health plan receive an HSA contribution from their employers.2 Think of it as a 401(k) match for your health. You won't get a tax deduction on what your employer contributes, but you will get extra money that has the potential to grow over time if invested.

You can invest funds held in your HSA By investing at least a portion of your HSA funds, you can potentially build up your medical spending nest egg, which can be especially valuable later in life.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

HSAs are not subject to "use-it-or-lose-it" rules This means you don't forfeit any money you don't use in a given year, and you can carry it forward until you reach a time that you want or need to use the money in your HSA. Combined with the ability to invest funds, this allows your health savings to benefit from compounding returns.

Your HSA is your account, not your employer's Unlike health care FSAs, which your employer technically owns, your HSA belongs to you. So when you leave a job, you keep all of the money you've saved up in your HSA and can transfer into a new HSA or employer-sponsored HSA at your next job. You can even open an HSA if you're in an HSA-eligible health plan and your employer does not provide one—or if they do but you prefer a third-party option. (But keep in mind you can only avoid FICA taxes if you contribute to your employer's HSA through payroll deductions.) It's also possible to have multiple HSAs. Some people have one for investing and another for cash to pay medical expenses.

You can still have an FSA to address certain immediate qualified medical expenses People often think the issue of FSA vs. HSA is either/or. The truth: HSA holders can have a limited-purpose FSA to pay for qualified expenses associated with dental and vision care. That can help you have the best of both worlds: using an HSA to save for future medical expenses while you pay for some current ones with an FSA. You can only open a limited-purpose FSA if your employer allows for it, however.

Starting at age 65, there is no penalty if you use HSA money for non-qualified medical expenses You will have to pay income tax, though, similar to making withdrawals from other retirement savings vehicles, like pre-tax 401(k)s or traditional IRAs. It's important to note that before you turn 65, you'll face a 20% penalty—plus any applicable taxes—on withdrawals not used for qualified medical expenses.

HSAs are not subject to required minimum distributions (RMDs) Unlike pre-tax 401(k)s and traditional IRAs, which require you start minimum withdrawals called RMDs when you turn 73, you'll never be required to take any funds out of your HSA. This can provide versatility in retirement income planning. If your spouse is the beneficiary of your HSA when you pass away, they can move the money into an HSA in their own name, however if a non-spouse inherits your HSA, the funds in the account will be distributed to them and they pay income tax on the proceeds.

HSA contribution limits

Contributing to your HSA early and often and investing those savings can help you better afford medical care later. The contribution limit for 2025 is $4,300 for individual coverage and $8,550 for family coverage. The HSA contribution limit for 2026 is $4,400 for self-only coverage and $8,750 for family coverage.

You and your employer may both contribute to your HSA, though the contribution limit remains the same, regardless of how much your employer puts in. For example, if your employer deposits $1,000 into your HSA, then you'd only be able to contribute $3,300 if you are enrolled in individual coverage in 2025 or $3,400 in 2026.

In addition, depending on when you enroll in an HSA-eligible health plan and how long you stay enrolled, your total contribution limit may be reduced. Also you typically have until the federal tax filing deadline (usually April 15) to contribute to an HSA for the prior tax year.

How to open an HSA

Step 1: Make sure you're eligible to open an HSA To open and contribute to an HSA, you'll need to be enrolled in an HSA-eligible health plan. This health plan does not have to be provided by your employer, but it must meet the requirements for an HSA-eligible high deductible health plan. If you aren't sure whether your plan qualifies, check with your benefits administrator or plan provider.

Step 2: Pick an HSA provider While HSAs are all similar in the tax advantages they offer, the specific features available at different providers vary. If you're interested in investing your HSA, for instance, you may want to go with a provider that requires no—or a low—amount of your HSA to remain uninvested in cash. You may want to research if potential HSA providers offer low-cost funds or automated investing options, like robo advisors, that meet your needs. You may also want to compare fees across different providers. Remember, too, you can have the flexibility to change your HSA provider even if you're no longer covered by an HSA-eligible health plan.

Step 3: Don't forget to invest your HSA If you intend to use your HSA to save for long-term medical expenses, don't forget to set up your investments. Only 21% of participants invest their HSA assets,3 suggesting the vast majority of Americans aren't using this valuable wealth-building tool as well as they could.

Read more: How to invest your HSA