Recessions are the normal part of the economic life cycle when things aren't going well. It's the opposite of economic expansion. While experiencing a recession may be unavoidable, understanding what they are and how they work can provide some perspective and help you prepare to weather the next one.

What is a recession?

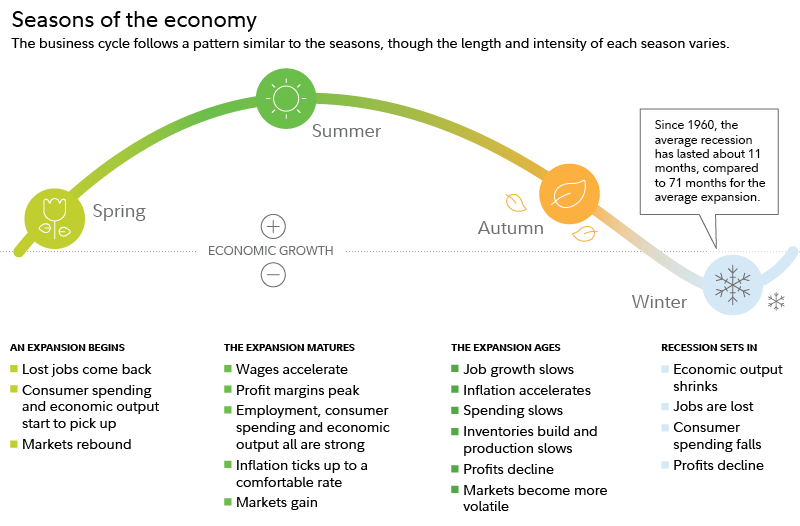

A recession is a prolonged period of negative economic growth in a country. It's 1 of 4 phases in the endless economic circle of life, spanning from growth to peak to recession to trough (aka the bottom of the recession)—and back again. While it's frustrating that economic progress doesn't travel in a straight upward line, it's helpful to keep in mind that historically, periods of recession have occurred much less than periods of expansion and growth. And the US has recovered from every recession it's encountered in its history.

In the US, the National Bureau of Economic Research (NBER)—a nonprofit, nonpartisan economic research organization—decides if we're in a recession by looking at signs of sustained economic decline across many parts of the economy. The data points it examines include real income, or individuals' purchasing power after considering inflation; employment levels; how much industrial producers output; how much wholesale retailers sell; and gross domestic product (GDP), or the value of all the goods and services produced during a time period.1

The NBER usually requires that these data points fall for more than a few months to ensure it's not a short-term fluke, but this isn't always the case: The 2020 COVID-19 pandemic recession only lasted 2 months.

An important note: Recessions are different than bear markets, even though many people think they refer to the same thing. Recessions relate to a country's economy, while bear markets only refer to its stock market. While stock performance may fall the 20% or more necessary to enter into a bear market during a recession, bear markets don't always indicate or even lead to recessions.

What happens during a recession?

In a recession, the economy shrinks, which can lead to lower levels of employment, worsening corporate performance, deteriorating stock market results, and higher borrowing costs for both consumers and companies.

Many recession effects cause negative chain reactions. For example, when a recession looms, people may become more conservative with their spending. While this helps them feel more financially secure, it can negatively impact the businesses they usually support. This in turn causes layoffs, which decreases the amount of income others have to spend to grow the economy and may harm a company's performance in the stock market. This could cause even more people to rein in spending, continuing the negative cycle. In some extreme cases, this decrease in demand can also lead to deflation, or price decreases.

Recessions may correct themselves over time or be helped along by governmental intervention.

What causes a recession?

There's no single cause for every recession. But recessions are often the result of:

- Unexpected shocks in the world. Economies prefer predictability. When they're hit abruptly with wars, pandemics, or international financial collapses, the resulting instability and uncertainty can send companies and people into a panic. When companies and people become more conservative about spending, the economy can contract, as seen in the short-lived 2020 COVID-19-induced recession.

- Asset bubbles bursting. When specific industries grow too quickly, their values may rise faster than is realistic or sustainable, creating what's called an asset bubble. This puts these industries in a position to burst if new money suddenly becomes unavailable or the overall economy changes, and they have no way to continue—or even simply maintain—their current level of expansion. When asset bubbles have grown large enough, as they did with dot-com-era tech companies or the 2007–2008 housing market, the bust can have far-reaching consequences, leading to a recession.

- Overheating economies. When the economy grows too quickly, demand for goods and services increases beyond sustainable supply levels. As the cost of materials and labor rises, businesses often raise prices in order to stay profitable. When inflation rises, central banks may respond by raising interest rates. A combination of higher borrowing costs and higher inflation discourages many businesses from investing and expanding. It also prompts consumers to rein in spending. As demand lessens, businesses may respond with hiring freezes and layoffs. Fewer people working and decreased consumer spending may cause an economic decline. If GDP growth is negative for 2 consecutive quarters, the economy is considered by many to be in recession.

How long do recessions last?

Since 1945, recessions have occurred on average about once every 6.5 years and lasted an average of 11 months, but lengths can vary widely.2 The Great Recession of 2008-2009 lasted 18 months, while the 2020 COVID-19 recession was just 2 months.

Recession vs. depression

When talk of a recession starts, people often become concerned about the possibility of a depression. Up until 1929, economists used "depression" to describe all prolonged periods of economic shrinking. But after the Great Depression's 43 months of economic decline, economists feared that using "depression" again would incite fear and panic and started using the milder term of "recession."3 These days, there is no clear definition of what would qualify as a "depression," though it would likely have to be a severe recession lasting years.

The bottom line on recessions

It's very difficult to predict when a recession will occur, how long it may last, or its financial impacts. But there are steps you can take now (or anytime) to prepare for a recession, like adding to your emergency savings so you have a financial cushion and maintaining a professional network in the event you experience a job loss. It's also a good idea to develop a long-term investment strategy that you can stick with even when the economy and markets get bumpy.