A budget is simply a spending plan, based on your income and expenses. Having a budget helps you understand how and where you're spending your money. It requires discipline, and it's a tool you can use to help reach your money goals. Here's how to budget for the first time—and then keep going every month.

1. Identify your goal

The first step is to identify a goal (or two). Whether it's booking a dream vacation, buying a home, being debt-free, or being able to afford more nights out with friends every month, setting goals can help motivate you to stick to a budget. Having a photo of your goal visible near where you do budgeting tasks or creating a vision board can encourage you even more.

Even if you don't have a concrete goal yet, taking control of your money is a good reason to start budgeting. Eventually, when you think of something you want to accomplish, you'll already be on the right track.

2. Track your spending

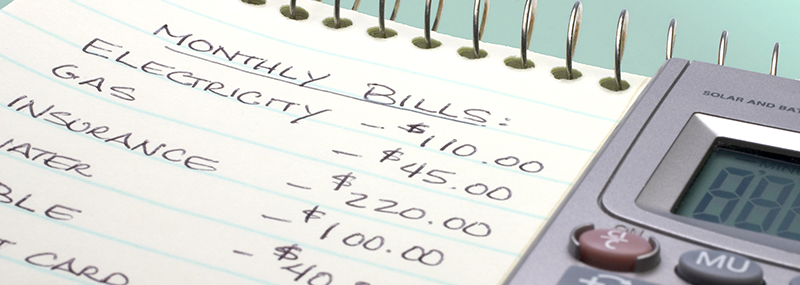

There are several budget trackers and planners to select from—free apps or worksheets are available online. No tool is perfect so be sure to pick whichever one that works for you. While tracking, it's a good idea to include your monthly income and spending categories. Some spending categories to consider are housing, transportation, food, and other monthly expenses.

3. Calculate your income

If you have a fixed amount of money you receive regularly (for example, a salary), then add your paychecks over the month and plug that into your budget. If your income varies from month to month, use the lower range of past monthly income. For instance, if your monthly take-home pay (post-tax and other deductions) ranges from $2,500 to $5,000, then create your budget as though you can only expect $2,500 each month. If you end up with more money than you expect, you can save it or use it where it's needed.

Additionally, don't forget about taxes. If you're a W-2 employee, your net pay, or "take home pay" has already had taxes deducted once it's been deposited into your account. However, if you're a contractor or self-employed, because your income may be gross pay, or total earned without any taxes taken out, be sure to set aside a percentage as you will have to pay taxes on it in the future.

4. List your monthly expenses

A budget is only helpful if it's accurate. Make sure to account for all your expenses—even ones you think only amount to a few dollars. Forgetting a bunch of smaller expenses makes it harder to understand where your money went at the end of the month.

If you use cash, keep your receipts. If you still use paper checks, make copies or write down how much you spent and where. For credit and debit purchases, examine your statements. Include one-off purchases and recurring charges, such as for streaming services and fitness apps. Examining your recurring charges in comparison to your other spending could help show where your dollars are going. If you have use peer-to-peer (P2P) payment networks (such as Apple® Cash, Zelle®, Venmo®, CashApp, or Google Pay™), be sure to keep track of your transactions.

5. Choose a budgeting method

Once you've listed your expenses, group them into high-level categories: essential expenses, retirement savings, and short-term savings. Fidelity's recommendation is to use the Plan Your Pay (PYP) budgeting guideline as a starting point for organizing your finances.

- 60% for essential expenses. Consider allocating no more than 60% of take-home pay to must-haves, such as your mortgage or rent, utilities, groceries, and monthly debt payments.

- 30% for nice-to-haves. Try to save 30% of monthly take-home pay for things you choose to spend your money, for example on restaurants, entertainment, and travel.

- 10 % for near-term goals and emergency savings. Setting aside 10% of monthly take-home pay can help save for unexpected or unplanned expenses such as medical bills or car or home repairs.

- 15% for retirement savings. Try to save 15% of pre-tax income (including any employer contributions) for "Retired You."

6. Cut yourself some slack

A budget is supposed to make you aware of your spending habits—not make you miserable. Avoid unrealistic spending limits or monthly savings goals. Aiming for the unachievable could make you want to stop budgeting because it can feel useless.

You're more likely to be successful with subtle nudges toward better spending habits than a radical shove in a new direction. Each month, if possible, adjust your estimated spending in a category or 2 to save more, or direct that money towards more pressing needs.

For example, say you want to cut your eating-out expenses from $1,000 a month to $500 a month. Instead of immediately halving that spending, try reducing it by $100 a month for the next 5 months. This could help you feel less stressed about the change and increase the chances that you'll hit the goal. Repeat the action for another category once you feel good about the progress you've made.

7. Stay consistent

Budgeting works best if you input your spending consistently. That's why when you're first figuring out how to budget, you may want to track your expenses as often as weekly. For the long term, consider setting aside time with yourself at the same time and day each week, or month. Adding it to your calendar may help you commit to getting the job done.

Consistently budgeting can not only help with achieving your money goals, but also identify how you've been spending your money—on your wants versus needs. It can be helpful in identifying wasteful spending and be a guiding tool for financial success over time.

Remember, it's okay to celebrate yourself. Whenever you hit a milestone, get or do something nice for yourself...just make sure you budget for it.