If you’re considering the possibility of early retirement, navigating the decision can feel complicated. But if you’re nearing 55—or between the ages of 55 and 59½—you may be able to take advantage of a US retirement provision for early retirees called the Rule of 55. This provision could help you access your 401(k) or 403(b) savings before the age of 59½ without incurring an early withdrawal penalty. Let’s look at how it works.

What is the Rule of 55?

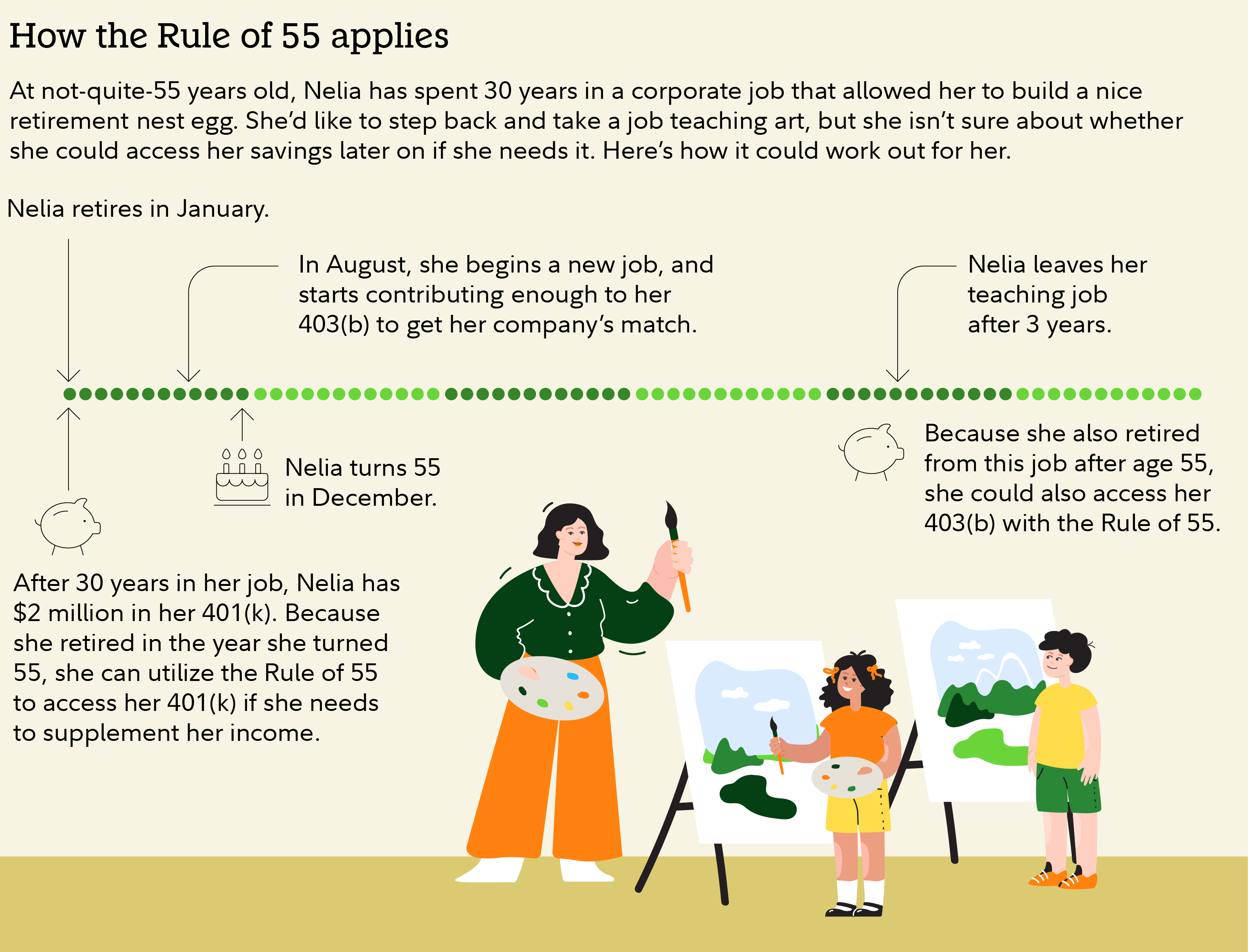

The Rule of 55 allows individuals to take penalty-free withdrawals from an employer’s workplace plan like a 401(k) or 403(b) account if they have separated from service in the year they turn 55 or later.

“Remember that it only applies to a former employer’s retirement plan. Rollover IRAs from 401(k)s are not included in this rule and withdrawals could incur a penalty,” says Michael Rusinak, vice president of Fidelity Financial Solutions.

It’s important to note that the Rule of 55 does not apply to any IRAs.

Key elements to consider with the Rule of 55

Before taking advantage of the Rule of 55, there are several factors to keep in mind.

- Consider withdrawal rules: Many plans do not offer partial withdrawals once you’ve left your job. This could mean you’ll need to withdraw the entire account balance at once—potentially incurring taxes, even if the penalty is waived. Review your withdrawal options with your plan provider before acting.

- Roth 401(k) tax considerations: If your workplace plan is a Roth 401(k), withdrawals will avoid penalties under the Rule of 55. However, remember that taxes on earnings may still apply if the account hasn’t met the 5-year rule for qualified withdrawals.

- Continuing job flexibility: If you decide to get another job and save in another workplace savings plan, you could continue taking withdrawals until age 59½—as long as the account you’re withdrawing from stays with the former employer. It cannot be rolled into an IRA or another workplace plan.

- Long-term impact on retirement savings: While the Rule of 55 grants early access to funds, it’s important to consider the long-term impact on your retirement savings. Withdrawing significant amounts could reduce your portfolio's growth potential and affect your future financial security.

Is the Rule of 55 right for you?

The Rule of 55 is an option worth considering for those who:

- Need immediate access to their retirement funds. If you’ve decided to retire during or after the year in which you attain age 55 and need immediate financial support, this rule can help you meet your shorter-term needs or start retirement early.

- Have significant savings in a 401(k). If you’ve managed to save well in your current 401(k), you may be able to retire early with enough income to take some withdrawals now and support yourself in your future retirement years.

- Anticipate a new career path or part-time work. Even if you’re retiring from your current employer, you can still benefit if you decide to pursue another job or career while utilizing the Rule of 55.

However, exploring other withdrawal strategies might offer better outcomes for those with the bulk of their retirement savings in a workplace savings plan like a 401(k) or who anticipate needing minimum withdrawals over time due to potential plan limitations.

But “if you’ve done the retirement analysis to see that you can have a successful, strong, and resilient retirement plan with retirement at age 55, then this rule allows earlier access to some assets to help fund your lifestyle,” says Rusinak.

Fidelity’s planning tools can help you find out if your savings are on track to support your retirement.

Next steps before using the Rule of 55

Setting yourself up for long-term financial success requires carefully evaluating all your options, including the Rule of 55. If you’re considering early retirement or want to explore how this rule might fit into your plans, here’s what you can do next.

- Contact your plan administrator: Confirm whether partial withdrawals are allowed once you’ve separated from employment.

- Consult with a financial professional: Get guidance from a professional regarding your retirement strategy and whether taking advantage of the Rule of 55 is right for you.

If you’ve done your research and concluded that the Rule of 55 works for your situation, you could start enjoying the fruits of your hard work sooner than you expected and get an early start on your retirement journey.