Setting out on your own as a small-business owner takes guts, grit, and lots of organization. One of the most important and complicated aspects of managing your finances when you're the boss, besides keeping the lights on and vendors paid, can be managing taxes.

Here's what you should know if you're considering self-employment.

1. An extra tax is coming your way: The self-employment tax

The first thing to understand is the self-employment tax. Self-employed people pay up to 15.3% in self-employment taxes—12.4% in Social Security taxes up to certain income limits indexed for inflation ($176,100 in 2025) and 2.9% for Medicare with no income limit. Some high earners are subject to an additional 0.9% Medicare tax: The income thresholds are $200,000 for single filers, $250,000 for those who are married and filing jointly, and $125,000 for married individuals filing separately.

Visit IRS.gov for more information.

2. Paying taxes is 4 times more fun with quarterly estimated taxes

It's a common misconception that the only time you need to pay taxes is when you file your tax return for the year.

"That's partly true," says Christopher Williams, principal at EY in the Private Tax group. "But for federal taxes, and for most states, what they actually look at is that you have some minimum amount of tax paid in every quarter, throughout the year."

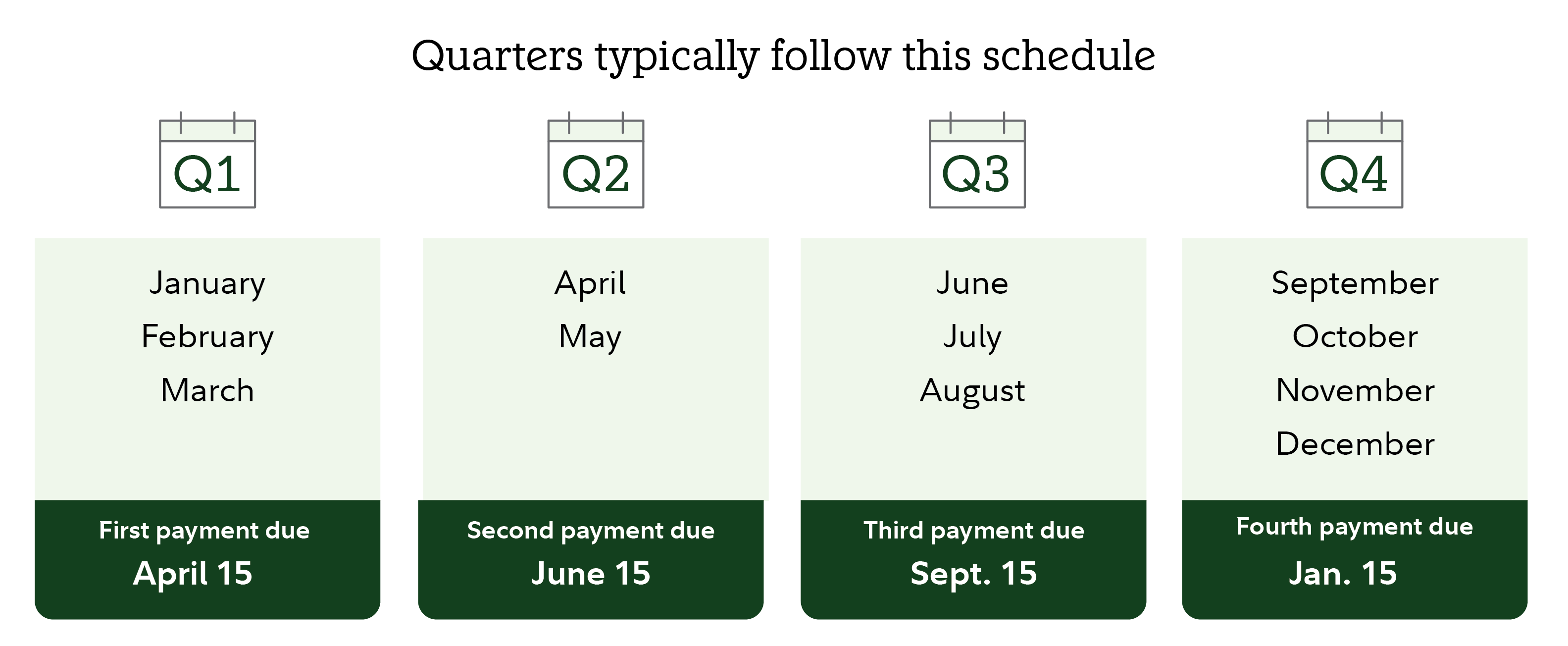

Payment dates vary but are generally the 15th day of the month (April, June, September, and January), unless the date falls on a weekend or holiday, then the deadline is moved to the next business day. For example, 2026 due dates are Q1: April 15, 2026; Q2: June 15, 2026; Q3: September 15, 2026; and Q4: January 15, 2027.

People who are employed by someone else usually have this done automatically, since taxes are generally withheld from every paycheck. But when it comes to taxes for the self-employed, it's important to make sure you're paying the right amount of tax each quarter.

Working with a tax professional can make sense for people who are self-employed. They can tell you how much to pay each quarter and you can focus on your business.

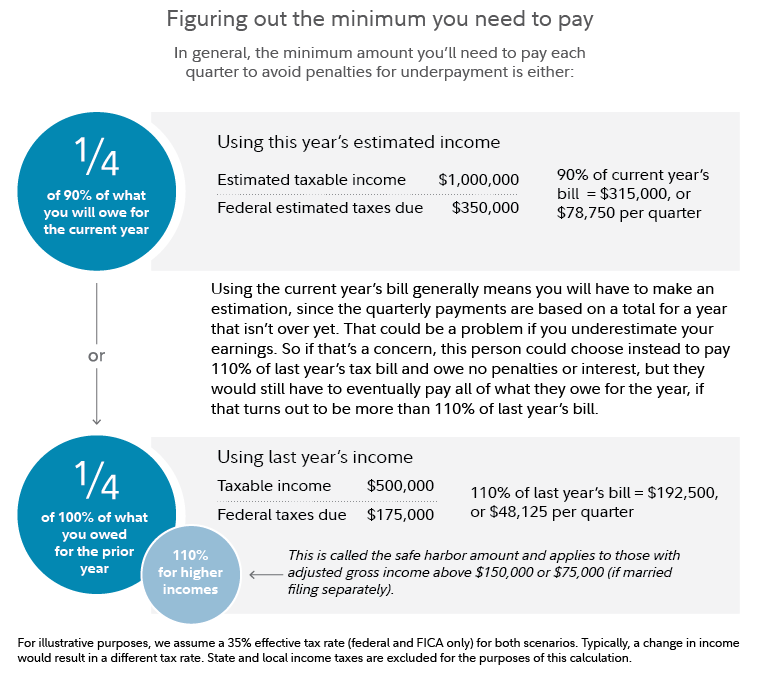

In general, the minimum amount you'll need to pay each quarter to avoid penalties for underpayment is the lesser of:

- 1/4 of 90% of what you will owe for the current year, or

- 1/4 of 100% (110% for higher incomes) of what you owed for the prior year. This is called the safe harbor amount.

90% of the current year's tax bill vs. 100%/110% of last year's tax bill

3. What if you underpay estimated taxes? There's a form for that

If you find that you have underpaid quarterly estimated taxes, Form 2210 may help you calculate the potential penalty you may owe.

Also, "You can report your income on a quarter-by-quarter basis and calculate what your tax owed would be each quarter," Williams says. "So if a lot of your income came at the end of the year, you may only have underpaid for that last quarter and may not have any penalties in the prior quarters."

4. Keep meticulous records—for 7 years

As a business owner, it's important to make sure you're capturing all of your business-related expenses—and keeping receipts.

"For most purposes, tax authorities can go back 3 years to look at your return. But there are some instances where they can go back as many as 6. So we recommend 7 years, just to have 1 extra year. After that you can usually shred the information," Williams says.

Keeping your tax returns and all of the supporting documents organized and accessible may seem cumbersome at first but it can pay off in case the IRS comes calling.

5. If you travel for work—keep track of state tax rules

If you work or otherwise have earnings in a state besides the one in which you live, you may need to file another state tax return. Most states have an earnings threshold. If you earn more than that amount working in the state, you need to file a tax return.

But different states have different rules so it makes sense to research the rules in each state you work in.

6. You may be able to take some deductions other people can't

It can sound like people who are self-employed get the short end of the stick when it comes to taxes, but the silver lining can be getting deductions for a home office or other business expenses. For instance, if you have a home office, you may be able to get a deduction for the dedicated space devoted to your business on property taxes paid, utilities, phone bill, or internet service.

"So it's not just for computer equipment and desks. It's also a portion of those indirect expenses of operating your house that get converted from a nondeductible personal expense to now a deductible business expense," Williams says.

According to the IRS, there are multiple methods by which your home expenses can be deducted for your business. One such method has the following two requirements:

- Regular and exclusive use

- Principal place of your business

See IRS Pub. 587 for more information, and consult a tax advisor regarding your situation.

If you're claiming a deduction for property taxes and utility bills and all the other expenses, hold on to those receipts in case there's a question about those deductions.

Finally, keeping a separate account to pay quarterly estimated taxes may make sense to help ensure the money is always available and ready to send. Options to consider include a checking or savings account, or a cash management account offered by brokerage companies. Learn more about keeping separate accounts.