Ah, summer. The time of year to enjoy long, lazy days … and tax holidays.

Many states offer a tax-free weekend each summer to help defray the cost of back-to-school shopping. But that’s not the only reason you might get a tax holiday. Here’s a rundown on what you can expect—and when your state may have a tax-free weekend.

What is a tax-free weekend?

States that offer tax holidays will lift the state sales tax on certain items for a limited period of time. Often, the focus is on back-to-school items like clothing, shoes, computers, and school supplies. Eligible products often have price caps—for instance, some states limit the price of clothing or footwear to $100 or less.

Not all states offer tax holidays. Five states don’t have a statewide sales tax to begin with (Alaska, Oregon, Montana, New Hampshire, and Delaware). And Colorado, which levies just a 2.9% sales tax, doesn’t have any tax holidays on the books.

Tax holidays can happen for just a weekend, or they can be longer. This year, Florida is exempting hunting and fishing equipment from the state's sales tax from Sept. 8 through the end of the year.

Tax holidays also may not be totally tax-free, as some localities levy a small sales tax that retailers may still have to collect.

When is my tax-free weekend?

Here are the states offering tax holidays for the rest of 2025.

Prices in the table refer to the maximum sale price per item, unless otherwise noted.

2025 sales tax holidays by state

| State | Dates | Description |

|---|---|---|

| Alabama | July 18–20 | Back-to-school items, including clothing ($100), computers ($750), school supplies ($50), and books ($30) |

| Arkansas | Aug. 2–3 | Clothing/footwear ($100), school supplies, art supplies, instructional supplies, electronic devices |

| Connecticut | Aug. 17–23 | Clothing/footwear ($100) |

| Florida | Aug. 1–31 | School supplies ($50), clothing ($100), and computers ($1,500) |

| Florida | Sept. 8–Dec. 31 | Hunting and fishing supplies |

| Iowa | Aug. 1–2 | Clothing and footwear ($100) |

| Maryland | Aug.10–16 | Clothing and footwear ($100) |

| Massachusetts | Aug. 9–10 | Tangible personal property, $2,500 or less |

| Mississippi | Aug. 29–31 | Hunting supplies |

| Missouri | Aug. 1–3 | School supplies ($50), clothing ($100), and computers ($3,500) |

| New Mexico | July 25–27 | School supplies ($30), clothing and shoes ($100), computers ($1,000), and computer equipment ($500) |

| Ohio | Aug. 1–14 | All tangible personal property that is $500 of less, with some exceptions. |

| Oklahoma | Aug. 1–3 | Clothing/footwear ($100) |

| South Carolina | Aug. 1–3 | Clothing, accessories, footwear; school supplies; computers, printers and printer supplies, and computer software. |

| Tennessee | July 25–27 | Clothing, school supplies and computers |

| Texas | Aug. 8–10 | School supplies, clothing, shoes, backpacks |

| Virginia | Aug. 1–3 | School supplies, clothing, footwear, hurricane and emergency preparedness items, and certain energy-saving products |

| West Virginia | Aug. 1–4 | Clothing ($125), computers ($500), school instruction material ($20), school supplies ($50), and sports equipment ($150) |

Can I shop online during my tax-free weekend?

Yes, online retailers will honor your state’s tax holiday, but it can get a little complicated by local rules.

Florida, for instance, requires retailers to include shipping charges in the cost of the item, and that can impact whether or not it is eligible for the tax break. And New Mexico does not require retailers to participate in the state’s tax holiday at all.

How much will I save?

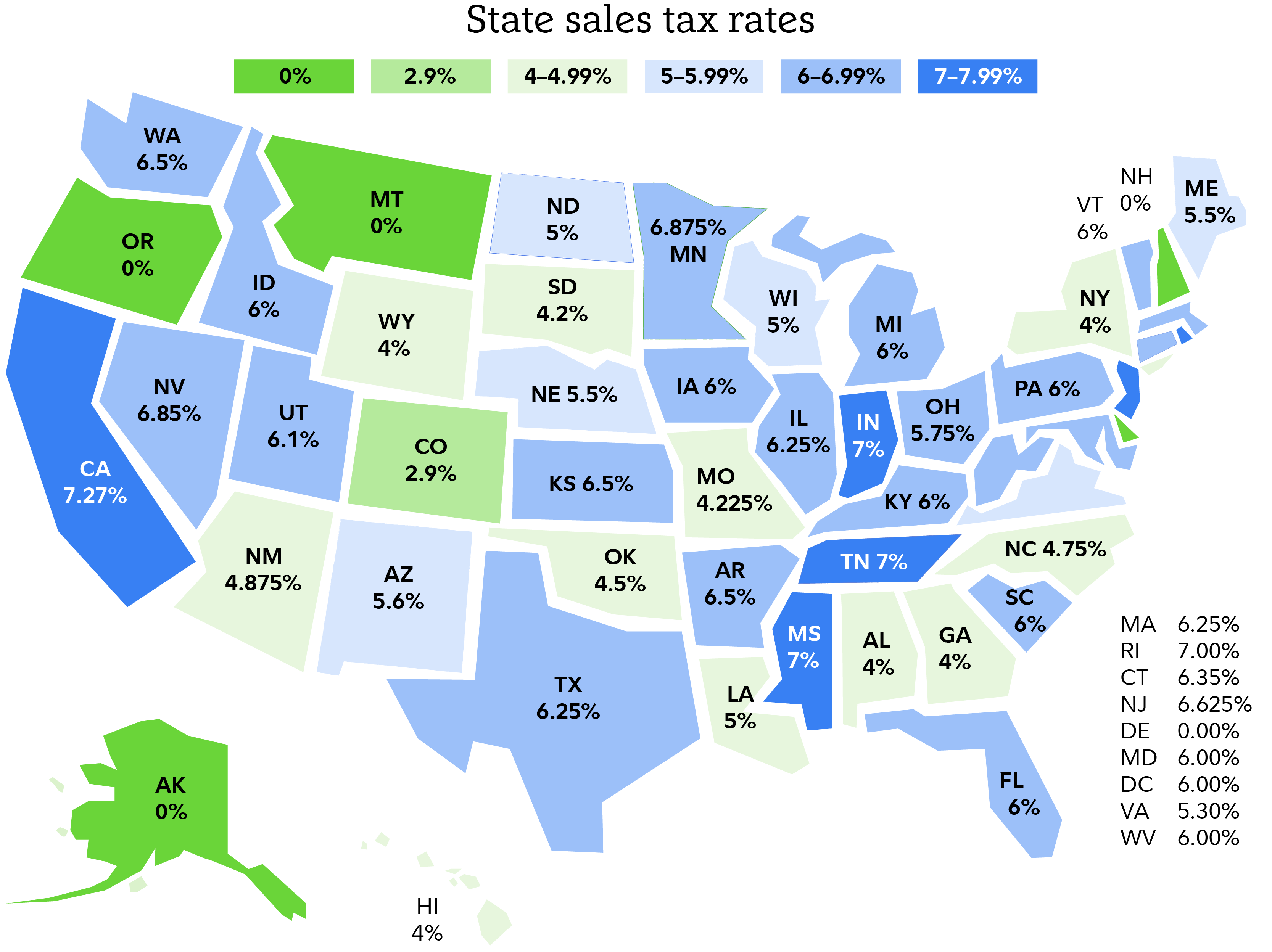

In the 45 states that do levy a sales tax, rates range from 2.9% (Colorado) to 7.27% (California). Here’s how all the states compare:

Tips for saving during tax-free weekends

Here are a few tips so you can make the most of your state’s sales tax holiday:

- Have a plan: That’s always a good way to keep a lid on your spending, but it’s especially true with tax holidays, which may only last a couple of days and have specific limits on prices.

- Set a calendar reminder: Seriously, the summer goes by so fast, and these weekends can sneak up on you.

- Get familiar with your state’s rules: Check out your local news or visit your state’s taxation and revenue website to get the details on your state’s rules before you hit the stores. There can be big differences in price caps: West Virginia caps its price for tax-free computers at $500, while Florida’s limit is $1,500. And in many states, athletic apparel is not included in the tax holiday, so you won’t get a break on your kid’s sports gear.

- Shop around: A store discount or sale price can be the difference between paying state tax on a $1,599 computer and not paying state tax on one that costs $1,500, so keep an eye out for sales.