The road to retirement is long and rarely follows a perfectly straight path. Sometime life just gets in the way. You lose a job, or need to take time off to help a loved one, or some other bump-in-the-night surprise knocks your best-laid plans off the rails. The good news is there are ways to get back on track when you're ready.

Here are 5 tips, in no particular order, to help you recover from a retirement savings setback.1. Go back to basics

Going back to the basics can make sense after a financial setback, and even put you in a stronger position for the long term. Some steps to take:

- Create a budget to get a better handle on expenses, if you don't already have one. In addition to your day-to-day expenses, don't forget to also budget for your recurring debt obligations and medical expenses.

- Protect what you have with basic insurance—particularly if it's available through your employer at a competitive cost. Health, disability, and life insurances are crucial for protecting your finances. Also remember to set up beneficiaries for your accounts and review them regularly.

- If you're eligible, saving money in a flexible spending account (FSA) or health savings account (HSA) can help you save on both health care costs and taxes.

- If you don't already have an emergency savings, consider saving $1,000 and working your way up to 3 to 6 months' worth of essential expenses.

- If you have access to a workplace savings plan, consider saving at least enough to get any match offered by your employer.

- Prioritize paying down high-interest debt, especially credit card debt, before aggressively saving for short- and long-term goals.

Read Viewpoints on Fidelity.com: How to balance debt, saving, and investing

2. Revisit your retirement contributions and investment allocation

In situations where income and expenses suddenly seem out of whack, many people freeze or cut back on contributions to their retirement accounts. When things get back to normal, one of the simplest actions you can take—restarting your contributions—can make a big impact. Remember, even 1% can make a difference over time.

One guideline to keep in mind is to try to contribute at least enough to get any available company match. This is like free money into your workplace savings plan.

A lot of people like the fact that workplace savings plans, like 401(k)s and 403(b)s, are "automatic savings" programs. Money goes directly into their workplace savings accounts every paycheck. And if by any chance you can increase your contributions, or if you're in a position to try to contribute more to "make up" for stopped contributions, even better. But just starting to contribute again, at any amount that is reasonable given your budget, is a great start.

If you don't have a retirement account through your employer, consider contributing to an IRA. You may be able to set up automatic transfers from your spending account or even have contributions made via direct deposit. Making your savings automatic is a great way to boost the odds of success since you never need to think about it or add it to your to-do list.

Tip: To start, try to gradually ramp up your contributions until you hit 15% of your income (this includes any employer contribution), a level that should set you on a course to help maintain your lifestyle in retirement. If your employer offers an auto increase program, be sure to enroll so that your contributions can increase automatically each year.

If your circumstances, goals, time horizon, or tolerance for market risk have changed, consider working with a Fidelity professional to help rebalance your portfolio if needed.

3. Did you take a withdrawal or 401(k) loan? Here's how to move forward.

If you've taken money out of a workplace savings plan to get through some tough times, consider contributing more each year to your retirement plan in order to help offset the money you took out.

In some cases, taking a 401(k) loan can be your best option. Here's what to know about repaying a 401(k) loan:

- You'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases.

- If possible, avoid borrowing more than you need or too many times.

- Continue saving and contributing to your retirement. It will likely be your biggest source of income when you retire.

- Remember, in the event that you leave your employer, any outstanding loans need to be repaid in full within a short period of time or you will have to pay the taxes on the outstanding balance, which would be treated as a distribution, not a loan from your account.

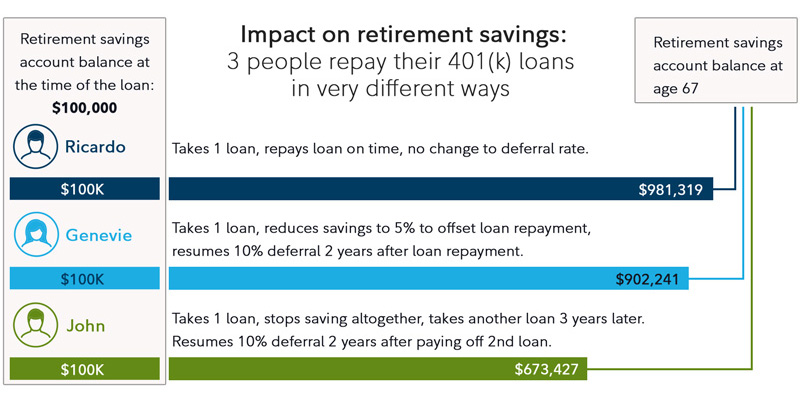

Let's look at an example of 3 people who took loans— but had very different outcomes. In the hypothetical example below, 3 people take a $20,000 loan against their 401(k). All were contributing 10% of their $75,000 salary, prior to the loan.

- Ricardo repays the loan on time and keeps saving for retirement.

- Genevie repays the loan on time, but cuts her contribution to her workplace retirement plan in half (from 10% to 5% of pay) for 2 years, until she is done repaying the loan.

- John stops saving altogether and 3 years later, takes a second loan of $20,000. After 8 years, he pays off both loans but he does not resume his contributions of 10% of salary to his 401(k) for a period of 10 years.

Bottom line: At their retirement age of 67, John has about 30% less saved for retirement than Ricardo.

4. Balance saving for retirement with other goals—like building up an emergency savings

Everyone knows the importance of saving, but a common struggle for many people is organizing different "buckets" of savings for different goals—things like retirement, emergency savings, and education—not to mention more enjoyable items like vacations.

The ongoing cost of living crisis has highlighted how hard it can be to build up an emergency savings account in addition to saving for retirement. Even if you've already tapped your emergency savings, don't let go of a goal for something you really need or want to save for over the next 1–5 years.

Tip: Use mental accounting: This approach involves saving separately for different goals and labeling each pot of money—ideally, with a photo—in a personally meaningful way. For example, name a new goal "save for George's college fund" or "save for my dream beach home in retirement."

To help you save for the things that matter to you, check out the Fidelity Goal Booster. It's designed to keep you on track to reach your savings goal by making saving more automatic. For example, if your goal was to establish an emergency savings of $6,000 in 3 years, using Fidelity's Goal Booster, you should plan to save $167/month or $39/week to reach your goal.1

5. Evaluate where you are today—and where you want to go

Over the years, we've developed key retirement guidelines designed to help people who ask these common 4 questions:

- What will my savings cover in retirement?

- How much do I need to save for retirement?

- How much should I save each year for retirement?

- How can I make my retirement savings last?

Learn more about our 4 key retirement metrics—a yearly savings rate, savings milestones, an income replacement rate, and a potentially sustainable withdrawal rate—and how they work together in the Viewpoints special report: Retirement roadmap.

Recent years have proven that you never know what could happen, so it's now more important than ever to take charge of your financial life. Whatever path you choose, we're here to help you take the steps—small, medium, or large—to get your retirement savings and financial life back on track.