Millions of Americans roll workplace savings accounts like 401(k)s into IRAs—then some of them unknowingly leave the money sitting in cash. That pause can quietly derail decades of saving by missing any market growth and letting inflation chip away at purchasing power. A rollover isn’t the finish line; it’s the starting line for your next phase of retirement planning.

Recent research found an alarming issue in rollover IRAs: Many investors leave assets in cash for months or years, often by accident. In a 2023–2024 survey of rollover investors, 68% who stayed in cash didn’t realize how their IRA assets were invested.1 In these cases, a simple misunderstanding can mean prime years of potential compounding returns lost.

What really happens when you roll over a 401(k) to an IRA

Here’s the surprise most people don’t see coming: When you roll over a 401(k), your investments don’t always come along for the ride. Some investments may be able to be transferred but it’s not the typical case. They’re generally sold, and the money lands in your IRA as cash. Unless you pick new investments—or choose a managed solution—that cash just sits there for the most part. At Fidelity, uninvested cash does earn interest though.

That’s why so many investors get caught off guard. It feels like everything should keep going automatically, but IRAs don’t work that way. There’s no default investment. You have to make the next move.

“Some people think they’re still invested after a rollover. In reality, most of your investments may have been sold and you’re starting fresh,” says Kenny Davin, CFP®, vice president and Fidelity branch leader in Ft. Lauderdale, Florida.

Why the disconnect? Workplace plans like 401(k)s are governed by laws that allow employers to offer default investments. IRAs aren’t covered by those rules, so there’s no automatic option—the responsibility is yours. It can also be easy to procrastinate choosing investments if you're in the middle of changing jobs. "People can get so focused on their new identity at work and their career that the investments become an afterthought," Davin adds.

Note: If you were happy with the investment mix in your workplace plan, consider printing out a copy of the investments or take a screenshot, and work to recreate it in an IRA. The exact investments and share classes may not be available but you may be able to find substitutes.

Where does the cash go?

At Fidelity, uninvested cash sits in your account’s core position—a holding place for cash transactions. At Fidelity, that’s typically a money market fund or an FDIC-insured sweep. You can see your core position by logging in and checking Account Positions. From there, you can change it if needed, but the bigger step is moving from cash to an investment strategy that fits your goals.

To learn more, read: What is a core position? (PDF)

Why investing can be critical

Your rollover may represent decades of your life’s work concentrated in one transfer. Leaving it uninvested introduces several risks:

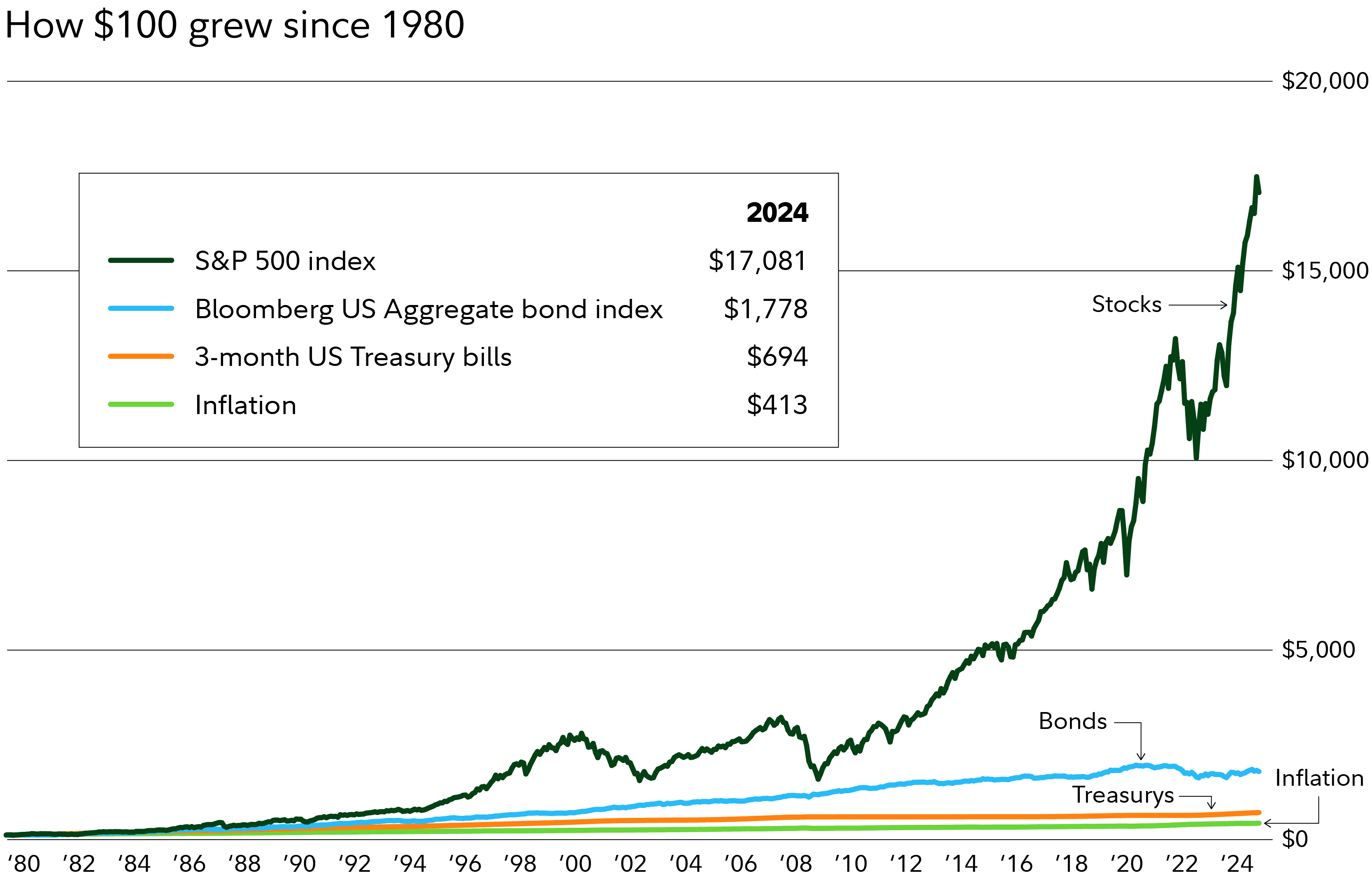

- Opportunity cost. Over long horizons, diversified portfolios have historically outpaced cash, so idle cash misses any market growth.

- Inflation erosion. Even when cash yields look decent in the short term, inflation can outpace them, shrinking purchasing power over time.

Planning first, then investing

A rollover is the perfect moment to zoom out and anchor decisions in a plan—especially if it’s been years since you last reviewed your retirement strategy. Life changes, markets move, and what worked when you started saving may not fit your goals today.

“One of the most impactful rollovers I helped a client with involved moving her retirement account that represented 30 years of working at a job that she didn’t enjoy,” says Davin. “I was able to give her the good news that she could retire sooner than she thought based on the planning she had already done. Before the check arrived, she already had a strategy in place setting up emergency savings, retirement income, and long-term growth potential.”

The earlier you can start the process—with a professional or on your own—the more prepared you can be. That can help avoid delays in addition to the other benefits of planning. A financial plan can show you where you stand in relation to your goals and provide a path to help meet them. Choosing investments is a critical part of the process. Here’s how the planning process can help:

- Defines purpose and timeline. Your target retirement age, income needs, and health care timeline may shape your mix of growth, income, and short-term investments.

- Aligns risk to reality. You may discover you’re either taking too much risk—or not enough—to meet your goals.

- Coordinates accounts. A holistic plan can ensure your new IRA complements any other accounts like a current 401(k), brokerage, other IRAs, and health savings account (HSA)—so your whole financial picture works together.

- Turns ideas into action. A plan can help you set up your investment mix and help keep your progress on track.

“The most frequently asked question I get from people who are saving for retirement is, 'Am I on track?'” says Davin. “Followed by, 'What can I do about it? Can I save more, invest better?' Those are the things we talk through and then through the planning process, we can see the impact of pulling the levers that are available—what you need to do to reach your goals in other words.”

Once you know where you stand relative to your goals, it’s easier to see the path that can help get you there. “Personal finance is more personal than finance—it’s an art and a science. The science shows if you’re on track; the art is what you’re actually willing to do,” Davin says.

Finish the job: Your post-rollover checklist

- Verify the money arrived and is ready to trade

Confirm that your rollover has arrived and the money is ready to trade.

- Choose your path—DIY or do it for me

- DIY: Select a diversified mix (e.g., target date or balanced funds) aligned with your timeline, risk tolerance, and goals. You aren’t totally on your own. Fidelity's digital planning tools allow you to link an account (or accounts) to a specific goal from your Planning Summary page. If you're not sure how to invest for a specific goal, Fidelity's tools can suggest an investment strategy for you.

- Do it for me: Consider a managed account if you prefer professional oversight and rebalancing. Learn more about the planning and investment advice offerings from Fidelity.

- Choose the investment mix you can live with. The right investment mix balances growth needs with the ability to stay invested through volatility. Read Fidelity Viewpoints: How to start investing

- Automate contributions (if applicable) and investing. Automation can help turn your plans into ongoing discipline.

- Schedule a future check-in. Life changes and markets move—revisit risk, savings rate, and progress against your targets.

Tactical tips that can help your rollover

- Choose a direct rollover. Ask your plan administrator to send your distribution directly to your IRA provider or new plan to avoid mandatory withholding and reduce paperwork and risk. Read about your options and their deadlines for an account with a former employer, like a 401(k): Considerations for an old 401(k)

- Know the 60-day rule. If you receive a check from your account personally (an “indirect” rollover), you must deposit the money into a qualified account within 60 days or the IRS treats it as a taxable distribution (and you may be penalized if you’re under 59½).

- Make sure your investment strategy fits your goals. Your 401(k) menu was likely curated and limited; an IRA can open the door to thousands of options. That flexibility is powerful—but it can feel overwhelming. You may not need to start over from the very beginning—if you previously had a target date fund, that may still make sense with other choices you might select within your IRA. Or consider looking at the way your former plan was invested and explore ways to recreate that if it makes sense.

Cash comes with its own risks

Cash can feel safe, but it may not be an appropriate long-term strategy. Without growth potential, you may fall short of the retirement you envision. Historically, diversified portfolios that include stocks, bonds, and other types of investments have delivered higher returns than cash over time. While past performance doesn’t guarantee future results, investing gives your money the potential to grow and keep pace with inflation.

If you're not comfortable investing all of your investment portfolio, consider a compromise: keeping an adequate cash buffer (for emergencies and short-term spending), and investing your retirement balances according to plan. Read Fidelity Viewpoints: How much to save for emergencies

Bring in a pro (especially if you’re stuck)

If you don’t have the time, interest, experience, or knowledge to select and monitor investments—consider working with a financial professional. They’ll help you:

- Translate goals into a spending and investment plan.

- Coordinate accounts (old 401(k)s, new IRAs, taxable accounts) so your full financial picture works together.

- Choose an investment mix you can stick with through market cycles.

- Set up automatic investing and rebalancing so your investments are positioned for future growth potential.

“It’s like cooking: You may experiment on a Tuesday, but you don’t experiment on Thanksgiving. Investing for retirement is similar, it’s high stakes and there is less room for mistakes,” Davin says.

“Some people have no business in the kitchen—and that’s fine. The important thing is that the meal gets made,” he says.