Compare before you invest

Make sure your uninvested cash is working hard, to help you invest more—without the need to pay account fees, subscription fees or trade commissions.2

| Fidelity | Robinhood | Schwab | |

|---|---|---|---|

|

Yields as of February 12, 2026 Yields may vary due to market conditions

|

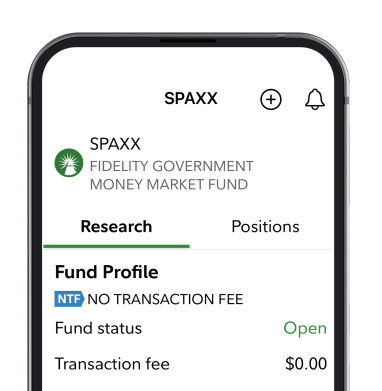

3.31% Government Money Market Fund 7-day yield

|

0.00% For non-Robinhood Gold subscription customers. Other rates apply for Gold members - see below for additional details.

|

0.01% Default Sweep APY

|

Before you invest

Money market funds have different characteristics than bank sweep accounts and savings accounts. Read any fund's prospectus carefully.

More information

An important difference is that bank sweep products have FDIC protection, which guarantees principal and interest within limits; and money market funds and non-bank default sweep products do not. See more information about safeguarding your accounts. The Fidelity fund yield is the average amount earned by the fund after expenses over the past 7 days (per date indicated) and annualized. For Robinhood non-Gold members, uninvested cash in Robinhood self-direct investing accounts will not be swept to a bank and will be held as a free credit balance and will not earn interest. Free credit balances while covered by SIPC, are not FDIC insured. As of February 2, 2026, Robinhood’s cash sweep program is now part of the high yield cash program which allows Robinhood Gold subscribers ($5/month) to earn a 3.35% annual percentage yield (APY) on eligible uninvested brokerage cash. Eligible cash up to and including $10,000 in Robinhood accounts will earn 3.35% APY as free credit balances as part of the Brokerage-Held Cash program while cash over $10,000 will also earn 3.35% APY but be swept to FDIC-insured program banks as part of the Cash Sweep Program. APY might change at any time at Robinhood’s discretion. The Schwab APY is the amount of total interest earned on a bank product in 1 year and reflects the Schwab Default Sweep for the Schwab One Interest for retail and Bank Sweep Account for retirement. Other rates may be available for other non-default core options which may be available and are not reflected in in the above average. Please consider each type of account and products carefully, as there are differences in services and fees.

You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.