Tapping into home equity can provide cash relatively quickly, but when should it be considered? In general, we believe there's no substitute for a fully funded emergency savings, savings for the future, and a financial plan to help everything stay on track. Things don't always go according to plan though, and in some cases an existing HELOC could come in handy as a backup if you need money in a pinch. The traditional use case for these types of loans is to make improvements to the property they're attached to, but there are no restrictions on what you can use the money for.

If you're considering borrowing from home equity, there are a few things to know before diving into one of these products.

What is a home equity loan?

A home equity loan allows you to borrow a lump sum against the equity you've built up in your property. Your equity is the current appraised value of your home minus what you owe on your mortgage.

How does a home equity loan work?

With a home equity loan, you can generally borrow a maximum of 85% of your home's worth minus what you owe on your mortgage. Once approved, you'll receive a set amount that you'll pay back at a fixed interest rate. Similar to a traditional mortgage, you'll repay the loan in equal amounts over a predetermined number of years.

Since the funds come in a lump sum, a home equity loan is often used for covering a large, one-time expense, such as putting in a backyard swimming pool or consolidating high-interest debt under one loan with a lower rate.

What is a HELOC?

A home equity line of credit, also known as a HELOC, provides a preapproved line of credit that is based on your equity. You can tap into the credit as needed.

How does a HELOC work?

Like a home equity loan, a HELOC usually provides access to up to 85% of your home's value minus outstanding mortgage payments. Yet it functions more like a credit card than a traditional mortgage. A HELOC provides a revolving line of credit to use as needed for a specific borrowing period (aka a "draw period"), usually 10 years. Typically, your lender will give you a debit card, credit card, or checks to draw on your line.

Unlike a home equity loan's fixed rate, HELOCs commonly come with a variable interest rate, which means the amount you pay can fluctuate monthly. (There is typically an upper and lower cap.) In many cases, you'll have the option to pay interest only during the draw period. After that time frame ends, you'll enter a repayment period where you'll pay principal and interest based on terms agreed with your lender.

Like a home equity loan, a HELOC can be used for a variety of expenses, such as home improvements or covering medical bills.

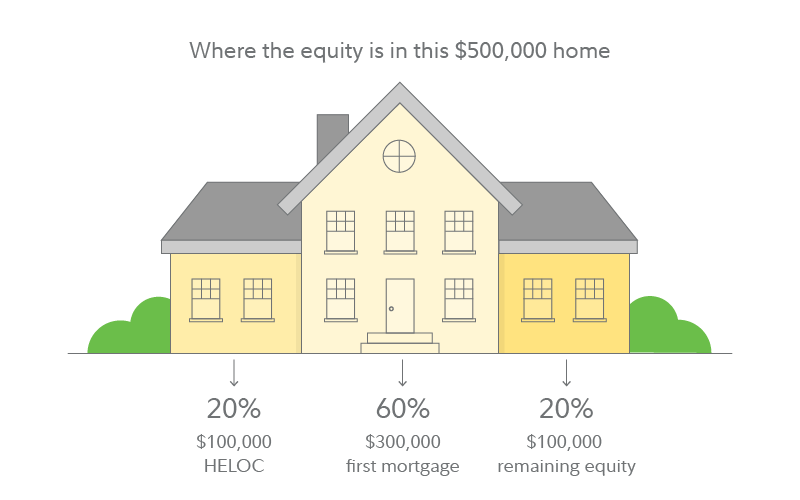

Doing the math on a HELOC

Generally, lenders are willing to lend up to 80% or 85% of the market price of a home minus any amounts owed. For a borrower who has a home valued at $500,000 and a first mortgage balance of $300,000, 80% would be $400,000 so in this case a lender may offer a HELOC with an available limit of $100,000 to the borrower. Assuming an 8.25% interest rate and a 10-year interest-only period followed by a 15-year repayment period:

- If the borrower drew $50,000 from the line of credit, they would have a minimum payment of $343.75 per month in interest at the current rate.

- At the end of the 10-year draw period, if they had not paid down any additional principal, the payment would reset to $485.07 per month for the duration at the current interest rate.

What are the most significant differences between HELOCs and home equity loans?

Each has nuances, but one big difference is that a home equity loan has fixed monthly payments, while HELOC payments can vary.

“With a home equity loan, you'll get the money today, but you'll start paying interest on it today as well,” says Michael Mariani, vice president of lending solutions at Fidelity Investments. “With the line of credit, you're only going to pay interest on the funds when you actually draw them.”

How to get a home equity loan or HELOC

Before you begin your inquiries, get your finances in shape, as your credit score and debt-to-income ratio can affect your eligibility and rates. Then, scout out a few quotes for a home equity loan, starting with your bank or credit union. While comparison shopping, also ask about closing costs and other fees.

“It’s worthwhile to shop around and see what rates and terms are offered,” Mariani says.

Keep in mind that some large banks have gotten more conservative in their lending and stopped offering these loans in recent years, says Mariani.

You can also get a HELOC from a bank or credit union. As with a home equity loan, compare rates and fees.

Home equity loan vs. HELOC: What to keep in mind

There are advantages and disadvantages of using a home equity loan or a HELOC. The ultimate decision will depend on your specific needs, the timeline for using the money, and comfort with a fixed or fluctuating rate. Here are some pros and cons to consider.

Pros

- Home equity loans

- Fixed monthly payment: You’ll owe a set amount each month, so you’ll know exactly how much to budget for this expense.

- HELOCs

- Flexibility: You’ll be able to draw money whenever you need it. In addition, you’ll only pay interest on the funds you use.

- Added security: It can be a safety net if you’re laid off or unexpected expenses arise. (Qualifying for a HELOC without a source of income can be difficult; planning ahead and getting set up early may make sense as an option, says Mariani.)

- Home equity loans and HELOCs

- Competitive interest rates: Typically, both offer lower interest rates than other forms of borrowing, such as credit cards.

- Tax deductibility: Interest on home equity loans and lines of credit may be deductible if the borrowed funds are used to buy, build, or substantially improve the home that secures the loan. A tax professional can let you know if you qualify.

Cons

- Home equity loans

- Potentially higher rates: Home equity loans generally have higher interest rates than HELOCs.

- HELOCs:

- Less predictability: With a fluctuating interest rate, payment amounts can change over time.

- Potential repayment shock: If you paid interest only and didn’t prepare to pay the principal and interest during the repayment phase, you may be in for an unpleasant surprise. “It can be a shock to some people, depending on the size of the balance,” says Mariani.

- Home equity loans and HELOCs

- Added expenses: You may need to pay closing costs and other fees.

- Risk of losing your home: Since your home is your collateral, you could lose it in foreclosure if you default.

A financial professional can help you determine what may be best for your situation, as well as walk you through other options for funding, such as a cash-out refinance, a personal loan or line of credit, or a securities-based line of credit.