Managing cash flow can feel like juggling chainsaws on a tightrope. And the high wire act can get stressful. But with the right strategies and smart spending, you may be able to keep your finances in balance and achieve your goals.

Foundational steps to consider

Deciding how to spend your money before you get it helps you prioritize what’s most important—whether it’s buying a home, saving and investing for children or education, or retirement. Here’s how to get started in no particular order:

- Get a clear picture of your income and expenses. Make sure you’re spending less than you earn.

- Start building your emergency savings. Fidelity suggests starting with a $1,000 cash buffer. Over time, aim to save enough to cover 3 to 6 months’ worth of essential expenses. Think of it as your financial safety net.

- Consider contributing to tax-advantaged accounts. You may be eligible to contribute to a health savings account or a workplace retirement plan. The potential tax benefits can help strengthen your savings over time.

- Make paying down credit card debt a priority. The sooner you tackle it, the more you can save for other goals.

Tracking expenses and budgeting

Ever wondered where all your money goes each month? Try tracking your expenses for a month—you might be surprised. Fidelity’s spending and budgeting experience can help you find out where your money goes and helps categorize expenses and set up your budget. For most Americans, housing, transportation, and food take up the biggest chunk of income.

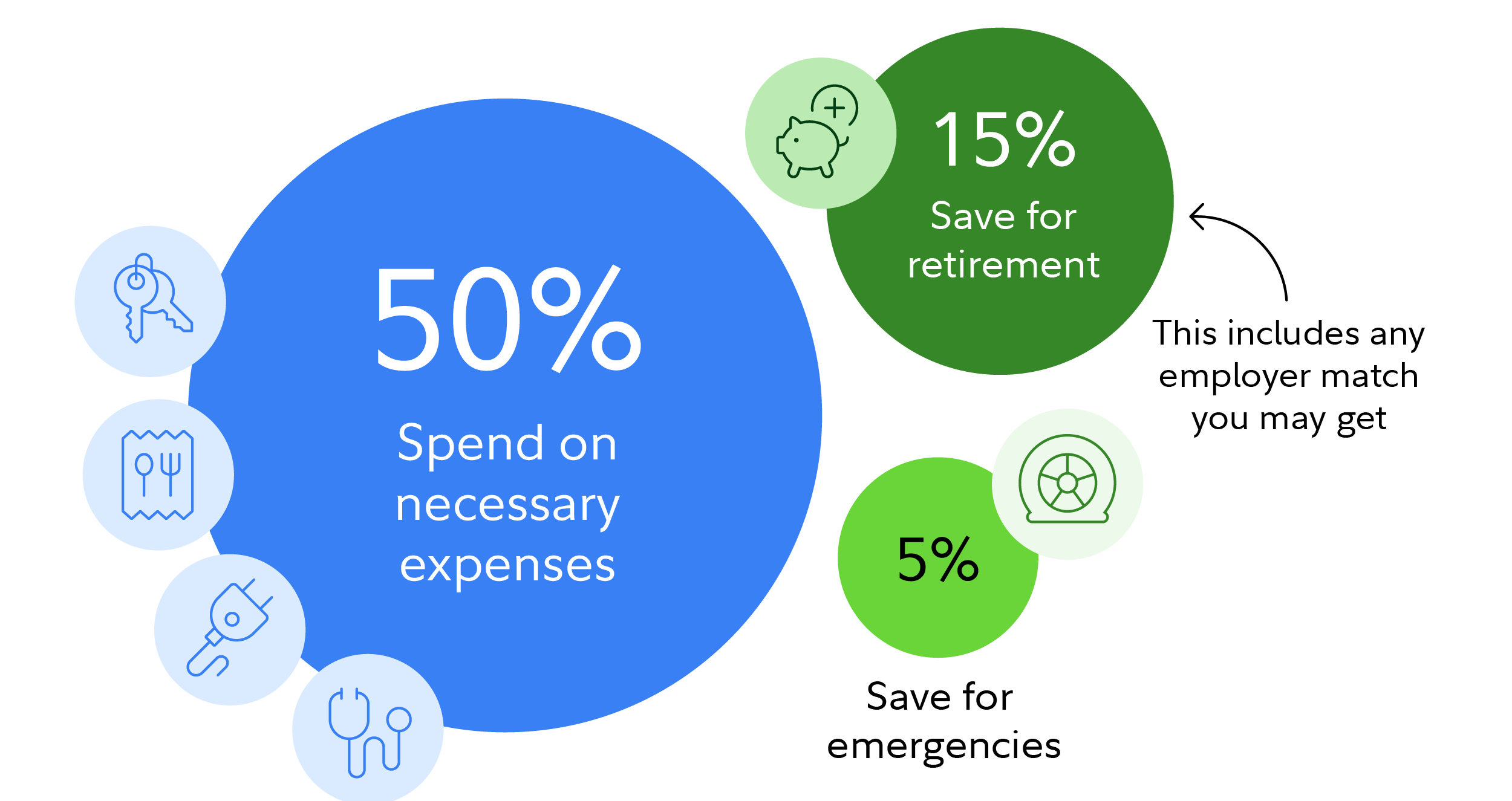

Fidelity’s 50/15/5 rule is a straightforward way to ensure you’re covering essentials, saving for retirement, and building emergency savings.

Since housing, transportation, and food are some of the biggest, here are some ways to try to keep these essential costs from taking over your budget.

Housing costs

Housing is generally the biggest monthly expense for most Americans, accounting for nearly a third of the average family’s budget.1

Finding affordable housing can feel like searching for a unicorn, but understanding your financial situation can help you find a home that fits your budget.

Before buying a home, consider these guidelines as you’re building a housing budget.

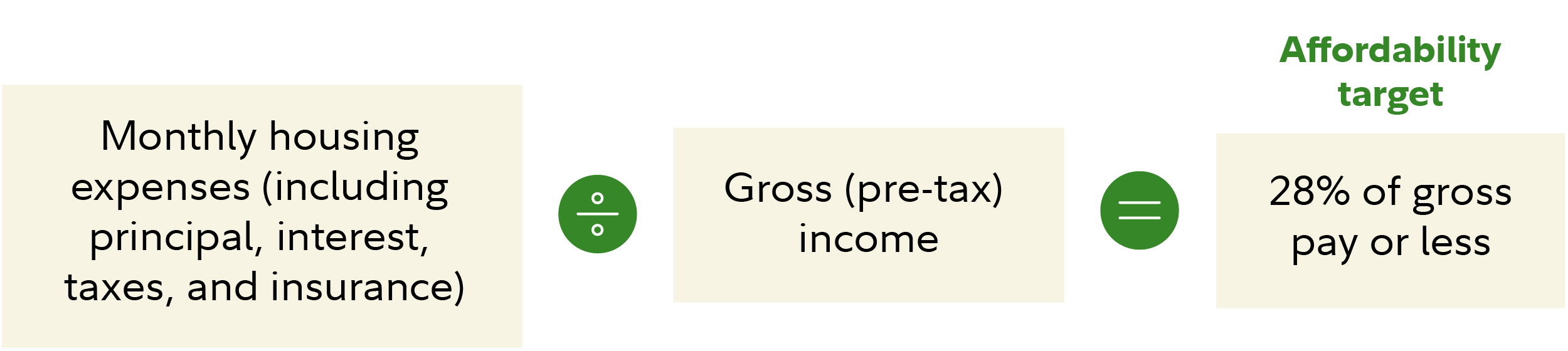

1. Keeping housing costs at or under 28% of gross pay can help make sure it doesn’t eat up all your paycheck. The further below 28%, the better, in general.

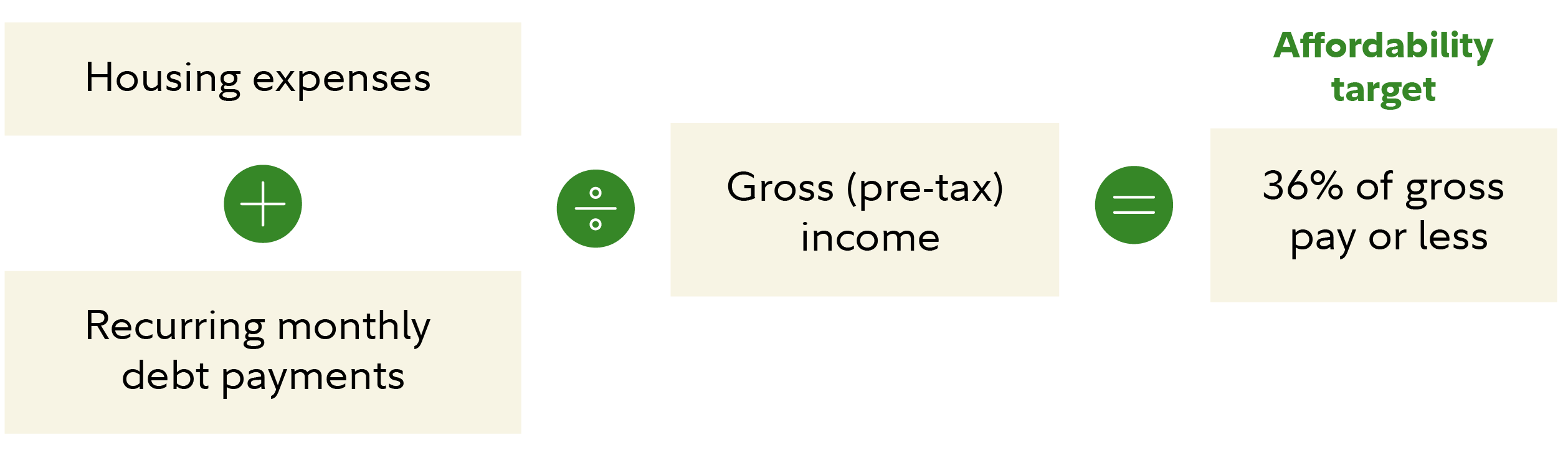

2. Keeping housing expenses and recurring monthly debt payments at or below 36% of income can make good sense. There may be more money left over after housing to help save for emergencies, pay for essentials and maintenance, save for retirement, and enjoy your life.

Fidelity’s guideline builds on this planning approach with a simple broad rule: For many homebuyers, a home priced between 3 to 5 times your household annual income can be a good starting point. Read Fidelity Viewpoints: How much house can I afford?

If lowering your housing costs is a priority, there are some options that could help you find relatively more affordable places to live.

Embrace efficient spaces. Smaller homes and apartments have benefits beyond a possibly smaller monthly cost. They can be cheaper to heat or cool, they don’t take much to furnish, and there’s less to clean.

Living with roommates or family. Under ideal circumstances, living with family members or roommates can be a dream. It offers the potential for extra savings for everyone while sharing monthly costs. Even for a short period of time, it could help bolster finances.

Read Fidelity Viewpoints: Should I buy a home or keep renting?

Home maintenance and insurance. Homeowners may be able to lower their monthly costs by investing in energy efficient appliances or home improvements. Making energy efficient upgrades to your home could help you save enough money on utilities to eventually recoup the costs of the upgrade. Plus some home improvements may be eligible for tax incentives like the Energy Efficient Home Improvement Credit or solar tax credit.

Plus, if you own your home, shopping around for homeowners insurance when your rates increase could help you keep monthly costs low. Read Fidelity Viewpoints: 6 ways to keep more of your income

Transportation costs

Transportation costs take the second biggest bite of most Americans' budget. Cars are expensive and paying cash for a car isn’t realistic for everyone. To help keep your finances on track, a good guideline is to borrow as little as you need, for as short a time as possible.

Here’s why that can make sense.

- The cost of a new car was $48,039 in February 2025 (skewed higher by sales of high-end cars) and the average used car was listed for a little more than $25,000.2,3

- The average interest rate for new car loans was 6.35%, according to Experian. For used cars, the average rate was 11.62%. Both have a significant range of rates by credit score.4

- The average term of those loans was 68 months for new cars and 67 months for used cars in 2024.5 Even longer-term loans are available—72 or 84 months.

- The longer the loan term, the lower the monthly payment. But it can cost a lot in the long run. Another danger is that you may owe more than the car is worth for most of the loan. Even if you sell the car, you could still owe money on the loan.

.png)

Consider starting the car shopping process knowing the total amount you can comfortably afford or want to pay.

And shopping around for a loan before you visit dealerships or online marketplaces can help improve your chances of finding the lowest cost loan that might be available, based on your credit score.

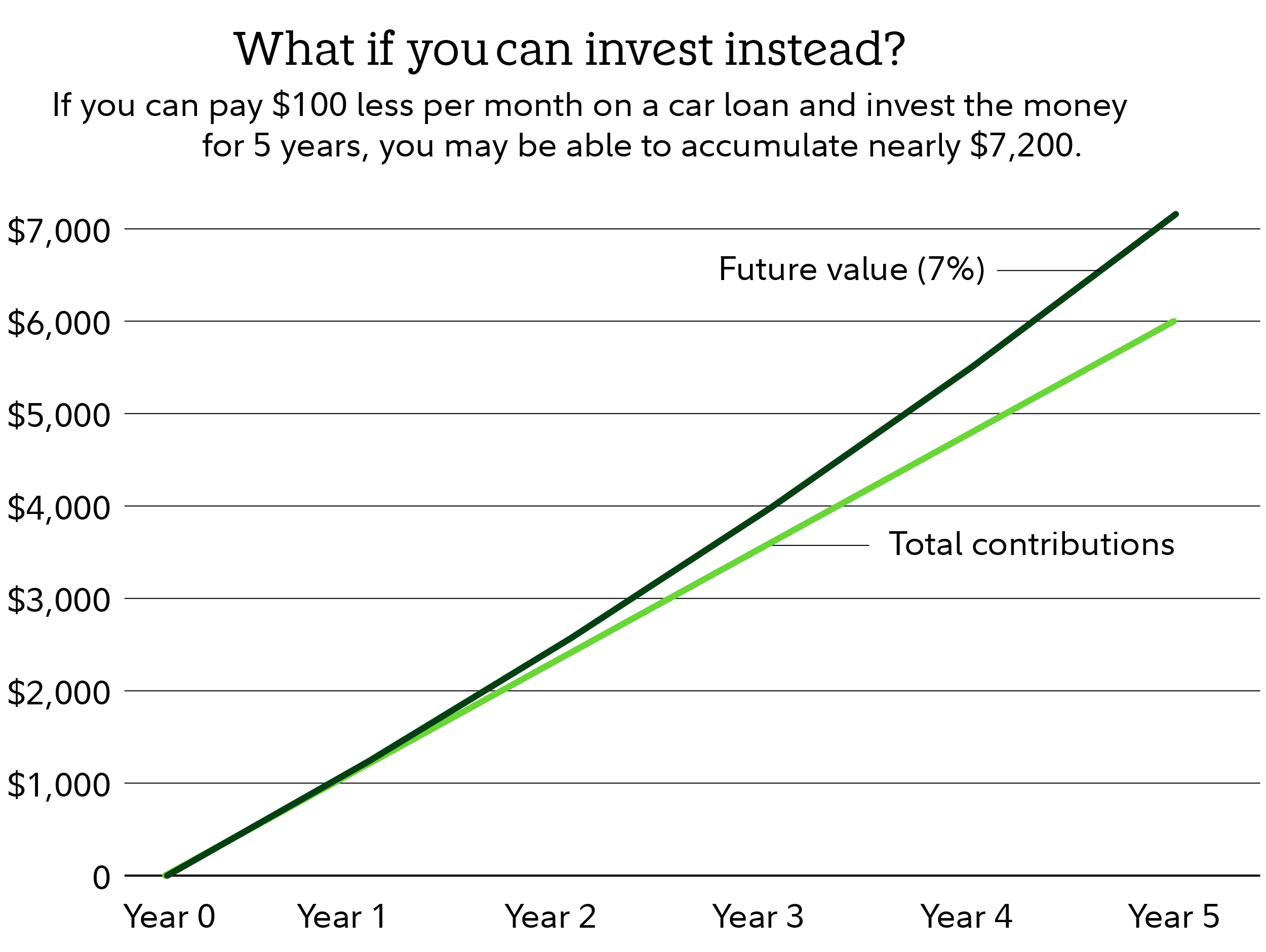

Consider what could happen if you paid just $100 less per month on a car loan and instead, invested $100 monthly for 5 years.

Food

Food is the third biggest expense in American budgets. With a bit of planning and smart budgeting, you can trim costs without sacrificing your favorite meals. Read Fidelity Smart Money: How to save money at the grocery store

Budgeting basics

Some areas of spending are easier to trim than others. It’s easier to cancel subscriptions than it is to sell your home and find a new one. Understanding the long-term implications of big purchases and how they could affect your goals is always a good start. Then you can use that to decide when it may be worth it to splurge and when your longer-term goals might be better served with a different choice.