Covered calls can generate income on investments you own, such as stocks or ETFs (exchange-traded funds) with the risk that you might be obligated to sell your shares at the strike price. Of course, it's important to learn the ins and outs of this options strategy before you put it to use. Here, we cover (pun intended!) what you should know about covered calls.

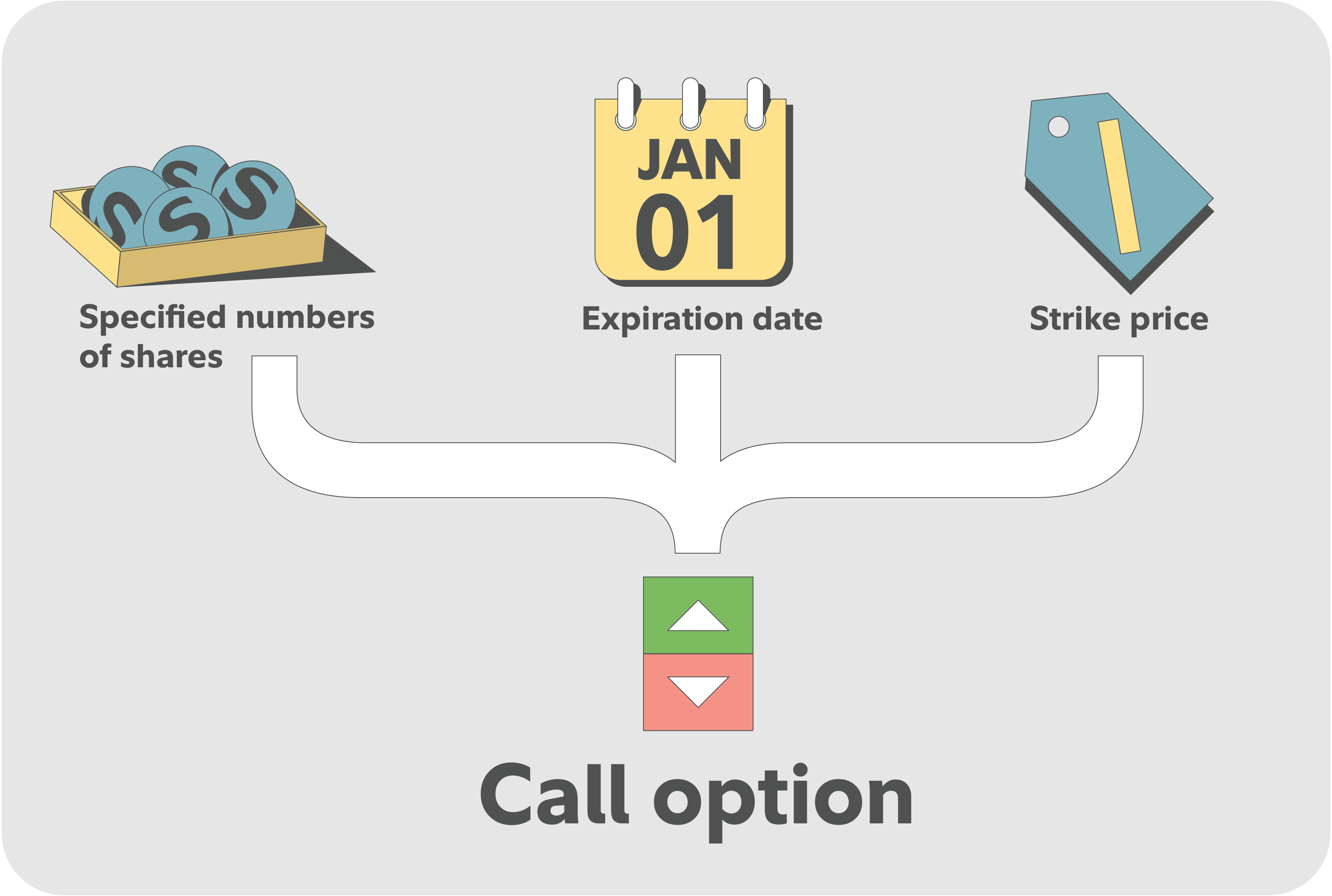

What is a call option?

A call option is a contract that controls a specified number of shares that can be exercised at a specified price (the strike price) before a specified date (the expiration date). If the contract is exercised by the buyer, the options seller is required to sell the underlying investment to the options buyer at the strike price, regardless of the current price.

The shares that are owned cover the obligation created by selling to open the options contract. This way, the shares are ready to be delivered to the option buyer (to cover the transaction) if the contract is exercised.

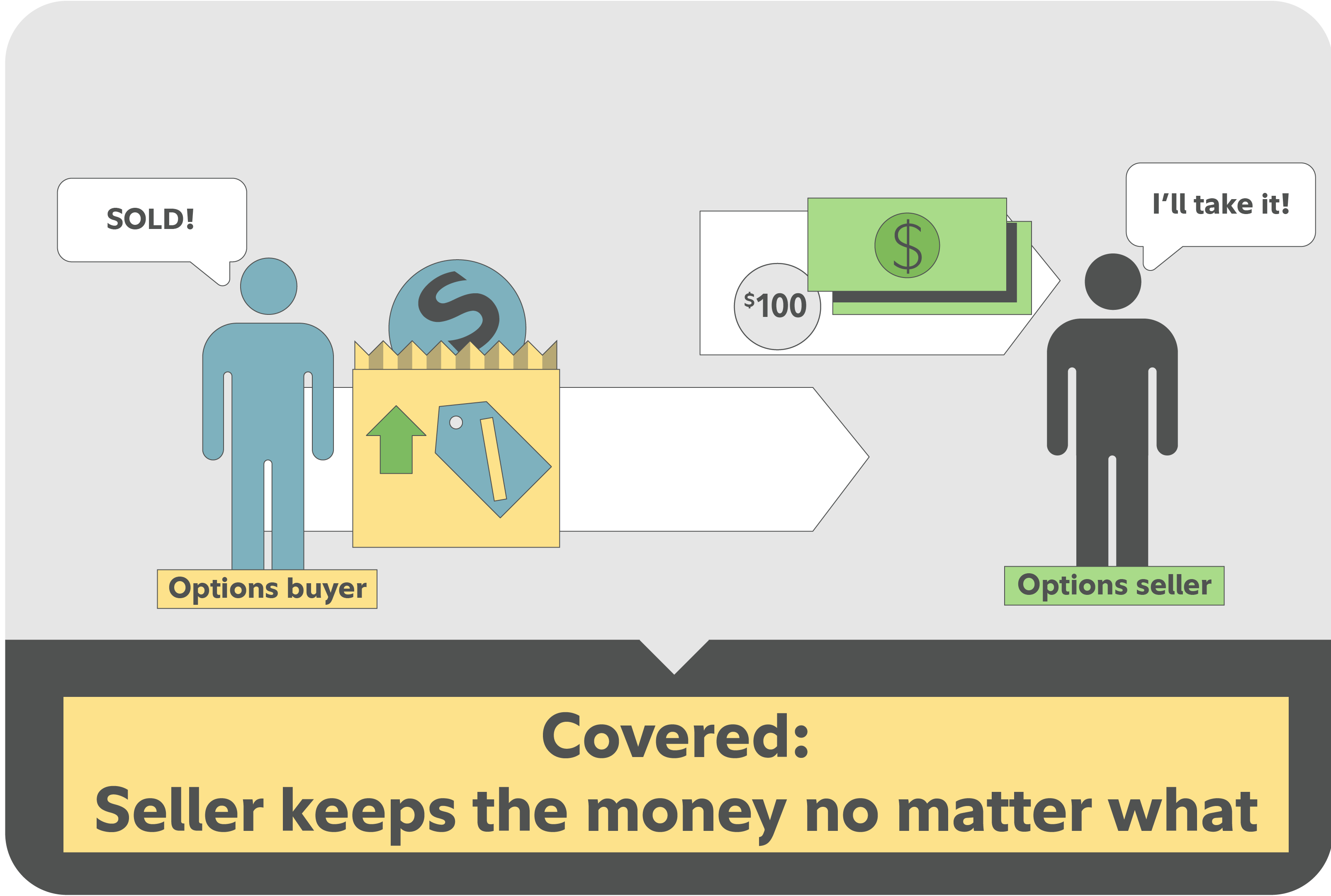

So, why is this an income-generating strategy? Because the options seller receives money—known as the premium in options lingo—for selling the call. The outlook of the seller is that the underlying stock price will remain mostly unchanged or rise a relatively small amount. If that outlook happens, the options seller gets to keep the premium and maintain ownership of the shares.

What is a covered call?

A covered call has 2 components: owning an investment (typically a stock—which we will use as the example going forward) and selling a call option on that same investment.

The stock can be owned well in advance (e.g., a long-term stock position in an IRA account) or it can be purchased while implementing a covered call. When you execute the trade, you can choose to do a "buy write," where you simultaneously purchase the stock and sell the call, or you can "over write" to sell the call on a stock you already own.

How does a covered call work?

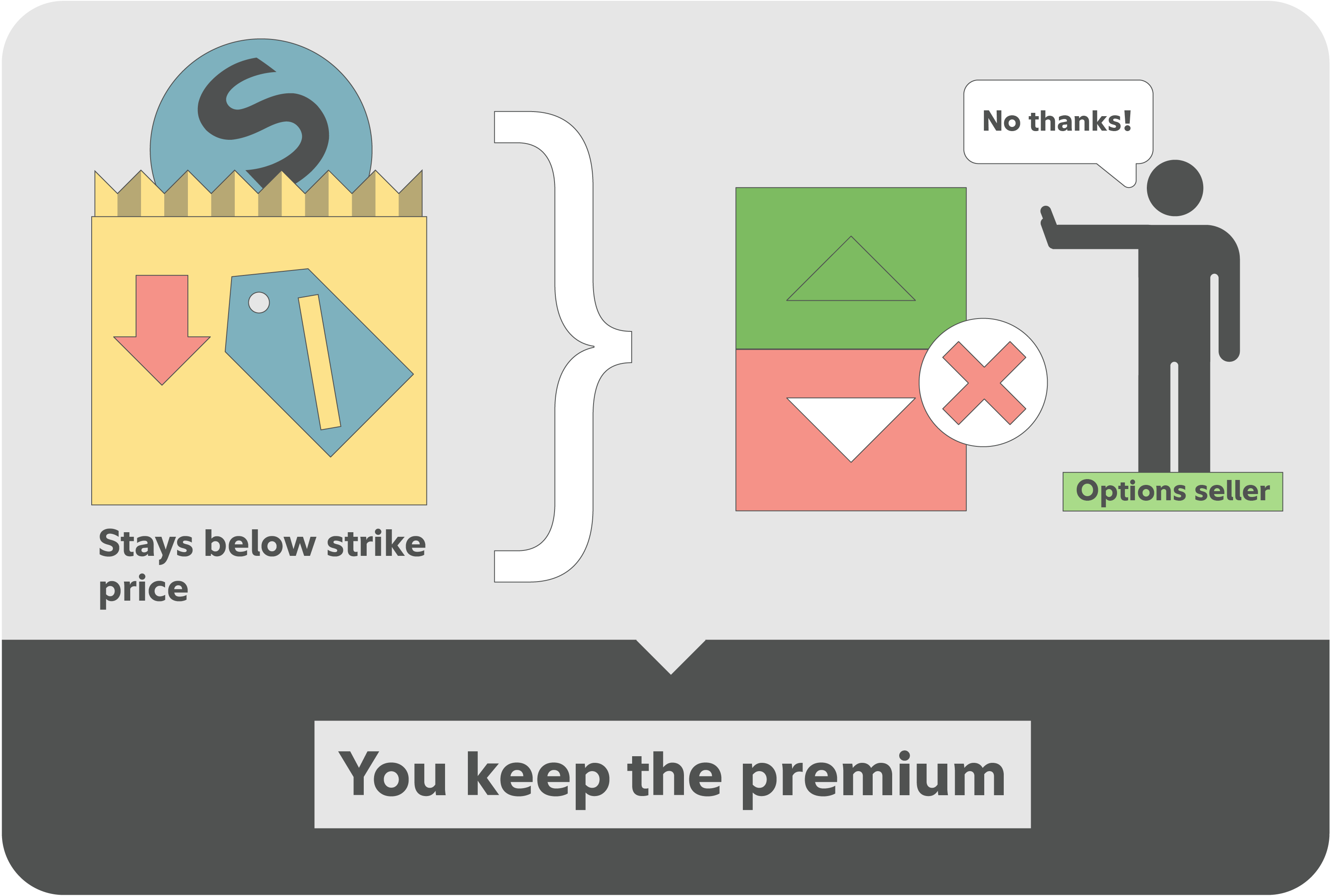

Stock price stays below the strike price:

If the actual price for the stock covered by the options contract stays below the strike price and the option buyer does not exercise the contract, you keep the stock and the premium you were paid. Remember that a covered call requires being ok with selling the underlying stock if the contract is exercised. You should also be sure you're ok with keeping the stock after the contract expires.

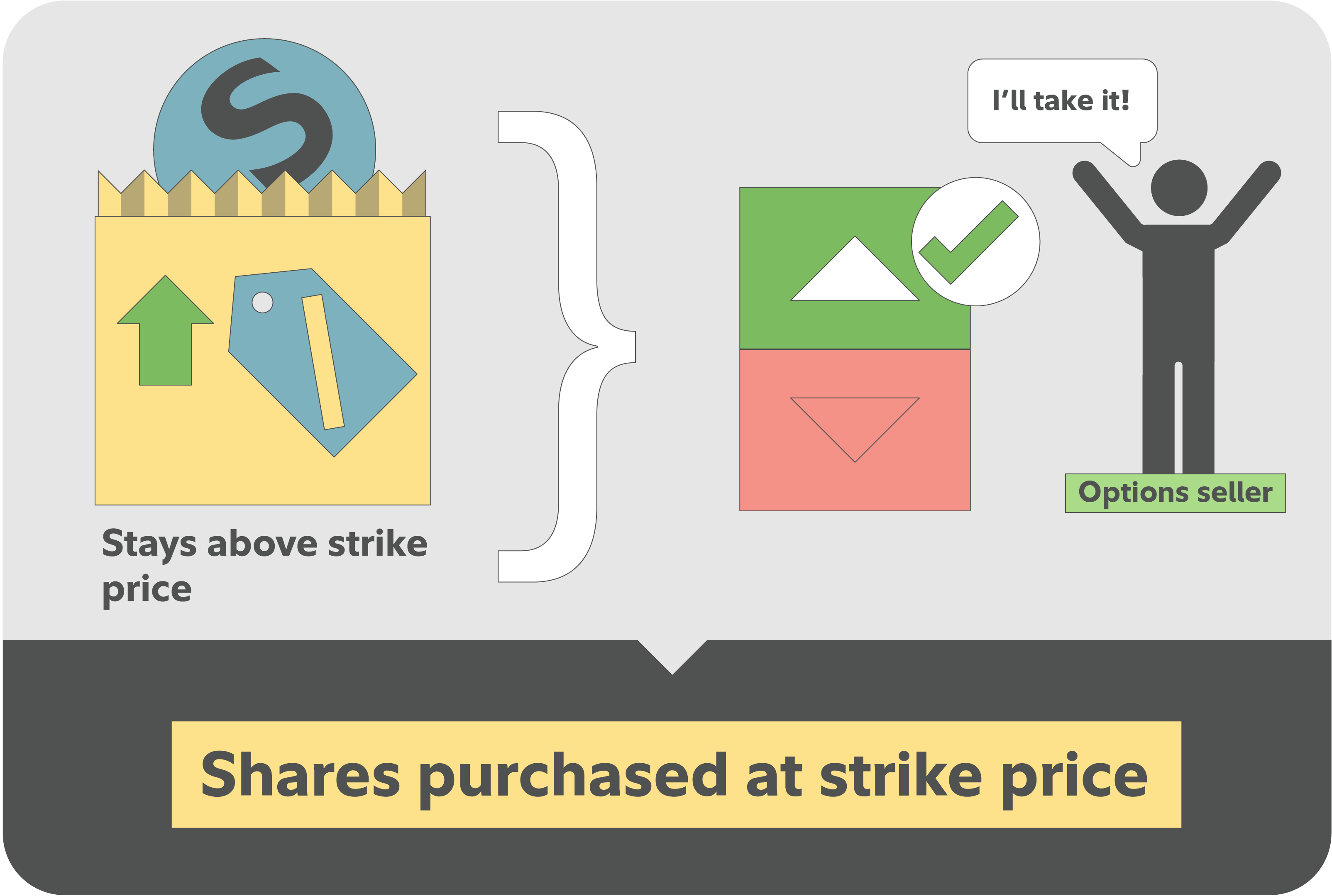

Stock price stays above the strike price:

Alternatively, if the actual price of the underlying stock or ETF rises above the strike price before expiration, on the other side of the trade the option buyer has the right to exercise the contract and buy the investment shares from you at the strike price. Remember that an option buyer and seller are on opposite sides of the same contract. This is one of the risks of executing a covered call—you get income for selling the call in exchange for losing out on upside potential of the underlying stock you own during the life of the contract. That's why the outlook for a covered call writer is for the stock to remain mostly the same or rise just a little from the current price.

An example of a covered call in action

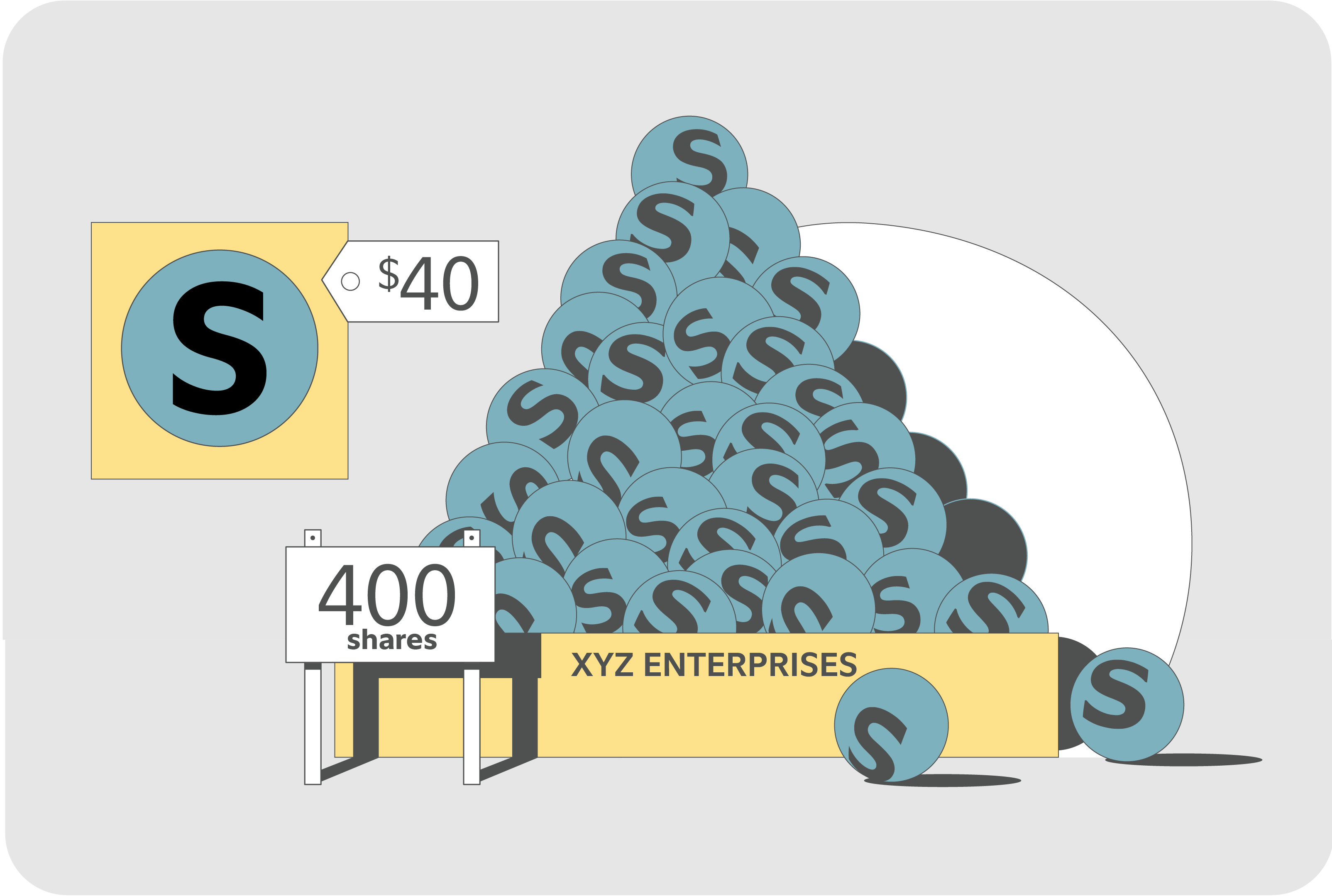

You own shares of a stock or ETF:

Let's use a hypothetical example to illustrate what we've covered. Let’s say you own 400 shares of a stock called XYZ, and each share is worth $40. You don’t expect the stock to go up much in the next couple of months, so you decide to sell a covered call to earn some extra income.

You sell a call option:

You sell 1 call option with a strike price of $45, and the buyer pays you a premium of $1 per share. Since each option contract covers 100 shares, you earn $100 upfront (100 shares × $1). You keep this money no matter what happens.

If the stock stays below $45, the buyer won’t use the option, and you keep both your shares and the $100. If the stock rises above $45, the buyer may choose to buy your shares at $45. You’ll be required to sell, even if the market price is higher. In that case, you make a profit of $5 per share from the stock price increase (from $40 to $45), plus the $1 premium, for a total of $6 per share.

However, that $6 is your maximum profit. Even if the stock jumps to $60 or higher, you still only make $6 per share because you agreed to sell at $45. Covered calls are a way to earn income when you expect little price movement, but they limit your upside if the stock takes off.

Advantages of covered calls

- You earn income immediately. Because you receive a premium when you sell the call, you get income without having to sell your stock.

- You potentially target a higher price for your investment. If you’re open to selling your shares at a certain level, a covered call gives you the possibility, not the guarantee, of having them sold at the strike price if the option is assigned. You earn a premium, but even if the stock trades above the strike, assignment isn’t certain. Unlike a limit order, which has a higher likelihood of executing at your predetermined limit price, a covered call does not ensure your shares are sold immediately.

- You get a little downside protection. By holding the securities until a certain price is reached, it's possible your security's price could drop in value while you wait. The premium you receive from the covered call can help offset some of those potentially realized losses, though certainly not all, as you saw in the example.

Disadvantages of covered calls

- Losing out on a possible large share price increase. If the price of the stock in the covered call rises, you may miss out on some—or the bulk—of its gains. The potential gains you could miss out on are hypothetically limitless, meaning a covered call probably isn't the right strategy for investments you're extremely optimistic about.

- Potential tax liability. If you end up having to sell your stock or other security, you may owe taxes on your profit if you're investing in a taxable brokerage account. If that investment has large unrealized gains, meaning the price you paid to buy is much less than the strike price you sold at, you could wind up with a taxable event.

- Assignment risk. If a contract is "in the money" (i.e., the price of the underlying stock is higher than the strike price), an options contract can be assigned at any time before the expiration. This could cause you to be forced to sell your underlying position. Remember that with a covered call, you must be comfortable with selling your position when entering the trade.

How to sell covered calls

Options contracts have unique characteristics and risks and should be carefully considered within the context of your overall investing plan. If you'd like to sell covered calls, here's a guide to consider.

- Open and fund a brokerage account. To be able to trade options, you first need a brokerage account. Look for an account with low fees, as well as the research, investing, and trading capabilities that align with your strategy before opening the account. Don't forget to fund your account once it's open.

- Apply to trade options. Depending on your financial institution, you may need permission to trade options. At Fidelity, you first have to complete an options application before you can execute strategies like selling covered calls.

- Research investment options and execute trades. Your brokerage may have resources to help you research and plan an options strategy. For instance, Fidelity offers the Option Strategy Builder to help you build and place an options trade. Once you have a stock or ETF in mind, log into your brokerage account to get started. There are tools like the options chain, which show you contracts at different strike prices and for different durations. Once you've found a combination that you like, you can start selling covered calls right from the options chain.