Goal

To profit from a stock price decline below the lowest strike price with near-zero risk if the stock price rises above the highest strike price while accepting the risk of a high-percentage loss if the stock price trades near the strike price of the long puts.

Explanation

A short skip-strike butterfly spread with puts is a three-part strategy involving four puts. If there are four strike prices, A, B, C and D, with D being the highest, a short skip-strike butterfly spread with puts is created by selling one put at strike D, buying two puts at strike C, skipping strike B and selling one put at strike A. All puts have the same expiration date, and the four strike prices are equidistant.

In the example below, one 110 Put is sold, two 105 Puts are purchased, the 100 strike is skipped, and one 95 Put is sold. In this example, the position is established for a net debit, and both the potential profit and maximum risk are limited.

This is an advanced strategy because the maximum risk is high in percentage terms and because “costs” are high. Given three strike prices, there are three bid-ask spreads when opening the position and again when closing it. As a result, it is essential to open and close the position at “good prices.” It is also important to consider the per-contract commission rate since commissions will impact the return on investment.

Example of short skip-strike butterfly spread with puts

| Sell 1 XYZ 110 put at 8.25 | 8.25 |

| Buy 2 XYZ 105 puts at 4.65 | (9.30) |

| Sell 1 XYZ 95 put at 0.70 | 1.45 |

| Net debit = | (0.35) |

Maximum profit

The maximum profit is equal to the difference between the lowest strike price (short put) and the strike price of the two long puts less the maximum risk.

If the position is established for a net debit as above, the maximum profit is realized if the stock price is at or below the lowest strike price at expiration. In the example above, the difference between the lowest strike price and the strike price of long puts is 10.00, and the maximum risk is 5.35, not including commissions. The maximum profit, therefore is 4.65 (10.00 – 5.35).

If the position is established for a net credit, there are two profit scenarios. If the stock price is equal to or above the highest strike price at expiration, then all puts expire worthless and the initial net credit for the position minus commissions is kept as profit. If the stock price is below the lowest strike price at expiration, then all puts are in the money and the maximum profit, as calculated in the previous paragraph, is realized.

Maximum risk

The maximum risk is the difference between the lowest strike price (short put) and the strike price of the two long puts minus the maximum profit including commissions. This risk is realized if the stock price is at the strike price of the long puts at expiration.

In the example above, the difference between the lowest strike price and the strike price of the long puts is 10.00, and the maximum profit is 4.65 not including commissions. The maximum risk, therefore, is 5.35 less commissions.

Breakeven stock price at expiration

If the position is established for a net debit as above, there is one breakeven point, which is the stock price equal to the strike price of the long puts minus the maximum risk including commissions. In the example above, the strike price of the long puts is 105, and the maximum risk is 5.35, so the breakeven point at expiration is 99.65.

If the position is established for a net credit, there are two breakeven points. The lower breakeven point is the stock price equal to the strike price of the long puts minus the maximum risk. The upper breakeven point is the stock price equal to the strike price of the long puts plus the maximum risk.

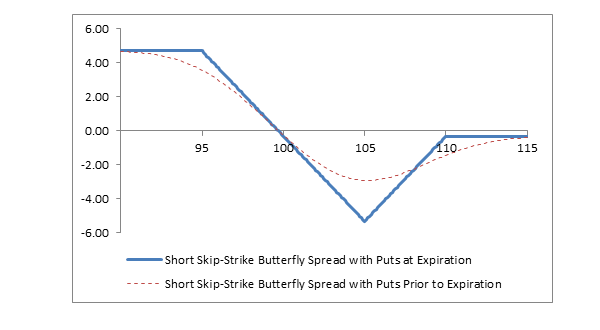

Profit/Loss diagram and table: short skip-strike butterfly spread with puts

| Sell 1 XYZ 110 put at 8.25 | 8.25 |

| Buy 2 XYZ 105 puts at 4.65 | (9.30) |

| Sell 1 XYZ 95 put at 0.70 | 1.45 |

| Net debit = | (0.35) |

| Stock Price at Expiration | Short 1 110 Put Profit/(Loss) at Expiration | Long 2 105 Puts Profit/(Loss) at Expiration | Short 1 95 Put Profit/(Loss) at Expiration | Net Profit/(Loss) at Expiration |

|---|---|---|---|---|

| 115 | +8.25 | (9.30) | +0.70 | (0.35) |

| 110 | +8.25 | (9.30) | +0.70 | (0.35) |

| 105 | 3.25 | (9.30) | +0.70 | (5.35) |

| 100 | (1.75) | +0.70 | +0.70 | (0.35) |

| 95 | (6.75) | +10.70 | +0.70 | +4.65 |

| 90 | (11.75) | +20.70 | (4.30) | +4.65 |

Appropriate market forecast

A short skip-strike butterfly spread with puts realizes its maximum profit if the stock price is at or below the lowest strike on the expiration date. The forecast, therefore, must be bearish.

Strategy discussion

A short skip-strike butterfly spread with puts is the strategy of choice when the forecast is for a stock price decline below the lowest strike price of the spread. Unlike a long put, however, the initial cash outlay for a short skip-strike butterfly spread is minimal. Therefore, if the stock price rises sharply, instead of falling as forecast, the risk is minimal. However, there are three tradeoffs. First, the maximum risk of a short skip-strike butterfly spread is much higher than the initial cash outlay and possibly higher than the cost of a comparable put. Second, the profit potential is limited, whereas the profit potential of a long put is substantial. Third, the commissions for a short skip-strike butterfly are much higher than for a long put.

Skip-strike butterfly spreads are sensitive to changes in the volatility in option prices, which is known as “implied volatility” (see Impact of Change in Volatility). The net price of a skip-strike butterfly spread falls when implied volatility rises and rises when implied volatility falls. Consequently some traders open short skip-strike butterfly spreads when they forecast that implied volatility will rise. Since implied volatility tends to rise in the period leading up to an earnings report, some traders will open a short skip-strike butterfly spread with puts two weeks or so before a report and hope for a stock price decline and a rise in implied volatility prior to the report. The position would then typically be closed immediately before the report. The potential profit is high in percentage terms and risk is limited if the stock price rises. However, if the stock price does not change and if implied volatility does not rise; the risk is very high in percentage terms.

If implied volatility is constant, short skip-strike butterfly spreads do not rise noticeably in value and do not show much of a profit until it is close to expiration and the stock price is close to the strike price of the short puts. The strategy, therefore, is sometimes described as a “strategy with a low probability of a high profit.”

Patience and trading discipline are required when trading short skip-strike butterfly spreads. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the strike price of the short puts as expiration approaches. Trading discipline is required, because, as expiration approaches, “small” changes in stock price can have a high percentage impact on the price of a skip-strike butterfly spread. Traders must, therefore, be disciplined in taking partial profits if possible and also in taking “small” losses before the losses become “big.”

Impact of stock price change

“Delta” estimates how much a position will change in price as the stock price changes. Long puts have negative deltas, and short puts have positive deltas.

The net delta of a skip-strike butterfly spread remains close to zero until two weeks or so before expiration. As expiration approaches, if the stock price is below the lowest strike price in a short skip-strike butterfly spread with puts, then the net delta is slightly negative. If the stock price is above the highest strike price, then the net delta is slightly positive. Overall, a short skip-strike butterfly spread with puts profits from a falling stock price and is hurt by time decay if the stock price is near the strike price of the long puts.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. When volatility falls, the opposite happens; long options lose money and short options make money. “Vega” is a measure of how much changing volatility affects the net price of a position.

Short skip-strike butterfly spreads with puts have a positive vega. This means that the price of a skip-strike butterfly spread falls when volatility rises (and the short spread makes money). When volatility falls, the price of a skip-strike butterfly spread rises (and the short spread loses money). Short skip-strike butterfly spreads, therefore, should be purchased when volatility is “low” and forecast to rise.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. “Theta” is a measure of how much time erosion affects the net price of a position. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion.

A short skip-strike butterfly spread with puts has a net negative theta if the stock price is near the strike price of the long puts. If the stock price moves away from this strike price, however, the theta becomes positive as expiration approaches.

Risk of early assignment

Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long puts in a short skip-strike butterfly spread have no risk of early assignment, the short puts do have such risk. Early assignment of stock options is generally related to dividends. Short puts that are assigned early are generally assigned on the ex-dividend date. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned.

If one short put is assigned (most likely the highest strike), then 100 shares of stock are purchased and the long puts and the other short put remain open. If a long stock position is not wanted, it can be closed in one of two ways. First, 100 shares can be sold in the marketplace. Second, the long 100-share position can be closed by exercising one of the long puts, if the long puts are in the money. Remember, however, that exercising a long put will forfeit the time value of that put. Therefore, it is generally preferable to sell shares to close the long stock position and then sell the long put. This two-part action recovers the time value of the long put. One caveat is commissions. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put.

If both of the short puts are assigned, then 200 shares of stock are purchased and the long puts remain open. Again, if a long stock position is not wanted, it can be closed in one of two ways. Either 200 shares can be sold in the marketplace, or both long puts can be exercised. However, as discussed above, since exercising a long put forfeits the time value, it is generally preferable to sell shares to close the long stock position and then sell the long puts. The caveat, as mentioned above, is commissions. Selling shares to close the long stock position and then selling the long puts is only advantageous if the commissions are less than the time value of the long puts.

Note, however, that whichever method is used, selling stock or exercising a long put, the date of the stock sale will be one day later than the date of the purchase. This difference will result in additional fees, including interest charges and commissions. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created.

Potential position created at expiration

The position at expiration of a short skip-strike butterfly spread with puts depends on the relationship of the stock price to the strike prices of the spread.

If the stock price is above the highest strike price, then all puts expire worthless, and no position is created.

If the stock price is below the highest strike (short put) and at or above the strike price of the long puts, then the highest strike short put is assigned. The result is that 100 shares of stock are purchased and a stock position of long 100 shares is created.

If the stock price is below the strike price of the long puts and at or above the lowest strike, then the highest-strike short put is assigned and the long puts are exercised. The result is that 100 shares are purchased and 200 shares are sold. The net result is a position of short 100 shares.

If the stock price is below the lowest strike, then both long puts are exercised and the short puts are assigned. The result is that 200 shares are purchased and 200 shares are sold. The net result is no position, although several stock buy and sell commissions have been incurred.

Other considerations

A short skip-strike butterfly spread with puts can also be described as the combination of a “narrow” bull put spread and a “wide” bear put spread. In the example above, the narrow bull put spread is comprised of the short 110 Put and one of the long 105 Puts. The wide bear put spread is comprised of the other long 105 Put and the short 95 Put.

A frequent source of confusion regarding skip-strike butterfly spreads is the margin requirement. While the margin requirement for most spread strategies is equal to the maximum risk of the strategy, this is not the case for skip-strike butterfly spreads. In this strategy, the bull put spread and the bear put spread are margined separately. Consequently, the total margin requirement for a skip-strike butterfly can be greater than the maximum risk of the strategy.

In the example above, the 105-110 bull put spread is sold for a net credit of 3.60 (8.25 – 4.65) not including commissions. The maximum risk and margin requirement for this this spread, therefore is 1.40. The 95-105 bear put spread is purchased for a net debit of 3.95 (4.65 – 0.70).

First, for purposes of margin, the margin requirement for the bull put spread is the maximum risk of the spread, or $140 in this example. Second, the bear put spread must be paid for. In this example, $395 of cash is set aside from account equity. Therefore, the total margin requirement for the short skip-strike butterfly spread in this example is $535 ($140 + $395), not including commissions. Note that the cash received for the bull put spread is held in reserve as part of its margin requirement; it is not applied to the cash paid for the bear put spread.

Skip-strike butterfly spreads are also known as “broken-wing butterfly spreads.” The term “butterfly” is thought to have originated from the profit-loss diagram of a long butterfly spread, because the peak in the middle of the diagram looks vaguely like the body of a butterfly, and the horizontal lines stretching out to either side look vaguely like the wings of a butterfly. The term “broken-wing” is thought to be a comparison of the profit-loss diagrams of the standard long butterfly and the long skip-strike butterfly. Whereas the “wings” of a standard butterfly spread are even, the wings of a skip-strike butterfly are uneven or “broken.”