Goal

To profit from neutral stock price action between the strike price of the short options with limited risk.

Explanation

A short iron condor spread is a four-part strategy consisting of a bull put spread and a bear call spread in which the strike price of the short put is lower than the strike price of the short call. All options have the same expiration date.

In the example below, one 95 Put is purchased, one 100 put is sold, one 105 Call is sold and one 110 Call is purchased, so the four strike prices are equidistant. However, it is normal for the distance between the short call and short put to be greater than the distance between the long and short options of the same type. For example, an 85-90 Bull Put Spread might be combined with a 105-110 Bear Call Spread to create a short iron condor in which the distance between the strike prices of the short options is 15 points while the distance between the strike prices of the bull and bear spreads are 5 points.

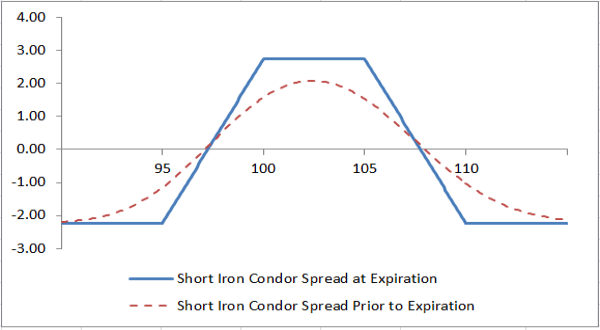

A short iron condor spread is established for a net credit, and both the potential profit and maximum risk are limited. The maximum profit is realized if the stock price is equal to or between the strike prices of the short options on the expiration date. The maximum risk is the difference between the prices of the bull put spread (or the bear call spread) less the net credit received. The maximum risk is realized if the stock price is above the highest strike price or below the lowest strike price at expiration.

This is an advanced strategy because the profit potential is small in dollar terms and because “costs” are high. Given that there are four options and four strike prices, there are multiple commissions in addition to four bid-ask spreads when opening the position and again when closing it. As a result, it is essential to open and close the position at “good prices.” It is also important to consider the per-contract commission rate since commissions will impact the return on investment.

Example of short iron condor spread

| Buy 1 XYZ 95 Put at 0.70 | (0.70) |

| Sell 1 XYZ 100 Put at 2.10 | 2.10 |

| Sell 1 XYZ 105 Call at 2.35 | 2.35 |

| Buy 1 XYZ 110 Call at 0.95 | (0.95) |

| Net Credit = | 2.80 |

Maximum profit

The maximum profit potential is equal to the net credit received less commissions, and this profit is realized if the stock price is equal to or between the strike prices of the short options at expiration. In this outcome, all options expire worthless and the net credit is kept as income.

Maximum risk

The maximum risk is equal to the difference between the strike prices of the bull put spread (or bear call spread) less the net credit received. In the example above, the difference between the strike prices of the bull put spread (and also the bear call spread) is 5.00, and the net credit received is 2.80, not including commissions. The maximum risk, therefore, is 2.20 not including commissions.

There are two possible outcomes in which the maximum loss is realized. If the stock price is below the lowest strike price at expiration, then the calls expire worthless, but both puts are in the money. With both puts in the money, the bull put spread reaches its maximum value and maximum loss. Also, if the stock price is above the highest strike price at expiration, then the puts expire worthless, but both calls are in the money. Consequently, the bear call spread reaches it maximum value and maximum loss.

Breakeven points

There are two breakeven points. The lower breakeven point is the stock price equal to the strike price of the short put minus the net credit received. The upper breakeven point is the stock price equal to the strike price of the short call plus the net credit received.

Profit/Loss diagram and table: short iron condor spread

| Buy 1 XYZ 95 Put at 0.70 | (0.70) |

| Sell 1 XYZ 100 Put at 2.10 | 2.10 |

| Sell 1 XYZ 105 Call at 2.35 | 2.35 |

| Buy 1 XYZ 110 Call at 0.95 | (0.95) |

| Net Credit = | 2.80 |

| Stock Price at Expiration | Long 1 95 Put Profit/(Loss) at Expiration | Short 1 100 Put Profit/(Loss) at Expiration | Short 1 105 Call Profit/(Loss)at Expiration | Long 1 110 Call Profit/(Loss) at Expiration | Net Profit/(Loss) at Expiration |

|---|---|---|---|---|---|

| 115 | (0.70) | +2.10 | (7.65) | +4.05 | (2.20) |

| 110 | (0.70) | +2.10 | (2.65) | (0.95) | (2.20) |

| 105 | (0.70) | +2.10 | +2.35 | (0.95) | +2.80 |

| 100 | (0.70) | +2.10 | +2.35 | (0.95) | +2.80 |

| 95 | (0.70) | (2.90) | +2.35 | (0.95) | (2.20) |

| 90 | +4.30 | (7.90) | +2.35 | (0.95) | (2.20) |

Appropriate market forecast

A short iron condor spread realizes its maximum profit if the stock price is equal to or between the strike prices of the short options on the expiration date. The forecast, therefore, can either be “neutral,” “modestly bullish” or “modestly bearish,” depending on the relationship of the stock price to range of maximum profit when the position is established.

If the stock price is in the range of maximum profit when the position is established, then the forecast must be for unchanged, or neutral, price action.

If the stock price is below the range of maximum profit when the position is established, then the forecast must be for the stock price to rise into the range of maximum profit at expiration (modestly bullish).

If the stock price is above the range of maximum profit when the position is established, then the forecast must be for the stock price to fall into the range of maximum profit at expiration (modestly bearish).

Strategy discussion

A short iron condor spread is the strategy of choice when the forecast is for stock price action between the center strike prices of the spread, because it profits from time decay. However, unlike a short strangle, the potential risk of a short iron condor spread is limited. The tradeoff is that a short iron condor spread has a much lower profit potential in dollar terms than a comparable short strangle. Also, the commissions for an iron condor spread are higher than for a strangle.

Short iron condor spreads are sensitive to changes in volatility (see Impact of Change in Volatility). The net credit received for a short iron condor spread rises when volatility rises and falls when volatility falls. Consequently some traders establish short iron condor spreads when they forecast that volatility will fall. Since the volatility in option prices tends to fall sharply after earnings reports, some traders will open a short iron condor spread immediately before the report. Due to this typical volatility behavior, it helps the strategy towards the potential profit with risk being limited. Success of this approach to trading short iron condor spreads requires that the stock price stay between the lower and upper breakeven prices of the iron condor. If the stock price rises or falls too much, then a loss will be incurred.

If volatility is constant and if the stock price is in the maximum profit range, then short iron condor spreads benefit from time decay and show slowly increasing profits as expiration approaches. In contrast, short straddles and short strangles show greater profits earlier in the expiration cycle as long as the stock price does not move out of the profit range.

Furthermore, while the potential profit of a short iron condor spread is a “high percentage profit on the capital at risk,” the typical potential dollar profit of one iron condor spread is “low.” As a result, it is often necessary to trade a large number of iron condor spreads if the goal is to earn a profit in dollars equal to the hoped-for dollar profit from a short straddle or strangle. Also, one should not forget that the risk of a short iron condor spread is still 100% of the margin requirement, which equals the maximum risk. Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close the position before a large percentage loss is incurred.

Patience and trading discipline are required when trading short iron condor spreads. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the range of maximum profit as expiration approaches. Trading discipline is required, because, as expiration approaches, “small” changes in stock price can have a high percentage impact on the price of an iron condor spread. Traders must, therefore, be disciplined in taking partial profits if possible and also in taking “small” losses before the losses become “big.”

Impact of stock price change

“Delta” estimates how much a position will change in price as the stock price changes. Long calls have positive deltas, short calls have negative deltas, long puts have negative deltas, and short puts have positive deltas.

Regardless of time to expiration and regardless of stock price, the net delta of a short iron condor spread remains close to zero until a week or two before expiration. If the stock price is below the lowest strike price in a short iron condor spread, then the net delta is slightly positive. If the stock price is above the highest strike price, then the net delta is slightly negative. Overall, a short iron condor spread does not profit from stock price change; it profits from time decay as long as the stock price is in the range of maximum profit.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. When volatility falls, the opposite happens; long options lose money and short options make money. “Vega” is a measure of how much changing volatility affects the net price of a position.

Short iron condor spreads have a negative vega. This means that the net credit for establishing a short iron condor spread rises when volatility rises (and the spread loses money). When volatility falls, the net credit of a short iron condor spread falls (and the spread makes money). Short iron condor spreads, therefore, should be established when volatility is “high” and forecast to decline.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. “Theta” is a measure of how much time erosion affects the net price of a position. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion.

A short iron condor spread has a net positive theta as long as the stock price is in the range of maximum profit. Consequently, a short iron condor spread profits from time erosion. If the stock price moves outside the range of maximum profit, however, the theta becomes negative and the position loses money as expiration approaches.

Risk of early assignment

Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long options in an iron condor spread have no risk of early assignment, the short options do have such risk. Early assignment of stock options is generally related to dividends. Short calls that are assigned early are generally assigned on the day before the ex-dividend date, and short puts that are assigned early are generally assigned on the ex-dividend date. In-the-money calls and puts whose time value is less than the dividend have a high likelihood of being assigned.

If the short call in a short iron condor is assigned, then 100 shares of stock are sold short and the long call and both puts remain open. If a short stock position is not wanted, it can be closed in one of two ways. First, 100 shares can be purchased in the marketplace. Second, the short 100-share position can be closed by exercising the long call, if in the money. Remember, however, that exercising a long call will forfeit the time value of that call. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long call. This two-part action recovers the time value of the long call. One caveat is commissions. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long call.

Note, however, that whichever method is used, buying stock and selling the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. Which, if an x-dividend date is involved, could lead the trader to pay the dividend due to the short shares (this could potentially result in a loss that is greater than the maximum loss). This difference will result in additional fees, including interest charges and commissions. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created.

If the short put is assigned, then 100 shares of stock are purchased and the long put and both calls remain open. If a long stock position is not wanted, it can be closed in one of two ways. First, 100 shares can be sold in the marketplace. Second, the long 100-share position can be closed by exercising the long put, if in the money. Remember, however, that exercising a long put will forfeit the time value of that put. Therefore, it is generally preferable to sell shares to close the long stock position and then sell the long put. This two-part action recovers the time value of the long put. Again, however, the caveat is commissions. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put.

Note, again, that whichever method is used, selling stock or exercising a long put, the date of the stock sale will be one day later than the date of the purchase. This difference will result in additional fees, including interest charges and commissions. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created.

Potential position created at expiration

The stock position created at expiration of a short iron condor spread depends on the relationship of the stock price to the strike prices of the spread, and there are five possibilities. The stock price can be below the strike price of the long put, which is the lowest strike price. It can be above the strike price of the long put but not above the strike price of the short put. It can be between the strike prices of the short put and short call. It can be above the strike price of the short call, but not above the strike price of the long call; or it can be above the strike price of the long call, which is the highest strike price.

If the stock price is below the strike price of the long put, which is the lowest strike price, then both puts are in the money and both calls are out-of-the-money. In this case both calls expire worthless, but the long put (lowest strike) is exercised and the short put (next higher strike) is assigned. As a result, stock is sold at the lowest strike and purchased at the next higher strike. As a result, the maximum loss is incurred, but no stock position is created.

If the stock price is above the strike price of the long put but not above the strike price of the short put, then the long put and both calls expire worthless, but the short put is assigned. The result is that 100 shares of stock are purchased and a stock position of long 100 shares is created.

If the stock price is between the strike prices of the short put and short call, then all options expire worthless and no stock position is created.

If the stock price is above the strike price of the short call but not above the strike price of the long call, then the long call (highest strike) and both puts expire worthless, but the short call is assigned. The result is that 100 shares of stock are sold short and a stock position of short 100 shares is created.

If the stock price is above the strike price of the long call, then both calls are in the money and both puts are out-of-the-money. In this case both puts expire worthless, but the short call (second-highest strike) is assigned and the long call (highest strike) is exercised. As a result, stock is sold at the second-highest strike and purchased at the highest strike. As a result, the maximum loss is incurred, but no stock position is created.

Other considerations

There is considerable disagreement among experienced traders on how the terms “long,” “short,” “buy” and “sell” apply to iron condor spreads.

This strategy is labeled "Short Iron Condor". This use of terminology aligns “selling to open” with receiving a net credit and “buying to close” with paying a net debit.

On the other hand, some traders refer to this strategy as "Long Iron Condor," because its profit and loss diagram looks like the diagrams of a long condor spread with calls and a long condor spread with puts. However, it is confusing for some traders to think of a position that is established for a net credit as a “long position” or “purchased position" and conversely closing, or “selling,” it for a debit.

Since even experienced traders frequently disagree on how to describe the opening and closing of this strategy, all traders who use this strategy should be careful to communicate exactly and clearly the position that is being opened or closed. Rather than say “buy” or “sell” or “long” or “short,” when trading short iron condor spreads, one might say “open for a net credit” or “close for a net debit.”