Goal

To buy stock on or before the expiration date and to limit risk during the life of the call.

Explanation

In return for paying a premium, the buyer of a call gets the right (not the obligation) to buy the underlying stock at the strike price at any time until the expiration date. Stock options in the U.S. typically cover 100 shares. Therefore, in the example provided, the investor pays $4.00 per share ($400 plus commissions) for the right to buy 100 shares of JKL stock at $100 per share until the expiration date (usually the third Friday of the month). The investor also deposits $10,000 cash in a money market account which will be used to pay for the 100 shares of stock if the call is exercised.

If the stock price is above the strike price of the call at expiration and if the investor still wants to buy the stock, then the call is exercised and stock is purchased and paid for with the cash held in the money market account.

If the stock price is below the strike price at expiration, then the call expires and the premium paid plus commissions are lost. The investor must then decide whether to buy the stock at the current price or to invest the cash elsewhere.

Example of long call - cash backed

Buy 1 JKL 100 Call at 4.00 per share ($400 plus commissions) Hold cash (or money market account) of $100.00 per share ($10,000 for 100 shares)

Maximum profit

The potential profit is unlimited as the underlying price can rise indefinitely.

Maximum risk

Risk is limited to the premium paid plus commissions, and a loss of this amount is realized if the call is held to expiration and expires worthless.

Breakeven stock price at expiration

Strike price plus premium paid

In this example: 100.00 + 4.00 = 104.00

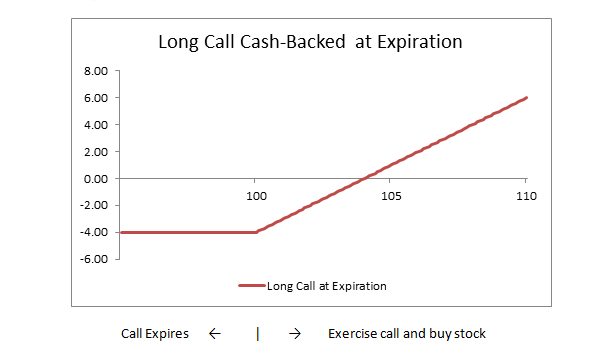

Profit/Loss diagram and table: Long 100 Call @ 4.00

| Stock Price at Expiration | 100 Call Value at Expiration | 100 Call Purchase Price | Profit/(Loss) at Expiration |

|---|---|---|---|

| 110 | 10.00 | 4.00 | +6.00 |

| 109 | 9.00 | 4.00 | +5.00 |

| 108 | 8.00 | 4.00 | +4.00 |

| 107 | 7.00 | 4.00 | +3.00 |

| 106 | 6.00 | 4.00 | +2.00 |

| 105 | 5.00 | 4.00 | +1.00 |

| 104 | 4.00 | 4.00 | -0- |

| 103 | 3.00 | 4.00 | (1.00) |

| 102 | 2.00 | 4.00 | (2.00) |

| 101 | 1.00 | 4.00 | (3.00) |

| 100 | 0 | 4.00 | (4.00) |

| 99 | 0 | 4.00 | (4.00) |

| 98 | 0 | 4.00 | (4.00) |

| 97 | 0 | 4.00 | (4.00) |

| 96 | 0 | 4.00 | (4.00) |

| 95 | 0 | 4.00 | (4.00) |

Appropriate market forecast

Buying a call to limit the risk of buying stock requires a 2-part forecast. First, the forecast must be bullish, which is the reason for wanting to buy the stock. Second, there must also be a reason for the desire to limit risk. Perhaps there is a pending earnings report that could send the stock price sharply in either direction. In this case, buying a call gives the investor control over 100 shares at the current price if the report is positive, and it limits the risk of a negative report. Alternatively, an investor could believe that a downward trending stock is about to reverse upward. In this case, buying a call limits the risk of the judgment about the change in trend being wrong.

Strategy discussion

Buying a call to limit the short-term risk of buying stock has two advantages and one disadvantage. The first advantage is that risk is limited during the life of the call. Second, buying a call to limit risk is different than using a stop-loss order on the stock. Whereas a stop-loss order is price sensitive and can be triggered by a sharp fluctuation in the stock price, a long call is limited by time, not stock price. The disadvantage of buying a call is that the total cost of the stock is increased by the premium paid.

The choice between (1) buying a stock today and (2) buying a call today and holding cash in reserve is a subjective decision that investors must make individually.

Impact of stock price change

Call prices, generally, do not change dollar-for-dollar with changes in the price of the underlying stock. Therefore, the owner of one call option will typically make or lose less than the owner of 100 shares of stock as the stock price fluctuates.

Call options change in price based on their "delta." At-the-money calls typically have deltas of approximately .50, so a $1 rise or fall in stock price causes an at-the-money call to rise or fall by 50 cents. In-the-money calls tend to have deltas greater than .50, but not greater than 1.00. Out-of-the-money calls tend to have deltas less than .50, but not less than zero.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. As a result, long call positions benefit from rising volatility and are hurt by decreasing volatility.

Impact of time

The time value portion of an option's total price decreases as expiration approaches. This is known as time erosion. Long calls are hurt by passing time if other factors remain constant.

If an investor decides to convert a long call position into a long stock position prior to the expiration date of the call, there are two ways this can be accomplished. First, the call can be exercised on any business day prior to established deadlines. Second, the call can be sold in one transaction and stock can be purchased in another transaction. Which is "best," i.e., the method that achieves the lowest net cost of the stock position, depends on the time value of the call option. If the time value of the call exceeds the cost of selling the call plus the cost of buying the stock, then it is generally advantageous to sell the call and buy stock rather than exercise the call.

Risk of early assignment

The owner of a call controls if and when a call is exercised, so there is no risk of early assignment.

Potential position created at expiration

If a call is exercised, then stock is purchased at the strike price of the call; and a long stock position is created.

Other considerations

When calls are purchased to limit the risk of acquiring stock, it is assumed that the calls will be exercised if the stock price is above the strike price at expiration. Since calls are automatically exercised at expiration if they are one cent ($0.01) in the money at expiration, an investor who owns calls and wants to buy the stock need take no action if the stock price is above the strike price at expiration. However, to ensure your intentions are fulfilled, it is always best to contact a Fidelity representative to give your instructions.

However, if the stock price is below the strike price at expiration, then a decision must be made. Should the stock be purchased at its current price? Or should the cash held in reserve be invested elsewhere? This is a subjective decision that investors must make individually.