Potential Goals

To earn leveraged income from neutral to bullish price action in the underlying stock.

Explanation

A covered straddle position is created by buying (or owning) stock and selling both an at-the-money call and an at-the-money put. The call and put have the same strike price and same expiration date. The position profits if the underlying stock trades above the break-even point, but profit potential is limited. Potential loss is substantial and leveraged if the stock price falls. Below the break-even point, losses are $2.00 per share for each $1.00 decline in stock price, because both the long stock and the short put lose as the stock price declines.

Note that the short put is not “covered” as the strategy name implies, because cash is not held in reserve to buy additional shares. See Strategy Discussion below.

Example of covered straddle (long stock + short A-T-M call + short A-T-M put)

| Buy 100 shares XYZ stock at 100.00 |

| Sell 1 XYZ 100 call at 3.25 |

| Sell 1 XYZ 100 put at 3.15 |

Maximum profit

Profit potential is limited to the total premiums received plus strike price minus stock price. In the example above, the maximum profit is 6.40, because the total premiums received are 6.40 (3.25 + 3.15) and the strike price equals the stock price, so the difference is zero. If the stock had been purchased for $99.00, then the maximum profit would be 7.40, $1.00 per share higher. If the stock had been purchased for $101.00, then the maximum profit would be 5.40, $1.00 per share lower.

Maximum risk

Potential loss is substantial and leveraged if the stock price falls. Below the break-even point at expiration, losses are $2.00 per share for each $1.00 decline in stock price, because both the long stock and the short put lose as the stock price declines.

Breakeven stock price at expiration

Stock price minus one-half the total premiums received

In this example: 100.00 – 0.50 × (3.25 + 3.15) = 96.80

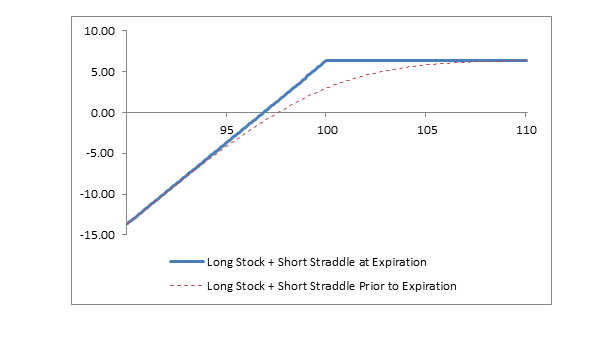

Profit/Loss diagram and table: covered straddle

| Buy 100 shares XYZ stock at 100.00 |

| Sell 1 XYZ 100 call at 3.25 |

| Sell 1 XYZ 100 put at 3.15 |

| Stock Price at Expiration | Long Stock Profit/(Loss) at Expiration | Short 100 Call Profit/(Loss) at Expiration | Short 100 Put Profit/(Loss) at Expiration | Covered Straddle Profit/(Loss) at Expiration |

|---|---|---|---|---|

| 108 | +8.00 | (4.75) | +3.15 | +6.40 |

| 107 | +7.00 | (3.75) | +3.15 | +6.40 |

| 106 | +6.00 | (2.75) | +3.15 | +6.40 |

| 105 | +5.00 | (1.75) | +3.15 | +6.40 |

| 104 | +4.00 | (0.75) | +3.15 | +6.40 |

| 103 | +3.00 | +0.25 | +3.15 | +6.40 |

| 102 | +2.00 | +1.25 | +3.15 | +6.40 |

| 101 | +1.00 | +2.25 | +3.15 | +6.40 |

| 100 | 0 | +3.25 | +3.15 | +6.40 |

| 99 | (1.00) | +3.25 | +2.15 | +4.40 |

| 98 | (2.00) | +3.25 | +1.15 | +2.40 |

| 97 | (3.00) | +3.25 | +0.15 | +0.40 |

| 96 | (4.00) | +3.25 | (0.85) | (1.60) |

| 95 | (5.00) | +3.25 | (1.85) | (3.60) |

| 94 | (6.00) | +3.25 | (2.85) | (5.60) |

Appropriate market forecast

The covered straddle strategy requires a neutral-to-bullish forecast. The forecast must predict that the stock price will not fall below the break-even point before expiration.

Strategy discussion

A covered straddle is the combination of a covered call (long stock plus short call) and a short put. The short put is not “covered” as the strategy name implies, however, because cash is not held in reserve to buy shares if the put is assigned. Rather, the long stock position, or account equity, is used as collateral to meet the margin requirement for the short put. Below the break-even point both the long stock and short put incur losses, and, as a result, percentage losses are twice what they would be for a covered call position alone.

Choosing the covered straddle strategy based on a neutral-to-bullish forecast requires both a high tolerance for risk and trading discipline. High tolerance for risk is required, because risk is leveraged on the downside. Trading discipline is required because the ability to “cut losses short” is an attribute of trading discipline. Many traders who use the covered straddle strategy have strict guidelines – which they adhere to – about closing positions when the market goes against the forecast.

Impact of stock price change

“Delta” estimates how much a position will change in price as the stock price changes. Long stock and short puts have positive deltas, and short calls have negative deltas. Although the net delta of a covered straddle position is always positive, it varies between 0.00 and +2.00 depending on the relationship of the stock price to the strike price of the options.

If the stock price is at the strike price, then the position delta is approximately +1.00, because the delta of the long stock is +1.00 and the negative delta of the short call almost exactly offsets the positive delta of the short put.

The position delta approaches zero as the stock price rises above the strike price, because the delta of the covered call (long stock plus short call) approaches zero, and the delta of the short put also approaches zero.

The position delta approaches +2.00 as the stock price falls below the strike price, because the deltas of the long stock and short put both approach +1.00, while the delta of the short call approaches zero.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Short option positions, therefore, rise in price and lose money when volatility rises. When volatility falls, short option positions make money. Since a covered straddle has two short options, the position loses doubly when volatility rises and profits doubly when volatility falls.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. Since a covered straddle position has two short options, the positions profits doubly from the passing of time to expiration.

Risk of early assignment

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

Both the short call and the short put in a covered straddle have early assignment risk. Early assignment of stock options is generally related to dividends.

Short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is above the strike price of the short call, an assessment must be made if early assignment is likely. In the case of a covered straddle, it assumed that being assigned on the short call is a good event, because assignment of the call converts the stock position to cash and a profit is realized (not including the short put which remains open – with risk – until expiration). However, if selling the stock is not wanted, then buying the short call to eliminate the possibility of assignment is necessary.

Short puts that are assigned early are generally assigned on the ex-dividend date. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is below the strike price of the short put, an assessment must be made if early assignment is likely. In the case of a covered straddle, it assumed that being assigned on the short put is not wanted, because the purchase of additional shares requires additional capital and/or a possible margin call. Therefore, if early assignment of the short put is deemed likely, the short put must be purchased to eliminate the possibility of assignment. However, if additional shares are wanted, then no action needs to be taken.

If early assignment of the short put does occur, and if the stock position is not wanted, the stock can be closed in the marketplace by selling. Note, however, that the date of the closing stock sale will be one day later than the date of the opening stock purchase (from assignment of the put). This one-day difference will result in additional fees, including interest charges and commissions. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position.

If the stock price is trading very close to the strike price of the short straddle as expiration approaches, then it may be necessary to close both the short call and short put, because last-minute trading action in the marketplace might cause either option to be in the money when trading halts.

Potential position created at expiration

If the short call in a covered straddle is assigned, then the stock is sold at the strike price and replaced with cash.

If the short put in a covered straddle is assigned, then stock is purchased at the strike price. Assuming the call expires, the result is that the initial stock position is doubled.

Other considerations

Although the short call in a covered straddle position is covered by the long (or owned) stock, the short put, as noted above, is not “covered,” because no cash is held in reserve as it is in the case of a cash-secured short put. In the case of a covered straddle, the account equity including the long stock is used as collateral for the margin requirement for the short put. Therefore, if account equity declines sufficiently, a margin call will be triggered. The covered straddle is suitable only for aggressive investors who are suited to taking this risk.